Discover the latest trends in global monthly funding data, with a unique focus on companies’ domain name choices, in our monthly funding reports.

Overview

| Round | Amount November (USD) | Number deals November | Amount December (USD) | Number deals December |

| Pre-seed funding | 116,638,600 | 54 | 94,259,910 | 50 |

| Seed Round | 851,298,000 | 139 | 673,940,400 | 116 |

| Series A | 1,906,220,000 | 87 | 2,309,610,000 | 87 |

| Series B | 2,502,780,000 | 60 | 2,150,720,000 | 53 |

| Series C | 2,029,860,000 | 28 | 1,438,100,000 | 24 |

| Series D | 1,015,400,000 | 10 | 2,315,600,000 | 11 |

| Series E | 104,3000,000 | 6 | 65,000,000 | 1 |

| Other | 30,232,883,4800 | 196 | 33,652,406,985 | 214 |

| Total | 38,759,380,080 | 580 | 42,699,637,295 | 556 |

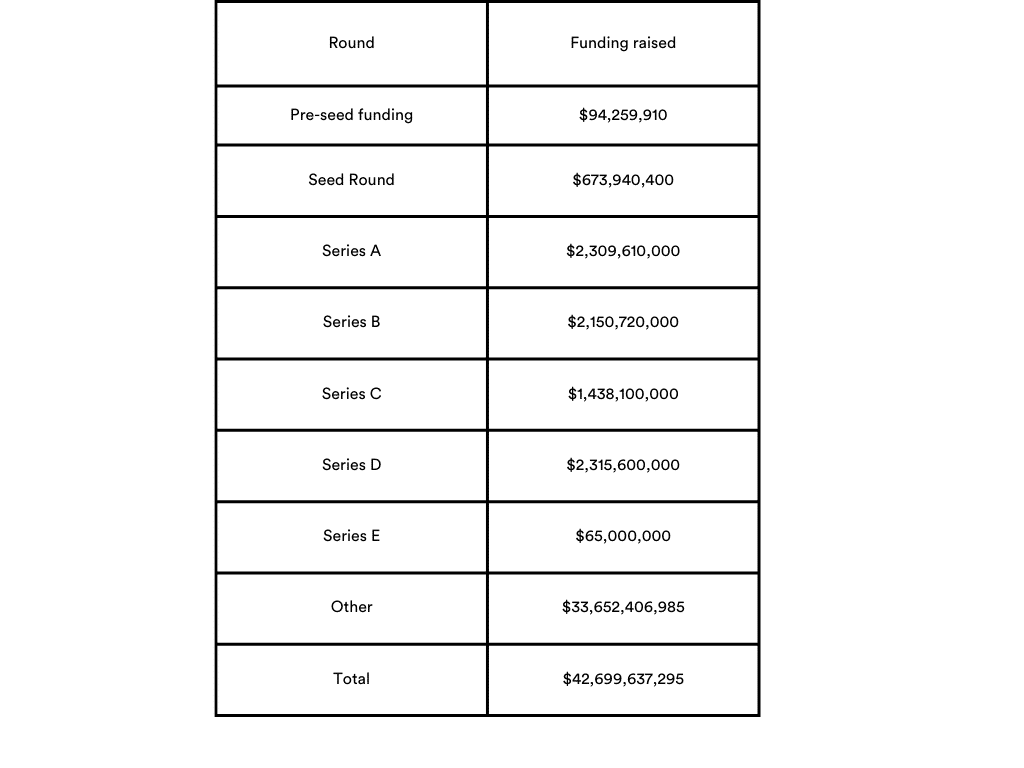

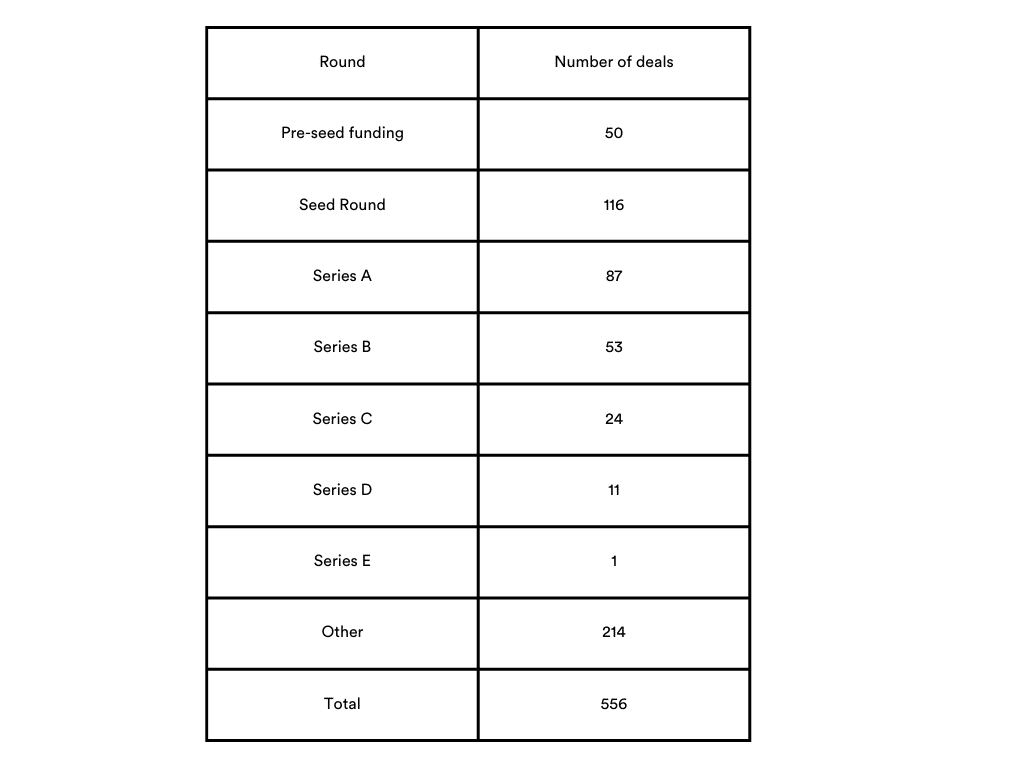

December 2024 witnessed $42.7 billion raised across 556 deals, reflecting a 10% increase in funding compared to November’s $38.8 billion, despite a drop in deal count. This growth was driven by significant funding rounds, including Databricks’ $10 billion raise, Crusoe Energy’s $600 million Series D, and Archer Aviation’s $430 million funding, underscoring strong investor interest in established companies with proven growth potential.

Early-stage funding experienced a decline in both Pre-seed and Seed rounds, with Pre-seed dropping to $94.3 million across 50 deals and Seed funding reaching $673.9 million across 116 deals. However, later-stage investments showed mixed trends. Series A funding remained consistent at $2.31 billion, while Series B and C rounds experienced declines to $2.15 billion and $1.44 billion, respectively. Series D rounds saw a remarkable surge, growing from $1.02 billion in November to $2.32 billion in December.

