Discover the latest trends in global monthly funding data, with a unique focus on companies’ domain name choices, in our monthly funding reports.

Overview

In June 2024, global startup funding across various rounds exhibited mixed trends compared to the previous month. Investors are strategically navigating the economic and political climates both in the U.S. and globally by adjusting their funding allocations, favouring sectors and stages that offer more stability against the backdrop of economic recovery and political developments.

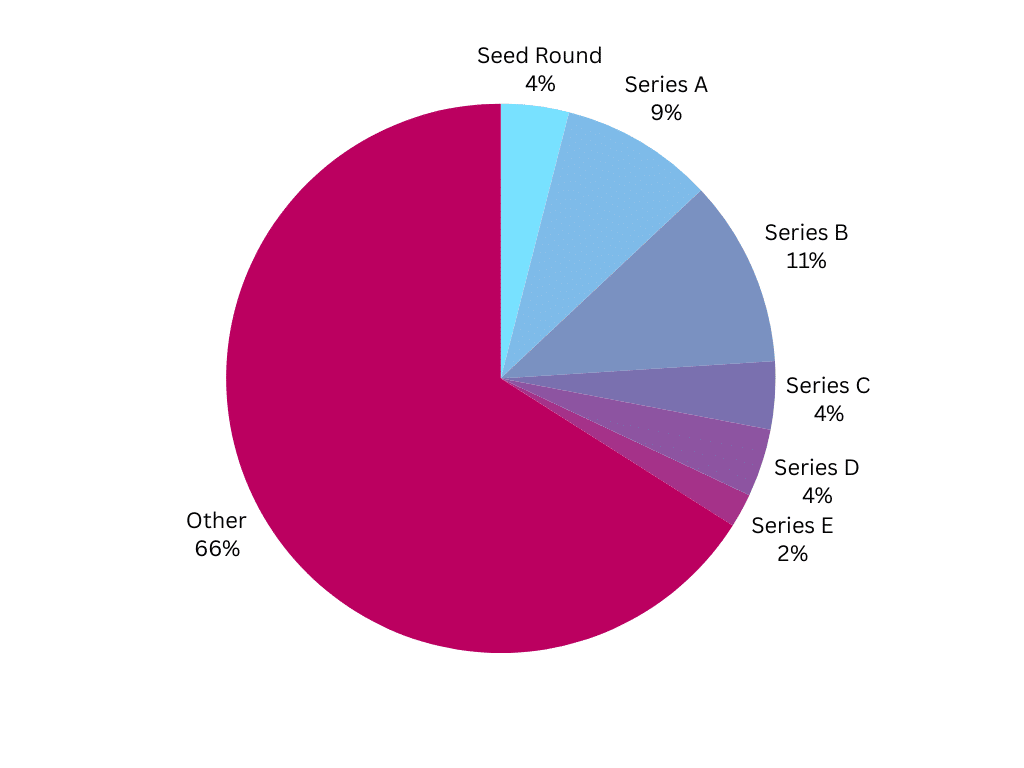

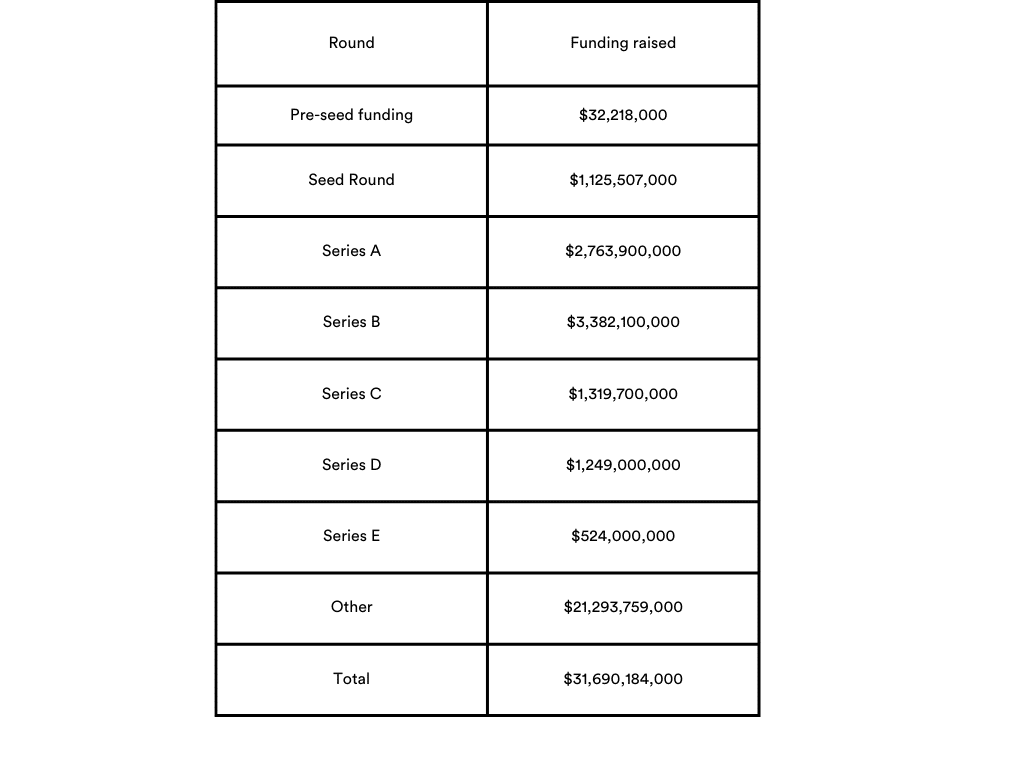

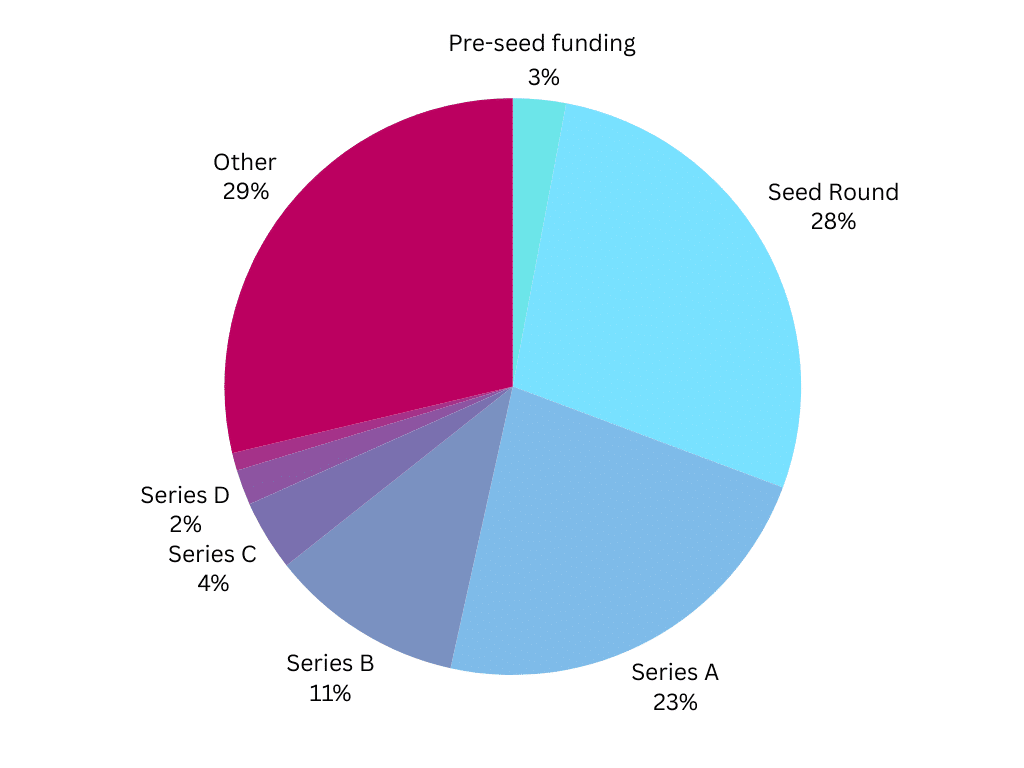

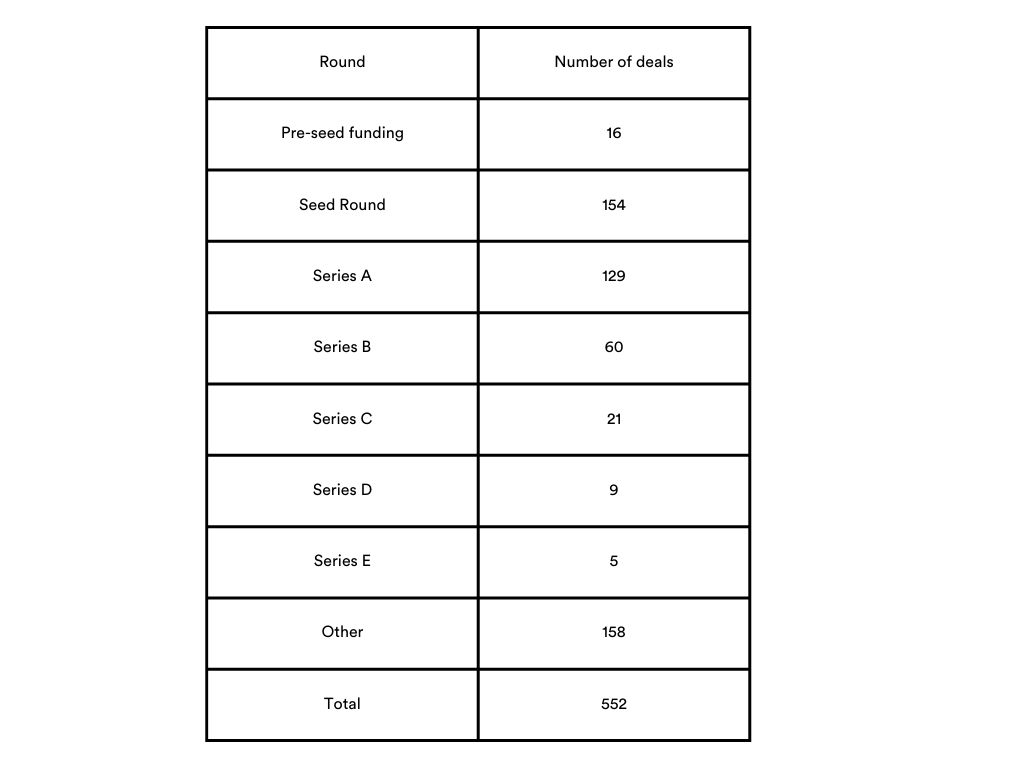

| Round | Amount May (USD) | Number deals May | Amount June (USD) | Number deals June |

| Pre-seed funding | 71,310,000 | 36 | 32,218,000 | 16 |

| Seed Round | 1,398,000,000 | 178 | 1,125,507,000 | 154 |

| Series A | 2,310,380,000 | 108 | 2,763,900,000 | 129 |

| Series B | 8,699,400,000 | 68 | 3,382,100,000 | 60 |

