Discover the latest trends in global monthly funding data, with a unique focus on companies’ domain name choices, in our monthly funding reports.

Overview

In May, there was a notable increase in the number and amount of funding across different investment rounds compared to April, particularly in the early stages, signalling a renewed interest in early-stage companies and a higher willingness among investors to take on risks.

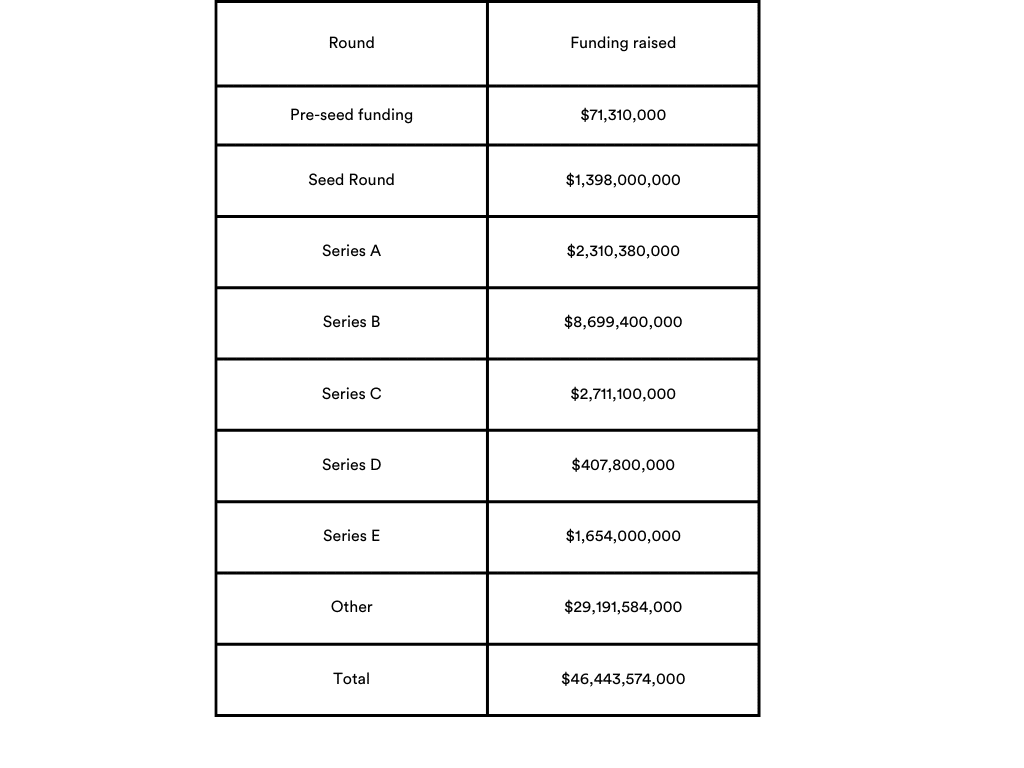

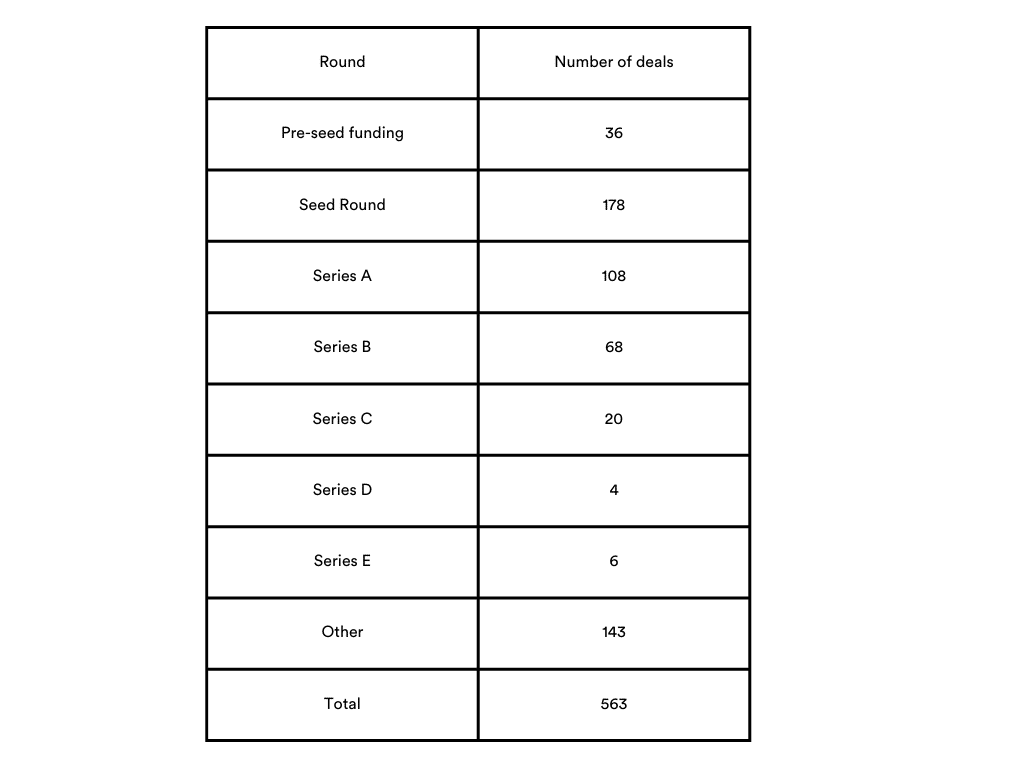

| Round | Amount April (USD) | Number deals April | Amount May (USD) | Number deals May |