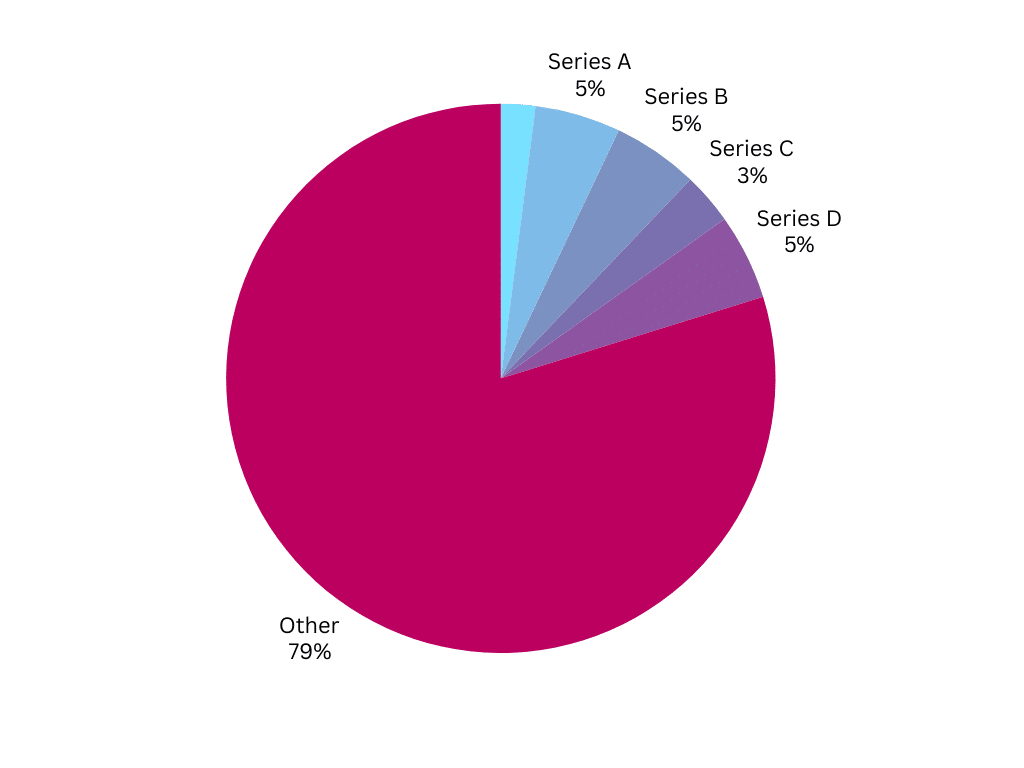

By funds raised/ Total funding $42,699,637,295

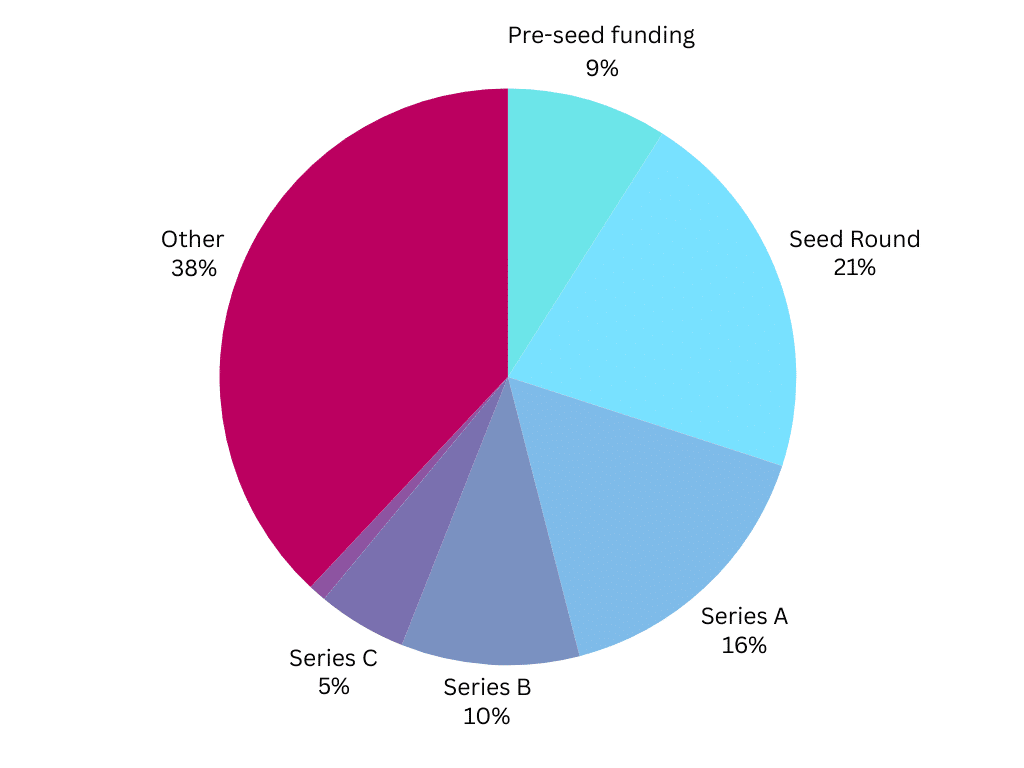

By number of deals/Total number of deals 556

Political and Economic Influences on December’s Funding Landscape

December 2024’s funding environment was shaped by a complex interplay of political developments, economic policies, and sector-specific trends. Investors exhibited a cautious yet opportunistic approach, balancing the potential for high returns against the backdrop of regulatory changes and global economic dynamics.

Political Influences

The global political landscape in 2024 was marked by widespread elections and escalating conflicts. Dubbed “The Year of the Vote,” over 80 countries held elections, with notable outcomes including Donald Trump’s unprecedented return as U.S. President, Keir Starmer’s rise in the UK, and Claudia Sheinbaum becoming Mexico’s first female president. While voter turnout reflected democratic engagement, political instability, such as the resignation of Bangladesh’s Sheikh Hasina and Syria’s government collapse, created uncertainty for investors.

Ongoing conflicts like the Israel-Hamas and the Russia-Ukraine wars added geopolitical risks, further affecting global funding flows. In this challenging environment, sectors associated with resilience and growth potential attracted the most investment activity.

Economic Influences

United States

Regulatory Environment: The anticipated return of Donald Trump to the presidency in January 2025 has generated optimism for a more favourable regulatory climate. Expectations of reduced regulations and potential tax cuts have encouraged investors to pursue new opportunities, particularly in sectors like technology and energy.

Interest Rates: The Federal Reserve’s indications of potential interest rate cuts have positively impacted investor sentiment. Lower interest rates reduce borrowing costs, making capital more accessible for investments in startups and expansion projects.

IPO Market Revival: Wall Street anticipates a resurgence in initial public offerings (IPOs) as private equity firms aim to capitalise on strong equity markets. Companies like Medline and Genesys have filed for IPOs, with more expected in the first half of 2025. This trend reflects a growing confidence in the market’s stability and potential for returns.

