Overview

Venture capital (VC) is an essential aspect of the startup ecosystem, especially in technology and high-growth sectors. It provides entrepreneurs with the resources they need to realize their innovative ideas, expand their operations and achieve growth. Without venture capital funding, many startups would struggle to secure the capital needed to realize their vision.

Venture capital firms not only provide funding but also bring their expertise, resources and networks to help startups succeed. These firms partner with founders and management teams to develop and execute effective growth strategies, focusing on scaling operations, increasing revenue and driving profitability.

However, the high potential for returns also carries a significant level of risk. While some startups thrive, others may not take off due to various reasons. To minimize this risk, venture capital firms undertake extensive research and analysis and may even concentrate their investments in specific niches within the technology industry, such as artificial intelligence.

Venture capital is an inherently optimistic form of investment – which is both its primary strength and its primary weakness.

Neil Blumenthal

Startup Funding Slowdown: A Year After Record-Breaking 2021

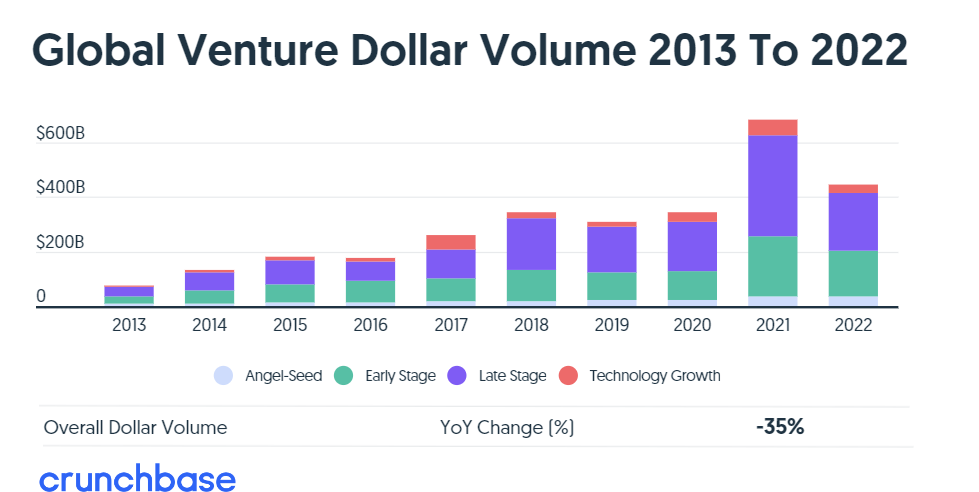

It’s been a year since the startup funding world experienced a booming period fueled by the record-breaking numbers of 2021. As we move into 2023, the picture has changed significantly. Despite initial expectations of sustained growth, the startup funding scene has slowed down significantly. According to Crunchbase, the global venture funding in 2022 was $445 billion, which is a marked decrease of 35% compared to the previous year when startups raised a total of $681 billion.

Nevertheless, many experts believe that startup funding will continue to grow in the future, with new and innovative businesses emerging and seeking investment to bring their ideas to life.

Exploring the Naming Strategies of Venture Capital Firms

In this report, we delve into the world of venture capital and examine the naming practices of some of the industry’s most successful firms. We will analyze the choices these firms have made regarding their names in order to gain a deeper understanding of the trends and strategies that have contributed to their success.

Namepicks

NEA / New Enterprise Associates

New Enterprise Associates (NEA) is a leading US venture capital firm that invests in companies across multiple industries, from the seed stage to the growth stage. Throughout its history, the firm has invested in nearly 1,000 companies, resulting in over 250 IPOs and 450 mergers and acquisitions. Some of the companies in NEA’s portfolio include well-known brands such as Databricks, Genies, MasterClass, Robinhood, Plaid, Cloudflare, Upwork, Box and more.

Founded in 1977 by C. Richard Kramlich, Chuck Newhall and Frank Bonsal, NEA is a leader in the global venture capital community with over $25 billion in capital committed.