| Pre-seed funding | 63,168,820 | 34 | 71,310,000 | 36 |

| Seed Round | 828,966,000 | 144 | 1,398,000,000 | 178 |

| Series A | 3,116,700,000 | 115 | 2,310,380,000 | 108 |

| Series B | 2,596,250,000 | 56 | 8,699,400,000 | 68 |

| Series C | 1,969,200,000 | 29 | 2,711,100,000 | 20 |

| Series D | 1,179,000,000 | 12 | 407,800,000 | 4 |

| Series E | 254,800,000 | 3 | 1,654,000,000 | 6 |

| Other | 30,358,241,000 | 192 | 29,191,584,000 | 143 |

| Total | 40,366,325,820 | 585 | 46,443,574,000 | 563 |

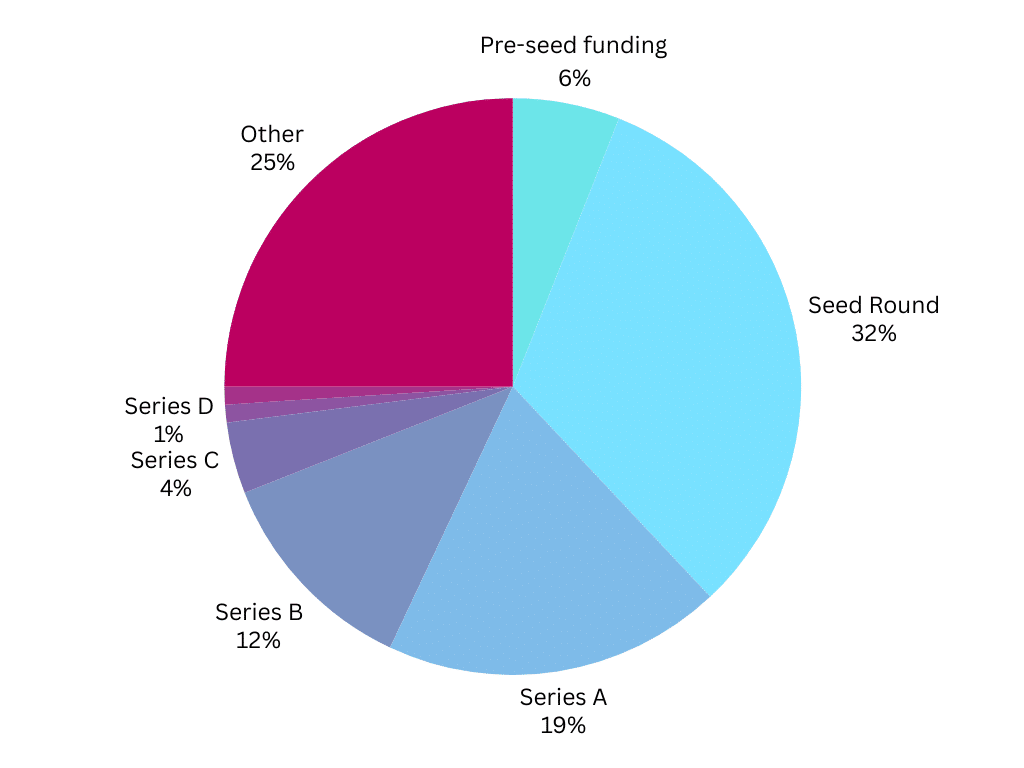

For the Pre-seed funding round, May saw $71,310,000 funded across 36 deals, up from April’s $63,168,820 with 34 deals. The Seed Round in May experienced an even more significant rise, with $1,398,000,000 distributed over 178 deals, compared to April’s $828,966,000 for 144 deals. This increased interest in early-stage investment could suggest a positive shift in investor confidence regarding the potential returns from early-stage startups.