Global Landscape

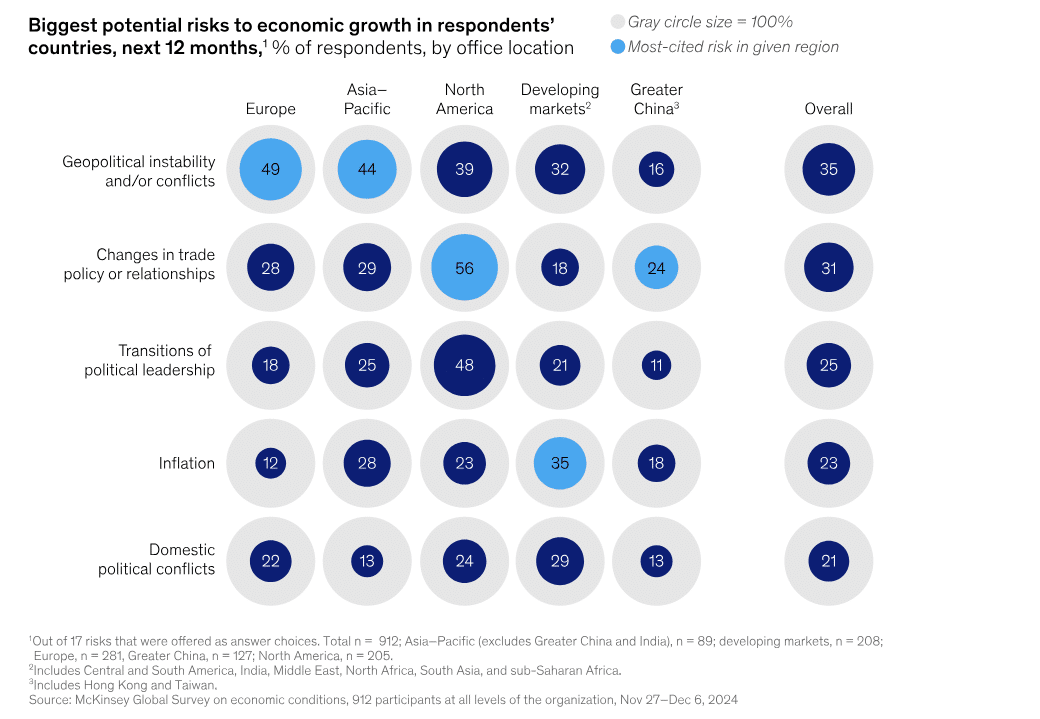

Trade and Geopolitical Uncertainty

The McKinsey Global Survey highlighted uncertainties around trade policies, geopolitical instability, and economic restructuring, which shaped global investor behaviour. Following a year of political elections, including the U.S. presidential race, respondents pointed to trade policy changes and geopolitical risks as key challenges to global growth in 2025.

