Discover the latest trends in global monthly funding data, with a unique focus on companies’ domain name choices, in our monthly funding reports.

Overview

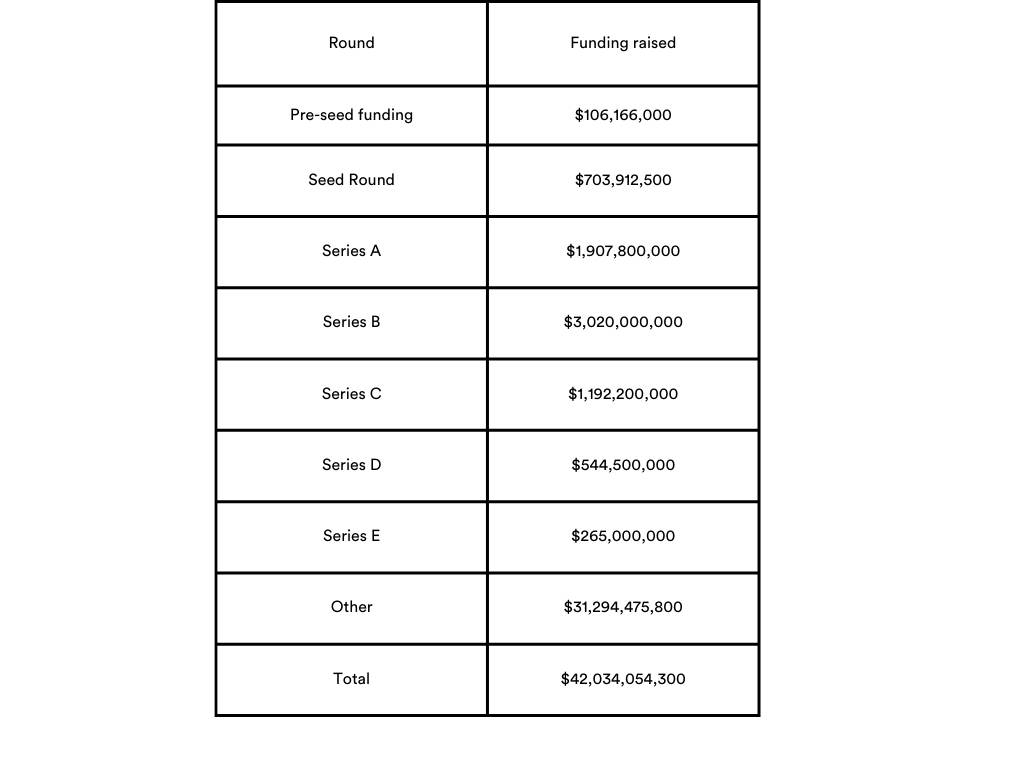

In January, Pre-seed funding decreased in the amount raised, reflecting cautiousness among investors in backing very early-stage ventures.

| Round | Amount December (USD) | Number deals December | Amount January (USD) | Number deals January |

| Pre-seed funding | 172,958,500 | 35 | 106,166,000 | 36 |

| Seed Round | 665,326,095 | 139 | 703,912,500 | 134 |

| Series A | 2,347,280,000 | 104 | 1,907,800,000 | 90 |

| Series B | 1,410,900,000 | 40 | 3,020,000,000 | 65 |

| Series C | 1,119,300,000 | 19 | 1,192,200,000 | 25 |

| Series D | 690,500,000 | 9 | 544,500,000 | 5 |

| Series E | 394,000,000 | 3 | 265,000,000 | 3 |

| Other | 24,787,442,700 | 156 | 31,294,475,800 | 203 |

| Total | 31,587,707,295 | 505 | 42,034,054,300 | 561 |

Seed Round saw a slight increase in funding despite a decrease in deals, showing that while investors are selective, they are willing to invest more in ventures they perceive as promising. This selectivity can lead to larger investments in fewer startups with higher potential.

In contrast, Series B funding experienced a significant uptick in the amount raised and the number of deals, indicating growing investor confidence in more mature startups. Series C funding also saw a slight increase in both the number of deals and total funding compared to December. At this stage, companies typically have established products and market presence, and the increased investment indicates belief in their long-term success.

