Discover the latest trends in global monthly funding data, with a unique focus on companies’ domain name choices, in our monthly funding reports.

Overview

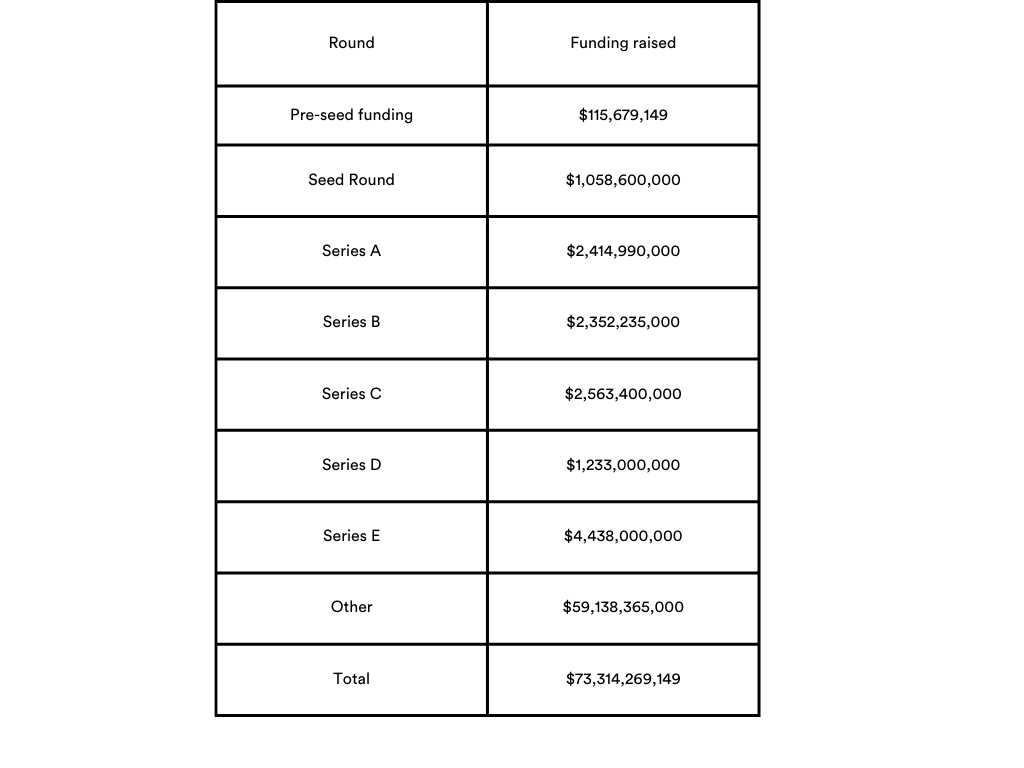

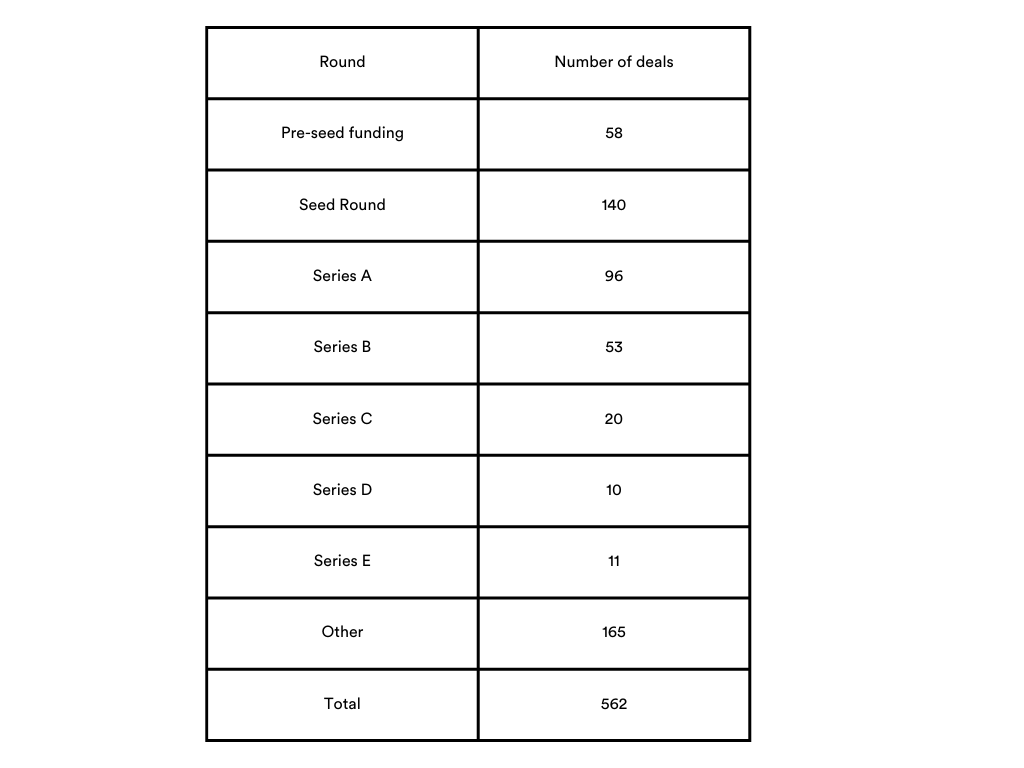

| Round | Amount February(USD) | Number deals February | Amount March(USD) | Number deals March |

