Discover the latest trends in global monthly funding data, with a unique focus on companies’ domain name choices, in our monthly funding reports.

Overview

In the pre-seed funding category, October marked an increase in the number of deals (from 29 to 33) and the total funding amount (from $43,406,538 to $71,238,482), signifying a healthy level of early-stage startup activity.

| Round | Amount September (USD) | Number deals September | Amount October (USD) | Number deals October |

| Pre-seed funding | 43,406,538 | 29 | 71,238,482 | 33 |

| Seed Round | 1,013,379,000 | 179 | 1,302,251,073 | 198 |

| Series A | 1,922,400,000 | 104 | 3,106,740,000 | 145 |

| Series B | 3,942,443,365 | 68 | 1,967,270,000 | 51 |

| Series C | 4,155,600,000 | 27 | 2,631,400,000 | 21 |

| Series D | 1,522,000,000 | 9 | 782,700,000 | 10 |

| Series E | 580,000,000 | 3 | 11,000,000 | 1 |

| Other | 12,409,954,674 | 104 | 33,308,545,210 | 132 |

| Total | 25,589,183,577 | 523 | 43,181,336,765 | 591 |

Seed Round saw a slight rise in the number of deals (from 179 to 198) and the funding amount in October (from $1 013 379 000 to $1 302 251 073), reflecting continued investor interest in supporting early-stage startups.

Series A funding saw a significant boost in October, with more deals (145 compared to 104 in September) and a substantial increase in total funding ($3 106 740 000 compared to $1 922 400 000), suggesting a growing appetite for supporting startups as they progress to the next stage of growth.

Conversely, Series B funding experienced a decline in the total funding amount in October, with fewer deals than in September.

Series C also reported a decrease in total funding (from $4 155 600 000 in September to $2 631 400 000 in October), though the number of deals remained relatively consistent.

There was a notable decrease in the funding amount in the Series D category despite a similar number of deals for both months.

Series E funding showed variations in the number of deals and the total funding amount, with October recording a single deal.

Other Rounds (Series F, Dept Financing, Post-IPO Debt, etc.) witnessed a significant increase in total funding in October, mainly due to substantial funding rounds in AI, pharmaceuticals, automotive, and banking and finance sectors.

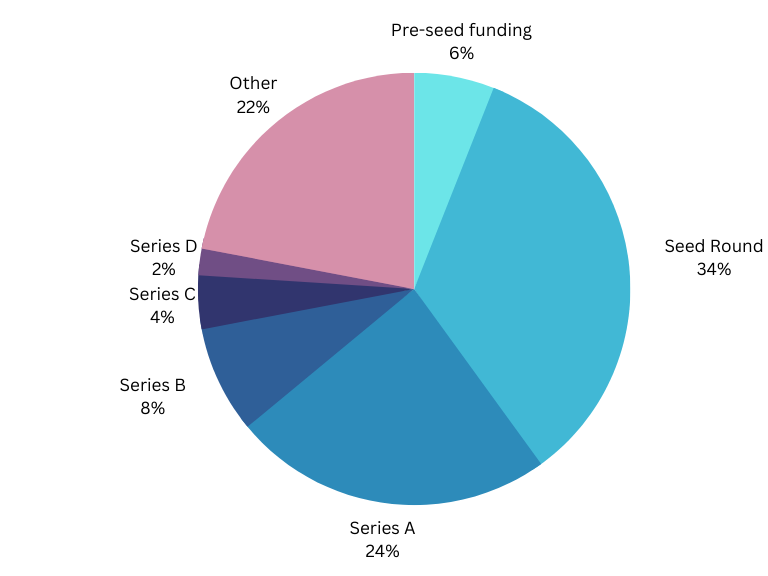

By funds raised/ Total funding $43,181,336,765

By number of deals/Total number of deals 591

Some industries that saw the most significant funding rounds include Artificial Intelligence, Information Technology, Machine Learning, Biotechnology, Banking, Finance, Financial Services, FinTech, Property Management, Real Estate, Automotive, Electric Vehicles and Clean Energy.

The funding data for October reveals a different story compared to September. In October, investor interest shifted away from later-stage startups, particularly in Series B and Series C, which were more prominent in September. Instead, October emphasises greater investor attention on early-stage ventures, potentially driven by the promise of innovative ideas and technologies, as indicated by the rise in the number of deals and total funding in the pre-seed and seed funding categories.

