Discover the latest trends in global monthly funding data, with a unique focus on companies’ domain name choices, in our monthly funding reports.

Overview

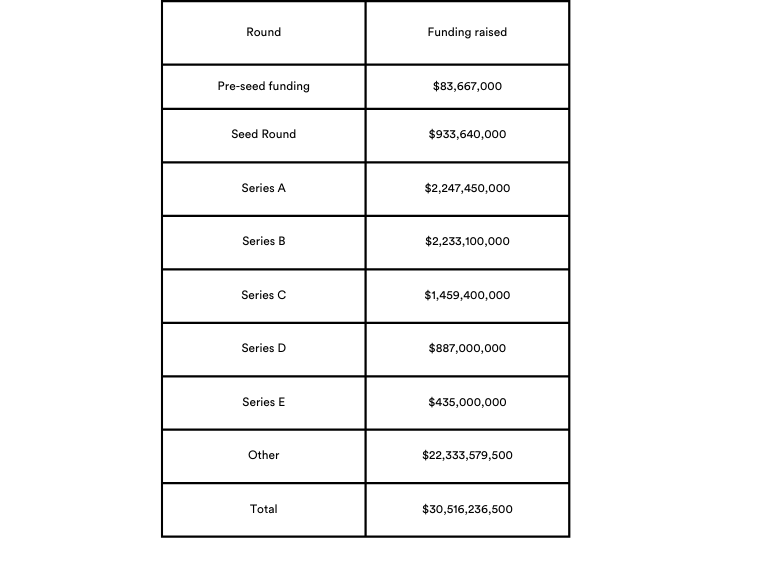

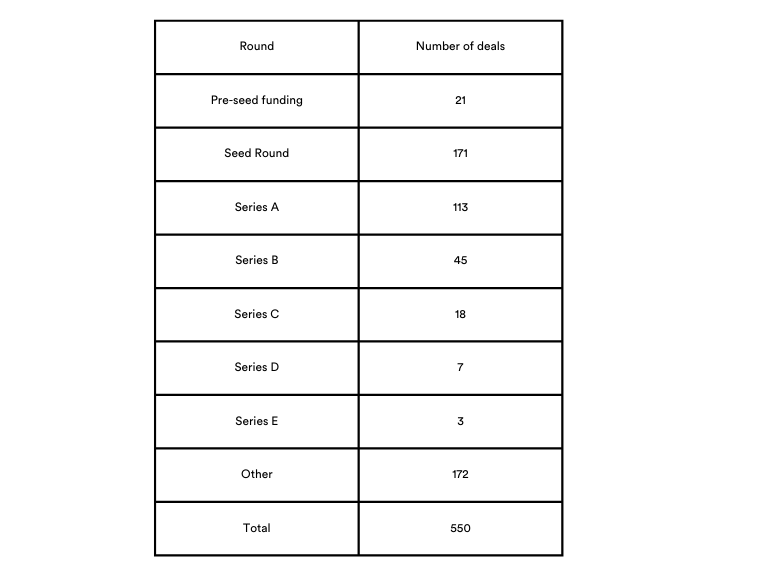

While Pre-seed funding, despite experiencing a decrease in the number of deals, witnessed an increase in the amount raised, Series Seed Round and Series A both saw declines in both the number of deals and the total raised, suggesting a possible shift in investor focus away from these stages.

| Round | Amount October (USD) | Number deals October | Amount November (USD) | Number deals November |

| Pre-seed funding | 71,238,482 | 33 | 83,667,000 | 21 |

| Seed Round | 1,302,251,073 | 198 | 933,640,000 | 171 |

| Series A | 3,106,740,000 | 145 | 2,247,450,000 | 113 |

| Series B | 1,967,270,000 | 51 | 2,233,100,000 | 45 |

| Series C | 2,631,400,000 | 21 | 1,459,400,000 | 18 |

| Series D | 782,700,000 | 10 | 887,000,000 | 7 |

| Series E | 11,000,000 | 1 | 435,000,000 | 3 |

| Other | 33,308,545,210 | 132 | 22,333,579,500 | 172 |

| Total | 43,181,336,765 | 591 | 30,516,236,500 | 550 |

Series B, similar to Pre-seed, exhibited a decrease in the number of deals but saw an increase in the total funding amount. This might indicate a preference among investors for slightly more mature startups with proven potential for growth. Series D followed a similar pattern, with fewer deals but a higher total funding amount, highlighting a continued investor interest in later-stage startups.

