Discover the latest trends in global monthly funding data, with a unique focus on companies’ domain name choices, in our monthly funding reports.

Overview

Startups continue to face a challenging fundraising climate due to a combination of economic headwinds and uncertainty about the future. The current economic downturn is causing ripple effects throughout various sectors, and the startup industry may be next to feel the impact. Recent research conducted by January Ventures suggests that the biggest mass extinction of early-stage ventures since the 2008 financial crisis could occur in 2023, with as many as four out of five startups at risk of failure.

The study found that 81% of early-stage startups only have less than 12 months of runway left, meaning they only have enough capital to keep the lights on for a short period. In a tweet thread, Tom Loverro, a venture capitalist at IVP, has predicted that there will be a “mass extinction event” for early and mid-stage companies in the near future, which could make the situation even worse for startups in late 2023-24 than it was during the 2008 financial crisis.

Despite a drop in the overall value of VC deals, there are still opportunities available in VC firms, as stated by Vishal Harnal, the managing partner of 500 Global.

There is definitely a drop in the allocation towards ventures this year, but it really depends on which markets you are investing in, and what the opportunities set in those markets are.

Vishal Harnal, managing partner of 500 Global, on CNBC’s “Squawk Box Asia”

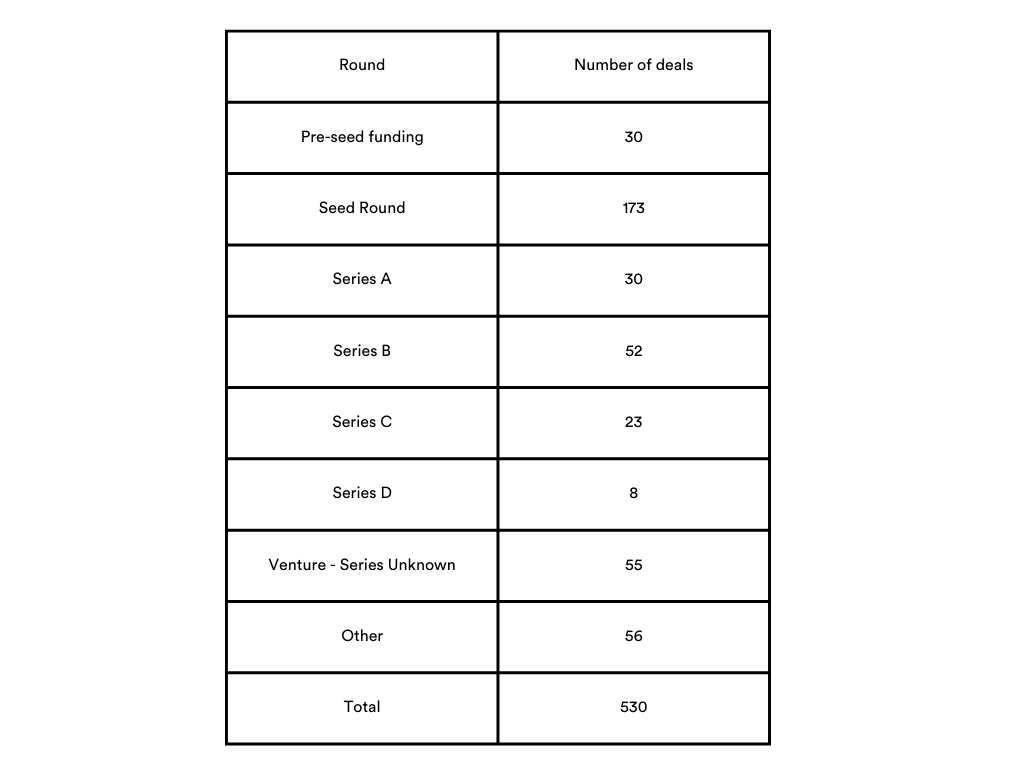

February saw a significant drop in VC funding, hitting its lowest point in the past six months with only $15.4 billion raised across 530 transactions. This represents a 40% drop from the previous month, which can largely be attributed to OpenAI’s impressive $11 billion funding round.

