Overview

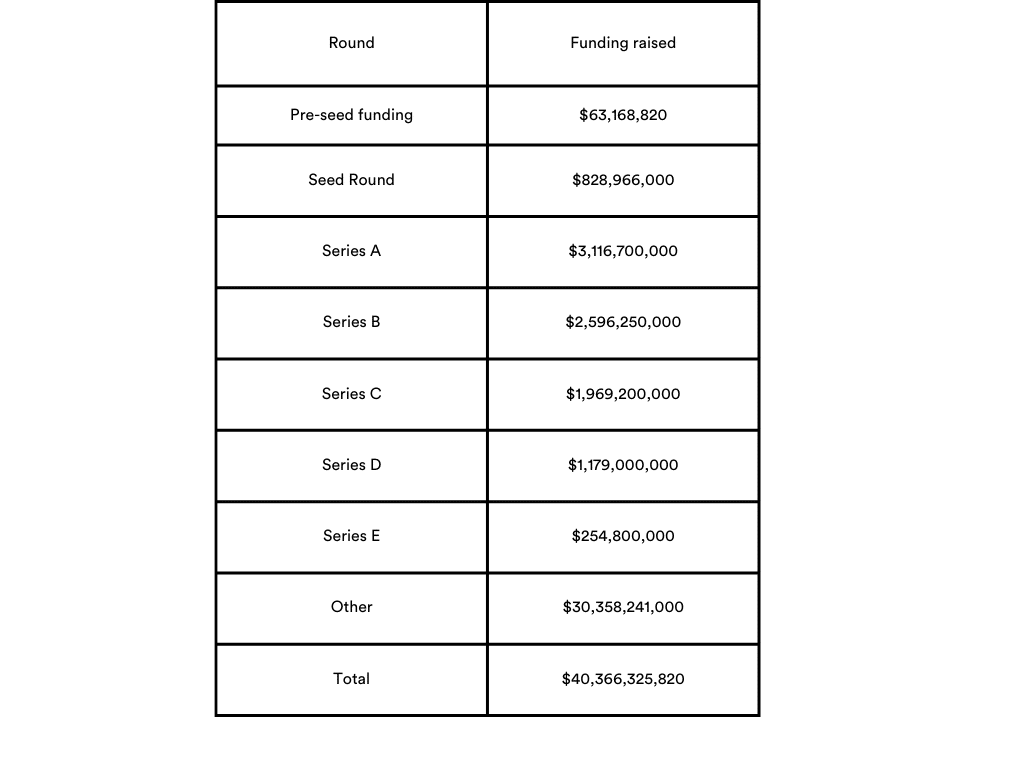

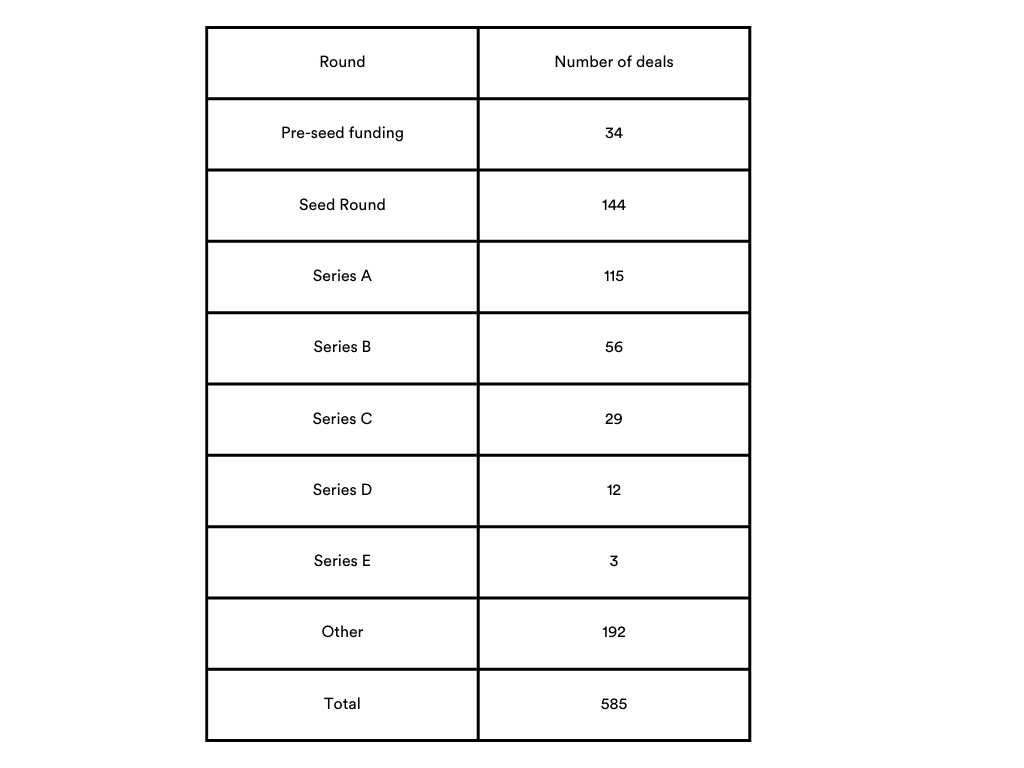

In April, pre-seed funding increased in the number of deals and the total amount raised, while seed rounds experienced a decline in the number of deals and the amount raised.

| Round | Amount March (USD) | Number deals March | Amount April (USD) | Number deals April |

| Pre-seed funding | 59,059,000 | 27 | 63,168,820 | 34 |

| Seed Round | 1,109,183,230 | 181 | 828,966,000 | 144 |

| Series A | 2,852,250,000 | 112 | 3,116,700,000 | 115 |

| Series B | 3,945,450,000 | 58 | 2,596,250,000 | 56 |

| Series C | 1,439,200,000 | 19 | 1,969,200,000 | 29 |

| Series D | 505,300,000 | 8 | 1,179,000,000 | 12 |

| Series E | 976,000,000 | 8 | 254,800,000 | 3 |

| Other | 25,456,781,000 | 149 | 30,358,241,000 | 192 |

| Total | 36,343,223,230 | 562 | 40,366,325,820 | 585 |

Series B funding may have experienced a slight decrease in the number of deals and a significant decline in the total amount raised compared to March, but the story is different for Series C and D funding. The number and amount of these funding rounds increased significantly, reflecting a robust appetite for investing in scalable, expandable startups. This trend suggests a healthy and promising environment for startups at later stages of development.