Series E funding, typically associated with more mature startups, showed growth in the number of deals and the total funding amount. This outlier suggests that certain late-stage startups continued to attract significant investments due to their proven track records and potential for further scaling.

The total number of deals and the total funding amount decreased significantly in November compared to October. This trend might be attributed to various factors, including investors becoming more selective or cautious in their choices or startups opting for different funding sources.

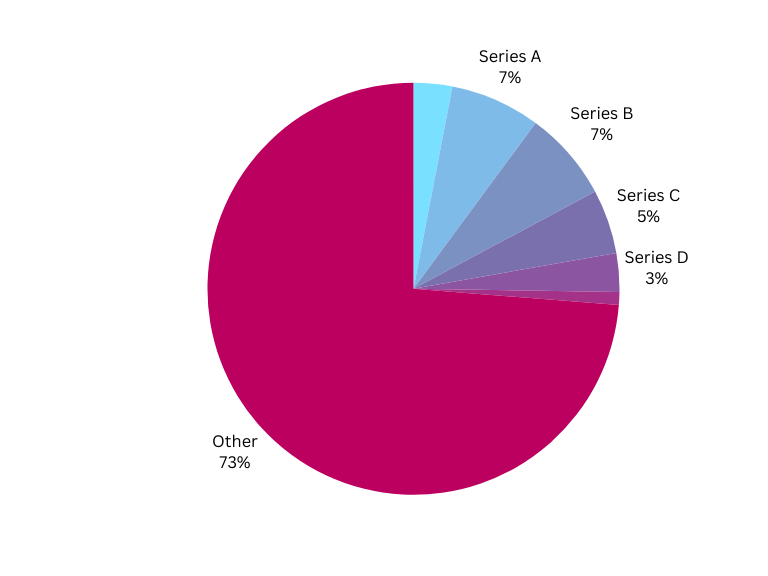

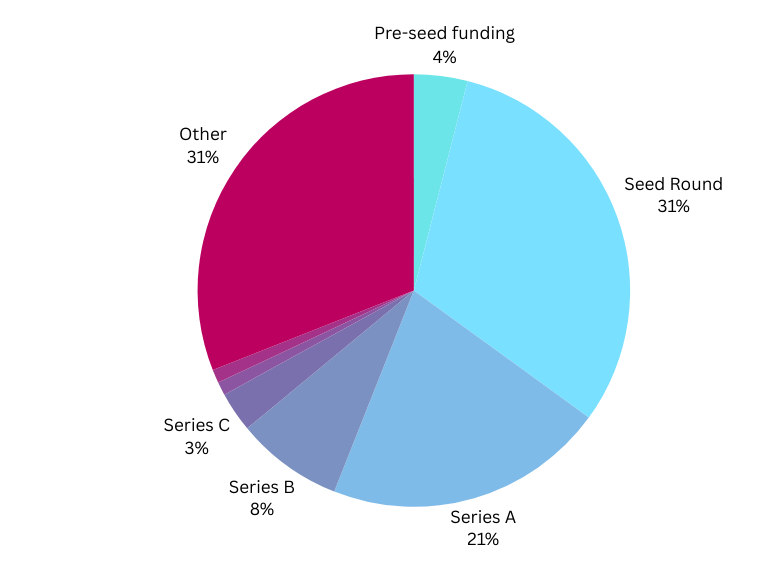

By funds raised/ Total funding $30,516,236,500

By number of deals/Total number of deals 550

Healthcare and financial services companies raised the largest amounts last followed by Artificial intelligence.

Below, we will examine some companies on our list and explore their brand and domain name choices.

Namepicks

Blockchain.com

Industry: Blockchain, Cryptocurrency, FinTech, Trading Platform

Funds Raised: $110,000,000 Series E

Crypto exchange and wallet provider Blockchain.com has raised $110 million in a Series E funding round led by Kingsway Capital. The funding round also involved investors such as Baillie Gifford, Lakestar, LSVP, GV, Access Industries, Moore Capital, Prudence, Freeman Capital, Coinbase Ventures, Pledge Ventures and others. According to Bloomberg, sources familiar with the situation have reported that Blockchain.com’s current valuation is “less than half” of the $14 billion peak it achieved.