The decrease in Series D funding in both deals and the total amount raised could signal a more critical assessment of companies at this later stage. Investors might examine growth potential and scalability more intensely before committing significant funds.

The stability in the number of deals but decreased total funding for Series E rounds suggests a consolidation phase. Companies at this stage are often preparing for public offerings or major expansion, and the funding patterns may reflect strategic investments rather than broad-based support.

The substantial amount raised in venture rounds, totalling $3,009,107,800 across 71 deals, underscores a healthy appetite for more mature, high-potential startups. This indicates a market that values established business models and clear paths to profitability or significant market impact.

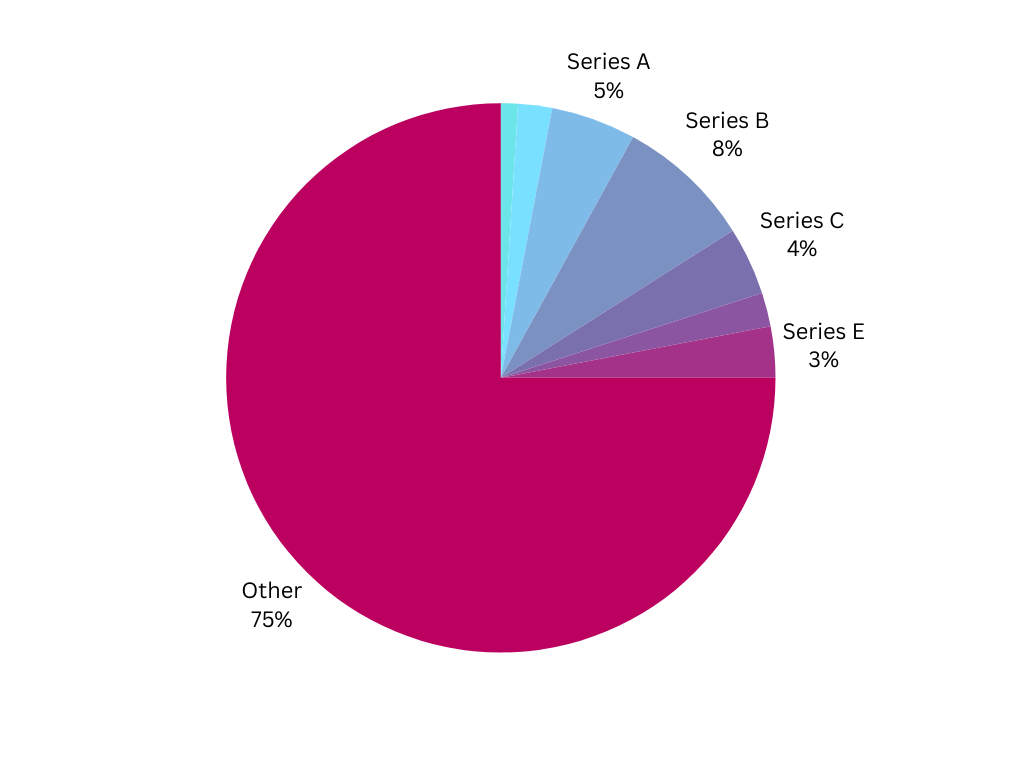

By funds raised/ Total funding $42,034,054,300

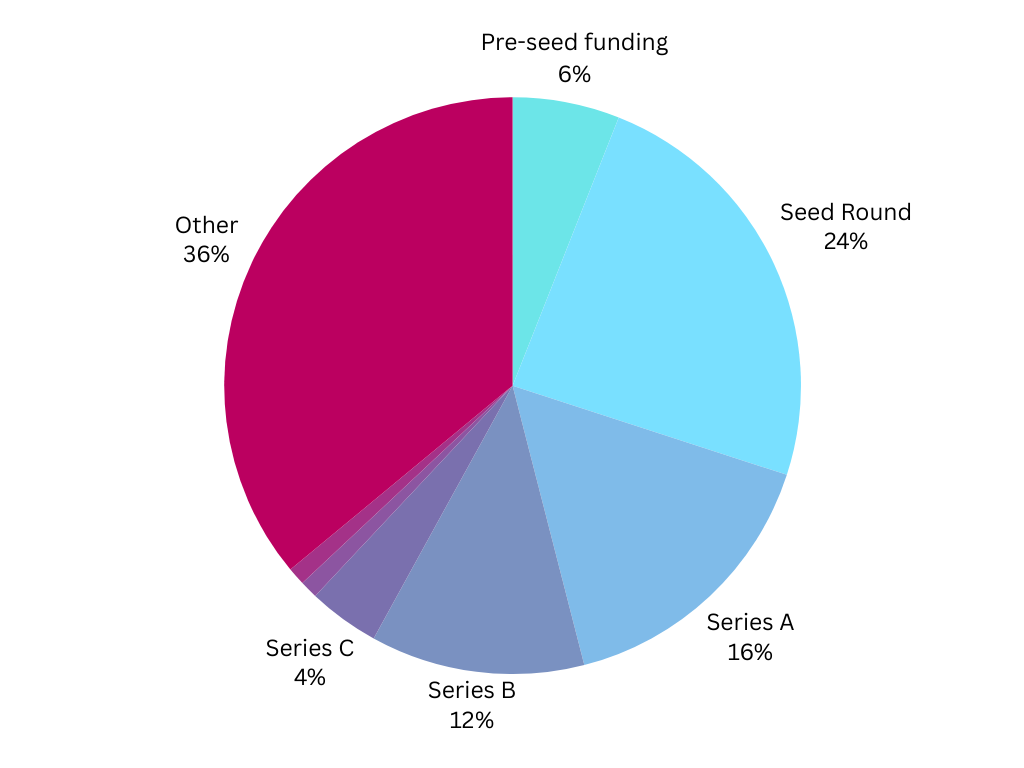

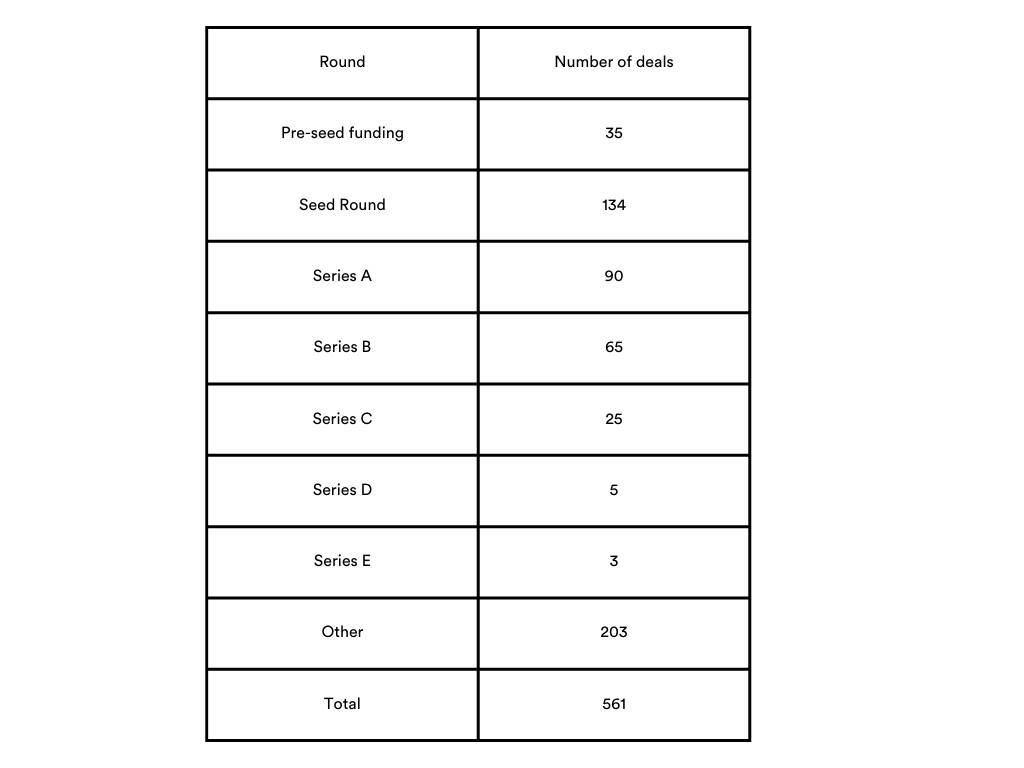

By number of deals/Total number of deals 561

January’s funding landscape, featuring higher total financing and more deals than December, signals a positive start to the year. This trend indicates a nuanced investor approach, balancing cautiousness in the earliest stages with strong support for more mature, promising startups.