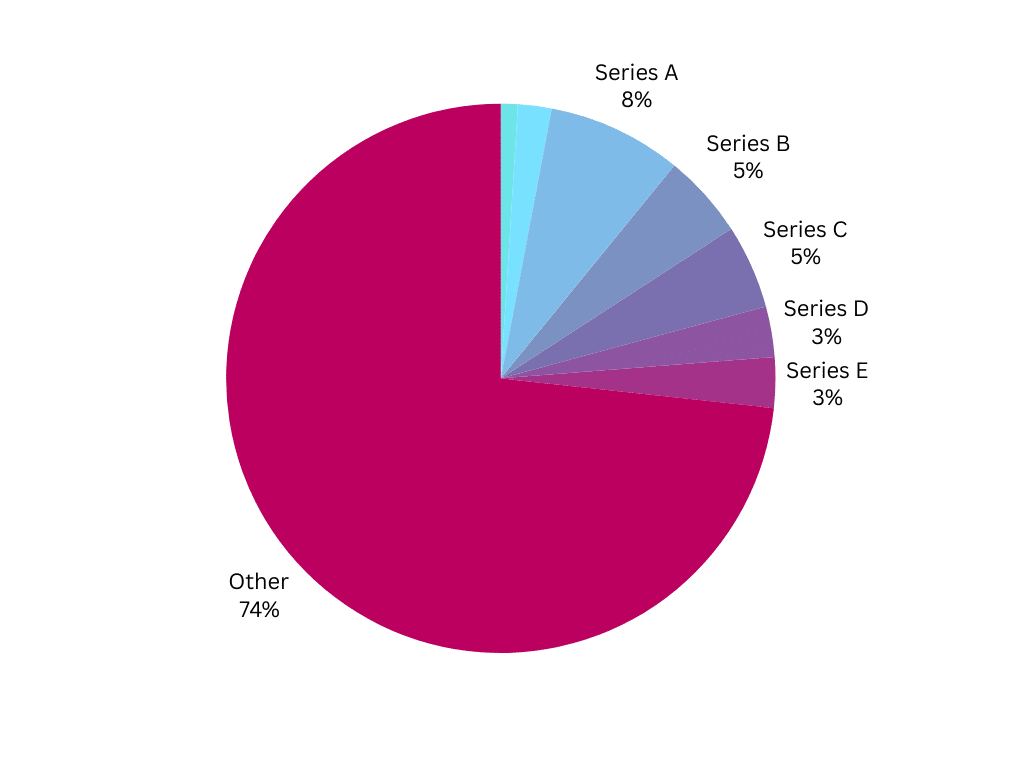

By funds raised/ Total funding $40,366,325,820

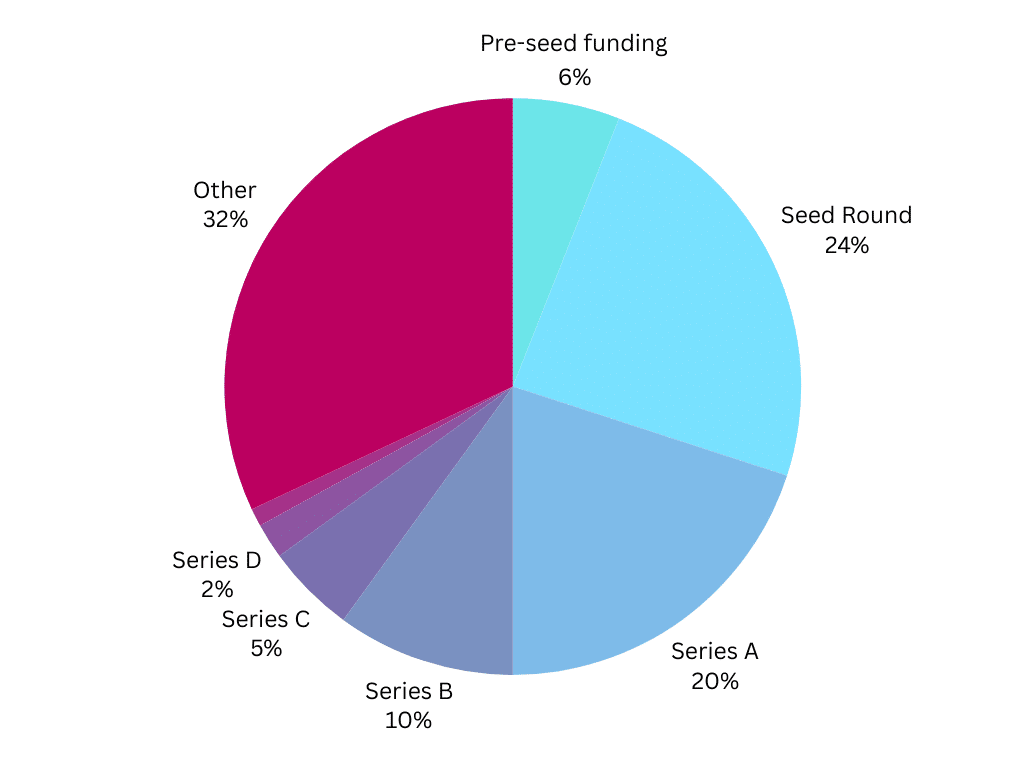

By number of deals/Total number of deals 585

With more entrepreneurs securing funding to support their ventures, the overall increase in deals and amount raised in April suggests an active and healthy startup ecosystem with a potential for further growth and development.

Biotechnology, health care, and pharmaceuticals collectively garnered significant attention from investors, indicating a strong interest in advancements in medical science and therapeutics. Artificial intelligence (AI) and related fields such as machine learning, augmented reality, and embedded systems have also attracted substantial funding, reflecting the growing importance of AI-driven technologies across various industries. Other sectors that saw significant investment include financial services and fintech, renewable energy, clean technology, and sustainability-related sectors.