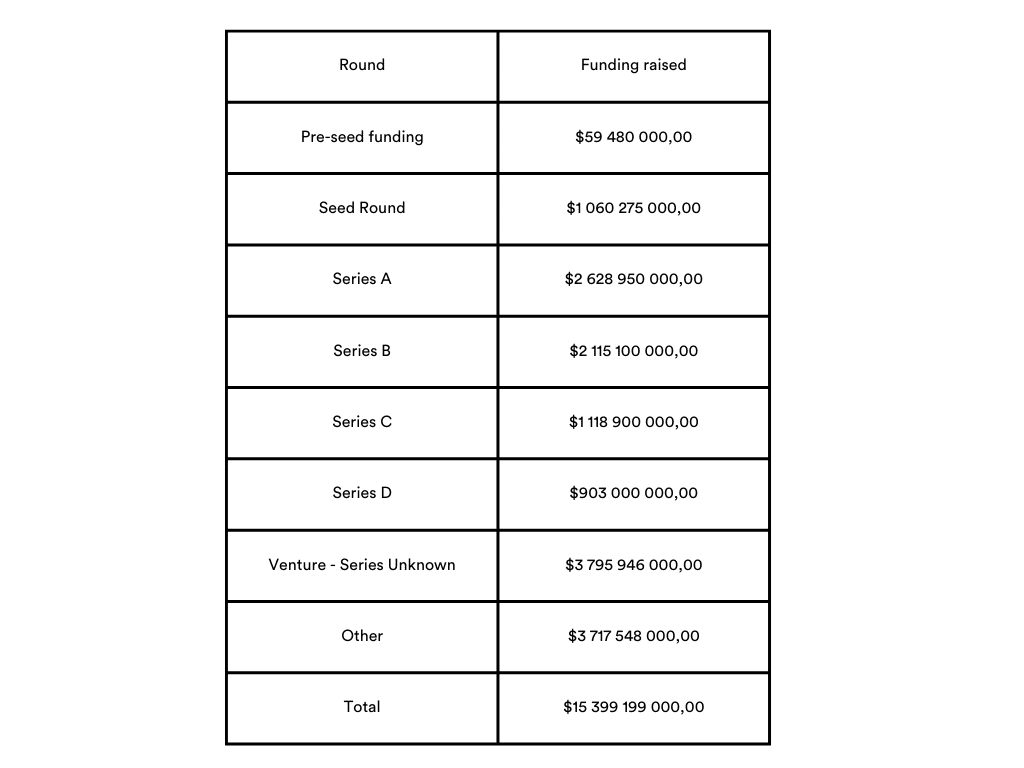

Investors have shown a clear preference for early-stage financing in terms of the number of deals, with 173 Seed Rounds closed in February. Series A funding rounds came in second, with $2.6 billion raised across 133 deals, and Series B funding rounds followed closely behind, with $2.1 billion raised across 52 deals. Venture – Series Unknown accounted for a total of $3.8 billion raised in 55 deals.