| Series C | 2,711,100,000 | 20 | 1,319,700,000 | 21 |

| Series D | 407,800,000 | 4 | 1,249,000,000 | 9 |

| Series E | 1,654,000,000 | 6 | 524,000,000 | 5 |

| Other | 29,191,584,000 | 143 | 21,293,759,000 | 158 |

| Total | 46,443,574,000 | 563 | 31,690,184,000 | 552 |

Pre-seed and seed funding saw declines, with pre-seed dropping to $32.22 million and seed funding decreasing to $1.13 billion, while their respective deal numbers fell from 36 to 16 and from 178 to 154. This indicates a growing caution among investors towards early-stage ventures. Series A funding rose to $2.76 billion, with deals increasing to 129 from 108, demonstrating heightened confidence in promising startups. Series B funding saw a sharp decrease from $8.70 billion to $3.38 billion, despite deal numbers only slightly reducing from 68 to 60. Series C funding decreased to $1.32 billion from $2.71 billion, with a minor increase in deals from 20 to 21, indicating smaller investments per deal due to rising uncertainties. Conversely, Series D funding increased significantly to $1.25 billion from $407.8 million, with deals almost doubling from 4 to 9, showing increased interest in more established, lower-risk companies.

By funds raised/ Total funding $31,690,184,000

By number of deals/Total number of deals 552

U.S. Economic Resilience and Global Impact: The U.S. economy’s robust performance in June 2024, characterized by GDP levels surpassing pre-pandemic figures and a healthy growth projection of 2% annually, considerably influences global market sentiment. This economic strength, underscored by effective inflation control and productivity gains, likely boosts investor confidence globally. However, the challenges of high debt and deficits could be causing a cautious recalibration in investor strategies, as seen in the funding patterns. The cautious approach in the early stages (Pre-seed and Seed rounds) might reflect concerns over potential economic tightening due to fiscal consolidation efforts suggested by the IMF.