Nobody ever said sourcing innovation, spotting big market opportunities and building great businesses was easy–it’s not! And doing it well for nearly four decades is no fluke. By combining deep sector knowledge, a collaborative team structure, and the broad perspective scale brings, we show up early, dive deep and make things happen.

NEA’s team

You can find the firm on their three-letter domain name NEA.com. Three-letter .com domains are rare and valuable due to the fact they are easy to remember and can be used as acronyms for companies with longer names. There are over 50,000 character combinations you can make with three characters, and by 1997, all of them are registered in .com. Over 60% of those are in use by companies like NEA, ABC, YSL, IBM, HTC and the like and will likely not be available for decades to come.

Accel

Accel is a venture capital firm that invests in early and growth-stage companies with a focus on technology and innovation. The firm has a long history of successful investments in companies that have gone on to become leaders in their respective industries, such as Facebook, Dropbox, Spotify, Atlassian, DJI, Discord, Hootsuite, Flipkart, BlaBlaCar, CoinTracker, and more.

Our decades-long experience has taught us the importance of patience and discipline—especially during periods of volatility and change like we are experiencing today. Accel has navigated multiple economic cycles before, across many different regions and industries. Through it all, we have been persistent, steadfast, and energized by the goal of turning emerging technology companies into global enduring businesses, both in good times and bad.

The Partners at Accel

Accel operates on the exact brand match domain name Accel.com signaling authority and trust – fully aligned with their positioning.

In the context of the venture capital firm, the name “Accel” suggests a focus on supporting and accelerating the growth of startups and entrepreneurs.

Kleiner Perkins

Kleiner Perkins is one of the largest and most established venture capital firms, with investments worth $10 billion in multiple leading companies such as Amazon, Google, Twitter, Genentech, Spotify, JD.com and Slack and more.

The company was founded in 1972 as Kleiner, Perkins, Caufield & Byers (KPCB) in Menlo Park, California and is named after its four founders: Eugene Kleiner, Tom Perkins, Frank J. Caufield, and Brook Byers.

For five decades we have partnered with intrepid founders to build iconic companies that made history. Today, Kleiner Perkins continues that legacy, investing in founders with bold ideas that span industries and continents, partnering with them from inception to IPO and beyond to maximize the potential of their ideas… and make history.

Kleiner Perkins’ team

The company operates on the exact match domain name KleinerPerkins.com and also owns KPCB.com. Having a good domain strategy is essential for any business that wants to maintain a reliable and recognizable presence online.

Our recent post delves into the topic of using a personal name as a brand name. Discover the stories behind some of the most successful companies that bear the names of their founders. The report highlights the benefits of using a personal name for branding purposes, such as establishing trust, fostering a more personal relationship with customers and giving the brand a unique character and genuine authenticity.

Battery

Founded in 1983, Battery Ventures is a global, technology-focused investment firm specialising in financing potentially cutting-edge, category-defining market businesses. The firm makes venture capital and private equity investments and operates globally through offices in the U.S., Europe and Israel. For its 40-year story, Battery has invested in more than 450 companies and names such as Affirm, Angi, Amplitude, Braze, BigPanda, Coinbase, Glassdoor and more.

At Battery, partnering with founders to build companies is in our DNA. Our stage-based approach was developed to provide valuable assistance throughout a company’s journey. Whether it’s assistance with early market validation or expanding into new customer segments, channels or markets, the team can help you navigate to your next stage of growth. Our community of executives, thought leaders and experts in their craft are ready to lend a hand.

Battery’s team

The name Battery symbolizes a source of power and energy and is well chosen to reflect the firm’s mission to invest in and support innovative companies on their way to growth.

Battery has invested in both, Battery.com and BatteryVentures.com. Domains with dictionary words are easy to remember, as they are typically straightforward and descriptive. They can convey credibility and professionalism, as they are often perceived as clearer and more reliable names. This can be especially important for businesses that want to build customer trust and credibility. They also give a strong competitive edge by increasing organic traffic and overall marketing effectiveness.