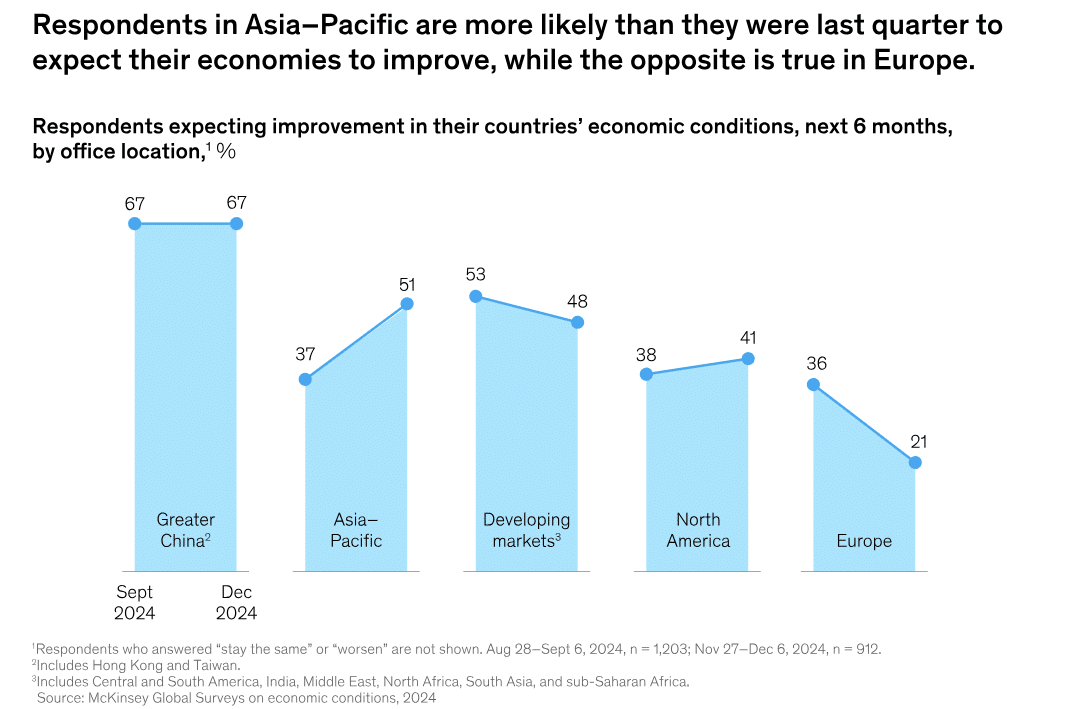

Regional Economic Divergence

Optimism varied by region: Asia-Pacific showed confidence in economic improvement, while Europe experienced growing pessimism. This difference influenced funding flows, with stronger economies drawing more investments.

Global Trade and Economic Balance

According to the World Economic Forum, global trade reached a record $33 trillion in 2024, driven by a 7% increase in services trade and a 2% rise in goods trade. However, despite this growth, the global economy remained sluggish, with calls for a new balance between productivity, equity, and sustainability.

Resilience Amid Challenges

Rising unemployment expectations and cautious consumer sentiment highlighted the need for flexible investment strategies. Yet, December 2024 demonstrated the resilience of venture funding, with billion-dollar rounds and strategic investments showing the market’s ability to adapt and grow despite challenges.

Key Investment Sectors in December 2024

December 2024’s funding landscape focused on technology, sustainability, and innovation. Key sectors included artificial intelligence (AI), machine learning, and SaaS platforms driving business automation alongside advancements in semiconductors, IoT, and cloud technologies. Energy investments prioritised clean solutions like solar, energy storage, and carbon capture, while biotechnology and healthcare saw funding for biopharma, diagnostics, and medical devices.

FinTech remained a critical area, with credit, lending, blockchain, and cryptocurrency platforms investments. Advanced manufacturing sectors, including aerospace and electric vehicles, continued to attract attention alongside consumer-focused industries like e-commerce, food delivery, and digital content.

Domain Names Highlights

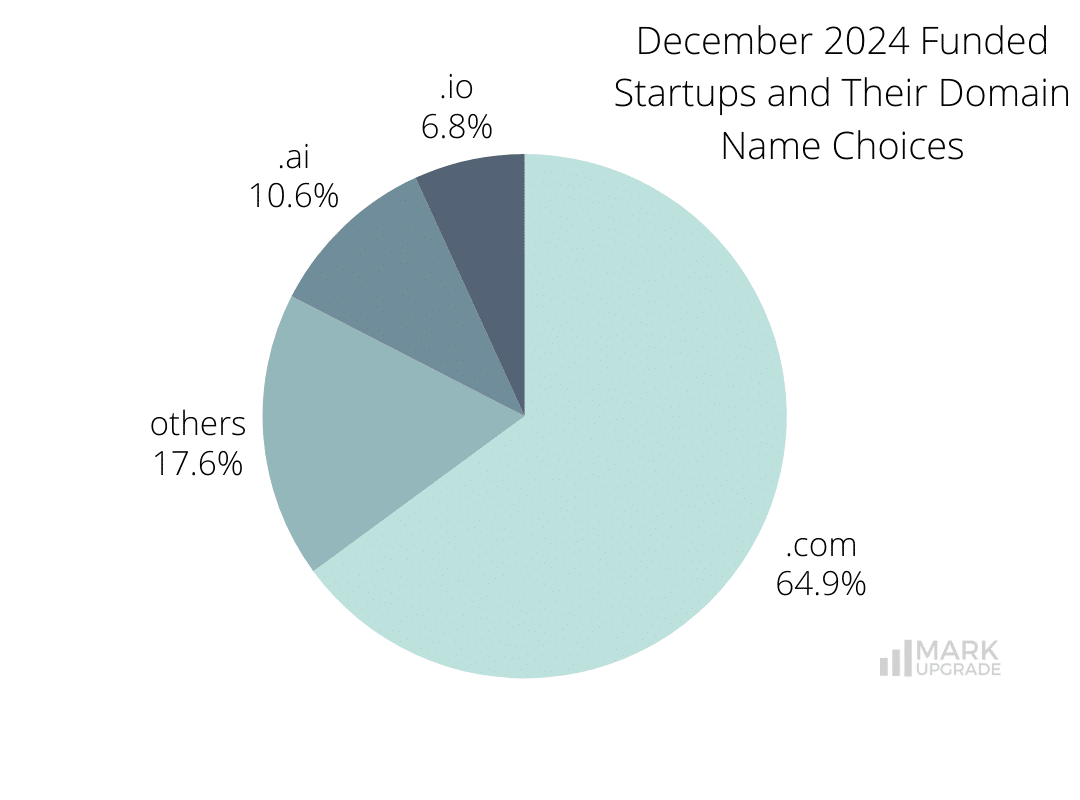

.com Domains

With 361 companies operating on .com, this extension remains the gold standard for global businesses. Its widespread familiarity and trust make it the go-to choice for establishing credibility and attracting a broader audience.