Below, we will examine some companies on our list and explore their brand and domain name choices.

Namepicks

Check out our article “How to Name a Unicorn?” for insights on choosing a brand name that can help elevate your startup to unicorn status.

Alterome Therapeutics

Industry: Biopharma, Biotechnology, Pharmaceutical

Funds Raised: $132,000,000 Series B

The biotechnology startup Alterome Therapeutics, co-founded by Massachusetts General Hospital oncologist Ryan Corcoran and serial entrepreneur Eric Murphy, recently completed a successful Series B financing round, raising $132 million. This funding round was led by Goldman Sachs Alternatives, bringing the company’s total funding to nearly $232 million. The newly acquired funds will be allocated to support the advancement of multiple wholly-owned pipeline programs, including two precision oncology programs slated to enter clinical development within the next 12 months.

Independently, we bring varied backgrounds and expertise. Collectively, we are committed to discovering novel, alteration-specific therapies. Alterome is dedicated to relentlessly pushing the boundaries of cancer treatments to transform patients’ lives.

Alterome’s website

The brand name “Alterome” likely represents the company’s dedication to modifying biological systems, suggesting its involvement in pioneering therapies for patients. Taking advantage of the Exact Brand Match (EBM) domain, Alterome.com allows the company to demonstrate brand consistency and online discoverability, aligning with the current trend among emerging biotech companies in 2024.

Cyera

Industry: Cloud Data Services, Cloud Security, Cyber Security, Enterprise Software, Security

Funds Raised: $300,000,000 in Series C

Founded in 2021 by Yotam Segev (CEO) and Tamar Bar-Ilan (CTO), Israeli data security company Cyera raised $300 million, nearly tripling its valuation to $1.4 billion in less than ten months. Cyera’s DSPM (Data Security Posture Management) system adopts an agentless data security approach to discover, classify, assess, and protect structured and unstructured data across clouds, SaaS, data lakes, and on-prem environments.

Businesses are moving data to the cloud faster than ever before, which increases the attack surface and compounds risk across their multi-cloud landscape. As organisations strive to become more data-driven, security teams must collaborate with their partners to leverage data securely. Cyera empowers every business to realise the full potential of their data to power a new era of development, growth, and productivity.

Yotam Segev, Co-founder and CEO, Cyera

Operating on Cyera.io while also securing the Exact Brand Match (EBM) domain Cyera.com, the company maximises its marketing reach across channels and mitigates potential security risks. This strategic move aligns with the preference for EBM domains among Israeli tech companies, ensuring enhanced brand visibility and credibility.

Pigment

Industry: Analytics, Business Development, Information Technology, Real-Time, SaaS

Funds Raised: $145,000,000 in Series D

Paris-based startup Pigment has secured an impressive $145 million funding round just five years after its establishment. Specialising in enterprise software, Pigment offers a robust business planning platform designed for large companies to precisely visualise their historical financial performance and forecast future quarters.

Pigment stands out as a flexible business planning tool, catering to chief financial officers and finance teams to generate reports and budgets effortlessly. Functioning as a modern SaaS platform, it seamlessly integrates with various company data sources such as ERP, HRIS, and data lakes, serving as a powerful collaboration tool.

Beyond finance, Pigment extends its utility to sales and HR teams. Sales professionals utilise the platform to set quotas and monitor performance against quarterly targets, while HR teams leverage it to align workforce scaling with strategic shifts and financial objectives.

Our current investors told us ‘if you’re going to raise money in 18 months to scale with others, we might as well offer you great terms right now for an internal round.’ And everything happened very quickly…In one week, it was a done deal.

Co-founder and co-CEO Eléonore Crespo for Techcrunch

Securing an Exact Brand Match (EBM) domain, a dictionary word like Pigment.com provides substantial advantages for a company’s online presence. It helps safeguard the brand identity, mitigate the risk of traffic diversion to competitors, reinforces brand recognition, and fosters trust among users.