Sectors like Digital Media, Fintech, and E-Commerce attracted attention, reflecting an increasing reliance on digital solutions in everyday life and financial transactions. Real Estate and Retail demonstrated adaptability to changing market dynamics. The tech industry, particularly in cutting-edge fields like Artificial Intelligence, Machine Learning, and Cyber Security, saw significant investments, highlighting a shift towards advanced, technology-driven solutions across business and consumer landscapes. This diverse funding activity signals robust innovation and growth potential in these sectors.

Below, we will examine some companies on our list and explore their brand and domain name choices.

Namepicks

Kore.ai

Industry: Artificial Intelligence (AI), Collaboration, Enterprise Software, Machine Learning, Natural Language Processing

Funds Raised: $150,000,000 Series D

Kore.ai offers AI-powered virtual assistants and applications for enhancing customer and employee experiences across various industries. The company secured a $150 Million strategic growth investment to drive AI-powered customer and employee experiences for global brands.

Kore.ai has included the “.ai” extension in its brand name to explicitly highlight its focus on Artificial Intelligence, signalling its core expertise and aligning the brand identity closely with the cutting-edge technology it specialises in.

As customer expectations continue to rise, they increasingly expect the type of world-class experience that our customers deliver using our best-of-breed conversational AI-based XO platform. We are absolutely thrilled to have such strong financial and strategic partners as investors, who can help guide us as we continue to grow exponentially in the market by enabling our customers to deliver extraordinary conversational AI experiences which result in extraordinary outcomes.

Raj Koneru, Founder and CEO of Kore.ai

The company’s ownership of the exact brand match domain Kore.com further strengthens its online presence. By owning both the ‘.ai’ and ‘.com’ domains, Kore.ai enhances brand consistency across digital platforms and offers flexibility in targeting different audience segments. The universally recognised and trusted .com domain broadens the company’s reach beyond just the tech-savvy audience, while the .ai domain specifically appeals to those with a keen interest in AI technology.

Owner.com

Industry: Marketing, Software, Restaurants, Sales Automation

Funds Raised: $33,000,000 Series B

Owner.com has developed a digital marketing platform aimed at assisting restaurants in generating revenue and managing their online presence. The platform recently secured $33M in a Series B funding round, focusing on enhancing online experiences for mom-and-pop restaurants.

Exciting news! Owner has raised our $33m Series B.

— Adam Guild (@adamguild) January 31, 2024

The round was led by Redpoint and Jack Altman.

Restaurant owners are being crushed online by huge corporations.

We’re using this cash to help them fight back.

•

Just 5 years ago, you’d succeed as a restaurant if you… pic.twitter.com/rCkt2pzZ47

Originally named ProfitBoss, the company rebranded to Owner.com in 2021 after acquiring the domain name Owner.com from Digimedia. Adam Guild, the co-founder and CEO, explained that the name was chosen to honour the journey of restaurant owners, over 80% of whom have worked their way up from being employees in other restaurants. This name reflects their pride in ownership. To enhance its branding strategy and improve online discoverability, the company also acquired the Twitter handle @Owner.

The strategic use of the domain name Owner.com positions the company to build a strong, consistent brand identity, laying a foundation for long-term success.

Xreal

Industry: Marketing, Software, Restaurants, Sales Automation

Funds Raised: $60,000,000 Venture Round

XREAL, a consumer augmented reality (AR) glasses provider, has successfully secured an additional USD $60 million in funding through a new strategic round, bringing their total funding to USD $300 million.