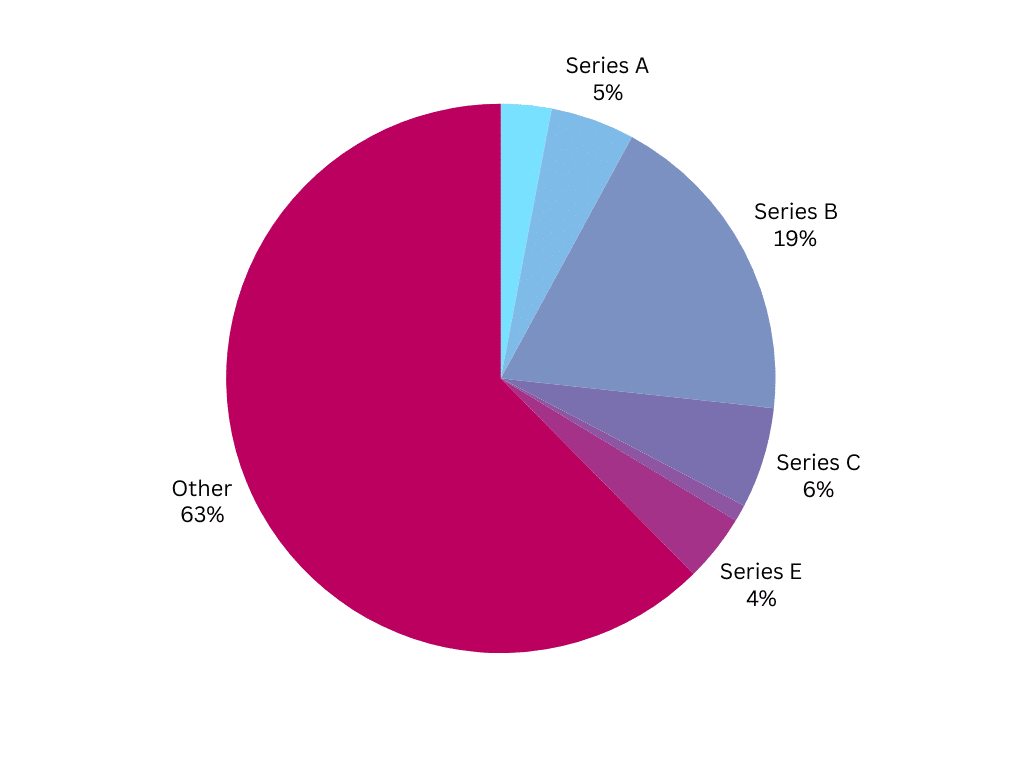

Series A funding saw a decrease in the number of deals and the amount raised, moving from $3,116,700,000 across 115 deals in April to $2,310,380,000 for 108 deals in May. In contrast, Series B rounds marked a substantial increase in funding, pulling in $8,699,400,000 from 68 deals in May, a sharp rise from $2,596,250,000 and 56 deals in April. This surge is mainly attributed to a significant $6 billion raised by xAI company.

Series C funding also grew, with May’s $2,711,100,000 across 20 deals surpassing April’s $1,969,200,000 from 29 deals. Series D rounds showed a decrease in both the number of deals and the amount of funding, going from 12 deals totalling $1,179,000,000 to just 4 deals totalling $407,800,000. This might indicate a shift in strategy or market conditions affecting the appeal or viability of further large-scale investments at this stage.