International Economic Landscape: The global economic outlook, with expected modest growth and the particular economic recoveries in the Eurozone and China, also impacts investment decisions. The notable increase in Series A funding and the number of deals could be influenced by global investors seeking to capitalise on growth opportunities in more stable, growth-posed startups amidst a generally improving global economic environment.

Impact of Political Events: The first presidential debate between Trump and Biden in 2024 potentially adds a layer of political uncertainty, influencing investor sentiment. Political stability and policies in the U.S. can significantly sway global markets due to the country’s economic influence. The debate outcomes might affect international trade policies and domestic economic strategies, which are crucial for investors. Given the ongoing trade tensions and the push for a rules-based trading system, investors might adjust their portfolios to mitigate risks associated with possible shifts in U.S. trade policies.

Correlation Between Economic Indicators and Investment Patterns: The cautious approach in early and late-stage investments might also reflect a response to the global economic indicators like elevated interest rates and persistent inflation, which are expected to impact consumer spending and economic growth negatively. The increased willingness to invest in later-stage, potentially lower-risk companies (as seen in Series D) aligns with the need for more secure, inflation-resistant investments during uncertain economic times.

Investor interest is concentrated in several key sectors: Financial Services and Fintech; Healthcare and Biotechnology; Energy and Sustainability; Technology and Artificial Intelligence; Real Estate and Commercial Properties; Manufacturing and Industrial; and Consumer and Retail Services,

Below, we will examine some companies on our list and explore their brand and domain name choices.

Namepicks

Check out our article “How to Name a Unicorn?” for insights on choosing a brand name that can help elevate your startup to unicorn status.

Creatio

Industry: CRM, Developer Tools, Information Technology ,SaaS, Software

Funds Raised: $200,000,000 Venture Round

Creatio (formerly bpm’online), a leading vendor of a no-code platform to automate CRM and enterprise workflows with a maximum degree of freedom raised $200 million capital at a $1.2 billion valuation.

Together with our channel partners, Creatio is on a mission to deliver an unprecedented time-to-value to our clients through the powerful combination of No-Code and AI. With this investment, we will continue to disrupt the traditional enterprise software approach, helping our clients to accelerate time-to-value and use technology as a competitive differentiation in their business.

Katherine Kostereva, CEO of Creatio

Creatio is recognised as a leader and strong performer in multiple Low-Code/No-Code and CRM reports by Gartner and Forrester. Its no-code platform has been positioned as the only leader in the recent report, The Forrester Wave™: Low-Code Platforms for Citizen Developers, Q1 2024.

The company rebranded in 2019 to better reflect its vision that everyone can be a developer, enabling users to automate business ideas and create custom solutions quickly.

Since our initial launch as bpm’online, our company, platform, and our global reach have changed a lot. We wanted a name that better reflected what our platform is about, and how our clients perceive our company and its products. Our new name, Creatio, emphasises the many powerful solutions that have been created using our platform, and it clearly communicates our vision of allowing anyone to become a developer.

Katherine Kostereva, CEO of Creatio

The investment in the Exact Brand Match (EBM) domain Creatio.com supported the rebrand to Creatio. EBM domains are the preferred choice for the majority of CRM startups. Having a recognisable and accessible online domain like Creatio.com also significantly increases a company’s visibility and credibility on a global scale, facilitating easier access for customers worldwide and reinforcing the brand’s identity and mission.