The ‘X’ in XREAL reflects our commitment to the vision of expanding reality and creating cross-reality experiences. It is also a reminder to ourselves that we need to be extra real when delivering value to customers.

Peng Jin, co-founder of Xreal for CNBC

Previously known as Nreal, XREAL has rebranded and secured the exact brand match domain Xreal.com, signifying a strategic shift to address legal disputes with Epic Games and align with its expansion goals into the European market, introduction of new products and commitment to creating cross-reality experiences.

DailyPay

Industry: Employee Benefits, Enterprise Applications, Financial Services, FinTech

Funds Raised: $175,000,000 Debt and Equity Funding

DailyPay, a leading financial technology company, has secured over $175 million in debt and equity funding to further accelerate its product innovation and drive expansion into adjacent categories and new markets.

This latest equity capital raise, from both long-time institutional investors and new financial partners, underscores DailyPay’s strength and market-leading position. We are eager to capitalise on this momentum as we continue to revolutionise the future of pay.

Kevin Coop, Chief Executive Officer of DailyPay

The company has invested in the exact brand match domain name DailyPay.com. In an industry where consumers entrust personal and financial information, a domain like DailyPay.com instils confidence and authenticity. It assures clients and partners of the company’s legitimacy and commitment to security, thus reducing the risk of phishing and scams often associated with mismatched or obscure domain names.

Owning the EBM domain enhances brand recognition and ease of access, reinforcing DailyPay’s reliability and professionalism in the highly competitive and security-conscious FinTech landscape.

The company has been featured in our January 2023 Monthly Funding Report and March 2022 Monthly Funding Report.

Flexport

Industry: Freight Service, Logistics, Shipping, Software

Funds Raised: $260,000,000 Convertible Note

Digital-oriented freight forwarder Flexport raised $260 million from e-commerce provider Shopify. This move comes on the heels of Flexport’s acquisition of Shopify’s logistics arm last year, a strategic expansion into e-commerce fulfilment and last-mile delivery services. Shopify acquired a 13% equity stake in Flexport and a seat on its board as part of this deal.

In an X’s post, the CEO of the company, Ryan Petersen, thanked Shopify CEO Tobi Lutke, saying:

Thank you @tobi and your entire team for this tremendous vote of confidence in our business and partnership. This is an important milestone along our journey to build an end-to-end logistics technology platform to make global commerce so easy that there will be more of it.

Ryan Petersen

The brand name Flexport melds flexibility with transport, underscoring the company’s innovative and adaptable approach to revolutionising the movement and management of goods on a global scale. Flexport has chosen a domain name that clearly corresponds to its global ambitions and communicates its vision – Flexport.com.