The Blockchain.com domain is a powerful asset reflecting the organisation’s expertise in the blockchain and cryptocurrency sector, making it an invaluable tool for branding and market positioning. It’s a clear statement that the company is a key player in the space, and it makes sense to showcase this strong domain name prominently in all aspects of their branding and communication strategy.

Using a generic word as a brand name can be hard to market, especially a term as popular as Blockchain. To avoid any confusion and direct users straight to their website, cutting out third parties and competitors, the company officially included the .com extension in its brand name.

While subtle, we think this is an important change that will not only help disambiguate our company from the underlying technology, but it will also help prospective customers better understand how to find us and how we can best serve them — whether it’s setting up a Blockchain Wallet or buying crypto on our exchange.

Peter Smith, CEO of Blockchain.com, about the company’s rebrand

Blockchain.com is featured in our 2010-2020 A decade of domains article.

Tenet

Industry: Financial Services, FinTech, Marketplace

Funds Raised: $10,000,000 Series A and $20,000,000 Debt Financing

Tenet, a climate-focused fintech platform dedicated to making electric vehicle (EV) ownership more affordable for consumers and businesses, has successfully secured over $30 million in funding. This sum includes a Series A investment of over $10 million and a $20 million warehouse debt facility.

The Series A round, led by Nyca Partners, aims to accelerate the expansion of Tenet’s pioneering EV financing product and enhance TenetConnect, their newly launched digital platform for renewable energy. The $20 million warehouse debt facility from Silicon Valley Bank will bolster Tenet’s ability to finance EV loans for both individual and business customers.

Our mission is to help our customers save money by electrifying their lives and serve as the financial fabric of the energy transition. Helping customers affordably purchase EVs is just the first step in our journey. With the support of partners like Nyca and SVB, we’re able to scale our unique platform in innovative new ways – like TenetConnect – to continue making EV ownership more accessible, affordable, and rewarding.

Alex Liegl, Co-founder and CEO of Tenet

The company owns the exact brand match domain name Tenet.com. Single-word .com domains are known for exuding a sense of authority and professionalism. They are easy to type, remember and share, thus contributing positively to user experience and brand engagement. The palindromic nature of the name “Tenet,” which reads the same forwards and backwards, adds a unique layer of memorability and distinction. This feature, combined with the brevity and clarity of the domain, makes it an invaluable asset in digital marketing and customer engagement, possibly increasing website traffic and promoting stronger brand recognition.

Petvisor

Industry: Business Intelligence, Software, Veterinary

Funds Raised: $100,000,000 Venture Round

Petvisor, a leading platform for managing veterinary and pet service businesses, has secured over $100 million in fresh funding. Apax Digital Funds spearheaded this investment, with support from Frontier Growth, PeakSpan Capital, and Petvisor’s own team. In addition, Mia Hegazy and Dave Evans from Apax Digital will now be part of Petvisor’s Board of Directors.

This funding arrives as pet ownership in the United States continues to surge, with 66% of households (equivalent to 86.9 million homes) now having a pet in 2023.

We started as a single software tool to make communication and pet health compliance easy for one-clinic practices, and we have grown into a suite of solutions covering the total patient engagement needs of pet healthcare and services providers – with the ability to service any multi-location provider. Now, with help from Apax Digital and Apax’s renowned operating team, we will accelerate our growth and fulfill our long-term vision of building a fully equipped platform that both enhances and extends the lives of pets around the globe.

Tim Callahan, CEO of Petvisor

To achieve a distinctive and memorable brand name, Petvisor used a hybrid naming approach by combining two words. As a result of this strategy, the company has been able to establish a robust and unique brand presence that effectively communicates its distinct value proposition to customers.

Petvisor serves as the parent company to a portfolio of renowned brands such as PetDesk, Vetstoria, WhiskerCloud, Kontak, and Groomer.io. The majority of the Petetch companies in our research about Pet tech companies and their domain name choices, including Petvisor itself, operate on exact brand match domain names. This strategic approach offers a host of benefits, foremost among them being seamless alignment between the brand identity and online presence. This synergy enhances recognition and builds trust and credibility in the minds of customers, making it a powerful tool for brand building.

