Discover the latest trends in global monthly funding data, with a unique focus on companies’ domain name choices, in our monthly funding reports.

Overview

The venture markets displayed increased discipline in 2023, leading to a potentially tough year for founders in a market where funders have the upper hand. Without a notable increase in exits, 2024 is expected to continue to be a challenging year for startups.

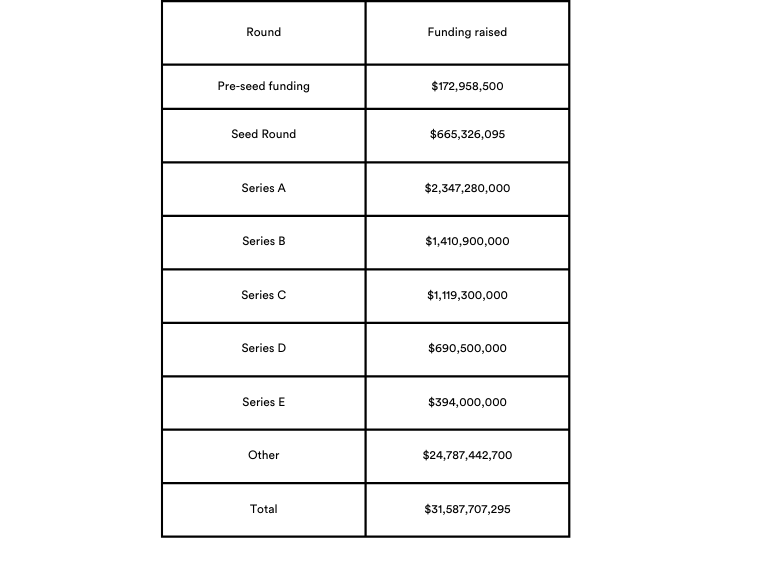

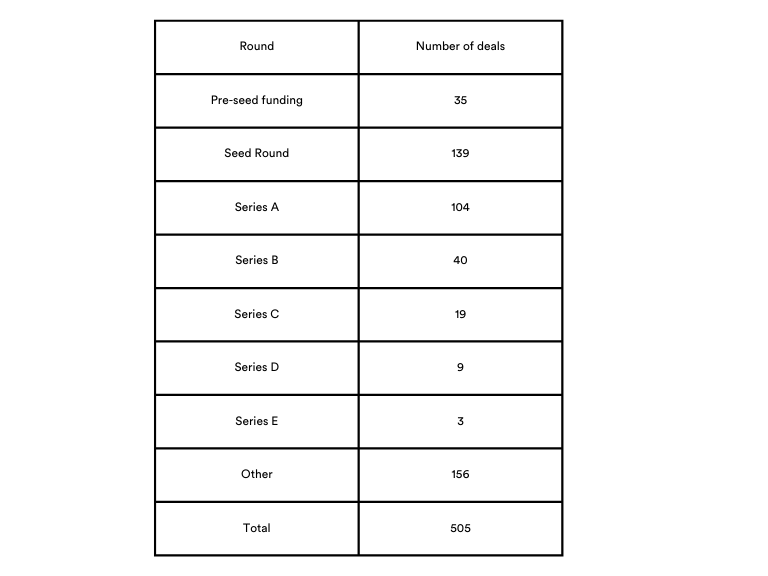

| Round | Amount November (USD) | Number deals November | Amount December(USD) | Number deals December |