Series E demonstrated growth in funds raised and the number of deals. While the total number of deals decreased from 585 in April to 563 in May, the total funding amount increased from $40,366,325,820 to $46,443,574,000. This trend suggests a higher average investment per deal, indicative of the market’s strategic adjustments, potentially influenced by prevailing economic conditions and investor assessments of higher-value opportunities despite fewer total transactions.

By funds raised/ Total funding $46,443,574,000

By number of deals/Total number of deals 563

Investing in technology, energy, healthcare, and financial services dominated in May, showing the drive for digital innovation. Artificial intelligence, machine learning, and embedded systems are among the most strongly funded technology sectors. There has been an increase in investment in renewable and clean energy, emphasising the importance of sustainability. Due to constant advancements in treatments and technology, healthcare, including biotechnology and medicine, has received robust funding. Financial services, particularly fintech and mobile payments, also drew considerable attention, reflecting the sector’s evolving digital finance landscape.

Below, we will examine some companies on our list and explore their brand and domain name choices.

Namepicks

Check out our article “How to Name a Unicorn?” for insights on choosing a brand name that can help elevate your startup to unicorn status.

DeepL

Industry: Artificial Intelligence (AI), Generative AI, Machine Learning, Software, Translation Service

Funds Raised: $300,000,000 Venture Round

DeepL, a startup specialising in generative AI, secured $300 million in funding, achieving a $2 billion post-money valuation, a significant increase from its previous valuation of over $1 billion in January 2023. This funding round, led by Index Ventures, also saw contributions from Iconiq Growth, Teachers’ Venture Growth, IVP, Atomico, and WiL (World Innovation Lab).

This new investment comes during what is on track to be DeepL’s most transformative year yet and is a testament to the crucial role that our Language AI platform has in solving the complex linguistic challenges global companies face today.

Founder and CEO Jarek Kutylowski said in a statement

Founded in 2017 by Polish entrepreneur Jarek Kutylowski, who serves as CEO, DeepL offers AI-powered writing, editing, and translation services across 63 markets in 32 languages, targeting business applications. The platform has already attracted over 100,000 customers, including businesses, governments, and various organisations.

The brand name “DeepL” signifies the company’s focus on deep learning technology, a subset of machine learning central to its AI-driven services.

Like most companies featured in our Top 100 AI Startups of 2023, DeepL operates under its Exact Brand Match (EBM) domain, DeepL.com. This strategy enhances online trust and credibility, essential for establishing lasting customer relationships and securing a competitive advantage.

Meesho

Industry: E-Commerce, E-Commerce Platforms, Fashion, Retail Technology

Funds Raised: $275,000,000 Venture Round

Meesho helps users start their businesses without investment by connecting small and micro business owners with customers via social media sites like WhatsApp, Facebook, and Instagram.

The company secured $275M in funding in a $600M round, with share transfers hinted at in SEC filings. In total, Meesho has raised $1.36 billion—including secondaries—since 2015. Meesho is among the fastest-growing e-commerce startups in India. The name “Meesho” is derived from “meri shop,” which is translated to “my shop” in Hindi.

Meesho has invested in the exact brand match domain name Meesho.com, signalling strong brand identity and authority online. For an e-commerce company, owning an EBM domain enhances user recall and ensures a direct and reliable point of contact for customers seeking authentic engagements, ultimately driving increased traffic and sales.

Motional

Industry: Automotive, Autonomous Vehicles, Fleet Management, Information Technology, Software

Funds Raised: $475,000,000 Corporate Round

Motional offers an autonomous driving platform tailored for robotaxi providers, fleet operators, and automotive manufacturers. Founded in March 2020, Motional is an American autonomous vehicle company established as a joint venture between Hyundai Motor Group and auto supplier Aptiv. The company recently closed a $475M funding round led by Hyundai Motor Group.

The name “Motional” combines “motion,” reflecting the movement facilitated by their driverless technology and their longstanding influence on the industry, with “emotional,” highlighting their commitment to safety and reliability, which ensures peace of mind for users.

Motional is a strong name that will signify to consumers they are riding in a driverless vehicle that is safe for passengers, cities, and the environment.

Kevin Clark, President and CEO, Aptiv

From its inception, Motional was poised for success, launching with the EBM domain Motional.com. This choice reinforces their online credibility and signals a serious, long-term commitment to leading in the autonomous vehicle industry.