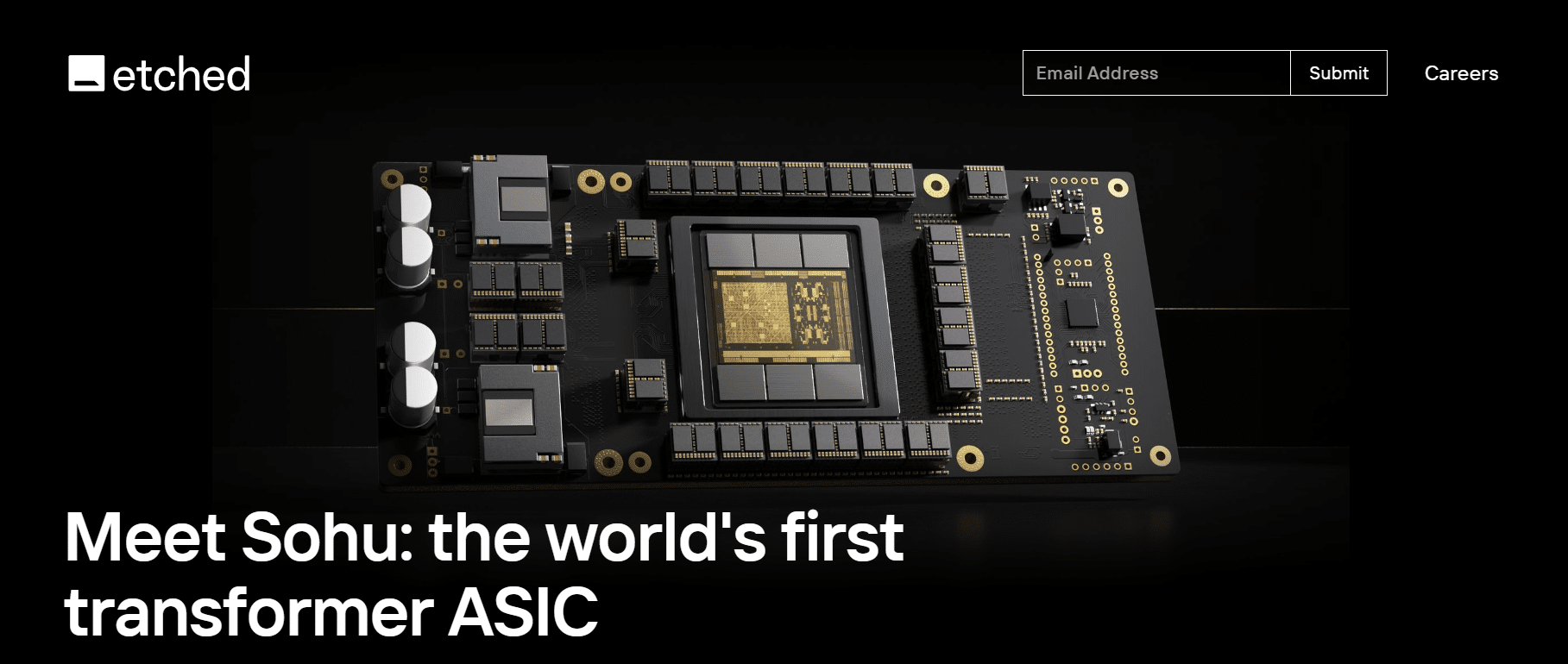

Etched

Industry: Computer, Hardware

Funds Raised: $120,000,000 Series A

San Francisco-based artificial intelligence startup, Etched, has secured $120 million in a Series A funding round. The company plans to use these funds to develop a specialised processor designed specifically for a type of AI model commonly used by platforms like OpenAI’s ChatGPT and Google. Etched’s CEO, Gavin Uberti, believes that the future of AI will increasingly rely on customized, hard-wired chips known as ASICs to handle the technology’s intensive computing demands.

If transformers go away, we’ll die..But if they stick around, we’re set to become the biggest company of all time.

Etched’s CEO, Gavin Uberti stated in an interview with CNBC

Etched has chosen a domain name that clearly corresponds to their global ambitions and communicates their vision – Etched.com.

FLO

Industry: Charging Infrastructure, Electric Vehicle, Renewable Energy

Funds Raised: $136,000,000 Series E

FLO, a leading North American electric vehicle (EV) charging network operator and smart charging solutions provider, has secured $136 million in long-term capital, principally from a Series E equity financing, led by Export Development Canada (EDC), to support the company’s continued growth in both the U.S. and Canada and accelerate the deployment of its reliable charging network. The investment will also help advance the rollout of FLO’s newest products, the NEVI and Buy America-compliant FLO Ultra fast charger and the next generation of FLO Home residential chargers. It will also help fund additional new charging solutions and the network expansion of FLO owned-and-operated stations at high-utilization sites with FLO’s strategic partners.

We are glad that FLO’s financing partners share our vision: long-term growth, a profitable business model and strategic market expansion via both the sale and ownership of reliable infrastructure. Together we will continue our work to deliver the best charging experience for all EV drivers.

Francis Baillargeon, Chief Financial Officer at FLO

FLO operates on FLO.com, an Exact Brand Match (EBM) domain. Owning a three-letter .com domain makes a powerful statement about a brand’s authority and vision for the future, signalling a company’s commitment to innovation and forward-thinking.