| Pre-seed funding | 83,667,000 | 21 | 172,958,500 | 35 |

| Seed Round | 933,640,000 | 171 | 665,326,095 | 139 |

| Series A | 2,247,450,000 | 113 | 2,347,280,000 | 104 |

| Series B | 2,233,100,000 | 45 | 1,410,900,000 | 40 |

| Series C | 1,459,400,000 | 18 | 1,119,300,000 | 19 |

| Series D | 887,000,000 | 7 | 690,500,000 | 9 |

| Series E | 435,000,000 | 3 | 394,000,000 | 3 |

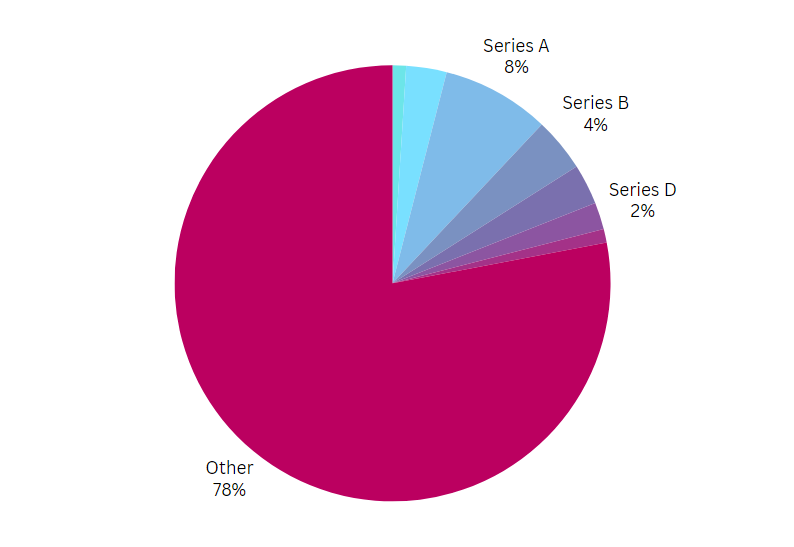

| Other | 22,333,579,500 | 172 | 24,787,442,700 | 156 |

| Total | 30,516,236,500 | 550 | 31,587,707,295 | 505 |

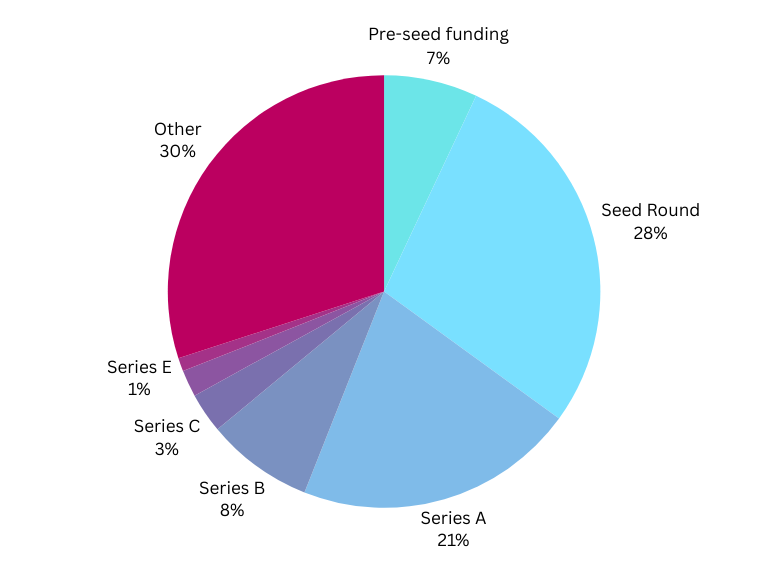

Pre-seed funding saw an increase in both the number of deals and the total funds raised, indicating a growing interest in early-stage startups. Seed Round funding decreased in the total amount raised and the number of deals.

Series A funding in December slightly outperformed November’s total funds raised despite a slightly lower number of deals. Series B funding significantly declined in the total amount raised, suggesting a potential shift in investor focus away from this stage.

While seeing an increase in the number of deals, Series C and D funding had a decrease in the amount raised, indicating a trend of more companies at these stages but with smaller individual funding rounds.

Series E funding remained relatively stable regarding the number of deals and the total amount raised. Overall, December’s funding landscape featured higher total financing but fewer deals than November’s.

By funds raised/ Total funding $31,587,707,295

By number of deals/Total number of deals 505

The sectors that attracted the highest funding rounds ranged from Credit, Financial Services, and FinTech to areas like Fitness and Wellness, AI and Software, Cyber Security, Automotive, Biotechnology, Adventure Travel, and Renewable Energy.

The last quarter of 2023 marked a relatively slow period for global startup funding, and the year appears to be the lowest for venture funding since 2018. This indicates a more cautious approach among venture capital investors throughout the year.

Despite some reductions, seed funding remained a relatively strong phase for funding new companies. With the increasing difficulty in securing Series A funding, many startups chose to seek additional seed funding instead. Early-stage funding experienced the sharpest drop in 2023 compared to other funding stages.

Funding for later stages varied over the year, with substantial investments directed towards sectors like AI, semiconductors, batteries, and clean energy. Given the growing number of startups and a tightening in funding availability, 2024 could witness a higher number of company closures due to financial constraints.

Below, we will examine some companies on our list and explore their brand and domain name choices.