Highlights

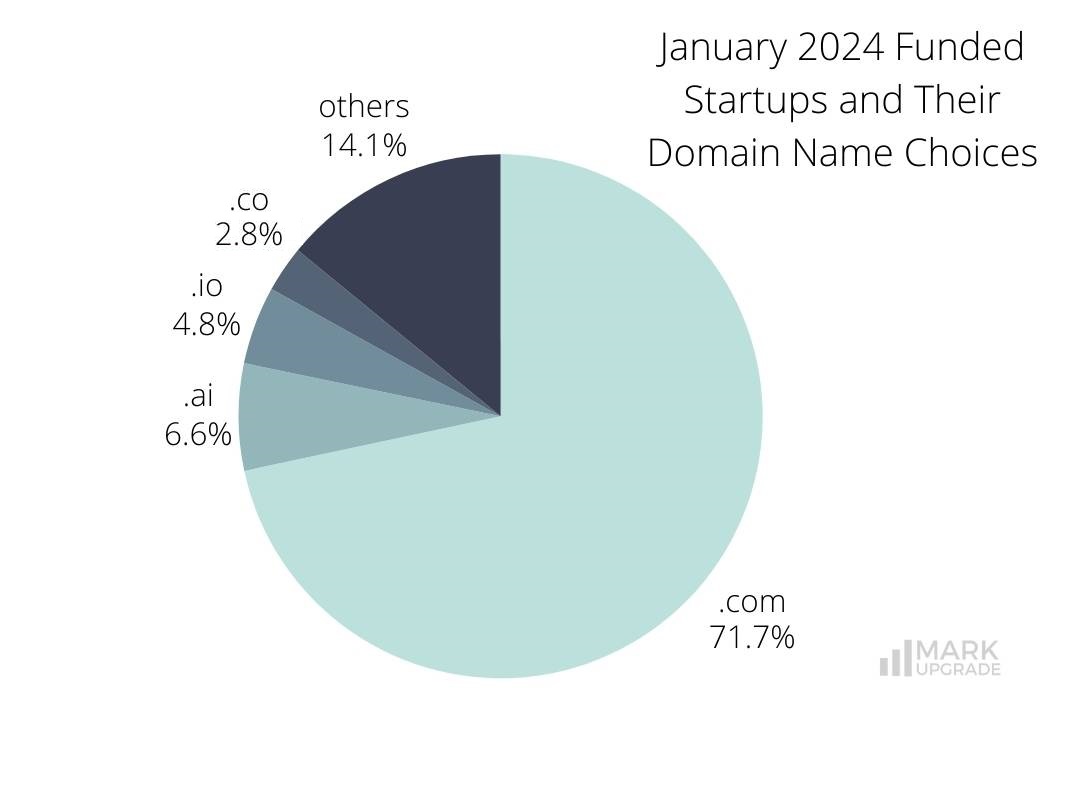

The companies on the list show a preference for .com domains, with 402 out of 561 opting for this extension, highlighting its widespread recognition.

Extensions like .ai and .io, popular among tech startups due to their association with innovation and technology, are used by 37 and 27 companies, respectively.

.co, a top-level domain extension and the acronym for company or corporation has been used by 16 companies. Country domain codes offer more freedom of choice but come with certain risks for businesses.

