Discover the latest trends in global monthly funding data, with a unique focus on companies’ domain name choices, in our monthly funding reports.

Overview

February shows a dynamic and evolving investment landscape, with investors adjusting their strategies to capitalise on opportunities in different stages of startup development.

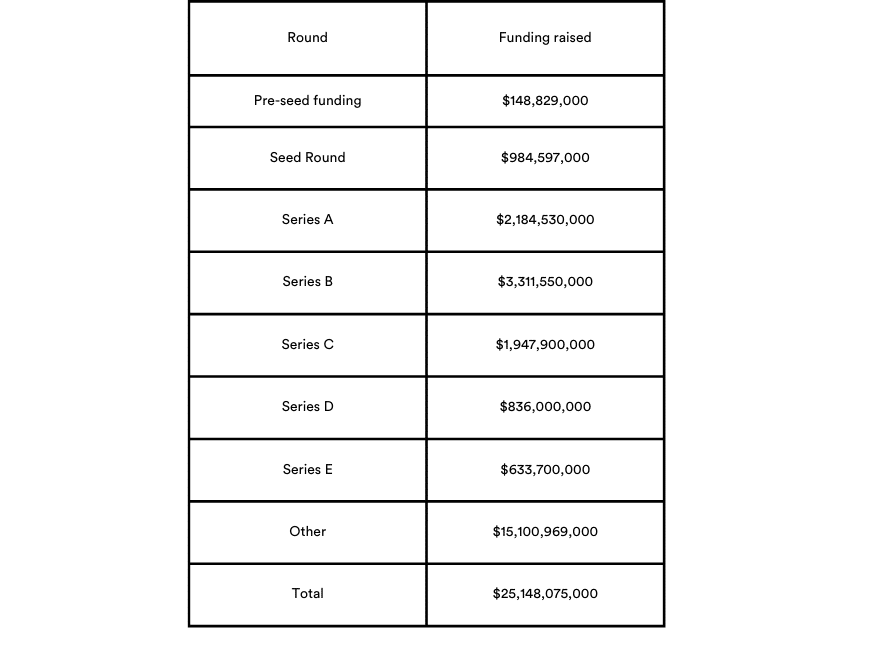

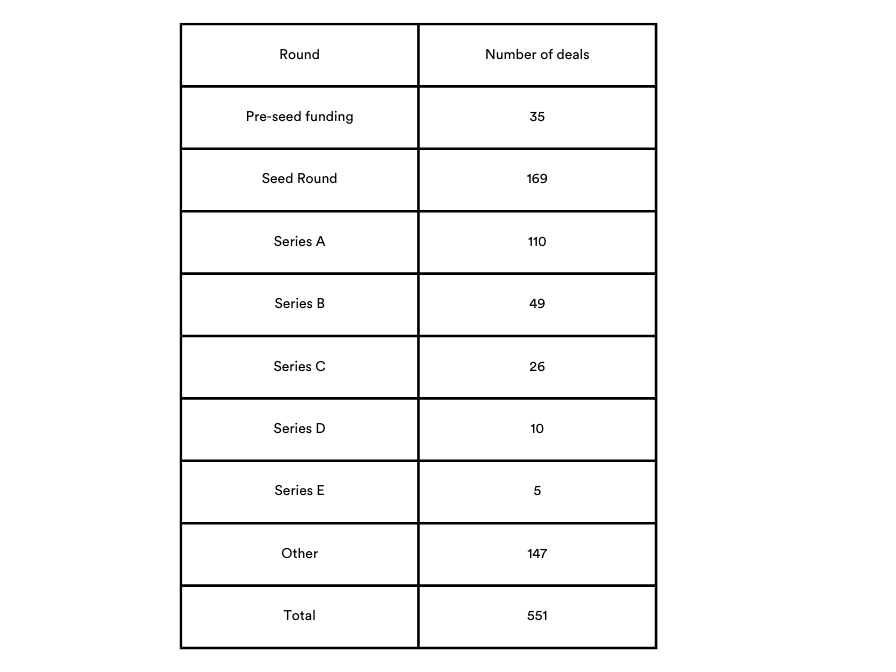

| Round | Amount January (USD) | Number deals January | Amount February (USD) | Number deals February |

