Overview

Fintech (Financial technology) refers to any business that uses technology and innovation to enhance or automate financial services. The origin of the term can be traced back to the early 1990s when Citigroup launched the “Financial Services Technology Consortium” project to encourage technical collaboration. The Global Financial Crisis in 2007-2008 pushed forward the Fintech industry and had a significant impact on its shaping. Many professionals working in the financial sector were left out of work, which led to a shift in mindset and reconsidering the traditional banking system, which paved the way to the Fintech industry. The GFC was followed by the release of Bitcoin in 2009 and the smartphone market boom that has enabled easy internet access worldwide and opened the doors for fintech services. This period is marked by the rise of many great new players along with those who currently existed.

Fintech has shown its potential to close gaps in the delivery of financial services to households and firms in emerging markets and developing economies.

Caroline Freund, World Bank Global Director for Finance, Competitiveness and Innovation

The fintech industry is growing every year. Throughout 2019, Fintech startups raised $34.5 billion in funding worldwide. According to KPMG, global fintech investments reached US$25.6 billion in the first half of 2020 and raised to $98 billion in the first half of 2021, with fintech deal volume reaching a new record of 2,456 in the first half of the year.

Technological innovations will be the heart and blood of the banking industry for many years to come, and if big banks do not make the most of it, the new players from Fin-Tech and large technology companies surely will.

David M Brear, CEO of 11:FS for TechTuesday

COVID-19 has prompted Fintech companies to make changes to their existing products, services, and policies. University of Cambridge’s research shows that fee or commission reductions and waivers, changes to onboarding criteria, and payment easements were the most implemented practices among the surveyed firms.

Customers are becoming more open to non-traditional means of handling finances, according to PwC research, with 30% of consumers wanting to increase their use of non-traditional financial services providers. Following the rising demand for fintech services, venture capitalists have increased their investments in fintech startups by 41% over the last four years.

The trend of Fintech taking over the startup space is still going strong, so we have gathered a list of 181 companies in the financial technology industry worth following.

Namepicks

Monzo

Monzo is a UK-based online bank. The company is offering its customers a wide range of products and services through a digital platform and marketplace. Monzo has raised a total of $648.1M in funding over 20 rounds. The company is operating on the exact brand match domain name Monzo.com. There is quite a story around Monzo’s rebrand from Mondo. There was also a rival that didn’t miss the opportunity to ride on their fame by getting a similar domain and redirecting the traffic to their own site. Monzo acquired the EBM (Exact Brand Match) domain name Monzo.com, upgrading from GetMonzo.co.uk.

Tide

Tide is a financial platform that provides digital business banking services for small and medium-sized enterprises. George Bevis founded the company in 2015 in the U.K. Tide has raised a total of $195.2M in funding over nine rounds, the latest one being closed in July 2021. Tide has chosen the Tide.co domain name. The famous laundry detergent brand Tide is operating on the .com domain.

Tandem

Tandem is a British challenger bank owned by Tandem Money. The company was founded in 2013 by Ricky Knox, Matt Cooper, and Michael Kent. Tandem offers savings, mortgages, and loans to assist customers in greening their homes and lives. Tandem is operating on the Tandem.co.uk domain name. Hewlett Packard Enterprise owns Tandem.com.

Venmo

Venmo is a mobile payment service owned by PayPal. Venmo allows its account holder to transfer funds via a mobile phone app under the condition of both the sender and the receiver living in the U.S. Venmo has chosen the exact brand match domain name Venmo.com.