Namepicks

Tamara

Industry: E-Commerce, Financial Services, FinTech, Payments, Retail, Shopping

Funds Raised: $340,000,000 Series C

Tamara, a leading fintech platform renowned for revolutionising shopping, payment, and banking experiences in Saudi Arabia and the broader GCC region, has recently achieved a significant milestone. It became the Kingdom’s first domestically founded fintech unicorn by raising $340 million in a Series C equity funding round. Based in Saudi Arabia and operating in the UAE and Kuwait, Tamara has over 10 million users and partnerships with more than 30,000 merchants. The company has reported a sixfold annual run rate revenue increase in under two years. Founded in late 2020 by Saudi co-founders Abdulmajeed Alsukhan, Turki Bin Zarah, and Abdulmohsen Al Babtain, Tamara is also among the pioneers to receive a permit for Buy Now, Pay Later (BNPL) services from the Saudi Central Bank (SAMA).

The name “Tamara” finds its roots in the Arabic terms “Tamrah” (تَمْرَة) and “Tamar” (تَمْر), which refer to the “date palm.” This tree is often seen as a representation of steadfast growth and enduring strength, which aligns closely with Tamara’s mission in the financial industry to cultivate enduring success and robust growth.

Tamara has invested in the exact brand match domain name Tamara.com. This choice aligns with the prevalent trend among fintech companies, as observed in our analysis of domain name preferences within the industry.

Devoted Health

Industry: Elder Care, Elderly, Health Care, Health Insurance

Funds Raised: $175,000,000 Series E

Devoted Health, a comprehensive healthcare company specialising in Medicare beneficiaries, offering health insurance, virtual-first medical care, and an exceptional service experience, has successfully concluded a Series E funding round, securing $175 million. This funding round comes on the heels of a year of impressive growth for Devoted Health, which now serves over 140,000 members as of December 2023, marking a year-over-year growth rate of over 70%. Established in 2017 by siblings Todd and Ed Park, Devoted Health represents a novel approach to healthcare, providing comprehensive care solutions for older Americans.

In a healthcare system that isn’t always accessible or easy to navigate, we at Devoted Health are profoundly honoured to provide each member with the same quality of care and service we’d want for our own families.

Ed Park, co-founder and CEO of Devoted Health

Devoted Health has chosen a descriptive brand name that effectively communicates the company’s mission and offerings. The company owns both Devoted.com and Devotedhealth.com domain names. Most successful global brands use the power of domains and maintain portfolios of names that serve different purposes – to protect their brand, as part of marketing campaigns, sub-brands or products, to appeal to specific audiences and many others.

Lazada

Industry: Consumer Goods, E-Commerce, Marketplace, Shopping

Funds Raised: $175,000,000 Series E

Lazada, a prominent e-commerce company in Southeast Asia, has secured a substantial investment of $634 million from its parent company, Alibaba Group. This latest funding brings Alibaba’s total investment in its subsidiary to over $1.8 billion for 2023. Despite fierce competition from companies like PDD Holdings and Tencent, Alibaba continues to evaluate and adjust its strategies in China.

Lazada has invested in the exact brand match domain Lazada.com, thus making the most out of its marketing across channels and avoiding security risks.

The company has been featured in our August 2022 Funded Startups and Their Domain Choices article.

Travelport

Industry: Adventure Travel, E-Commerce, Information Technology, Internet, Shopping, Transportation, Travel, Travel Accommodations

Funds Raised: $570,000,000 Private Equity Round

Travelport, a technology company established in 2001 by Cendant following its acquisitions of Galileo GDS for $2.9 billion and CheapTickets for $425 million, has continually focused on enhancing the experience of buying and managing travel. In December 2023, the company secured a significant boost with $570 million in new equity financing from its existing equity holders and lenders. This investment aims to enhance Travelport’s technology and drive innovation for better customer service in the travel industry.

The company underwent a significant transformation in 2021, launching a new and dynamic visual identity to reflect its refined focus and ambitions. CEO Greg Webb emphasised Travelport’s commitment to connecting passionate buyers and sellers in the travel sector, highlighting the company’s agility, independence, and bold decision-making in simplifying travel complexities.

The exact brand match domain Travelport.com, simple and memorable, encapsulates the essence of the company – a gateway to innovative travel solutions, highlighting its role as a key player in the world of travel and technology.