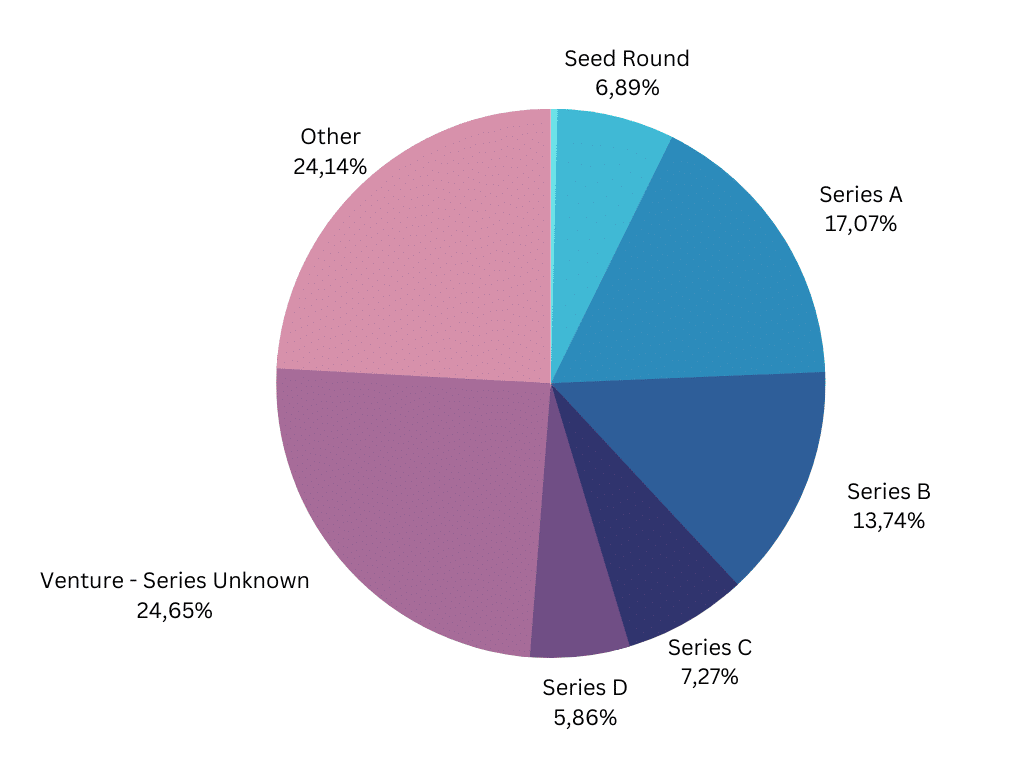

By funds raised/ Total funding $15 399 199 000,00

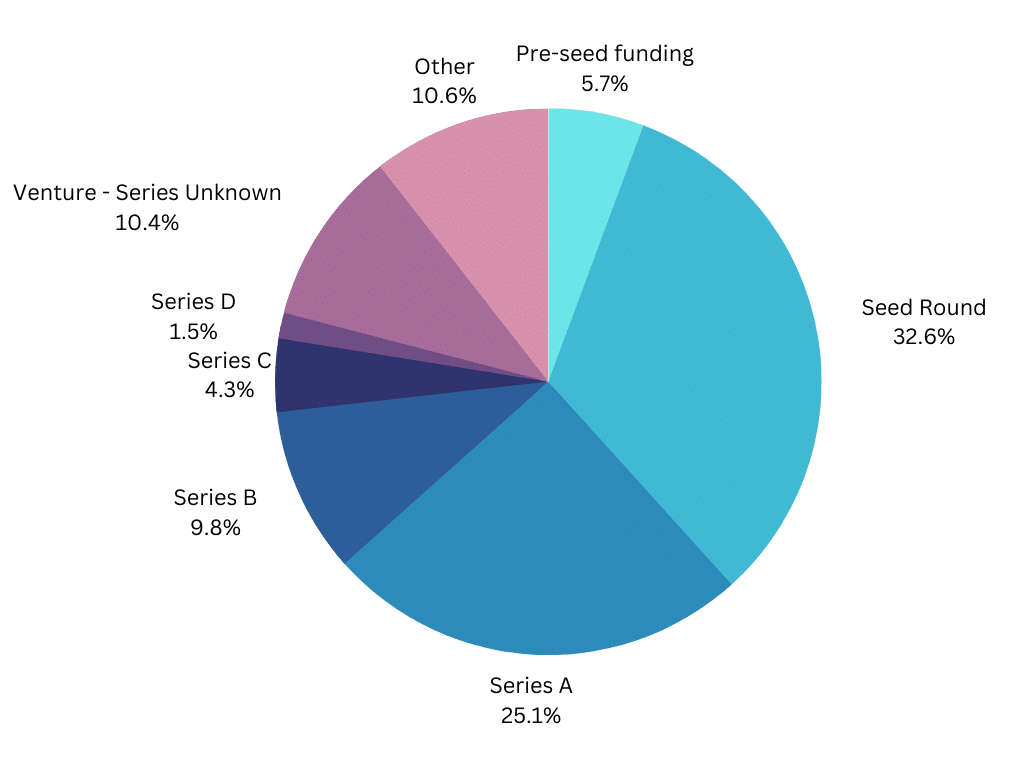

By number of deals/Total number of deals 530

In terms of deal type, Seed Round funding accounted for the highest percentage of all deals at 32.6%, with Series A funding following closely behind at 25.1%.

Investors have shown a keen interest in several sectors, including Autonomous Vehicles, Electric Vehicles, Biopharma and Biotechnology, AI and Machine Learning, Industrial Manufacturing, FinTech, and Cybersecurity, as evidenced by the significant funding rounds raised by companies operating within these industries.

Namepicks

Hemab

Hemab was cofounded by Johan Faber and Søren Bjørn, who previously worked together at Novo Nordisk. The clinical-stage biotech company is focused on developing the first prophylactic therapeutics for serious, underserved bleeding and thrombotic disorders. With locations in the US and Denmark, Hemab is currently advancing a pipeline of monoclonal and bispecific antibody-based therapeutics aimed at revolutionising the treatment of patients with high unmet needs.

The company reported successfully completing a Series B funding round, raising $135 million, which will be crucial in supporting its scientific and corporate growth strategies through 2025.

Hemab is fundamentally reimagining the treatment paradigm for underserved bleeding and thrombotic disorders. This financing will allow us to progress our clinical programs for the first prophylactic treatments for Glanzmann Thrombasthenia and von Willebrand Disease, delivering functional cures for patients in need.

Benny Sorensen, MD, PhD, CEO & President of Hemab

Hemab’s short and indicative brand name makes it easy for potential customers and investors to remember the company and search for it online. By investing in an exact brand match domain name like Hemab.com, the company has further increased its trust and credibility among customers and investors alike. This is especially important in the highly competitive biotech industry, where companies strive to stand out from the crowd and build a strong reputation for innovation and quality.