Highlights

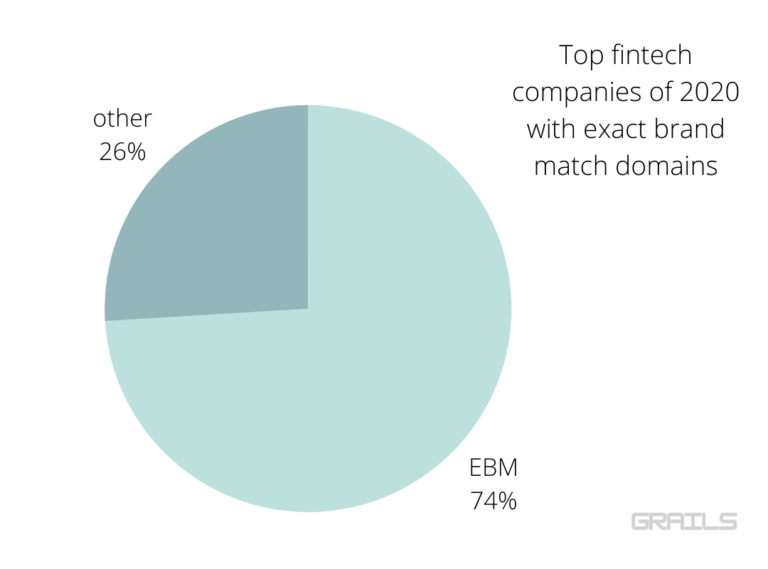

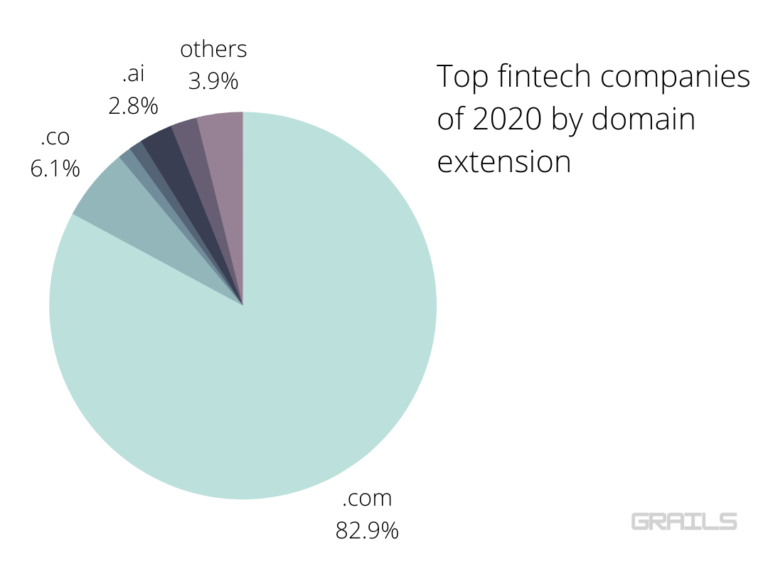

The majority of the companies on the list, 150 out of 181, have chosen the .com extension, with 134 opting for EBM.

Owning a .com domain extension highlights the brand’s credibility. It is more familiar to a broader audience as 46% of the websites use a .com domain name. 11 companies have chosen to use the .co extension. .co is the Internet country code top-level domain (ccTLD) assigned to Colombia but has been recently used by many up-and-coming startups as an alternative to .com.

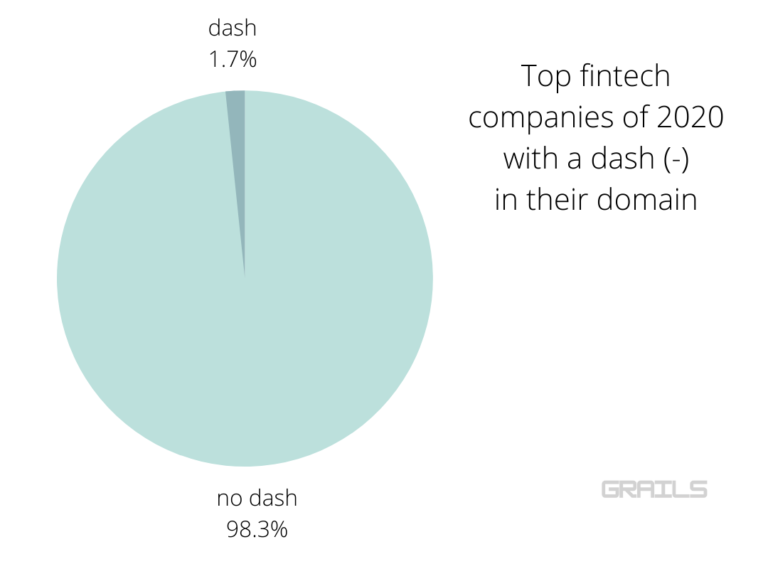

Three companies use a dash in their domains. Dashes are often included with two-word brand names or added words when the business has to compromise on their domain if the exact brand match name is taken/not within reach.

| DOMAIN EXTENSION | Top Fintech Companies Of 2020 using it |

|---|---|

| .com | 150 |

| .co | 11 |

| .co.uk | 2 |

| .io | 2 |

| .ai | 5 |

| .net | 4 |

| others | 7 |

While we make every effort to ensure the data on our site is accurate, complete, and up-to-date, we cannot guarantee its reliability. Our data is provided for informational purposes only and should not be relied upon as legal, financial, or other advice. We strongly recommend that you independently verify any information before relying on it.

How does your brand name match your company vision? What new horizons can a better name open? Get in touch if you feel your brand deserves a better name, we are always happy to help.

branding domain domain name domains finance fintech naming neobank startup startups technology upgrade

Previous Next