Below, we will examine some companies on our list and explore their brand and domain name choices.

Namepicks

Eavor

Industry: Clean Energy, CleanTech, Energy, GreenTech, Renewable Energy

Funds Raised: $182,000,000 Series B

Eavor (pronounced “Ever”) is a leading geothermal technology company that aims to revolutionise clean, reliable, and affordable energy worldwide. Their groundbreaking solution, Eavor-Loop™, offers scalable, clean, and consistently available power. Recently securing $182 million in Series B financing, Eavor plans to advance its geothermal technology further.

Founded in 2017, Eavor Technologies has become a prominent player in scalable geothermal energy. In 2020, key partnerships were forged with Carmacks Development Corporation for Eavor-Loop implementation in Yukon and with Enex Power Germany for projects in Bavaria, Germany, benefiting from government subsidies.

Eavor Technologies may have chosen the brand name “Eavor” for its ease of pronunciation, memorability, uniqueness, relevance to its mission, and domain exact brand match domain Eavor.com availability.

Lendbuzz

Industry: Artificial Intelligence, Financial Services, FinTech

Funds Raised: $345,000,000 Lending Debt and Equity Financing

Lendbuzz, a well-known fintech company specialising in auto loans using alternative data, machine learning, and deep neural networks, has raised $345 million in funding, consisting of $45 million in stock and a significant $300 million forward flow facility. The funds will support continued initiatives in product innovation, R&D, and advanced technology to serve customers and dealer partners better.

Our focus remains on using alternative data and machine learning to provide better access to credit for underserved populations and better software solutions for our growing network of dealership partners nationwide.

Amitay Kalmar, Co-Founder and CEO of Lendbuzz for BusinessWire

Lendbuzz’s unique business model, which has been profitable for ten consecutive quarters, has achieved tremendous financial growth, with a 135% revenue increase in 2022 and over 80% in the first half of 2023, exceeding an annual revenue run-rate of more than $200 million.

By adopting Lendbuzz.com, Lendbuzz increases its online recognition, improving the visibility and credibility of its brand.

Zolve

Industry: Banking, Financial Services, FinTech

Funds Raised: $100,000,000 Debt Financing

Crossborder neobank Zolve has secured a $100 million warehouse debt facility from US-based impact investor Community Investment Management (CIM). This funding will support expanding their credit products for Indian immigrants moving to the US.

I believe that when individuals embark on journeys to new countries, be it for education or work, financial barriers should never impede their progress. With the recent capital we’ve raised, we move closer to realising a world where access to essential financial resources transcends borders and backgrounds.

Zolve founder Raghunandan G.

Zolve’s choice to secure an exact brand match domain Zolve.com aligns with a common practice among leading global brands. It underscores trust and authority, making it easier for customers to connect with the brand.

Veruna

Industry: InsurTech, Productivity Tools, SaaS, Sales Automation

Funds Raised: $10,000,000 Series B

Veruna, an all-in-one agency management system built directly on Salesforce’s premier CRM platform, has recently closed a successful Series B funding round. This cutting-edge platform incorporates predictive analytics and no-code reconfigurability, providing a distinct Customer360 solution to enhance revenue, efficiency, and customer satisfaction.

The infusion of new capital will expedite Veruna’s product development and foster expansion in critical areas, encompassing engineering, sales, marketing, and customer support.

We’re thrilled by the significant support from industry leaders. This funding gives us the fuel to push our vision forward and revolutionise the insurance sector.

Veruna CEO Jennifer Carroll

Veruna operates on the exact brand match domain Veruna.com, optimising its marketing efforts across various channels while mitigating security risks.

Pulumi

Industry: Cloud Computing, Computer, DevOps, SaaS, Software

Funds Raised: $41,000,000 Series C

Pulumi Corp, a pioneering infrastructure-as-code startup, has successfully closed a $41 million Series C funding round led by Madrona, with participation from NEA, Tola Capital, and Strike Capital. This marks Pulumi’s first external funding effort since its $37.5 million raise in October 2020, bringing the company’s total investments to $99 million since its inception in 2017.