LeafLink

LeafLink is a B2B technology platform that has become a leading force in the cannabis industry by standardising and streamlining the operations of thousands of brands, distributors, and retailers. Its innovative tools have revolutionised how legal cannabis businesses create, manage, pay for, and ship their orders. With its marketplace currently processing approximately $5 billion in annual transactions, LeafLink has cemented its position as a major player in the legal U.S. wholesale cannabis commerce, accounting for an estimated 50% of all such transactions.

LeafLink closed a $100 million Series D funding round led by CPMG, L2 Ventures, and Nosara Capital, with participation from existing investors. The investment will be disbursed in two tranches, providing LeafLink with additional resources to further enhance its technology platform and expand its market reach.

Despite recent headwinds, the cannabis industry is poised for significant growth in the years ahead. Since the Company’s inception, our team has built solutions that solve some of the industry’s most critical problems. The Series D financing provides us with a strong balance sheet that will enable continued innovation alongside our customers

Ryan G. Smith, Executive Chairman of the Board of Directors at LeafLink

LeafLink is a highly effective and suitable brand name for a company in the cannabis industry as it combines two key elements that are instantly recognisable and associated with the industry: leaves and links. The word “leaf” is commonly associated with cannabis due to its iconic leaf-shaped symbol, while the word “link” implies connectivity and the ability to bring disparate elements together. By combining these two elements, LeafLink conveys a sense of innovation and modernity that resonates with its target audience, which comprises thousands of brands, distributors, and retailers within the legal cannabis space.