Vida Health

Industry: Health Care, Medical, mHealth, Personal Health, Therapeutics

Funds Raised: $28,500,000 Venture Round

Vida Health is a purposefully designed virtual care platform focusing on holistic healthcare, addressing mental and physical well-being in unison. The company raised $28,500,000 in a Venture Round led by existing investors such as General Atlantic, Ally Bridge, Canvas Ventures, Hercules Capital, and other insiders, aimed to support Vida Health’s continued growth, with a particular focus on expanding its presence in the GLP-1 market.

The company intends to use the funds to scale further and pursue ongoing growth opportunities.

Vida’s offering has the potential to redefine virtual cardiometabolic care and improve the lives of millions, and I am passionate about advancing our mission and leading the company through our next phase of growth.

Joe Murad, CEO of Vida

The brand name “Vida,” which translates to “life” in Spanish and Portuguese, perfectly aligns with the company’s mission of eradicating chronic diseases and enhancing lives through improved health. The abstract “V” or “Bloom” in the Vida logo symbolises individuals reaching their full potential. The company has invested in the premium CVCV exact brand match domain, Vida.com. Such domain names are concise, universally pronounceable, memorable, and radiate a positive and vibrant energy, conveying confidence to customers, investors, and business partners alike.

Castore

Industry: Brand Marketing, Sports, Wearables

Funds Raised: $184,200,000 Growth Funding

Castore, the tech-driven sportswear brand headquartered in Manchester, has seen its valuation soar to £950 million following a substantial £150 million investment. Established in Liverpool in 2016 by brothers Thomas and Philip Beahon, this funding initiative was spearheaded by The Raine Group, a globally recognised TMT merchant bank, in collaboration with Hanaco Ventures and Felix Capital.

With this investment, the Beahon brothers aim to increase the company’s financial capabilities, allowing them to make strategic investments in supply chain enhancements and data analytics.

Our vision when we founded Castore was to create a proudly British brand competing on the global stage and we won’t stop until we get there. The mission continues.

Thomas Beahon, Co-Founder of Castore

“Castore” originates from the Greek myth of Castor and Pollux, two brothers who famously challenged the mighty Zeus. The name fits perfectly with the brand’s beginnings, which Tom and Phil’s competitive nature inspired. They grew up near Castore’s current office in the Wirral, where Tom was a skilled footballer, and Phil was a rising cricket star.

In a savvy move, the brothers secured the exact brand match domain name Castore.com. This clever decision positions the brand for a promising future and a prominent standing in the sportswear industry.

Highlights

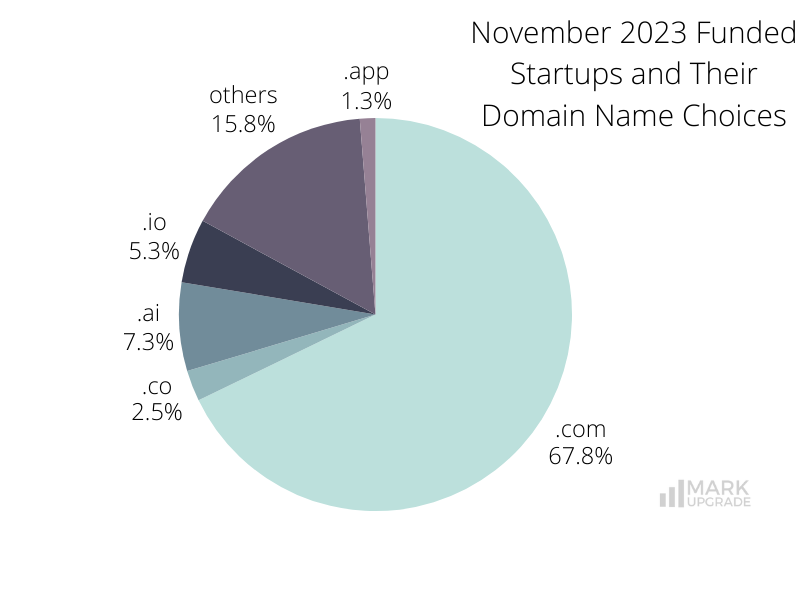

Unsurprisingly, “.com” emerges as the most favoured domain extension, with 373 companies opting for its universal appeal.