Foodsmart

Industry: App, Health Care

Funds Raised: $200,000,000 Series D

Foodsmart (formerly Zipongo), a San Francisco, CA-based telenutrition company and provider of a food benefits management platform, raised $200M in funding. The Rise Fund led the round. The company intends to use the funds to expand operations and its business reach.

Founded in 2010 by CEO Jason Langheier, Foodsmart supports those facing chronic disease and food insecurity by partnering with health plans and providers to give patients access to personalized and affordable healthy eating options. It combines virtual nutrition counselling through a network of Registered Dietitians in the US with an integrated digital food benefits management platform through which patients can plan personalized meals, order quality food through grocers nationwide and local medically tailored food partners, apply for SNAP benefits, and learn ways to buy good food affordably.

In 2020, the company rebranded to more accurately reflect its evolving product offerings and the direct benefits these provide. The original brand name, Zipingo, often confused users and did not clearly communicate the company’s focus on smart, healthy eating solutions. The rebrand to Foodsmart aligned with its expanded features, including more recipes and new partnerships. It conveyed the company’s mission to enhance nutrition—a need made particularly urgent during health crises like COVID-19. This name change simplified the brand message and directly connected with its goal of helping users achieve their nutrition objectives without needing further explanation.

During the rebranding, the company acquired the EBM domain name Foodsmart.com, thus making the most of their marketing across channels and avoiding security risks.

Semperis

Industry: Cyber Security, Enterprise Software, Identity Management, Information Technology

Funds Raised: $125,000,000

The funding round was led by J. P. Morgan and Hercules Capital at a valuation of over $1 billion. Semperis raised a $200 million Series C two years ago. The cyber company has also named a new CFO, CRO, and CLO as it continues to gear up for a potential IPO.

Semperis is a clear leader in the urgently needed area of identity system defence, with machine-learning-based attack prevention, detection, and response. Leading organizations worldwide depend on Semperis to safeguard their hybrid Active Directory environment, which is foundational to the IT infrastructure and heavily targeted by attackers.

Scott Bluestein, CEO and CIO at Hercules Capital

Semperis operates on Semperis.com. Investing in an Exact Brand Match (EBM) domain for a cybersecurity company is essential for maintaining online security and brand integrity. It also ensures easy accessibility for customers, business partners, and investors, reinforcing trust and professional credibility. EBM domains are the preferred choice for the majority of Israeli Tech Companies.