| Pre-seed funding | 179,355,700 | 69 | 115,679,149 | 58 |

| Seed Round | 963,739,330 | 156 | 1,058,600,000 | 140 |

| Series A | 2,340,305,000 | 98 | 2,414,990,000 | 96 |

| Series B | 2,917,880,000 | 63 | 2,352,235,000 | 53 |

| Series C | 2,777,600,000 | 25 | 2,563,400,000 | 29 |

| Series D | 1,666,200,000 | 10 | 1,233,000,000 | 10 |

| Series E | 597,000,000 | 3 | 4,438,000,000 | 11 |

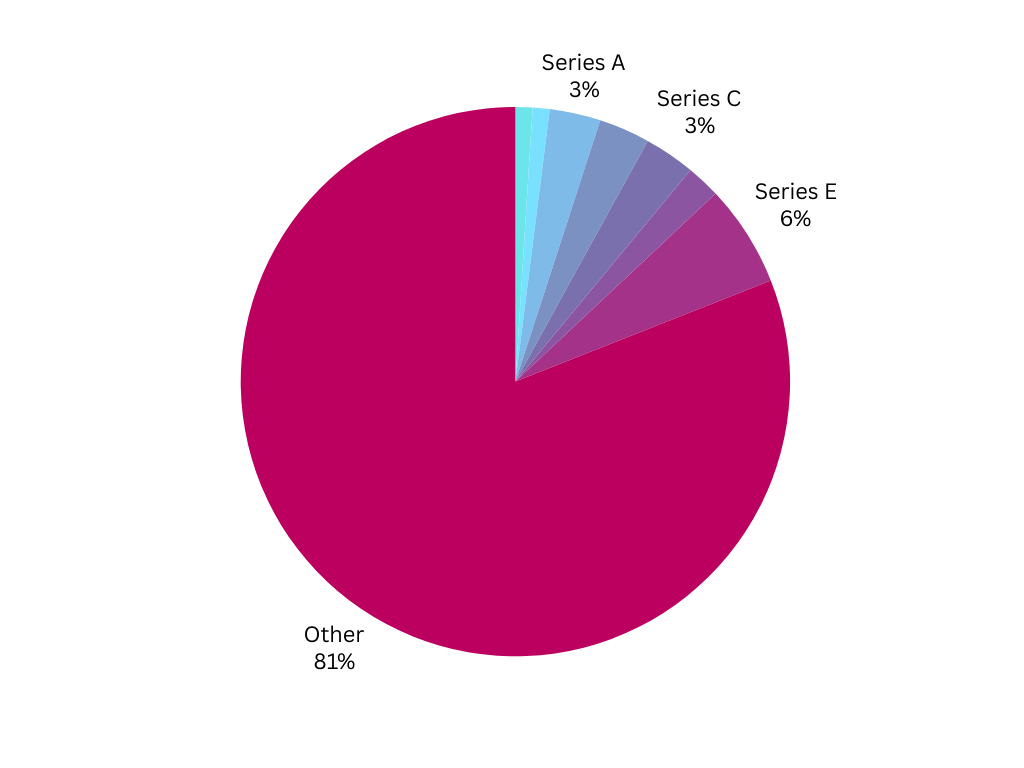

| Other | 22,006,778,690 | 180 | 59,138,365,000 | 165 |

| Total | 33,241,558,720 | 604 | 73,314,269,149 | 562 |