Rippling

Industry: Employment, Human Resources, Information Technology, InsurTech, IT Management, Productivity Tools

Funds Raised: $200,000,000 in Series F

Rippling is an HR management company that offers a workforce management platform that streamlines IT and HR operations in organisations. In addition to raising $200M in new financing, the company has signed agreements with investors to repurchase $590M in equity from employees, former employees, and early investors. Funds from this fund will be used to expand into new markets and invest heavily in R&D to support the company’s current offerings.

Rippling’s brand name suggests the company strives to create a ripple effect in the HR management landscape, revolutionising traditional practices and bringing positive changes to all workplaces.

Rippling is the first global workforce management platform designed to support companies at every stage of growth—from paying your first global contractor to managing a workforce worldwide.

Rippling’s press release

Rippling has secured the Exact Brand Match (EBM) domain Rippling.com. As observed with HR companies, EBM domains are increasingly popular due to their ability to improve brand recognition and reliability, enabling companies to gain a competitive edge.

Xaira Therapeutics

Industry: Artificial Intelligence (AI), Biotechnology, Health Care, Therapeutics

Funds Raised: $1,000,000,000 in Venture Round

Xaira Therapeutics, an integrated biotechnology company, has secured a landmark $1 billion funding round in April, marking a significant milestone in its mission to revolutionise drug discovery and development through artificial intelligence. Based in San Francisco, the startup has assembled a formidable team of AI research, drug development, and venture capital experts to establish and leverage a cutting-edge R&D platform. The biotech was incubated jointly by ARCH Venture Partners and Foresite Labs, both of which have also contributed funding to support its endeavours. With this substantial investment, Xaira aims to advance its AI research initiatives, building upon the pioneering work conducted at David Baker’s lab at the University of Washington School of Medicine. Baker, renowned as the university’s Institute for Protein Design director, and his team have developed groundbreaking RFdiffusion and RFantibody models for protein and antibody design.

This creates an enormous opportunity for us to rethink drug discovery entirely. For this reason, Xaira is the largest initial funding commitment in ARCH history.

Robert Nelsen, Arch Venture Partners’ managing director, in a statement

Given its remarkable launch, it comes as no surprise that Xaira has invested in the Exact Brand Match (EBM) domain name Xaira.com. This strategic decision underscores the importance for startups, as well as all businesses, to align their domain name with their brand identity, enabling them to establish immediate credibility, trustworthiness, and respect within their industry and setting the stage for further success and recognition.