Our research indicates that over 80% of the top cannabis companies in the US operate on a .com extension, with more than 50% investing in EBM domains. By adopting a similar approach and investing in LeafLink.com, LeafLink is positioning itself for long-term success and growth in this dynamic and competitive market while also enhancing its online visibility and credibility among potential customers and investors.

Raylo

Raylo was founded in 2019 by Karl Gilbert, Richard Fulton, and Jinden Badesha, with headquarters located in London and an additional office in Belfast. Initially launching as an iPhone subscription service, Raylo has since expanded to offer a wider selection of refurbished smartphones, tablets, and laptops, which customers can lease for specific periods, making these products more accessible and affordable. When customers return their devices, they are refurbished and resold as part of Raylo’s circular process, maximising their lifespan and sustainability.

Raylo recently raised £110 million in debt financing, enabling the company to expand its tech subscription platform further and make the latest gadgets accessible to more people. The company’s focus on sustainability, affordability and accessibility has made it a popular choice for customers seeking an alternative to traditional purchasing methods while also contributing to a more environmentally friendly future.

This financing supports our strategy to further expand our platform and provide even more customers with affordable and sustainable access to the tech products they really want.

Karl Gilbert, co-founder and CEO of Raylo

Raylo has chosen a short, catchy, and brandable name that strikes just the right balance regarding syllable count. Research has shown that words with fewer syllables tend to have higher memorisation rates than words with three or more syllables. The company has successfully secured the exact brand match domain name Raylo.com, which provides numerous benefits, including increased brand recognition, enhanced authority and trustworthiness.

Skydio

Headquartered in San Mateo, California, Skydio is an American drone manufacturer that has gained significant traction in the industry. In March 2021, the company achieved unicorn status, becoming the first US drone manufacturer to surpass $1 billion in value. Skydio’s cutting-edge products are the culmination of over a decade of R&D by leading experts in drones, AI, and computer vision.

Skydio recently announced the successful completion of a $230 million Series E fundraising round at a $2.2 billion valuation, which will provide vital support for the company’s continued growth and expansion. In addition, Skydio also unveiled plans to construct a new manufacturing facility in America, further strengthening its commitment to innovation and manufacturing excellence in the US.

Drones enable the core industries that our civilisation runs on — transportation, public safety, energy, construction, communications, defence and more — to operate more safely and more efficiently by putting sensors wherever they’re needed, whenever they’re needed while keeping people safely on the ground

Adam Bry, Co-founder and CEO at Skydio in a release

Skydio’s choice of name reflects the company’s innovative and forward-thinking approach, not just in its products but also in its branding strategy. By combining the keyword “sky” with “dio,” which means God in Latin, Skydio has created a unique and memorable name that effectively captures the company’s mission to push the boundaries of what is possible in the drone industry.

Skydio’s investment in the exact brand match domain name Skydio.com clearly demonstrates the company’s unwavering commitment to innovation, excellence, and market leadership.

Planet42

South Africa-based car subscription company, Planet42, has secured $100 million in equity and debt funding from a diverse range of investors. The new financing, which includes equity, a credit facility, and debt, will enable the company to rapidly scale its business and provide car subscriptions to a million people globally who have been excluded from traditional car financing options. Since its last funding round in 2021, Planet42 has significantly grown its business, purchasing over 5,000 cars in South Africa alone and adding nearly 1,000 dealerships to its network. The company’s expansion into Mexico aligns with its strategy to address transport inequality on a global scale, as it seeks to provide greater mobility and access to affordable transportation options to individuals and communities around the world.

I’m thrilled to support Planet42 as they expand worldwide and improve the lives of thousands of individuals who face limited access to private transportation, which can significantly impact their quality of life and opportunities. Planet42’s team has displayed remarkable execution, with a proven innovative, cash-generating, and globally scalable model.