Highlights

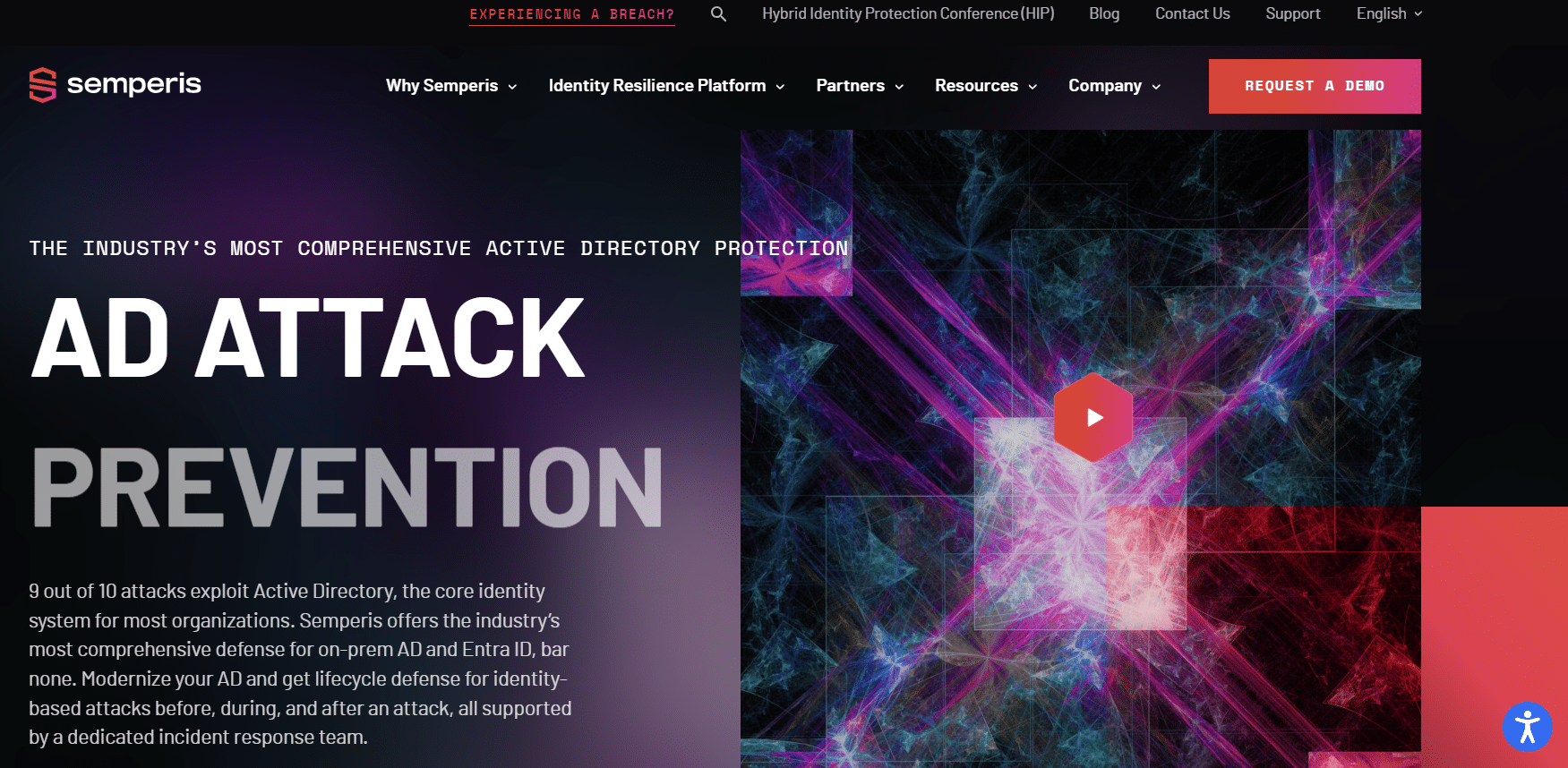

Out of 552 companies, 357 use the .com extension, which remains the most recognised and trusted domain, enhancing a company’s professional image and market reach.

59 companies have chosen the .ai extension, followed by the .io extension with 28 users. Both extensions are popular among tech and AI startups, with .ai focusing on artificial intelligence and .io appealing to tech-savvy audiences. However, their niche appeal might limit broader audience reach compared to .com.