GV / Google Ventures

GV, formerly known as Google Ventures, is the venture capital arm of Alphabet Inc. Established in 2009, the firm operates as an independent entity and invests in a diverse range of startups spanning the Internet, software and hardware industries to life sciences, healthcare, AI, transportation, cybersecurity and agriculture. With over $8 billion in assets under management and a portfolio of 400 active companies in North America and Europe, GV boasts a distinguished investment history, including successful investments in Uber, Nest, Slack, GitLab, Duo Security, Flatiron Health, Verve Therapeutics, and One Medical.

We got into venture capital for the venture (and the adventure) — to help founders take on the world’s biggest challenges, knowing that part of their preparation requires capital. But it also requires the right mindset, building the right team, developing the right product, and picking a partner for the journey with the know-how for giving support and space to grow and learn.

GV’s team

GV can be found on the rare and valuable two-letter .com domain name GV.com. These types of domain names are highly coveted in the market due to their uniqueness and rarity, as there are only a total of 676 two-letter .com domain names that exist.

Google has a vast portfolio of premium domain names for its services, including Wallet.com for Google Wallet and Nest.com for Google Nest, a line of smart home products. In addition to its premium domain names, Google also owns various misspellings of its own name, such as Googl.com, Gogle.com, and Goggle.com. This helps ensure that users are redirected to the search engine even if they accidentally misspell the name. The practice of owning a broad range of domain names, including misspellings, is common among companies to secure their brand.

The giant also has other interesting acquisitions like abcdefghijklmnopqrstuvwxyz.com and GoogleSucks.com as a safeguard. The latest Whois data shows that Google LLC owns over 137K domain names.

Highlights

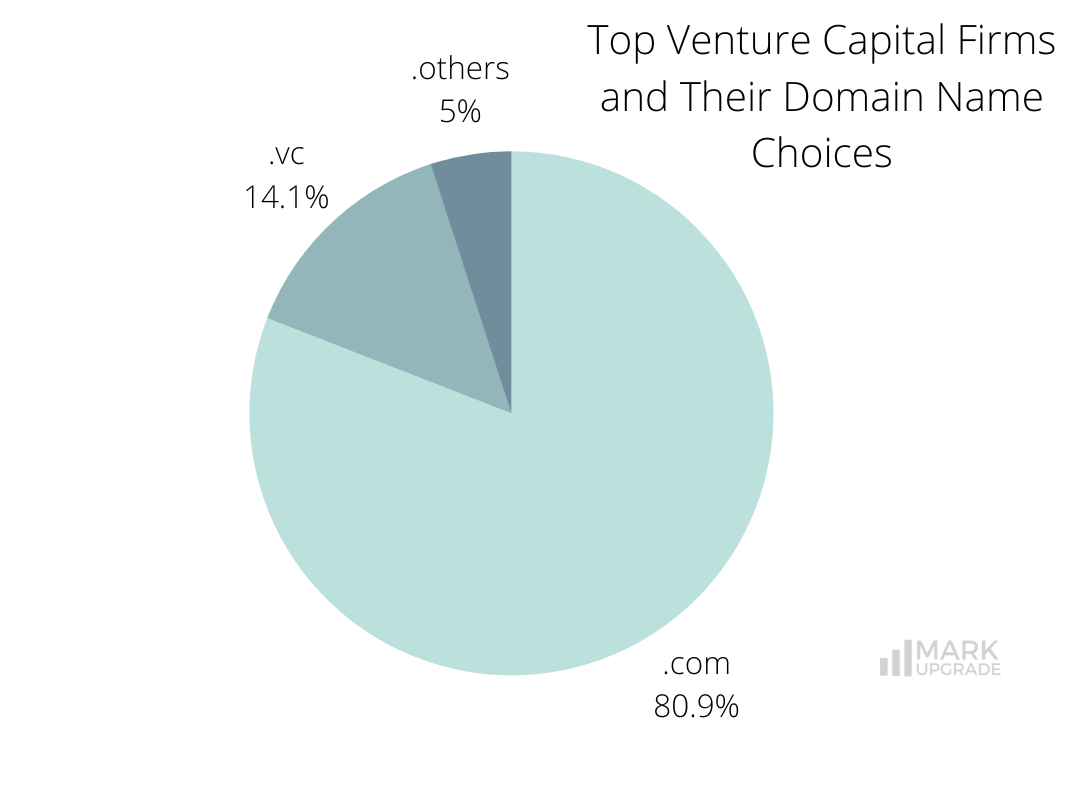

Securing a .com domain name is the preferred choice for businesses looking to establish their online presence, with 254 out of 300 companies on our list choosing this extension. The .com domain is widely regarded as the most credible and respected choice and can assist businesses in building trust and credibility with their target audience.