Highlights

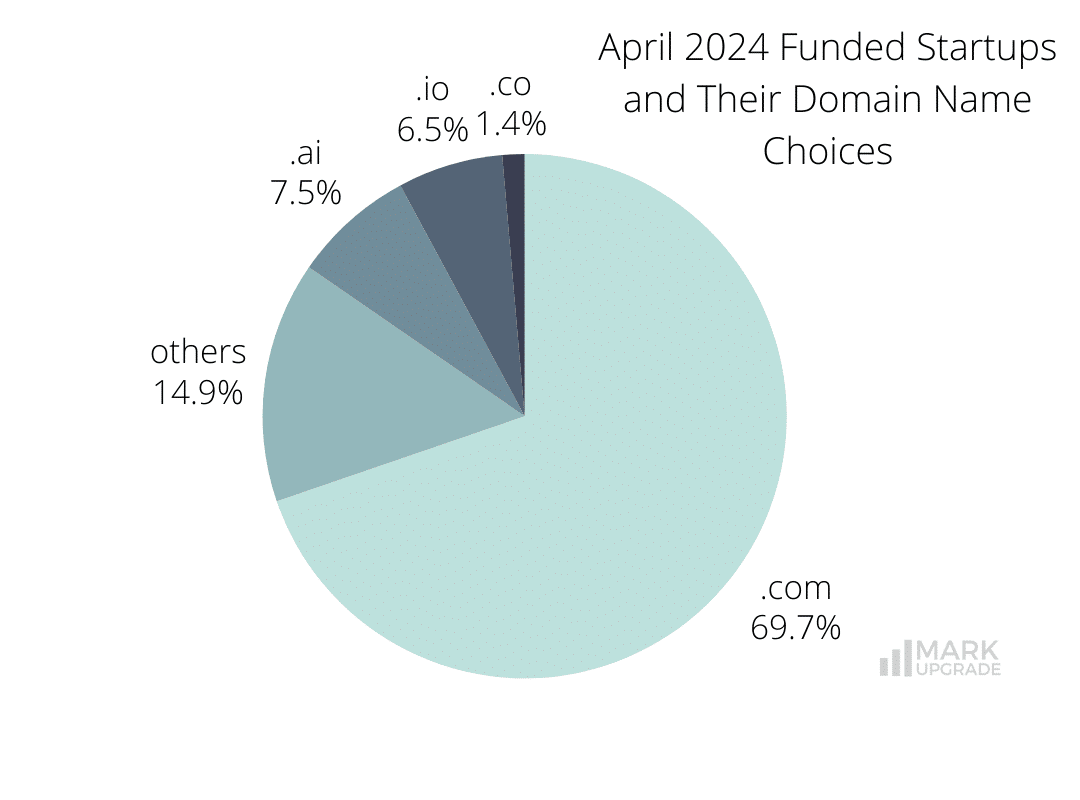

The .com extension remains the preferred choice due to its universal recognition, trustworthiness, and authority online, with 408 out of 585 companies opting for it.

Extensions such as .io and .ai, known for their association with technology and innovation, are chosen by a smaller number of companies seeking to convey a tech-savvy image or specialisation in artificial intelligence. Country domain codes offer more freedom of choice but come with certain risks for businesses.

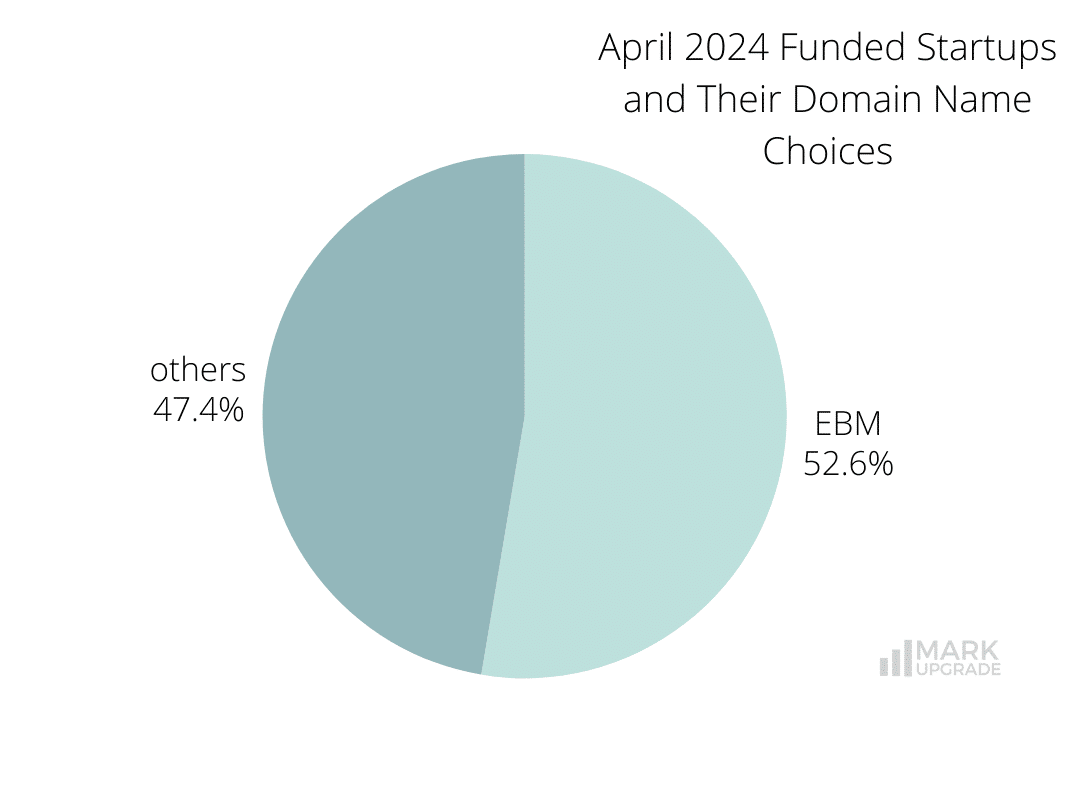

Exact Brand Match (EBM) domains, like .com, enhance brand recognition and credibility and offer unique advantages, reflected in the significant number of 308 EBM selections.