VAST Data

Industry: Artificial Intelligence (AI), Database, Software

Funds Raised: $118,000,000 Series E

The VAST Data Platform integrates storage, database, and containerised compute engine services into one scalable software solution, designed from scratch to enhance AI and GPU-accelerated tools in contemporary data centres and clouds. Recently, the company raised $118 million in a Series E funding round, with Fidelity Management & Research Company taking the lead and support from New Enterprise Associates (NEA), BOND Capital, and Drive Capital.

This latest funding will advance VAST Data’s commitment to creating a new category of infrastructure focused on placing data at the core of system operations, decision-making, and discovery processes.

To be truly impactful in this era of AI and deep learning, you not only want to have a lot of data but also high-quality data that is correctly organised and available at the right place, at the right time. The VAST Data Platform delivers AI infrastructure that opens the door to automated discovery that can solve some of humanity’s most complex challenges.

Renen Hallak, CEO and Co-Founder of VAST Data

“Vast” suggests a comprehensive and expansive approach, resonating with the company’s capability to manage large-scale data intricacies. The term “Data” is directly tied to the company’s core business, emphasising its focus on data storage, processing, and management. Together, “VAST Data” conveys a powerful message about the company’s ability to provide expansive, robust, and innovative data solutions, aligning with their mission to revolutionise data infrastructure and harness the full potential of data in AI and GPU-accelerated environments.

VAST Data operates on the exact brand match domain Vastdata.com, strengthening its online presence while preventing customer confusion and communication leaks.

Highlights

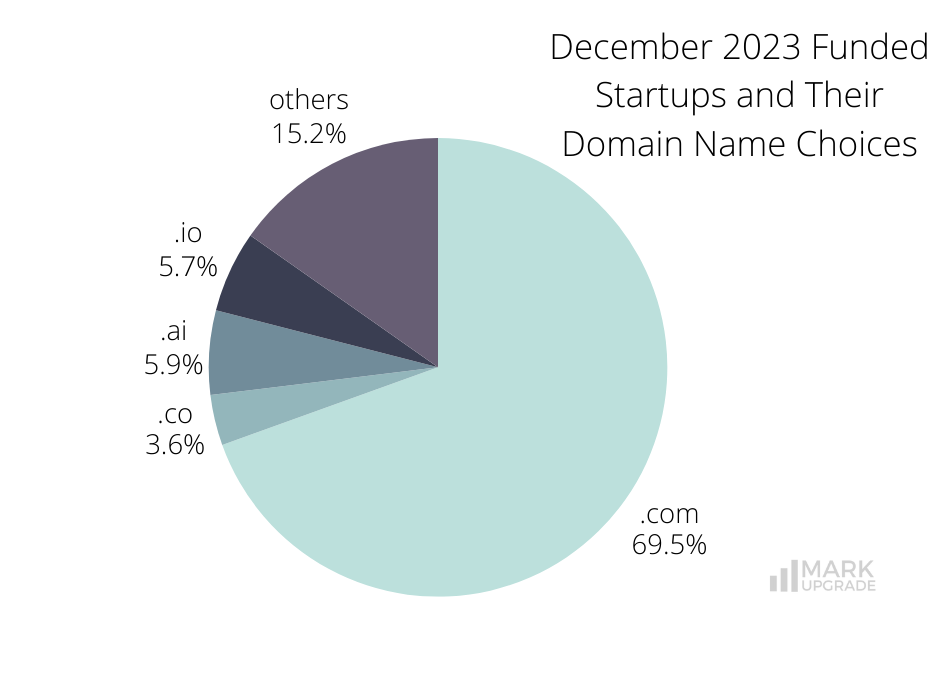

.com remains the most popular extension, widely chosen by 351 companies, offering global recognition and credibility.

.io and .ai, with 29 and 30 companies, respectively, are favoured extensions within the tech sector, associating with technology and artificial intelligence.

18 entries use the .co extension, often viewed as an alternative to .com, particularly for startups and entrepreneurs. Country domain codes offer more freedom of choice but come with certain risks for businesses.