It’s no surprise that .vc is the second most popular extension with 34 firms. This is a common practice among VC companies, as it communicates their field of activity. The .vc extension is actually the Internet country code top-level domain for Saint Vincent and the Grenadines, and many of the businesses in the field are rarely aware of that fact and the risks it can carry for their brands.

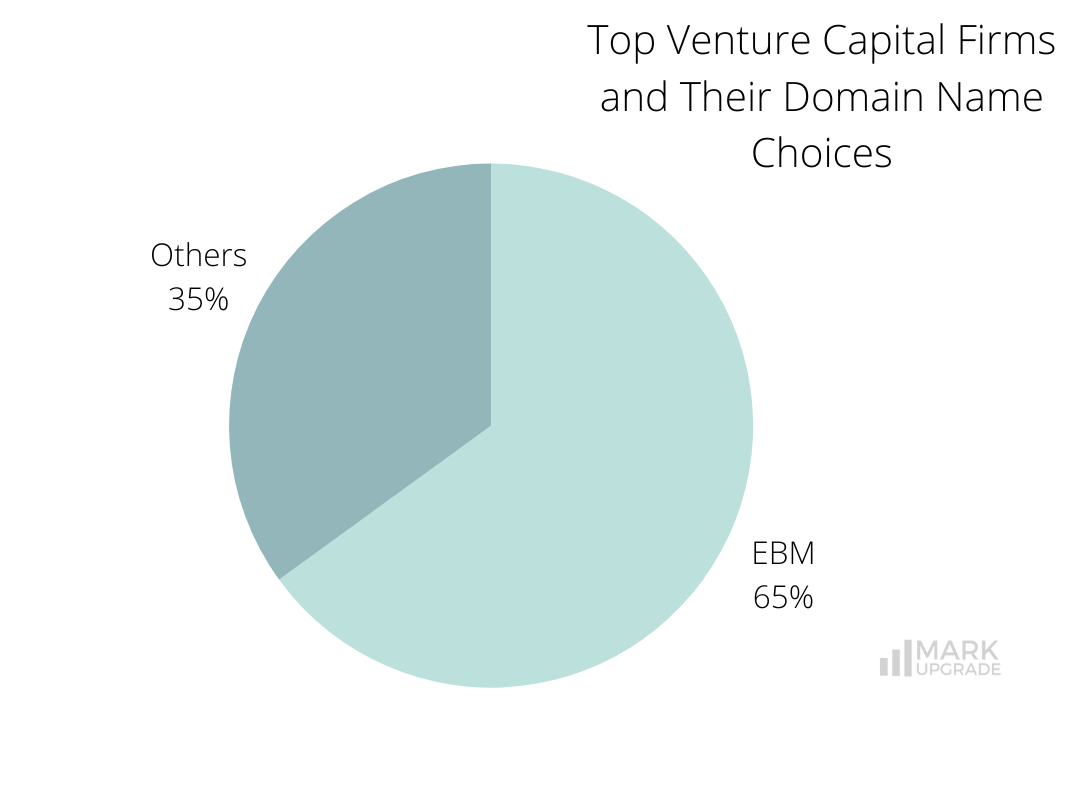

Exact Brand Match .com Domain Names

195 firms on the list have invested in exact brand match .com domains. Having an exact match domain name is a great way to make sure your business is secure and easily found online, as customers will usually look for the exact domain name when searching for your brand. Owners of premium domain names report a wide range of benefits, including improved brand recognition, increased visibility and customer trust.