Andrew Rolfe, general partner at ARS Holdings, who joins Planet42 as a member of its supervisory board

Out of the 2.9 million active trademark registrations on the US Federal Register for 2022, only 1% are comprised of Alphanumeric brand names, which include numbers. However, numbers have proven to be a successful branding strategy for many companies, as they can convey specific meanings or values, such as the number of products offered or the year of founding. It’s crucial to strike a balance between creativity and practicality when incorporating numbers into a brand name, ensuring that they are relevant and meaningful to the company’s mission and values.

While the exact meaning behind the choice of the number 42 in Planet42’s brand name remains unclear, it is significant in popular culture for its association with “The Hitchhiker’s Guide to the Galaxy,” where it is famously referred to as the “Answer to the Ultimate Question of Life, the Universe, and Everything.” In this context, the number symbolises the quest for knowledge, understanding, and enlightenment, values that are deeply ingrained in Planet42’s culture and vision for the future. By harnessing the power of the number 42, Planet42 has created a unique and memorable brand identity, inspiring customers and investors alike to join the company in its ongoing quest for a more equitable and sustainable future. The company has also invested in the exact brand match domain name Planet42.com, further solidifying its brand identity and enhancing its online presence.

Highlights

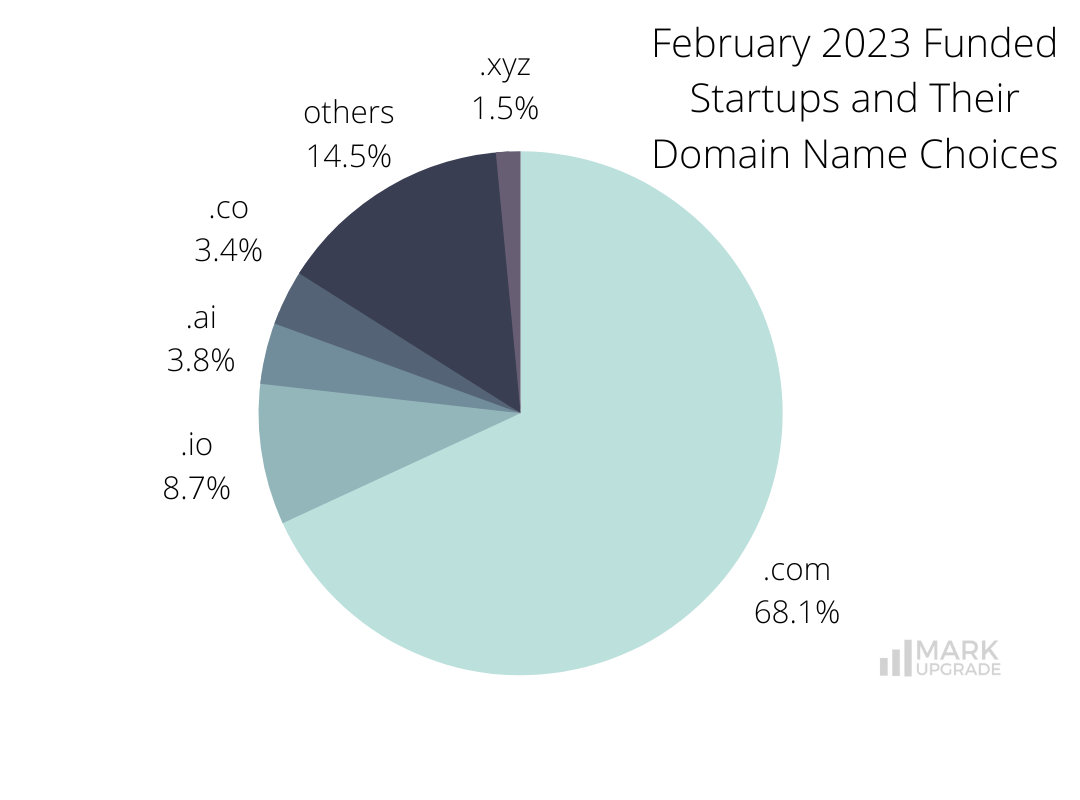

Out of 530 companies analysed, the overwhelming majority of 361 chose to invest in the .com extension, indicating its continued dominance as the most popular and trusted domain name choice for businesses.