| Pre-seed funding | 106,166,000 | 36 | 148,829,000 | 35 |

| Seed Round | 703,912,500 | 134 | 984,597,000 | 169 |

| Series A | 1,907,800,000 | 90 | 2,184,530,000 | 110 |

| Series B | 3,020,000,000 | 65 | 3,311,550,000 | 49 |

| Series C | 1,192,200,000 | 25 | 1,947,900,000 | 26 |

| Series D | 544,500,000 | 5 | 836,000,000 | 10 |

| Series E | 265,000,000 | 3 | 633,700,000 | 5 |

| Other | 31,294,475,800 | 203 | 15,100,969,000 | 147 |

| Total | 42,034,054,300 | 561 | 25,148,075,000 | 551 |

Series A funding saw a modest increase in the amount raised and the number of deals, while Series B funding experienced a significant increase in both metrics. This trend may indicate that investors are increasingly confident in mid-stage startups and are willing to allocate more capital to support their growth, seeing promising opportunities in companies that have already proven their viability and are now ready to scale up their operations.

The increase in Series C funding and the surge in Series D funding reflects strong investor confidence in late-stage startups. These companies are likely seen as more mature and capable of achieving significant milestones, leading investors to allocate more substantial investments to support their expansion plans.

On the other hand, the decline in total funding for other rounds despite a similar number of deals suggests a shift in investor priorities. Investors may be becoming more selective in their investments, focusing on mid to late-stage startups with proven track records and strong growth potential. This may lead to increased competition for funding among early-stage startups, resulting in fewer resources available for these companies.