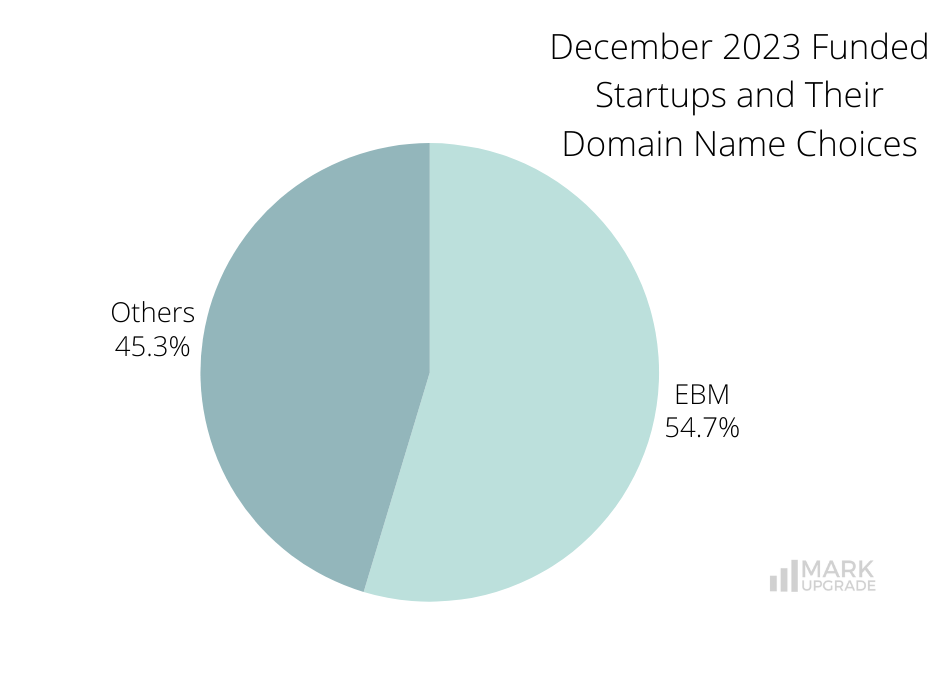

The majority of companies (276 out of 505) have opted for exact brand match domain names, which ensures their brand protection and fosters trust among customers and business partners.

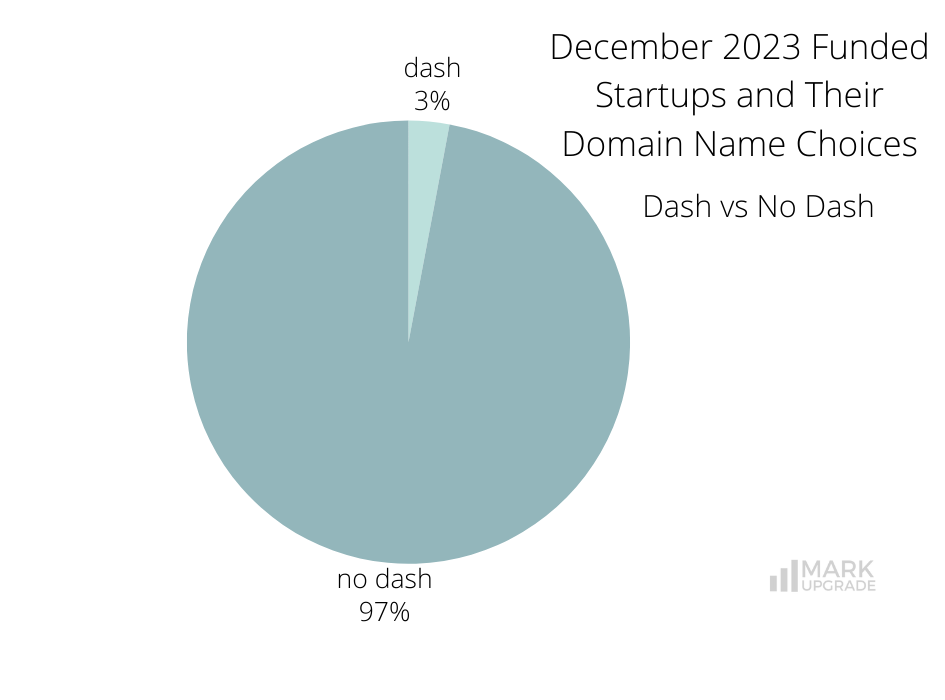

15 companies incorporated a dash in their domain names, which can sometimes make the domain name harder to remember and create confusion.

While we make every effort to ensure the data on our site is accurate, complete, and up-to-date, we cannot guarantee its reliability. Our data is provided for informational purposes only and should not be relied upon as legal, financial, or other advice. We strongly recommend that you independently verify any information before relying on it.

Whether you’re a small business owner or a large corporation, a premium domain name can help boost your brand and increase your online presence. If you’re ready to take the next step, contact us to learn more about our premium domain name options and how they can benefit your business.

Other resources

2023 branding business december domain domain name domain names domains funding naming startup

Previous Next