.io is the third preferred choice with 46 companies operating on this extension, followed by .ai with 20 entries. While .io and .ai domains may be less expensive and easier to obtain than some other popular extensions, they may not be as widely recognized by potential customers and may not convey the same level of credibility.

18 companies chose the .co extension, which is the country code top-level domain (ccTLD) for Colombia, but it is also commonly used by companies and individuals as an alternative to the more well-known .com extension.

8 companies went with the unique .xyz domain, while 77 chose other extensions, indicating a diverse range of choices.

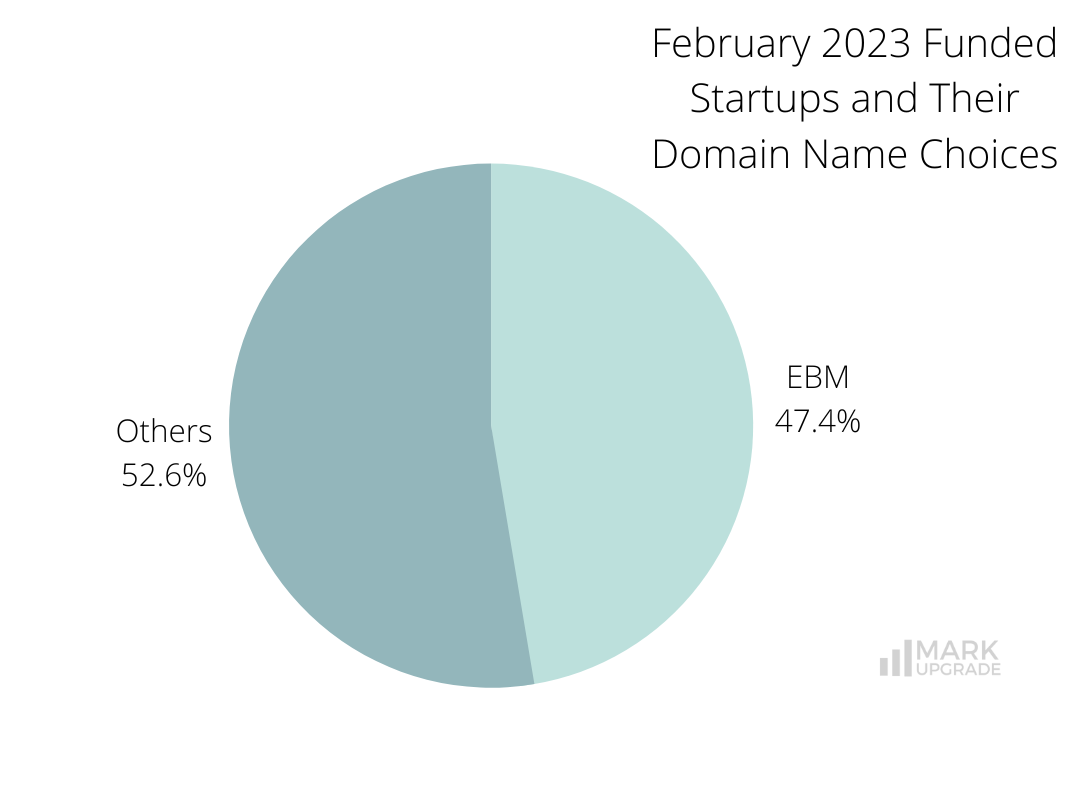

251 companies invested in Exact Brand Match (EBM) .com domains, highlighting the importance of brand recognition and credibility in the online space.