In March, the startup funding landscape saw fewer deals but significantly more capital raised, with $73.3 billion across 562 deals, compared to $33.2 billion across 604 deals in February. The surge in funding was driven mainly by OpenAI’s historic $40 billion round, the largest ever secured by a private tech company, which dramatically reshaped the month’s overall figures.

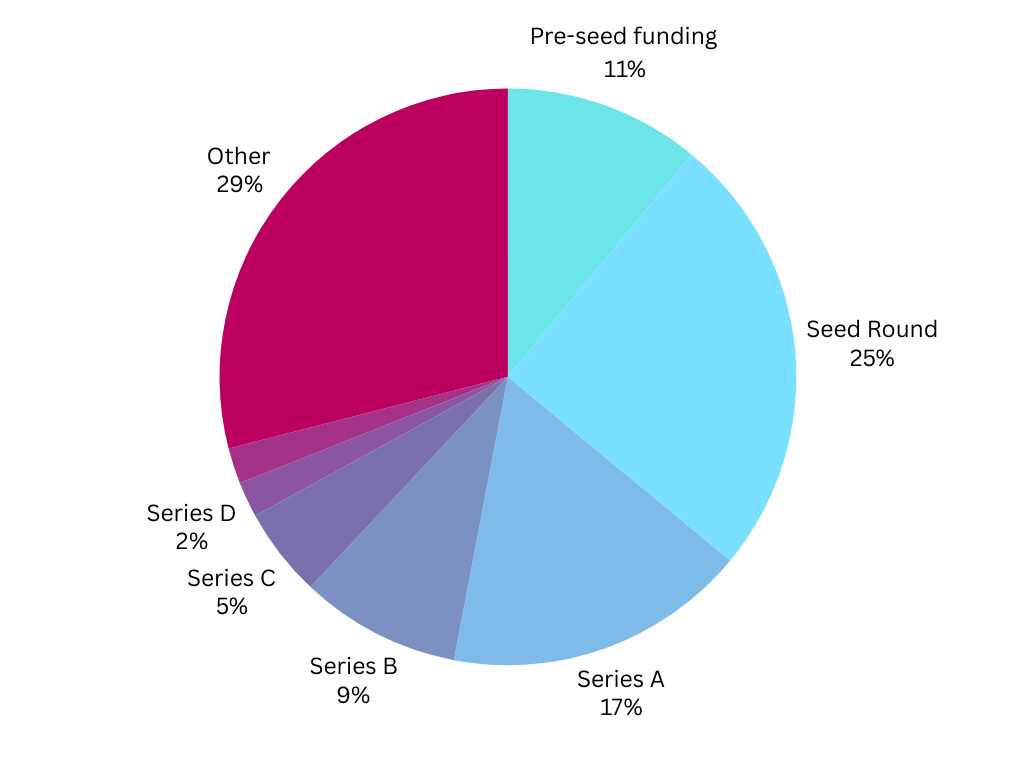

Early-stage activity was mixed. Pre-seed funding declined in both deal count (58 vs. 69) and amount raised ($115.7M vs. $179.4M). In contrast, Seed and Series A rounds saw gains, with Seed climbing to $1.06B and Series A reaching $2.41B.