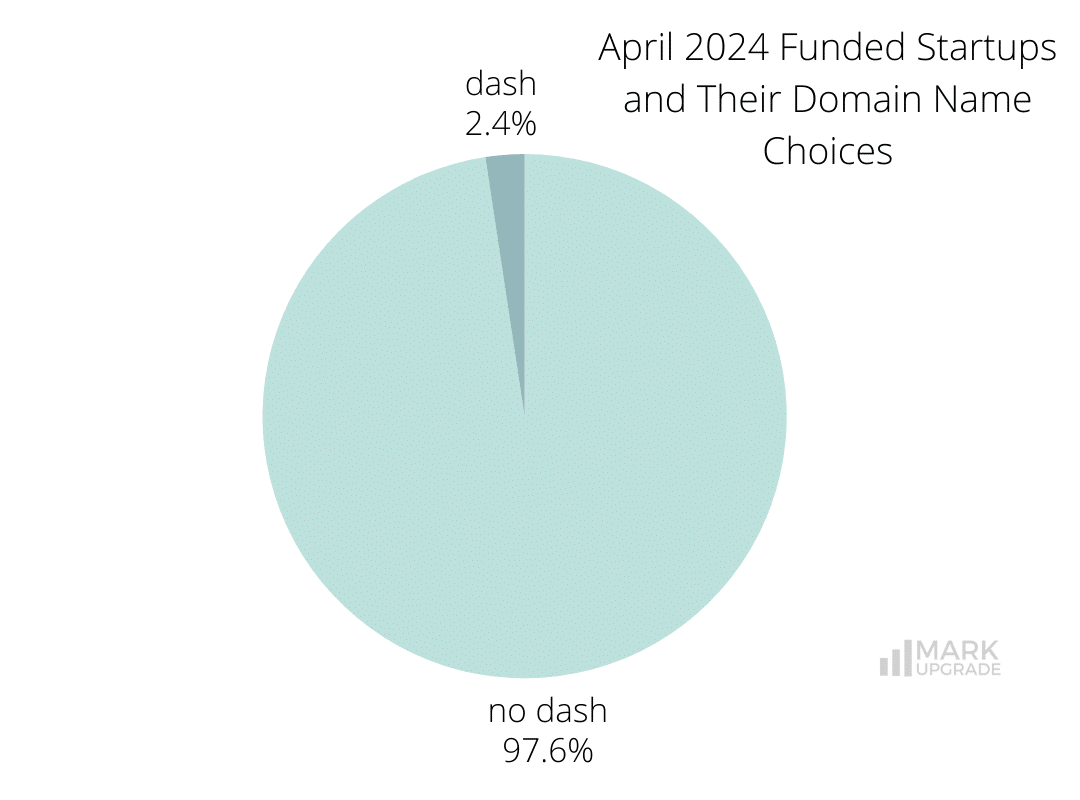

The presence of dash-separated domains underscores some companies’ creative naming strategies or domain availability constraints, though they are less common overall.