Scale

Industry: Artificial Intelligence (AI), Data Collection and Labeling, Generative AI, Image Recognition, Machine Learning

Funds Raised: $1,000,000,000 Series F

Founded in 2016, Scale AI provides vast amounts of accurately labelled data, which is crucial for training advanced tools like OpenAI’s ChatGPT. The company assists clients, including tech giant Microsoft, Wall Street bank Morgan Stanley, and AI firms such as OpenAI and Cohere, in creating and refining data sets. Scale AI recently raised $1 billion in a late-stage funding round led by venture capital firm Accel, with participation from tech giants Nvidia (NVDA.O), Amazon (AMZN.O), and Meta (META.O), bringing the AI data startup’s valuation to nearly $14 billion.

Initially, Scale AI launched using the Scale.ai domain name, benefiting from the .ai extension that aligns with its focus on artificial intelligence. While descriptive extensions can provide more availability than a .com, they can lock a business in an area of activity and limit its growth when expanding to new services and markets. Recognising this, Scale AI strategically acquired the premium domain name Scale.com. This move not only broadened their branding scope but also enhanced their credibility and trustworthiness in the marketplace.

xAI

Industry: Artificial Intelligence (AI), Generative AI, Information Technology, Machine Learning

Funds Raised: $6,000,000,000 Series B

Elon Musk’s company xAi, the star of May’s fundings, raised $6 billion to fund its race against ChatGPT and all the rest. xAI is valued at $24 billion as it reportedly seeks to build its own AI supercomputer by late next year. So far, xAI has launched Grok, a supposedly edgier version of OpenAI’s ChatGPT available via X, formerly known as Twitter, where the chatbot is currently only available to X Premium subscribers.

xAi operates on the x.ai domain name, a choice that aligns with Elon Musk’s longstanding fascination with the letter ‘X’, a consistent theme throughout his entrepreneurial career, marking many of his ventures. This obsession started in 1999 with the launch of X.com, an online banking site, which later evolved into PayPal after merging with Confinity. Despite losing the original X.com to PayPal, Musk reacquired the domain in 2017, hinting at future plans, culminating in Twitter’s rebranding to X. His interest in ‘X’ has also manifested in SpaceX, the Model X from Tesla, and even in naming his child.

Musk’s vision for X as an ‘everything app’ and his control of both the x.ai and X.com domains highlight a clear branding strategy that raises questions about how these platforms might integrate and evolve. Given Musk’s history of quick and significant changes, the development of X and xAi could greatly impact their respective markets and user interactions, potentially reshaping how we engage with social media and artificial intelligence technologies.