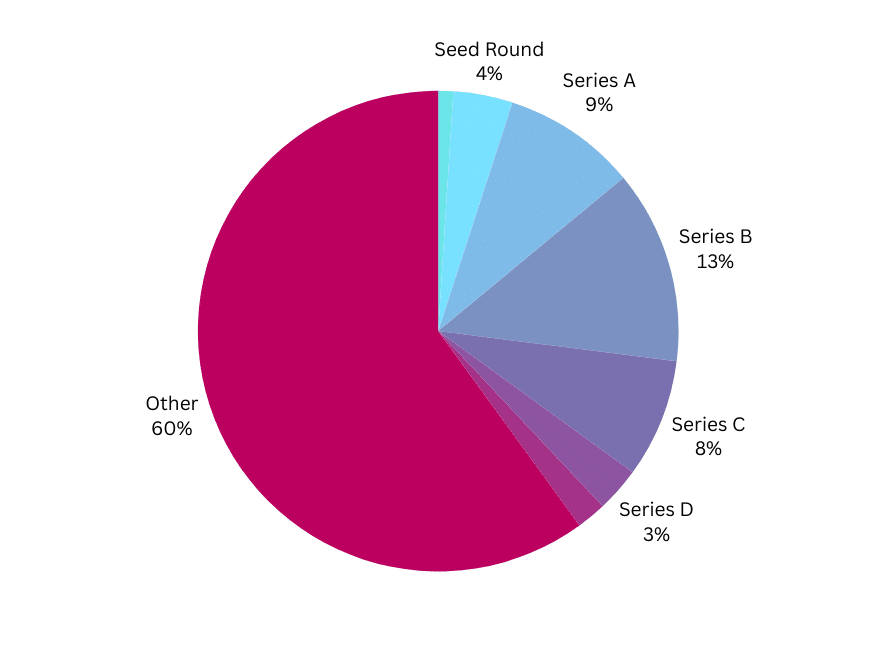

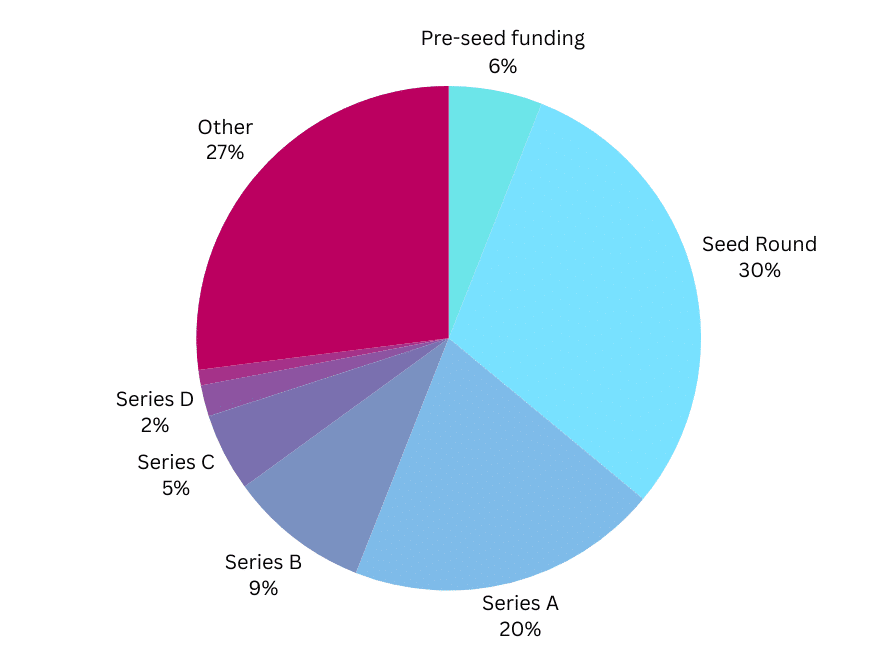

By funds raised/ Total funding $25,148,075,000

By number of deals/Total number of deals 551

AI companies attracted a larger share of startup investment in February, with more than a fifth of all venture funding going to such companies. The preference for AI as a favoured investment sector is driven by advancements in semiconductor technology, the internet, cloud computing, and hardware, which have enabled the development of more powerful and efficient solutions. These advancements have expanded the potential applications of AI across industries, fueled by access to vast amounts of data and computing resources.

Other sectors that saw high investor interest in February included Electronics, Manufacturing, Semiconductors, Renewable Energy, Solar, Employee Benefits, Financial Services, FinTech, Payments, Health Care, Medical, Medical Devices, and Robotics. These sectors likely attracted investors.

Below, we will examine some companies on our list and explore their brand and domain name choices.

Namepicks

Abridge

Industry: Artificial Intelligence (AI), Clinical Trials, Health Care, Machine Learning, Medical

Funds Raised: $150,000,000 Series C

Abridge, a leading provider of AI technology for clinical documentation, has announced a significant $150 million investment, building on the success of its product, which has been widely adopted by health systems across the country. This funding round follows closely on the heels of a $30 million Series B just four months ago, marking one of the largest investments in healthcare-focused generative AI to date. The Series C funding was led by Lightspeed Venture Partners, reflecting growing investor confidence in Abridge’s innovative approach to healthcare technology. With this new capital infusion, the company plans to further its research efforts and develop foundational models that leverage extensive healthcare data to drive innovation.

Abridge has set new standards for quality and responsible deployment of generative AI in health systems across the U.S., cementing it as the industry’s most trusted AI platform

Sebastian Duesterhoeft, Partner at Lightspeed Venture Partner, in an Abridge press release

Abridge’s name implies the act of shortening or condensing, reflecting the company’s mission to provide concise and accurate summaries of complex medical information. Abridge operates on the Exact Brand Match (EBM) domain Abridge.com, safeguarding its brand online, preventing traffic and email leaks, and minimising confusion among customers and business partners.

DataBank

Industry: Consulting, Information Technology, Risk Management

Funds Raised: $456,000,000 Debt Financing

DataBank, a Texas-based company, has successfully raised $456 million in its first-ever green financing round. This milestone marks the company’s fourth securitisation since 2021, boosting its total portfolio to an impressive $2.16 billion in investment-grade bonds. The financing round, which attracted contributions from nine new investors alongside support from existing backers, represents a strategic move by DataBank to strengthen its financial position and fuel its expansion endeavours.

This financing reflects not only DataBank’s commitment to sustainability and efficiency, but also the tremendous growth opportunity ahead of us, and the value and stability of our portfolio’s earnings. It signals the strong endorsement of investors in our strategy, footprint, and ability to execute profitably across that entire portfolio.

Kevin Ooley, DataBank’s president & CFO, in a press release

DataBank’s investment in the EBM domain DataBank.com reinforces the company’s reputation as a reliable provider in the data services market, promoting trust and credibility in its offerings.

Epic Games

Industry: Developer Platform, Gaming, Metaverse, Software, Video Games

Funds Raised: $150,000,000 Series D

Epic Games, the creative force behind Fortnite, has been a powerhouse since its inception in 1991, accumulating an impressive $8 billion in funding. Renowned for its innovative approach to interactive entertainment, Epic Games develops captivating games and provides state-of-the-art game engine technology to fellow developers.