This new infusion of capital builds upon a remarkable innovation and expansion period for Pulumi. The company achieved a 100% increase in revenue over the past year, boasting a customer base of over 2,000 enterprises and 150,000 users on its platform. Prominent enterprises such as Univision, Moderna, Pinecone, the LEGO Group, and others have adopted Pulumi to expedite their innovation initiatives. A noteworthy milestone is that over half of the Fortune 50 companies now utilize Pulumi to simplify the complexities of the cloud.

Pulumi, a Hawaiian term meaning “broom,” pays tribute to Chris Brumme, a dear friend and mentor of CEO and co-founder Joe Duffy, even though it is a playful mispronunciation of his name. The company’s founding principles revolve around community and empowering developers with “superpowers.” While Pulumi has witnessed substantial growth, it remains committed to the open-source ethos, making its resources accessible to the community, which remains at the heart of its mission.

To safeguard its brand online, eliminate the risk of traffic and email confusion, and bolster trust among customers and partners, Pulumi has secured the exact brand match domain Pulumi.com.

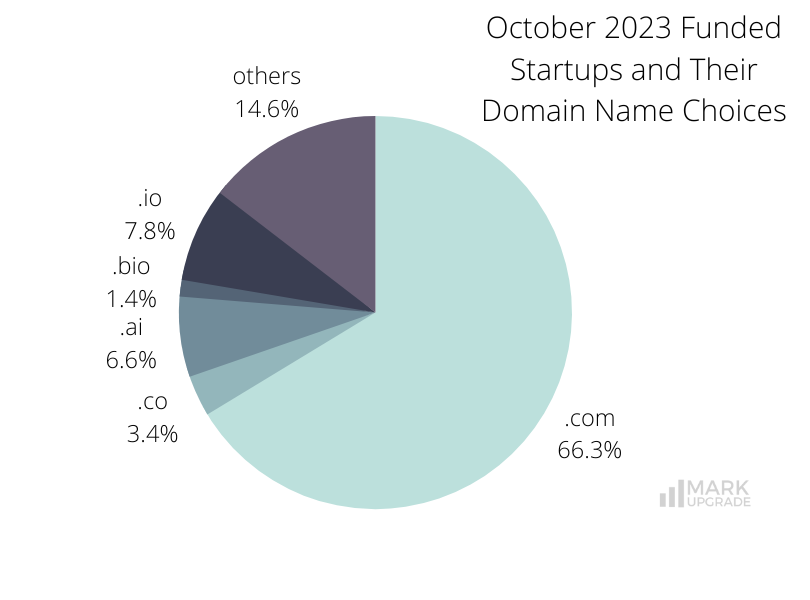

Highlights

.com extension and exact brand match ( EBM) domains continue to be the preferred choices for companies due to their trustworthiness and brand-building potential. While newer extensions like .io and .ai are gaining popularity, .com remains the gold standard for online presence. Companies choosing .com and EBM domains benefit from strong brand recognition and the ability to stand out in a crowded digital landscape.

392 out of 591 companies use the .com extension: The .com widespread recognition and familiarity make it an excellent choice for businesses looking to establish a solid online presence and build brand credibility.

.io and .ai are used by 46 and 39 entries. Tech startups have widely adopted both as they are associated with popular technology terms) and offer a lot more availability than other TLDs.

20 companies operate on .co. The .co extension is a top-level domain extension and is the acronym for company or corporation. It is often seen as an alternative to .com, especially for startups and entrepreneurs. Country domain codes offer more freedom of choice but come with certain risks for businesses.

A smaller number of companies on our list have chosen a variety of other domain extensions. These may align with specific industry niches or creative branding strategies.

Nearly half of the companies on the list have chosen to operate on exact brand match domains are highly valuable in establishing a unique online identity, enhancing brand recognition, trust, and customer engagement.

20 companies include dashes in their domain names. Adding hyphens is not advised since it adds complexity for consumers who frequently overlook it while typing in a domain name.