The tech sector sees “.ai” and “.io” as preferred choices, with 40 and 29 companies, respectively. “.ai” signifies a focus on artificial intelligence, while “.io” typically relates to input/output.

7 companies have chosen to operate on the .app extension. The “.app” domain extension is a generic top-level domain (gTLD) introduced by Google. It was designed primarily for mobile and web app developers and businesses, offering a distinct and recognisable domain space for application-related content.

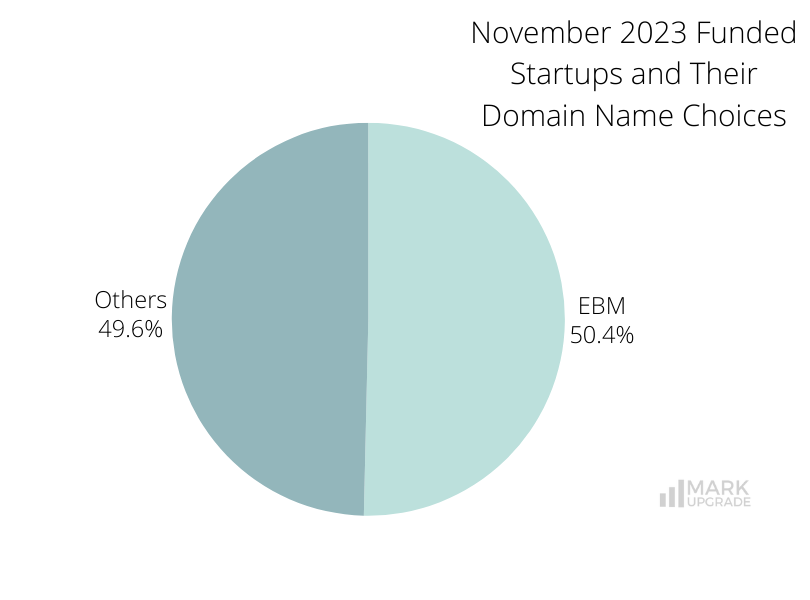

The majority of companies have invested in exact brand match domain names, a decision that not only safeguards their brand online but also shields them from issues like traffic and email leaks.

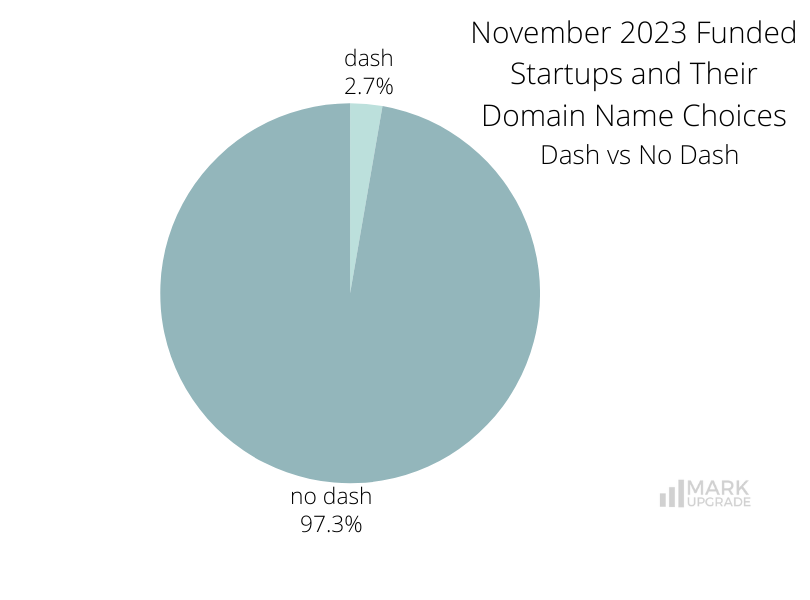

Dashes (“-“) feature in the names of 15 companies, a common choice when crafting domain names for two-word brands or when compromises are necessary due to domain availability, reaffirming the adaptability of businesses in securing their online presence.