Series B and C rounds both dipped. Series B dropped by over $500M, while Series C funding fell slightly from $2.78B to $2.56B, despite a slight deal increase. Series D also declined in both activity and capital raised.

Series E posted the largest jump, with funding rising from $597M to $4.44B and deal count increasing from 3 to 11. This spike was driven primarily by Anthropic’s $3.5 billion raise, one of the largest AI funding rounds to date.

By funds raised/ Total funding $73,314,269,149

By number of deals/Total number of deals 562

While the number of deals decreased overall, March marked a record-breaking month for venture funding, highlighting a growing investor appetite for AI and large-scale, late-stage opportunities.

Political and Economic Influences on March’s Funding Landscape:

United States

In March 2025, the U.S. political environment saw the introduction of sweeping trade measures as President Donald Trump imposed a 10% baseline tariff on all imports and increased rates targeting select countries. While intended to protect domestic industries, these policies stirred market volatility and raised concerns about inflation and a potential recession. On the legislative front, the federal government continued operating under a short-term funding resolution through mid-March, maintaining current spending levels and averting a shutdown. At the same time, nonprofits and public programs braced for expected federal funding cuts amid shifting policy priorities and fiscal tightening.

Global Landscape

Internationally, major economic powers faced a mix of structural and geopolitical pressures. Germany’s Bundesbank, long known for its conservative stance, supported greater government borrowing and investment, signaling a broader shift in the EU’s approach to economic recovery. Geopolitical instability, especially the ongoing war in Ukraine and tensions in the Middle East, continued to create uncertainty across markets. At the global level, trade frictions intensified as more countries adopted tariffs and restrictions, leading to heightened concerns about fragmentation and the resilience of global supply chains.

Economic Influences

United States

The U.S. economy showed signs of slowing. The Federal Reserve downgraded its GDP growth forecast for 2025 to 1.7%, reflecting more cautious consumer spending and investment expectations. Core inflation was projected at 2.8%, prompting further scrutiny of pricing pressures and monetary policy responses. These forecasts, combined with trade tensions and policy uncertainty, contributed to a cautious investment climate.

Global Landscape

Global economic conditions were shaped by a combination of weak growth, high debt, and rising fragmentation. The worldwide GDP forecast for 2025 was trimmed to 2.5%, the lowest since 2009 outside of pandemic-related shocks. The World Economic Forum reported that 56% of leading economists expected weaker global conditions in the year ahead, citing risks such as sovereign debt burdens, political instability, and fractured international cooperation. The global funding landscape in March reflected these dynamics, with capital increasingly flowing toward established, AI-focused companies able to demonstrate scale and resilience in a turbulent environment.

Key Investment Sectors in March 2025

In March, funding activity was dominated by large-scale investments in artificial intelligence, with AI continuing to lead across sectors, including enterprise software, cybersecurity, healthcare, and manufacturing. Landmark raises by OpenAI ($40B) and Anthropic ($3.5B) reflected investor appetite for scalable, AI-driven innovation focused on sectors poised for long-term transformation.

Healthcare and biotech also remained strong, especially where AI intersects with diagnostics, therapeutics, and biopharma. FinTech saw continued interest across payments, lending, insurance, and blockchain, while CleanTech funding focused on renewable energy, energy storage, and smart grid technologies.

Cybersecurity attracted capital as businesses prioritised cloud protection and compliance, often backed by AI. In mobility, investments flowed into electric vehicles, fleet management, and autonomous systems. Meanwhile, SaaS and analytics platforms supporting enterprise productivity and decision-making maintained steady growth.