Highlights

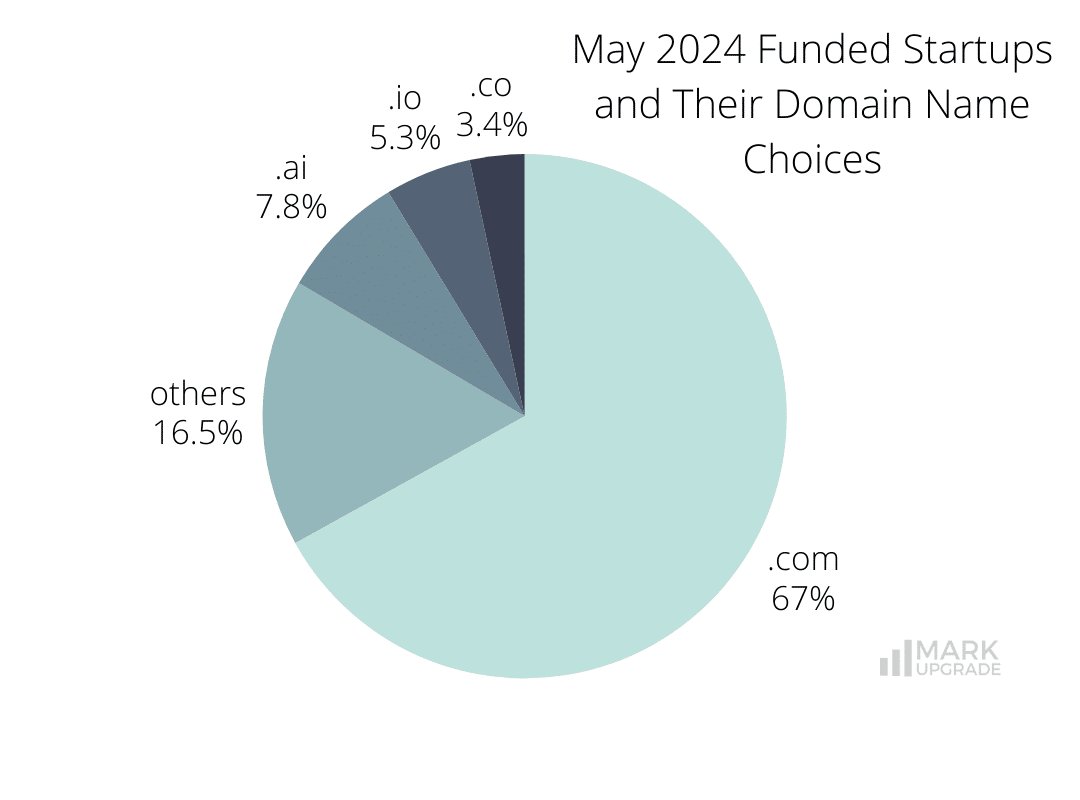

The .com extension remains the top choice due to its universal recognition and trustworthiness, with 377 out of 563 companies opting for it. This extension provides a strong foundation for businesses aiming to establish a broad and credible online presence.

The .io and .ai extensions, selected by 30 and 44 companies, respectively, are preferred choices among tech companies — .io is often associated with input/output in tech circles, while .ai directly references Artificial Intelligence. While these extensions enhance brand relevance and appeal within the technology sector, their niche associations may potentially limit the company’s appeal as it grows and seeks to expand beyond strictly tech-oriented audiences.

19 companies have chosen the .co extension. Originally assigned as the country code top-level domain (ccTLD) for Colombia, the .co extension has been globally adopted by companies and startups as a popular alternative to the .com domain.