| domain | company | round | funding | ebm |

|---|---|---|---|---|

| 10minuteschool.com | 10 Minute School | Seed Round | $5 500 000,00 | yes |

| 1337.org | 1337 | Pre-Seed Round | $4 000 000,00 | no |

| aampe.com | Aampe | Seed Round | $7 500 000,00 | yes |

| acceldata.com | Acceldata | Series C | $10 000 000,00 | yes |

| accessvascularinc.com | Access Vascular | Series C | $22 000 000,00 | no |

| accountlabs.com | Account Labs | Seed Round | $7 700 000,00 | yes |

| aclid.bio | Aclid | Seed Round | $3 300 000,00 | no |

| actymtherapeutics.com | Actym Therapeutics | Series A | $59 500 000,00 | yes |

| adlumin.com | Adlumin | Series B | $70 000 000,00 | yes |

| affine.pro | AFFiNE | Seed Round | $8 000 000,00 | no |

| agentsync.com | AgentSync | Series B | $50 000 000,00 | yes |

| agomab.com | AgomAb | Series C | $100 000 000,00 | yes |

| ai-build.com | Ai Build | Series A | $8 500 000,00 | no |

| aiclearing.com | AI Clearing | Series A | $14 000 000,00 | yes |

| aindo.com | Aindo | Series A | $6 300 000,00 | yes |

| aiolosbio.com | Aiolos Bio | Series A | $245 000 000,00 | yes |

| akahu.nz | Akahu | Venture Round | $1 400 000,00 | no |

| akuramed.com | Akura Medical | Series B | $35 000 000,00 | no |

| algenesismaterials.com | Algenesis | Seed Round | $5 000 000,00 | no |

| alianza.com | Alianza | Series D | $61 000 000,00 | yes |

| allarahealth.com | Allara | Series A | $10 000 000,00 | no |

| alliumdata.com | Allium | Pre-Seed Round | $750 000,00 | no |

| alpaca.markets | Alpaca | Convertible Note | $15 000 000,00 | no |

| amazon.com | Amazon | Series A | $25 000 000,00 | yes |

| ambient.ai | Ambient.ai | Venture Round | $20 000 000,00 | no |

| amenli.com | Amenli | Seed Round | $1 000 000,00 | yes |

| ampacimon.com | Ampacimon | Series C | $10 600 000,00 | yes |

| amperon.co | Amperon | Series B | $20 000 000,00 | no |

| ankra.io | Ankra | Pre-Seed Round | $1 160 000,00 | no |

| anonybit.io | Anonybit | Seed Round | $3 000 000,00 | no |

| anthropic.com | Anthropic | Corporate Round | $500 000 000,00 | yes |

| anyplace.com | Anyplace | Series B | $10 270 000,00 | yes |

| anysignal.com | AnySignal | Seed Round | $5 000 000,00 | yes |

| anysphere.co | Anysphere | Seed Round | $8 000 000,00 | no |

| aoadx.com | AOA | Venture Round | $17 000 000,00 | no |

| aon.com | Aon | Post-IPO Debt | $1 000 000 000,00 | yes |

| appwebel.com | Webel | Seed Round | $2 200 000,00 | no |

| aqtual.com | Aqtual | Series A | $16 000 000,00 | yes |

| arctop.com | Arctop | Series A | $10 000 000,00 | yes |

| arogga.com | Arogga | Seed Round | $4 000 000,00 | yes |

| arteria.ai | Arteria AI | Series B | $30 000 000,00 | no |

| askvera.io | Vera | Pre-Seed Round | $2 700 000,00 | no |

| assureful.com | Assureful | Pre-Seed Round | $1 500 000,00 | yes |

| astraveus.com | Astraveus | Grant | $11 000 000,00 | yes |

| astronautx.bio | AstronauTx | Series A | $59 000 000,00 | no |

| astrus.ai | Astrus | Pre-Seed Round | $2 400 000,00 | no |

| atalantech.com | Atalan | Seed Round | $2 500 000,00 | no |

| atana.com | Atana | Series A | $6 000 000,00 | yes |

| atombp.com | Atom Bioscience | Series D | $83 000 000,00 | no |

| auditcue.com | AuditCue | Seed Round | $1 500 000,00 | yes |

| audoo.com | Audoo | Venture Round | $5 000 000,00 | yes |

| auquan.com | Auquan | Seed Round | $3 500 000,00 | yes |

| automata.tech | Automata | Venture Round | $40 000 000,00 | no |

| autone.io | Autone | Seed Round | $2 700 000,00 | no |

| avishya.com | Avishya | Angel Round | $1 400 000,00 | yes |

| azul3d.com | Azul 3D | Series A | $15 000 000,00 | yes |

| azumuta.com | Azumuta | Series A | $2 900 000,00 | yes |