Fortnite is a global phenomenon with 350 million accounts and 2.5 billion friend connections worldwide. Epic Games secured an additional $1.5 billion in funding through a groundbreaking partnership with Disney to amplify the visibility of its iconic characters and properties, including beloved Marvel Comics figures. The investment marked a notable decline in valuation, with reports indicating Disney’s participation at a $22.5 billion valuation.

Epic Games operates under the Exact Brand Match (EBM) domain EpicGames.com and manages a vast portfolio of over 4000 domain names, as reported by Whoxy. Many successful global brands leverage the power of domains, maintaining diverse portfolios that protect their brand, support marketing campaigns, establish sub-brands or products, target specific audiences, and more.

Jow

Industry: Specialty Retail, Information Services (B2C), Application Software

Funds Raised: $13,000,000 in additional funding

Jow, a Paris-based grocery shopping and menu recommendation app provider, secured $13 million in additional funding, with backing from Northzone and Eurazeo. Previously, the company raised $20 million from Eurazeo, Stride, Headline, and DST Global. The new funds will fuel the company’s expansion into the US market. Leveraging partnerships with retailers and brands, Jow’s platform combines retail media, consumer data, and algorithms to streamline meal planning and grocery shopping. With over 6 million users globally and 150 million meals served, Jow collaborates with major grocery retailers like Auchan, Carrefour, and Intermarché. The French startup plans to utilise the new financing to grow its US workforce, which includes remote workers nationwide and staff at the company’s new New York office. Jow’s funding round and US expansion coincide with recent innovations in the grocery industry, particularly in shoppable recipes and e-commerce profitability enhancement.

Jow has invested in the Exact Brand Match (EBM) three-letter domain name Jow.com. Domains like these are highly regarded for their value and prestige, owing to their brevity, versatility, and limited availability.

Tuum

Industry: Financial Software

Funds Raised: $27,000,000 Series B

The core banking platform Tuum has secured $26 million in Series B funding to expand its reach across new territories in Europe and the Middle East. This investment will facilitate the company’s expansion into central and southern Europe, increase its direct sales and marketing efforts, and establish new managed service relationships.

With this Series B funding, we’re not just expanding our reach: we’re redefining the very essence of core banking for a digital-first future.

Myles Bertrand, CEO of Tuum

Known initially as Modularbank, the Estonian company rebranded to Tuum two years after its inception to better align with its values and market offerings. The name Tuum, which translates to core in Estonian, underscores the company’s native roots and mission to empower businesses from within. This rebrand reflects Tuum’s evolution beyond solely serving banks to assisting fintechs and non-financial businesses in offering financial services.

At some point in its journey, Tumm upgraded from the limiting domain name Tuumplatform.com to the Exact Brand Match (EBM) domain Tuum.com, a domain name that clearly corresponds to its global ambitions and communicates its vision.

Highlights

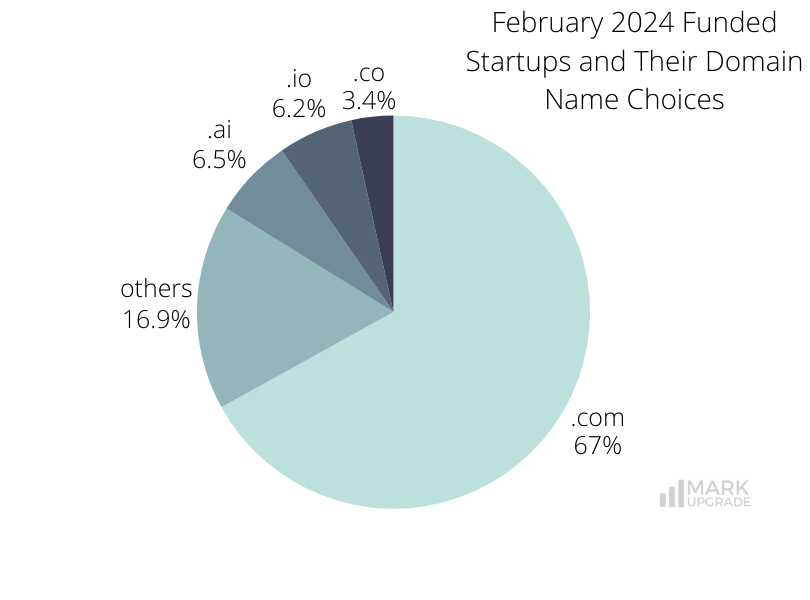

.com domains, chosen by 369 companies, are preferred for their widespread recognition, credibility, and versatility.