Domain Names Highlights

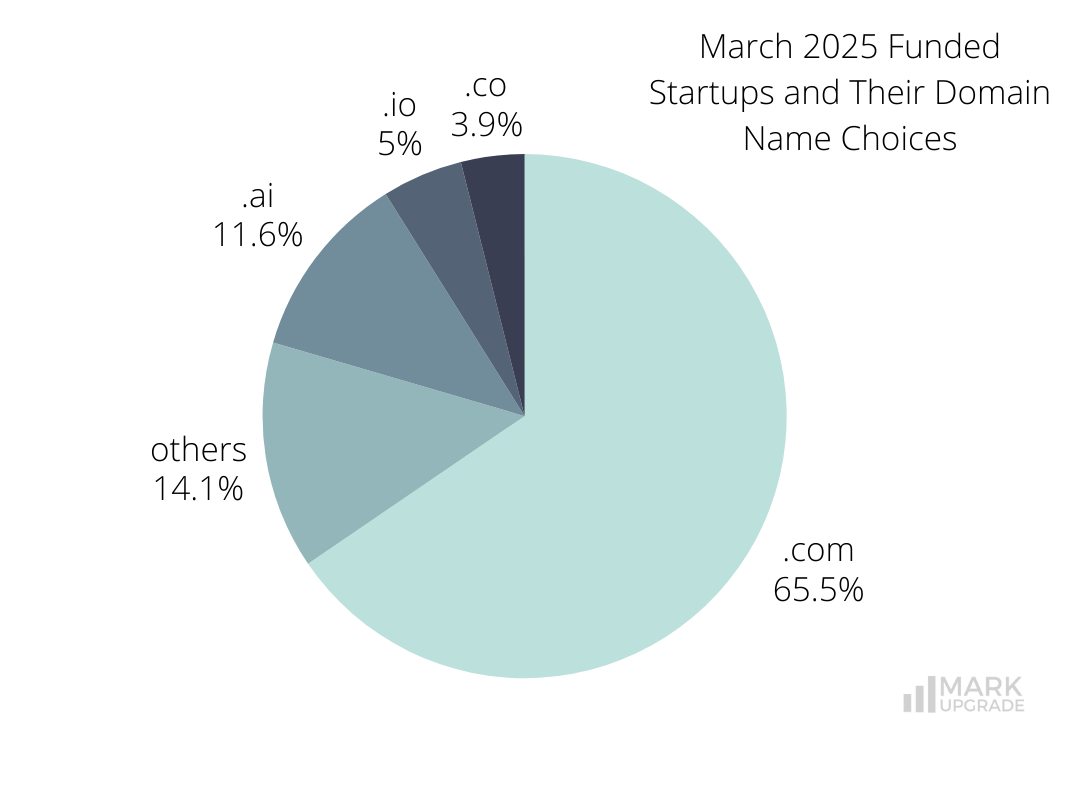

.com remains the most dominant extension, used by 368 companies (65%), reinforcing its status as the most intuitive and globally trusted domain.

Among alternative extensions, .ai (65) continues to be a favorite among AI-driven startups, while.io (28) and .co (22) maintain niche appeal.