| baichuan-ai.com | Baichuan AI | Series A | $300 000 000,00 | no |

| baseflow.xyz | Baseflow | Angel Round | $2 500 000,00 | no |

| basis.com | Basis | Seed Round | $3 600 000,00 | yes |

| beatthebomb.com | Beat The Bomb | Series B | $15 000 000,00 | yes |

| bedrockenergy.com | Bedrock Energy | Seed Round | $8 500 000,00 | yes |

| beldex.io | Beldex | Venture Round | $3 000 000,00 | no |

| betabugs.uk | Beta Bugs | Venture Round | $2 080 000,00 | no |

| betteromics.com | Betteromics | Series A | $20 000 000,00 | yes |

| bharatagri.com | BharatAgri | Series A | $4 300 000,00 | yes |

| bisly.com | Bisly | Venture Round | $3 800 000,00 | yes |

| blackbird.xyz | Blackbird | Series A | $24 000 000,00 | no |

| blockaid.com | Blockaid | Series A | $33 000 000,00 | yes |

| bluebirds.com | Bluebirds | Seed Round | $5 000 000,00 | yes |

| bluenalu.com | BlueNalu | Series B | $34 000 000,00 | yes |

| bms.com | Bristol Myers Squibb | Post-IPO Debt | $4 500 000 000,00 | yes |

| boksi.com | Boksi | Series A | $7 400 000,00 | yes |

| bolt.earth | Bolt.Earth | Venture Round | $20 000 000,00 | no |

| bondvet.com | Bond Vet | Private Equity Round | $50 000 000,00 | yes |

| bonsairobotics.ai | Bonsai | Seed Round | $13 500 000,00 | no |

| bonusx.it | BonusX | Seed Round | $3 400 000,00 | no |

| bonvivant-food.com | Bon Vivant | Seed Round | $15 800 000,00 | no |

| borealisfoods.com | Borealis Foods | Debt Financing | $25 000 000,00 | yes |

| borrdrilling.com | Borr Drilling | Post-IPO Debt | $1 730 000 000,00 | yes |

| brickeye.com | Brickeye | Venture Round | $7 200 000,00 | yes |

| britepayments.com | Brite | Series A | $60 000 000,00 | no |

| cambrium.bio | Cambrium | Seed Round | $8 400 000,00 | no |

| canarywharf.com | Canary Wharf | Venture Round and Debt Financing | $486 000 000,00 | yes |

| candidate.fyi | Candidate.fyi | Pre-Seed Round | $1 300 000,00 | no |

| canoo.com | Canoo | Post-IPO Equity | $45 000 000,00 | yes |

| canopyservicing.com | Canopy | Series A | $15 200 000,00 | no |

| capaloai.com | Capalo AI | Pre-Seed Round | $530 000,00 | yes |

| capitalrx.com | Capital Rx | Venture Round | $50 000 000,00 | yes |

| carbonequity.com | Carbon Equity | Series A | $6 300 000,00 | yes |

| cardino.de | Cardino | Pre-Seed Round | $1 068 000,00 | no |

| carihealth.com | CARI Health | Grant | $2 800 000,00 | yes |

| castelion.com | Castelion | Seed Round | $14 200 000,00 | yes |

| castellum.ai | Castellum.AI | Seed Round | $4 000 000,00 | no |

| cedar.build | Cedar | Seed Round | $3 000 000,00 | no |

| cemvita.com | Cemvita | Grant | $1 100 000,00 | yes |

| censys.com | Censys | Series C and Debt Financing | $75 000 000,00 | yes |

| centml.ai | CentML | Seed Round | $27 000 000,00 | no |

| centrocommerce.com | Centro | Pre-Seed Round | $2 000 000,00 | no |

| cerebrumtechnologies.com | Cerebrum Tech | Series A | $1 800 000,00 | no |

While we make every effort to ensure the data on our site is accurate, complete, and up-to-date, we cannot guarantee its reliability. Our data is provided for informational purposes only and should not be relied upon as legal, financial, or other advice. We strongly recommend that you independently verify any information before relying on it.

Premium domain names are an important consideration when it comes to building and protecting your brand. If you’re ready to take the next step and invest in a premium domain name for your business, contact us to learn more about our available options and how we can help you get started.

Other resources

2023 branding business domain domain name domain names domains Funded Startups funding Monthly Funding Report naming october startup

Previous Next