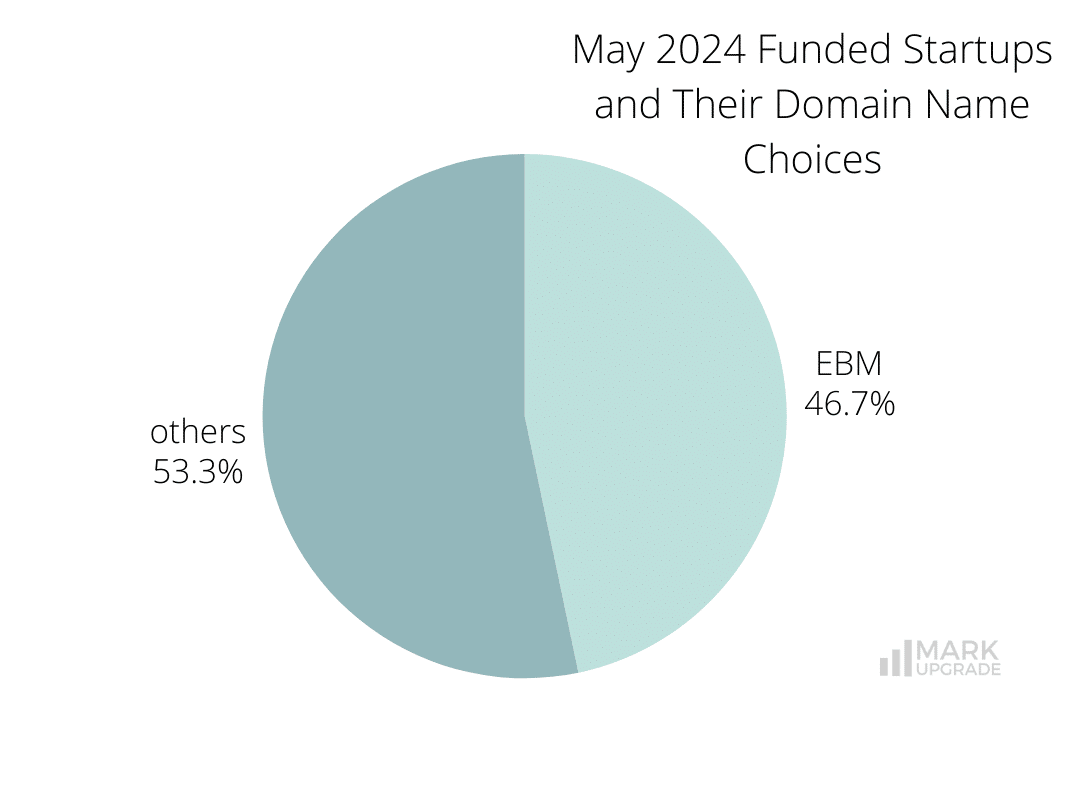

Exact Brand Match (EBM) domains are chosen by 263 companies. An EBM domain directly enhances brand recognition and marketing effectiveness.

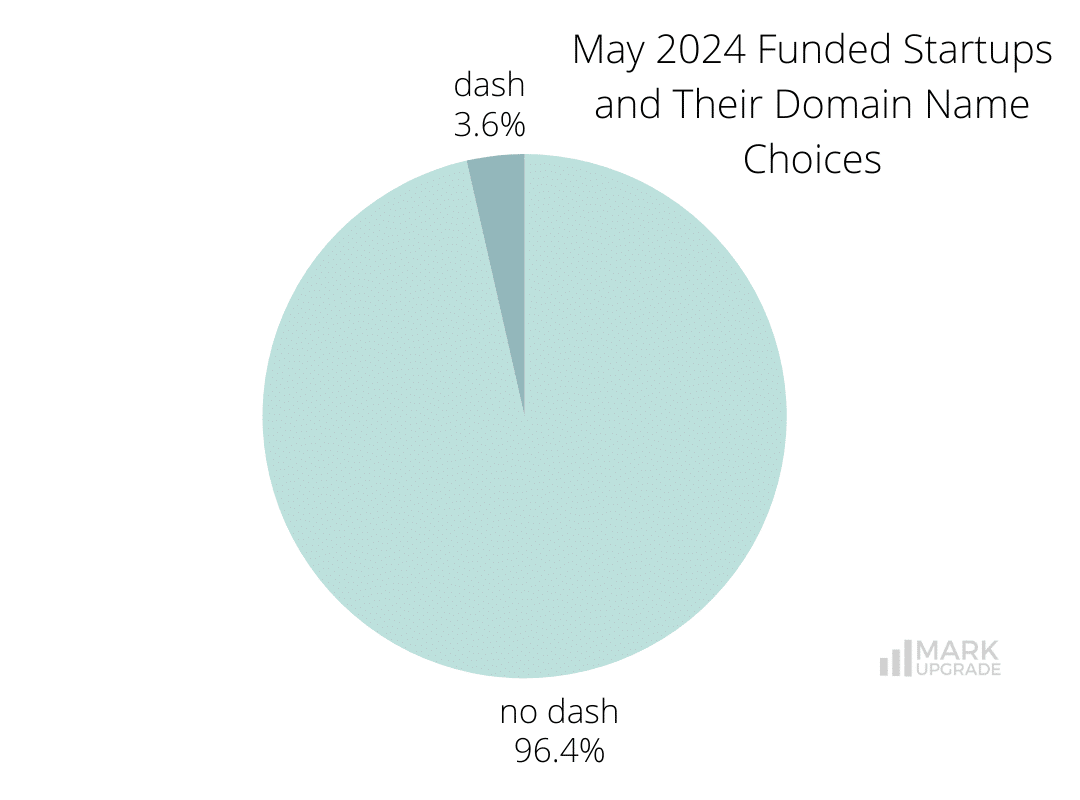

20 companies have used dash in their domain names. Dashes are frequently used in domain names for two-word brand names or when additional words are added, often as a compromise when the EBM domain is already taken or not attainable.

While we make every effort to ensure the data on our site is accurate, complete, and up-to-date, we cannot guarantee its reliability. Our data is provided for informational purposes only and should not be relied upon as legal, financial, or other advice. We strongly recommend that you independently verify any information before relying on it.

In today’s competitive online market, a premium domain name can set your business apart from the competition. Don’t settle for a compromise – contact us to explore the many benefits of premium domain names and how they can help your business grow.

Other resources

2024 branding business domain domain name domain names funding may Monthly Funding Report naming startup

Previous Next