.ai and .io Domains

Adopted by 59 and 38 companies, respectively, .ai and .io domains are favoured by tech startups and AI-driven companies for their modern, industry-specific appeal. However, challenges like regional associations, stability concerns, and limited global trust hinder their scalability compared to .com.

Other Extensions

98 companies use a variety of other domain extensions, catering to niche or localised markets. While these may align with specific branding goals, they often lack the universal recognition of more established extensions.

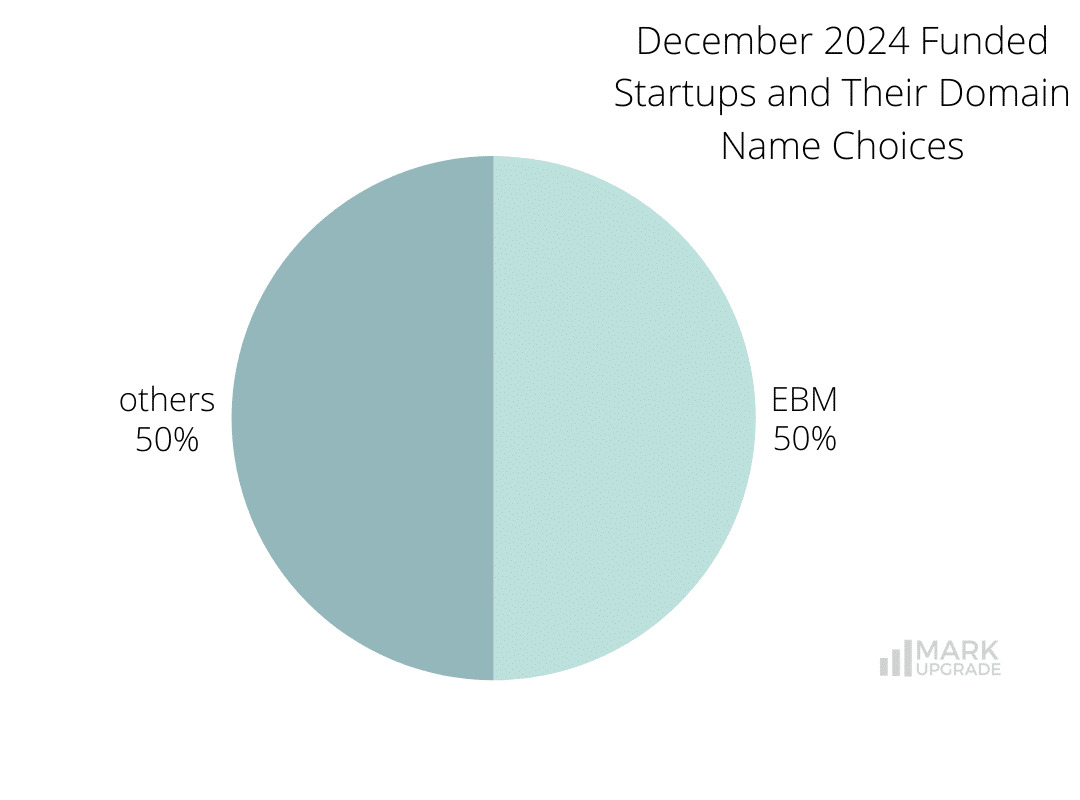

Exact Brand Match (EBM) Domains

278 companies out of 556 from our list have adopted Exact Brand Match (EBM) domains, reflecting a commitment to building a strong brand identity and ensuring seamless recognition for users. EBMs simplify navigation, enhance memorability, and foster trust by aligning the company name with its digital presence.