| domain | company | round | funding (USD) | ebm |

|---|---|---|---|---|

| 1up.ai | 1up | Pre-Seed Round | 2.500.000 | no |

| 21bitcoin.app | 21bitcoin | Seed Round | 2.200.000 | no |

| abb.com | ABB | Post-IPO Debt | 544.500.000 | yes |

| accelextech.com | Accelex | Series A | 15.000.000 | no |

| aclaritywater.com | Aclarity | Series A | 15.900.000 | no |

| acorai.com | Acorai | Grant | 2.400.000 | yes |

| adionics.com | Adionics | Series B | 27.000.000 | yes |

| advancedelectricmachines.com | Advanced Electric Machines | Series A | 28.900.000 | yes |

| aeliusbiotech.co.uk | Aelius Biotech | Venture Round | 1.500.000 | no |

| aetherbiomedical.com | Aether Biomedical | Series A | 5.800.000 | yes |

| africahealthcarenetwork.com | Africa Healthcare Network | Venture Round | 20.000.000 | yes |

| agentio.com | Agentio | Seed Round | 4.250.000 | yes |

| ai21.com | AI21 | Series C | 53.000.000 | yes |

| aigen.io | Aigen | Series A | 12.000.000 | no |

| aikidosecurity.com | Aikido | Seed Round | 5.400.000 | no |

| aircompany.com | Air Company | Venture Round | 30.400.000 | yes |

| airexpert.net | AireXpert | Seed Round | 3.000.000 | no |

| airloomenergy.com | Airloom Energy | Seed Round | 4.000.000 | yes |

| aleph-alpha.com | Aleph Alpha | Series B | 500.000.000 | no |

| algomo.com | Algomo | Grant | 1.500.000 | yes |

| almondfintech.com | Almond FinTech | Seed Round | 7.000.000 | yes |

| almondfintech.com | Almond FinTech | Seed Round | 7.000.000 | yes |

| alpheya.com | Alpheya | Venture Round | 300.000.000 | yes |

| altoneuroscience.com | Alto Neuroscience | Series C | 45.000.000 | yes |

| altr.com | ALTR | Series C | 25.000.000 | yes |

| ambercycle.com | Ambercycle | Venture Round | 5.000.000 | yes |

| amini.ai | Amini | Seed Round | 4.000.000 | no |

| anotherball.com | AnotherBall | Seed Round | 12.700.000 | yes |

| aperiambio.com | Aperiam Bio | Seed Round | 9.000.000 | yes |

| apiture.com | Apiture | Venture Round | 10.000.000 | yes |

| appflowy.io | AppFlowy | Seed Round | 6.400.000 | no |

| appmap.io | AppMap | Venture Round | 10.000.000 | no |

| aptoide.com | Aptoide | Corporate Round | 9.000.000 | yes |

| aptus.ai | Aptus.AI | Seed Round | 3.600.000 | no |

| arch.co | Arch | Series A | 20.000.000 | no |

| aristamd.com | AristaMD | Series C | 16.500.000 | yes |

| arobiotx.com | Aro Biotherapeutics | Series B | 41.500.000 | no |

| arrival.com | Arrival | Post-IPO Debt | 50.000.000 | yes |

| arrivobio.com | Arrivo | Series B | 45.000.000 | no |

| artica-tx.com | Artica Therapeutics | Seed Round | 12.900.000 | no |

| artisan-ai.com | Artisan | Pre-Seed Round | 2.300.000 | no |

| ascidian-tx.com | Ascidian | Series A | 40.000.000 | no |

| astrobeam.com | AstroBeam | Seed Round | 3.000.000 | yes |

| atlas.design | Atlas | 6.000.000 | no | |

| atombank.co.uk | Atom | Equity Round | 121.549.500 | no |

| augment.org | Augment | Seed Round | 6.000.000 | no |

| augmentus.tech | Augmentus | Series A | 5.000.000 | no |

| avantihelium.com | Avanti Helium | Post-IPO Equity | 1.200.000 | yes |

| axify.shop | Axify | Series A | 13.000.000 | no |

| aypa.com | Aypa | Debt Financing | 550.000.000 | yes |

While we make every effort to ensure the data on our site is accurate, complete, and up-to-date, we cannot guarantee its reliability. Our data is provided for informational purposes only and should not be relied upon as legal, financial, or other advice. We strongly recommend that you independently verify any information before relying on it.

Whether you’re a small business owner or a large corporation, a premium domain name can help boost your brand and increase your online presence. If you’re ready to take the next step, contact us to learn more about our premium domain name options and how they can benefit your business.

Other resources

2023 branding business domain domain name domain names domains funding Monthly Funding Report naming november

Previous Next