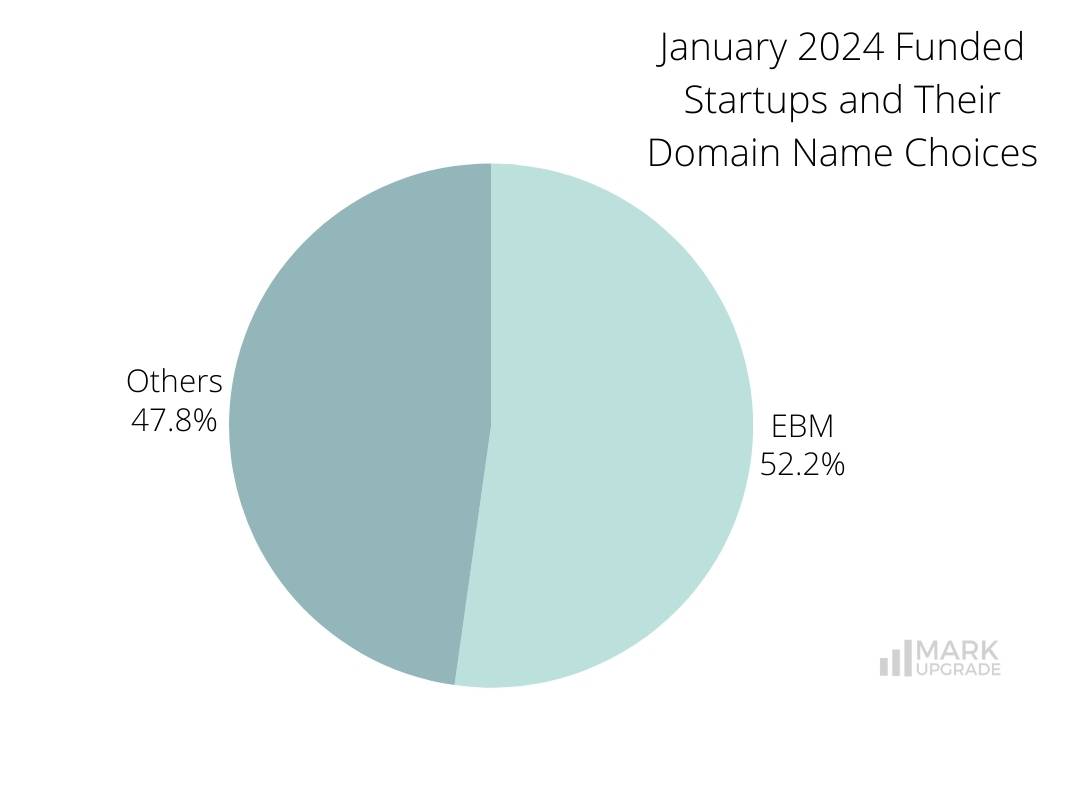

293 companies opt for exact brand match domains, leveraging the advantage of enhancing brand recognition, credibility, and customer trust.

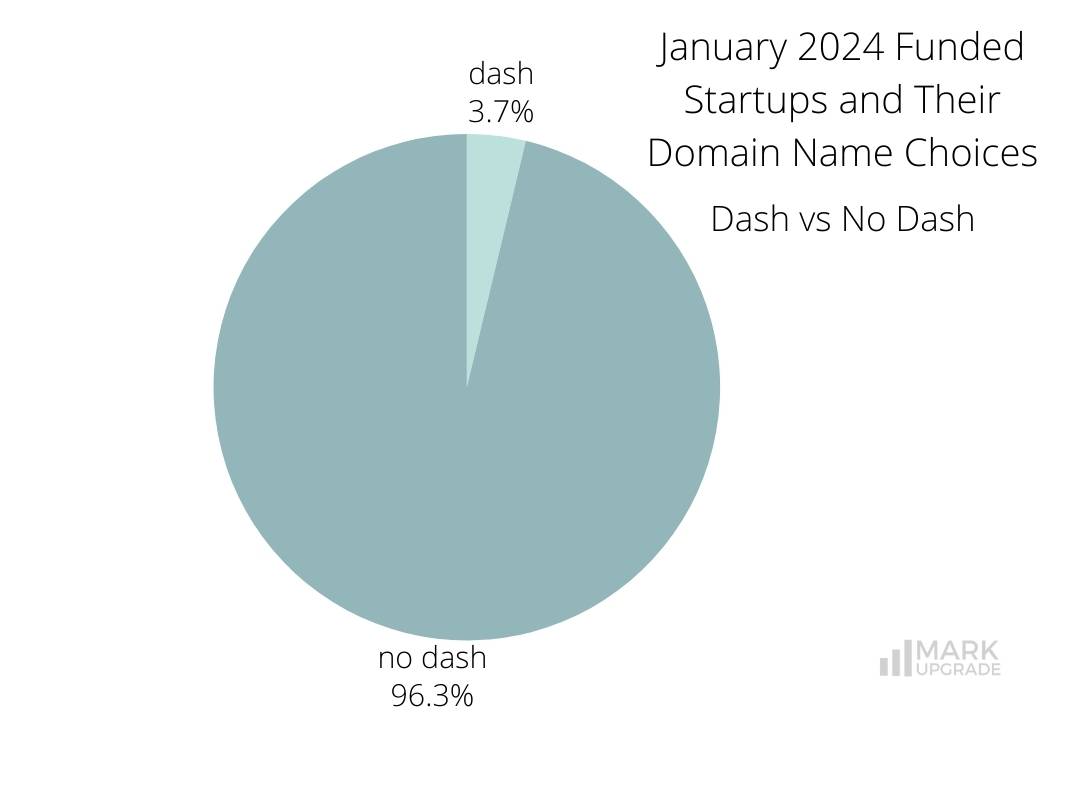

21 entries incorporate dashes, typically included in two-word brand names or as an alternative when the desired domain is unavailable.

While we make every effort to ensure the data on our site is accurate, complete, and up-to-date, we cannot guarantee its reliability. Our data is provided for informational purposes only and should not be relied upon as legal, financial, or other advice. We strongly recommend that you independently verify any information before relying on it.

Whether you’re a small business owner or a large corporation, a premium domain name can help boost your brand and increase your online presence. If you’re ready to take the next step, contact us to learn more about our premium domain name options and how they can benefit your business.

Other resources

2024 branding business domain domain name domain names domains funding January naming startup

Previous Next