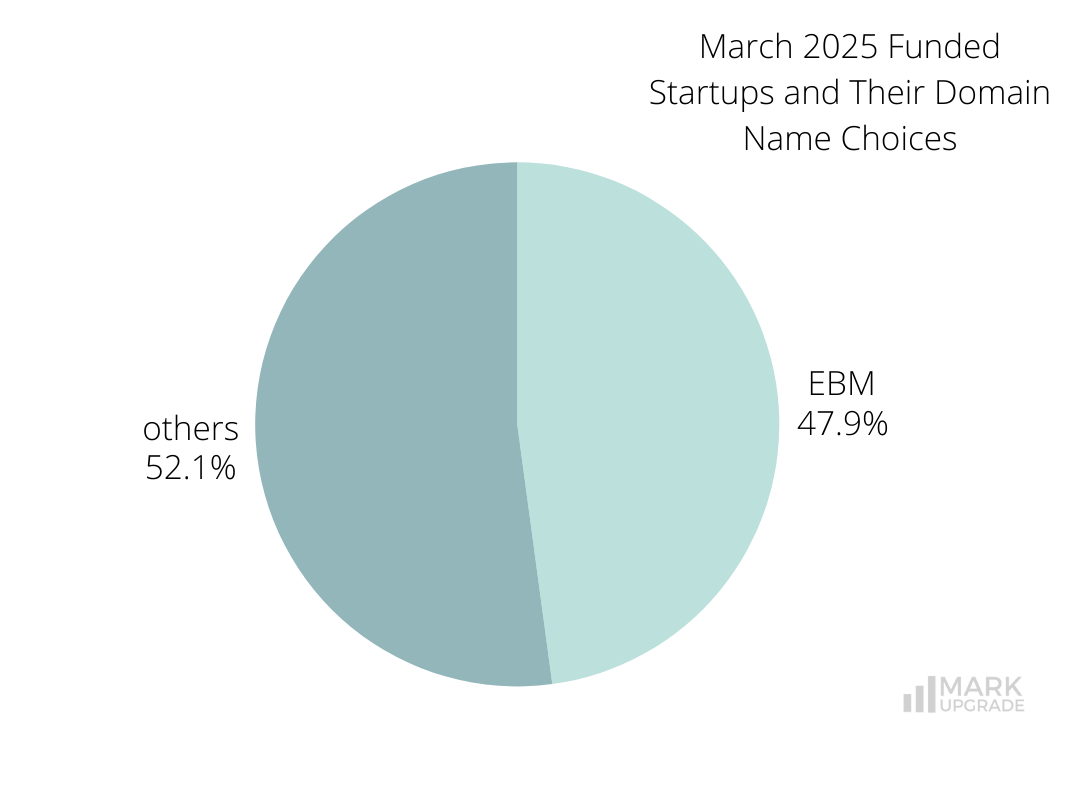

Out of 562 companies tracked in March, 269 (48%) operate on Exact Brand Match (EBM) domains, reflecting a strong commitment to brand clarity, consistency, and digital independence. Companies securing EBM .com domains benefit from stronger brand recognition, enhanced discoverability, and protection against traffic loss or confusion.