Three-Letter .com Domain Names

14 companies on the list own a three-letter .com domain name. Three-letter .com domains hold significant value because of their rarity and high demand. They are also short and easy to remember. Names like that are rare branding assets and communicate instant authority and trust.

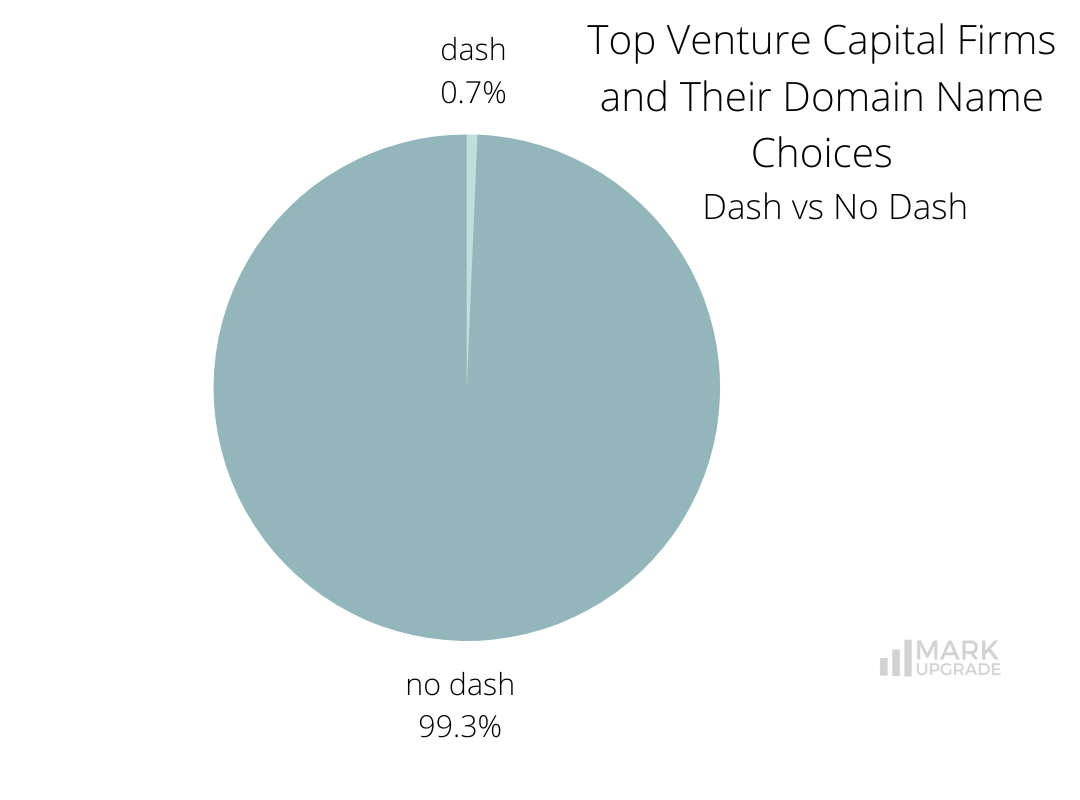

Uses of a Dash in Domain Names

2 firms use a dash in their domain name. One of the downsides of using a hyphen in a domain name is that adding it to your domain name makes it harder to reach when typing.

While we make every effort to ensure the data on our site is accurate, complete, and up-to-date, we cannot guarantee its reliability. Our data is provided for informational purposes only and should not be relied upon as legal, financial, or other advice. We strongly recommend that you independently verify any information before relying on it.

Other resources

- Stephane Nasser on the Rapid Growth of OpenVC and How to Secure Venture Funding

- Is It Worth Paying for a Premium Domain Name?

- What Makes Premium Domain Names Strategic Assets?

- From Adventures to Online Ventures: James Oliver’s Story

In today’s fast-paced online market, a premium domain name can be the difference between success and failure. Don’t let your competition get ahead – invest in a premium domain name today and avoid the potential loss of customers and revenue.

branding business domain domain name domain names domains firms naming venture capital

Previous Next