The .io and .ai extensions, selected by 36 and 34 companies, respectively, are popular among AI startups for their association with innovation and technology, reflecting the sector’s high funding activity this month. Country domain codes offer more freedom of choice but come with certain risks for businesses.

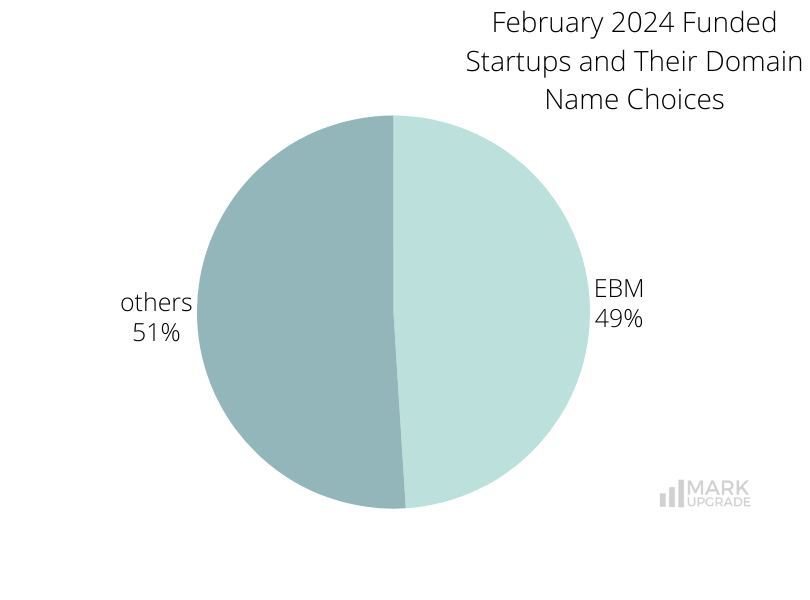

270 companies have opted for Exact Brand Match (EBM) domains, enhancing brand recognition and customer trust.

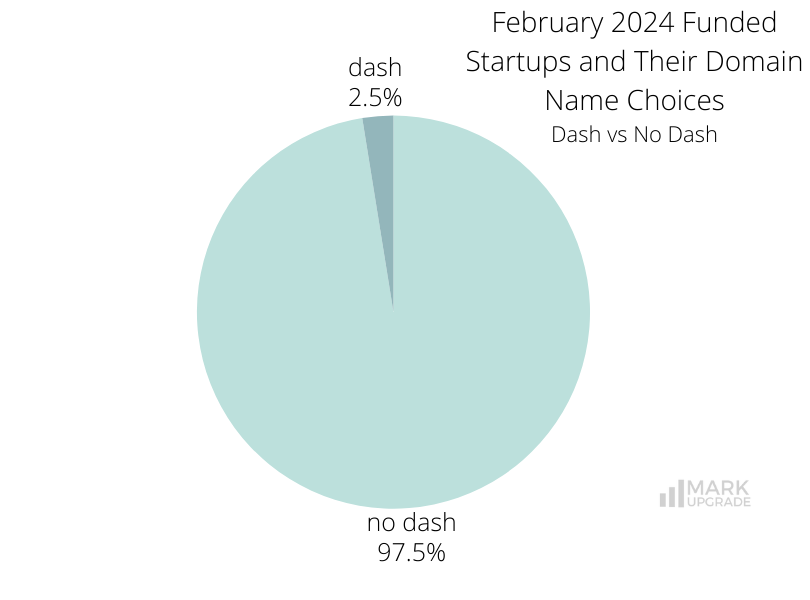

14 companies have chosen dash domains. Using hyphens in domain names is generally not recommended as it can make them more challenging to remember and type accurately.

While we make every effort to ensure the data on our site is accurate, complete, and up-to-date, we cannot guarantee its reliability. Our data is provided for informational purposes only and should not be relied upon as legal, financial, or other advice. We strongly recommend that you independently verify any information before relying on it.

In today’s competitive online market, a premium domain name can set your business apart from the competition. Don’t settle for a compromise – contact us to explore the many benefits of premium domain names and how they can help your business grow.

Other resources

2024 branding business domain domain name domain names domains february funding Monthly Funding Report naming startup

Previous Next