| domain | company | round | funding (in USD) | EBM |

|---|---|---|---|---|

| tetrixx.io | Tetrixx | Seed Round | 2.000.000 | no |

| lockchain.ai | Lockchain | Seed Round | 4.600.000 | no |

| vodex.ai | Vodex | Seed Round | 2.000.000 | no |

| higgsfield.ai | Higgsfield | Seed Round | 8.000.000 | no |

| homefromcollege.com | Home From College | Seed Round | 5.400.000 | yes |

| conformationx.com | Conformation-X | 3.650.000 | yes | |

| medcurainc.com | Medcura | Convertible Debt | 22.400.000 | no |

| alluresecurity.com | Allure Security | Series A | 10.000.000 | yes |

| biofidelity.com | Biofidelity | 24.000.000 | yes | |

| joinhomebase.com | Homebase | Series D | 60.000.000 | yes |

| obsidiantx.com | Obsidian Therapeutics | Series C | 160.500.000 | no |

| noble.ai | NobleAI | Series A | 10.000.000 | no |

| aiorde.com | Aiorde | Seed Round | 1.000.000 | yes |

| permiso.io | Permiso | Series A | 18.000.000 | no |

| nucleaimd.com | Nucleai | Venture Round | 14.000.000 | no |

| trojai.com | TrojAI | Seed Round | 5.800.000 | yes |

| miachortho.com | Miach Orthopaedics | Series B | 20.000.000 | no |

| actnano.com | Actnano | Venture Round | 40.000.000 | yes |

| he360.com | HawkEye 360 | Debt Financing | 40.000.000 | no |

| datavolo.com | Datavolo | Series A | 21.000.000 | yes |

| ravensr.com | Raven | 15.000.000 | no | |

| deliverycollective.com | Delivery Collective | 3.800.000 | yes | |

| warwickacoustics.com | Warwick Acoustics | Venture Round | 8.800.000 | yes |

| ailytics.ai | Ailytics | Seed Round | 2.700.000 | no |

| healtharc.io | HealthArc | Venture Round | 5.000.000 | no |

| techgrid.com | TechGrid | Series A | 9.200.000 | yes |

| burnbot.com | BurnBot | Series A | 20.000.000 | yes |

| supersimple.io | Supersimple | Pre-Seed Round | 2.200.000 | no |

| proxima.ai | Proxima | Series A | 12.000.000 | no |

| modallearning.com | Modal | Series A | 25.000.000 | no |

| quadratichq.com | Quadratic | Seed Round | 5.600.000 | no |

| hailo.ai | Hailo | Series C | 120.000.000 | no |

| earlitecdx.com | EarliTec Diagnostics | Series B | 21.500.000 | no |

| juniperbiomedical.com | Juniper Biomedical | Seed Round | 3.000.000 | yes |

| meltpharma.com | Melt Pharmaceuticals | Series B | 24.000.000 | no |

| sesolabor.com | Seso | Series B | 26.000.000 | no |

| thinkaidium.com | Aidium | Series A | 19.000.000 | no |

| praiahealth.com | Praia Health | Series A | 20.000.000 | yes |

| prismastake.finance | PrismaStake | Seed Round | 6.000.000 | no |

| sparxell.com | Sparxell | Seed Round | 3.200.000 | yes |

| moongate.id | Moongate | Seed Round | 2.700.000 | no |

| seluxdx.com | Selux | Venture Round | 48.000.000 | no |

| burnt.com | Burnt | Series A | 25.000.000 | yes |

| vialase.com | ViaLase | Series C | 40.000.000 | yes |

| bioconsortia.com | BioConsortia | Venture Round | 15.000.000 | yes |

| eirenecremations.com | Eirene | Seed Round | 4.100.000 | no |

| alignedmarketplace.com | Aligned | Seed Round | 8.000.000 | no |

| neurosterix.com | Neurosterix | Series A | 63.000.000 | yes |

| brimfinancial.com | Brim | Series C | 85.000.000 | no |

| diagonaltx.com | Diagonal Therapeutics | Series A | 128.000.000 | no |

While we make every effort to ensure the data on our site is accurate, complete, and up-to-date, we cannot guarantee its reliability. Our data is provided for informational purposes only and should not be relied upon as legal, financial, or other advice. We strongly recommend that you independently verify any information before relying on it.

In today’s competitive online market, a premium domain name can set your business apart from the competition. Don’t settle for a compromise – contact us to explore the many benefits of premium domain names and how they can help your business grow.

Other resources

2024 april branding business domain domain name domain names domains funding Monthly Funding Report naming startup

Previous Next