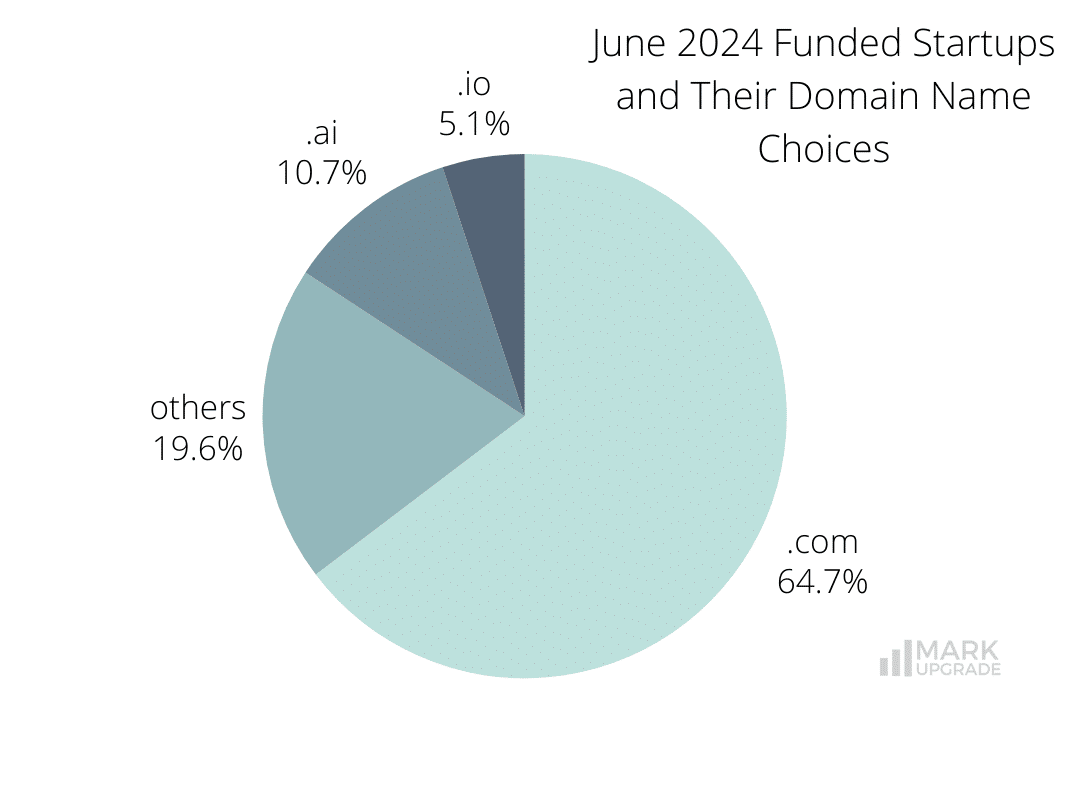

Exact Brand Match (EBM) domains, used by 240 companies, account for approximately 43% of the total. These domains are essential for strengthening brand identity and online presence, as well as effective marketing and easy customer recall.

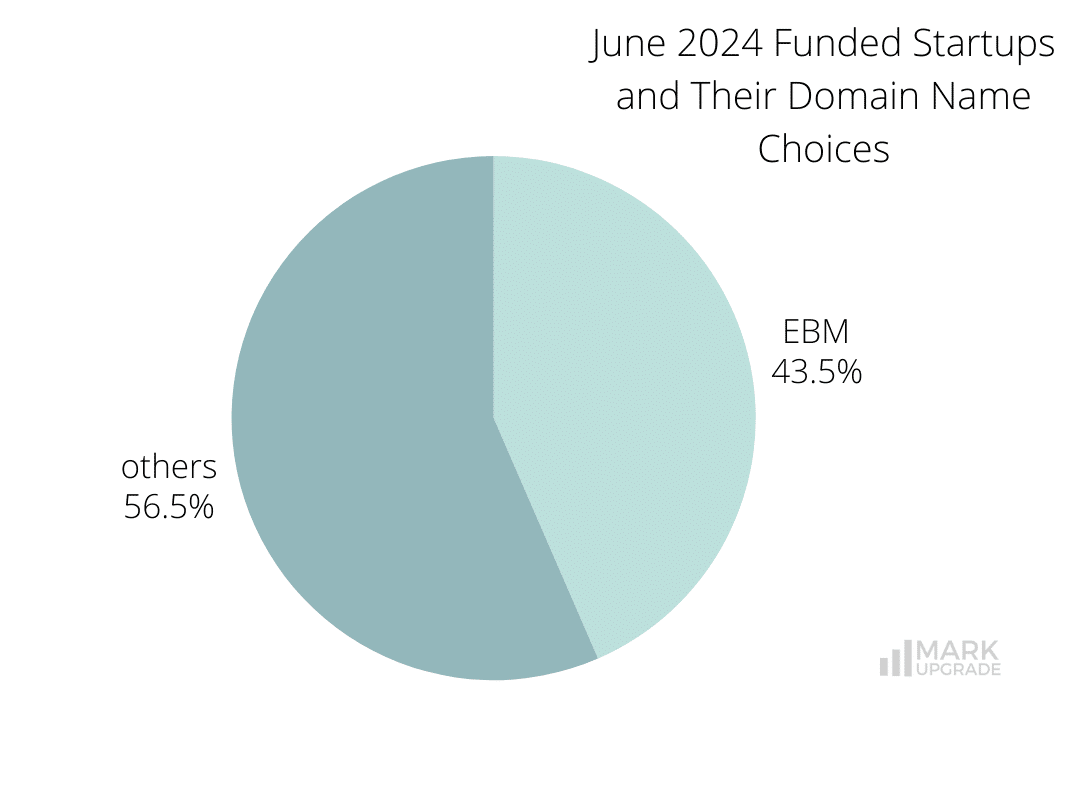

17 companies use a dash in their domain names. Dashes are often included with two word brand names or with added words when the business has to compromise on their domain if the EBM name is taken/not within reach.

While we make every effort to ensure the data on our site is accurate, complete, and up-to-date, we cannot guarantee its reliability. Our data is provided for informational purposes only and should not be relied upon as legal, financial, or other advice. We strongly recommend that you independently verify any information before relying on it.

In today’s competitive online market, a premium domain name can set your business apart from the competition. Don’t settle for a compromise – contact us to explore the many benefits of premium domain names and how they can help your business grow.

Other resources

branding business domain domain name domain names domains funding naming startup

Previous Next