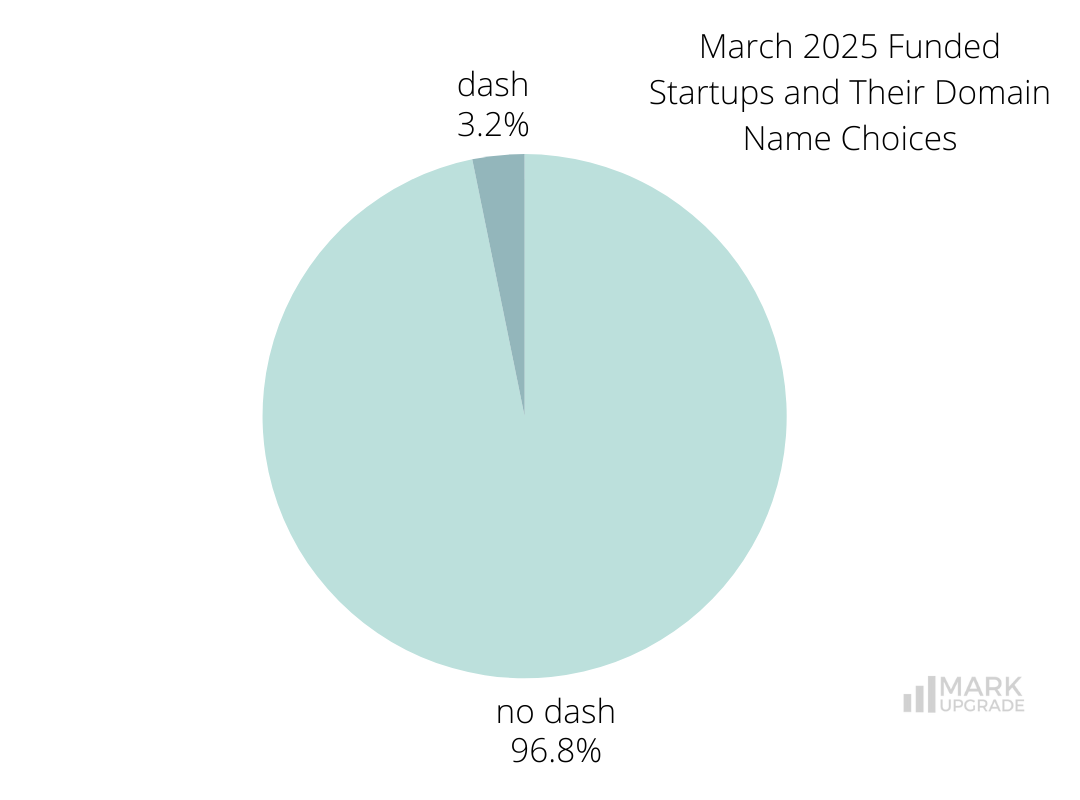

18 domains include hyphens, which can hinder memorability and lead to user friction.

Namepicks

Anthropic

Industry: Artificial Intelligence (AI), Generative AI, Information Technology, Machine Learning

Funds Raised: $3,500,000,000 Series E

Anthropic is an AI safety and research company building Claude, an advanced AI assistant designed to be helpful, honest, and harmless. Its technology is used by companies like Zoom, Pfizer, Replit, and Thomson Reuters to power everything from coding and tax assistance to clinical reporting and virtual assistants like Alexa+.

In March 2025, Anthropic raised $3.5 billion at a $61.5 billion valuation, following a $4 billion round in 2024, with backing from Amazon, Google, Salesforce, and top-tier venture firms. The funding supports its global expansion, infrastructure growth, and deeper research into safe and interpretable AI.

Anthropic operates on Anthropic.com, an Exact Brand Match (EBM) domain that strengthens its digital presence and brand trust. The company is featured in SmartBranding’s roundup of top AI startups by domain strategy and in an article on the importance of strong domain names for brand strength and scalability.

Aura

Industry: Cyber Security, Information Technology, Network Security, Security

Funds Raised: $140,000,000 Series G

Aura, an AI-driven platform focused on digital safety for individuals and families, has raised $140 million in equity and debt in a Series G funding round, valuing the company at $1.6 billion. The round was led by Ten Eleven Ventures and Madrone Capital, with participation from AT&T Ventures, Accel, Warburg Pincus, and General Catalyst.

This is Aura’s first funding round since its spin-off from Pango Group (now Point Wild) in 2024. The newly independent company uses AI, branded as Aura Intelligence, to power an all-in-one product that provides identity theft protection, scam and fraud alerts, cyberbullying and predator detection, and device security features for families.

With around 50% GAAP revenue growth year-over-year in 2024, Aura plans to use the funds to continue developing intelligent safety features and scale its product offerings to meet growing demand.

Aura operates on the Exact Brand Match (EBM) domain Aura.com, a rare and highly valuable four-letter .com name. Short domains like this are easy to remember, signal brand strength, and offer a clean, professional presence, qualities that contribute to lasting impact and are frequently associated with successful global brands.

Binance

Industry: Bitcoin, Cryptocurrency, FinTech, Stock Exchanges, Web3

Funds Raised: $2,000,000,000 Venture Round

Binance, the world’s largest cryptocurrency exchange by trading volume, has received a $2 billion investment from MGX, an Abu Dhabi-based investment firm. The deal marks the first institutional investment in Binance and MGX’s initial foray into digital assets. The funds were provided in an undisclosed stablecoin, signaling rising institutional interest in the crypto space.