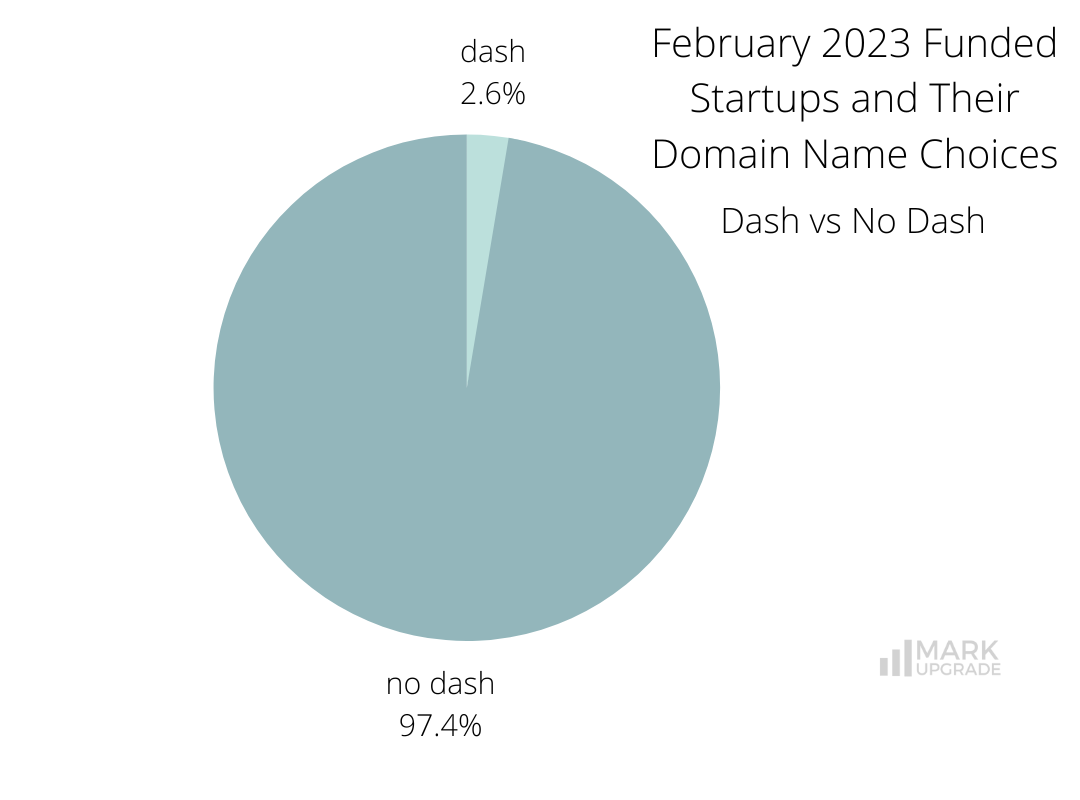

14 companies opted for a dash in their domain name, suggesting that most companies prefer to avoid using a dash and opt for more traditional domain name structures.

While we make every effort to ensure the data on our site is accurate, complete, and up-to-date, we cannot guarantee its reliability. Our data is provided for informational purposes only and should not be relied upon as legal, financial, or other advice. We strongly recommend that you independently verify any information before relying on it.

Other resources

- Monthly Funding Report: January 2023 Funded Startups and Their Domain Name Choices

- The Importance of Investing in a Strong Domain Name for Your Business

- Tatiana Bonneau Talks with Jason Barnard About Domain Names as Brand Assets

- The Power of Premium Domains: How Entrepreneurs Are Investing in the Future

When it comes to premium domain names, it’s important to weigh the potential loss in terms of brand recognition and revenue against the cost of the investment. In the long run, a premium domain name can be a valuable asset for your business. Contact us to learn more about our premium domain options and how they can help your business succeed.

2023 branding business domain domain name domain names domains february funding Monthly Funding Report naming startup

Previous Next