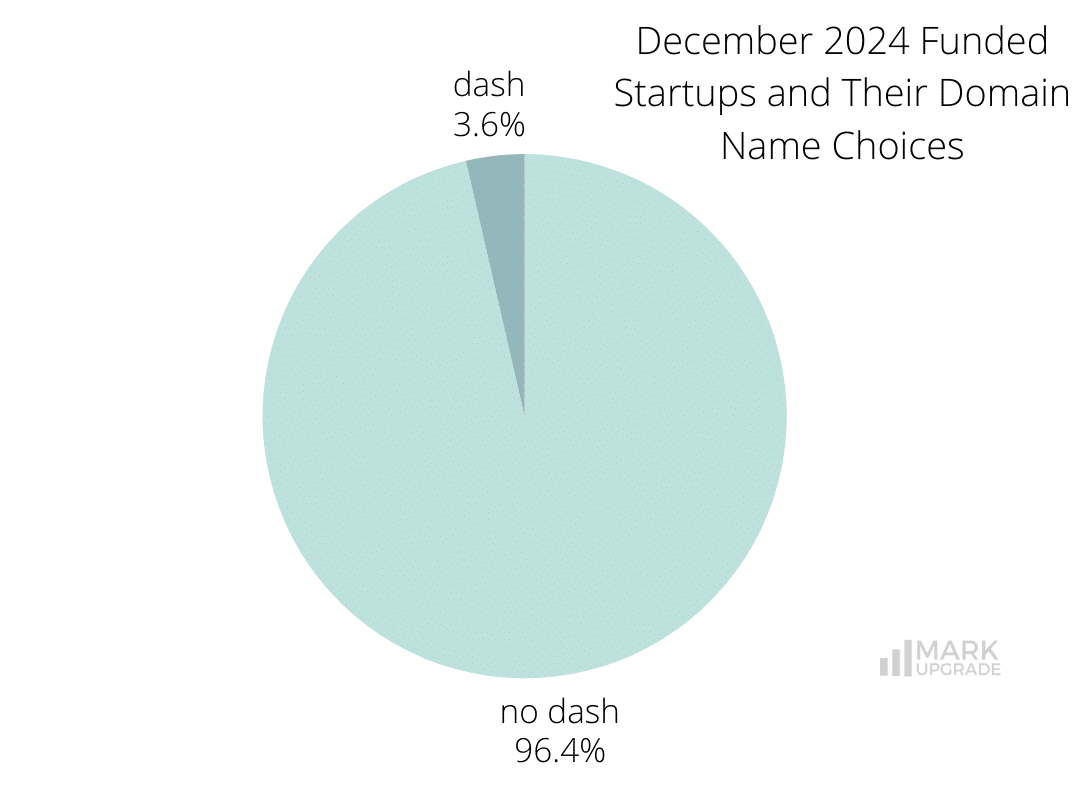

Dash Domains

20 companies have adopted dash domains. While practical in some cases, dashes can reduce brand recall and complicate user navigation.

The preference for .com and EBM domains highlights their unmatched value in ensuring global appeal, trustworthiness, and strong business branding.

Namepicks

Archer

Industry: Aerospace, Air Transportation, Electric Vehicle, Manufacturing

Funds Raised: $430,000,000

Archer Aviation, based in San Jose, CA, is a leader in developing electric vertical takeoff and landing (eVTOL) aircraft. Founded by Adam Goldstein and Brett Adcock, the company initially collaborated with the University of Florida, where both founders are alumni, and later established a research lab on campus. Archer’s early backing included private funding and support from Marc Lore, a Walmart executive.

Archer’s recent $430 million funding, backed by investors like Stellantis and Abu Dhabi’s 2PointZero, will advance its hybrid VTOL aircraft for defence applications in partnership with Anduril. With nearly $2 billion raised to date, the company is also preparing for FAA certification of its Midnight aircraft, solidifying its role in shaping the future of sustainable urban and defence aviation.

Archer Aviation operates on the Exact Brand Match (EBM) domain Archer.com, enhancing its visibility and credibility. This intuitive and memorable domain strengthens customer trust and aligns with Archer’s innovative mission, simplifying access for partners, investors, and stakeholders.

Calo

Industry: Apps, Food and Beverage, Nutrition, Subscription Service

Funds Raised: $25,000,000 in Series B

Calo, a Bahrain-based startup founded in 2019 by Ahmed Al Rawi, specialises in delivering personalised ready-to-eat meals targeting health-conscious consumers. The company operates across Saudi Arabia, UAE, Kuwait, Qatar, and Bahrain and offers meal subscriptions tailored to specific needs such as weight loss, muscle gain, or dietary restrictions like diabetes and IBS.

In December 2024, Calo raised $25 million in Series B funding, led by Nuwa Capital, with participation from Khwarizmi Ventures and STV, bringing its total funding to $51 million and valuing the company at $250 million. This funding will fuel its expansion into new markets, including an acquisition in the U.K., and support the development of its customised meal offerings. With 10 million meals served this year, Calo plans to extend its global footprint and aims to go public in the near future.

In early 2023, Calo secured the EBM domain Calo.com to support its growth and global ambitions. While still operating on Calo.app, with Calo.com redirecting to it. Investing in a valuable CVCV digital asset strengthens the brand, builds trust, and prepares for global expansion.