With a strong operational base in the UAE, Binance employs around 1,000 people in Abu Dhabi and holds key regulatory approvals, including a VASP license in Dubai and authorisation to offer custody services in Abu Dhabi. CEO Richard Teng, formerly the head of the Abu Dhabi Financial Services Regulatory Authority, reinforces the company’s strategic regional alignment.

Binance operates on Binance.com, its Exact Brand Match (EBM) .com domain. This is the natural choice of most internet users, and securing that domain for their business clearly indicates that Binance is here to stay.

Mercury

Industry: Banking, Financial Services, FinTech, Information Technology, InsurTech

Funds Raised: $300,000,000 Series C

Mercury, a San Francisco-based fintech company streamlining business banking and financial workflows, has raised $300 million in Series C funding, reaching a $3.5 billion post-money valuation. The round was led by Sequoia Capital, with participation from Spark Capital, Marathon, and existing backers Coatue, CRV, and Andreessen Horowitz. The funding included both primary and secondary capital.

Founded by Immad Akhund, Mercury offers a modern banking stack for startups and businesses, including checking accounts, credit cards, and financial tools for payroll, invoicing, taxes, accounting, and cash flow management. In 2024, the company launched Mercury Personal, expanding into consumer finance.

Mercury reported $500 million in 2024 revenue, $156 billion in annual transaction volume, and serves over 200,000 businesses across tech, e-commerce, and VC. The company has maintained ten consecutive profitable quarters based on EBITDA and GAAP standards.

Mercury operates on Mercury.com, a high-value dictionary word .com domain. Owning a strategic-grade domain like Mercury.com gives the company a powerful digital identity, supports brand recognition, and ensures marketing effectiveness across all channels, making it the natural choice for a globally ambitious fintech brand.

OpenAI

Industry: Artificial Intelligence (AI), Generative AI, Machine Learning, Natural Language Processing, SaaS

Funds Raised: $40,000,000,000 Venture Round

OpenAI, the company behind ChatGPT, has officially closed a $40 billion funding round, making it the largest private tech investment on record. The deal values OpenAI at a staggering $300 billion, placing it among the top private companies globally, alongside ByteDance and just behind SpaceX.

The round was led by SoftBank, which committed $30 billion, with the remaining $10 billion coming from a syndicate of investors, including Microsoft, Coatue, Altimeter, and Thrive. A significant portion of the funds, around $18 billion, is expected to support OpenAI’s joint venture project Stargate with Oracle and SoftBank.

OpenAI plans to use the capital to push the boundaries of AI research, scale its computing infrastructure, and accelerate product development. The company, which now reports 500 million weekly ChatGPT users, expects its revenue to triple to $12.7 billion in 2025. Investors are banking on OpenAI to maintain its explosive growth as competition in the generative AI space intensifies.

The deal also comes with conditions: SoftBank’s full investment depends on OpenAI converting to a for-profit entity by the end of 2025, a move requiring approval from Microsoft and the California Attorney General, and likely to face legal challenges.

OpenAI operates on the Exact Brand Match (EBM) domain OpenAI.com, reinforcing its core brand with a trusted and instantly recognisable online identity. In addition to its primary domain, the company has expanded its portfolio with high-value assets like Chat.com, now redirecting to ChatGPT, and Sora.com, which leads to its text-to-video model, Sora. These acquisitions reflect a deliberate domain strategy focused on clarity, accessibility, and long-term brand scalability.

While we make every effort to ensure the data on our site is accurate, complete, and up-to-date, we cannot guarantee its reliability. Our data is provided for informational purposes only and should not be relied upon as legal, financial, or other advice. We strongly recommend that you independently verify any information before relying on it.

The right domain name is an important consideration when it comes to building and protecting your brand. If you’re ready to take the next step and invest in a perfect domain name for your business, contact us to learn more about our available options and how we can help you get started.

Other resources

branding business domain domain name domain names domains funding march naming startup

Previous Next