Learn more about how Calo.com supports the company’s global ambitions in our article: Enhancing Brand Authority: How Calo’s Investment in the EBM Calo.com Supports Its Global Ambitions.

CleanSpark

Industry: Bitcoin, Blockchain

Funds Raised: Closing of Offering of $650 Million Zero-Coupon Convertible Notes

CleanSpark is a leading Bitcoin mining company that operates multiple mining facilities across the U.S., optimised for low-cost, reliable energy use. CleanSpark integrates Bitcoin mining with operational excellence and sustainable energy practices to deliver value to shareholders.

In December 2024, CleanSpark raised $650 million by issuing 0.00% Convertible Senior Notes due 2030.

In a press release, Zach Bradford, CleanSpark’s CEO, emphasised that the funding will fully support their growth strategy, including expansions, opportunistic acquisitions, and increasing Bitcoin reserves.

We are proud to have closed this offering with some of the strongest institutional investors in the world and are excited to share that our growth through 50 EH/s and beyond is now expected to be more than fully funded from the proceeds.

Zach Bradford, CEO and President

CleanSpark has invested in CleanSpark.com – an exact brand match .com name. This is the natural choice of most internet users, and securing that domain for their business is a clear indication that CleanSpark is here to stay.

Databricks

Industry: Analytics, Artificial Intelligence (AI), Information Technology, Machine Learning

Funds Raised: $10,000,000,000 in Series J

AI and data technology company Databricksraised $10 billion in Series J funding, reaching a valuation of $62 billion. Supported by well-known investors like Thrive Capital and Andreessen Horowitz, this funding highlights Databricks’ impact on helping businesses use AI and data to solve real-world problems. The company plans to use the funds to create new AI products, expand globally, and continue making data tools more accessible for businesses everywhere.

Databricks’ journey as a brand is deeply rooted in its identity as an engineering-led company driven by open-source innovation. Founded by a group of students and teachers from a Berkeley research lab, the company embraced collaboration, science, and impact as core values, focusing on simplifying data and AI to empower data teams. Initially avoiding traditional branding, Databricks let its reputation grow organically through its groundbreaking contributions to the industry. Now, as one of the fastest-growing SaaS companies trusted by over 10,000 organisations, including many Fortune 500 companies, the brand is intentionally embracing its identity, highlighting its commitment to collaboration, innovation, and making a lasting impact on the world.

Brand is about how you’re perceived – it’s not something you can define for yourself. It’s crafted over time, through the sum of experiences that people have with your company. By definition, a brand needs this time — about seven years in our case — before it can really be captured and defined in a way that’s credible and true to your roots.

Databricks’ blog post

Like most SaaS companies in our article, Databricks has secured the EBM domain Databricks.com. A valuable domain like this offers instant recognition, builds trust, and strengthens brand recall. It empowers Databricks to establish direct customer relationships, foster long-term loyalty, and confidently navigate new markets, ensuring the brand stands out in a competitive landscape.

Tyme Group

Industry: Banking, Financial Services, FinTech

Funds Raised: $250,000,000 in Series D

Tyme Group, a Singapore-based digital banking company, has secured $250 million in a Series D funding round, elevating its valuation to $1.5 billion and achieving unicorn status. The round was led by Nubank, which invested $150 million, with additional contributions from M&G Catalyst Fund and existing shareholders.

This funding will propel our growth strategy, enabling us to realise our stated goal of being a top three retail bank in South Africa in the next three years.

Karl Westvig, CEO of TymeBank in South Africa for Reuters

Tyme Group operates digital banks in South Africa and the Philippines, serving over 15 million customers. The new capital will support Tyme’s expansion into Southeast Asian markets, including Vietnam and Indonesia, and its goal to become a top-three retail bank in South Africa within the next three years.

The company has invested in the prestigious CVCV EBM domain, Tyme.com. Its simplicity, global accessibility, and memorability enhance brand visibility and streamline user engagement, fostering trust among customers and investors. Valuable domains like Tyme.com are increasingly recognised as strategic assets, differentiating brands in a competitive market and ensuring long-term relevance and scalability.

While we make every effort to ensure the data on our site is accurate, complete, and up-to-date, we cannot guarantee its reliability. Our data is provided for informational purposes only and should not be relied upon as legal, financial, or other advice. We strongly recommend that you independently verify any information before relying on it.

Whether you’re a small business owner or a large corporation, a strong domain name can help boost your brand and increase your online presence. If you’re ready to take the next step, contact us to learn more about our domain name options and how they can benefit your business.

Other resources

branding business december domain domain name domain names domains funding Monthly Funding Report naming startup

Previous Next