Overview

Fintech (Financial technology) refers to any business that uses technology and innovation to enhance or automate financial services. The origin of the term can be traced back to the early 1990s when Citigroup launched the “Financial Services Technology Consortium” project to encourage technical collaboration. The Global Financial Crisis in 2007-2008 pushed forward the Fintech industry and had a significant impact on its shaping. Many professionals working in the financial sector were left out of work, which led to a shift in mindset and reconsidering the traditional banking system, which paved the way to the Fintech industry. The GFC was followed by the release of Bitcoin in 2009 and the smartphone market boom that has enabled easy internet access worldwide and opened the doors for fintech services. This period is marked by the rise of many great new players along with those who currently existed.

Fintech has shown its potential to close gaps in the delivery of financial services to households and firms in emerging markets and developing economies.

Caroline Freund, World Bank Global Director for Finance, Competitiveness and Innovation

According to Bluetree. digital, the fintech industry was valued at approximately $194 billion in 2023 and is projected to reach $492 billion by 2028, growing at a compound annual growth rate (CAGR) of about 25.18% over the forecast period. The global fintech market is expanding rapidly, with publicly traded fintech firms representing a market capitalisation of $550 billion as of mid-2023, double their value in 2019. Some forecasts project the industry reaching as much as $16.65 trillion by 2028, driven by strong adoption of digital financial services, insurtech, blockchain, robo-advisory solutions, and alternative lending platforms, reflecting the increasing demand for innovative financial solutions.

Technological innovations will be the heart and blood of the banking industry for many years to come, and if big banks do not make the most of it, the new players from Fin-Tech and large technology companies surely will.

David M Brear, CEO of 11:FS for TechTuesday

COVID-19 has prompted Fintech companies to make changes to their existing products, services, and policies. University of Cambridge’s research shows that fee or commission reductions and waivers, changes to onboarding criteria, and payment easements were the most implemented practices among the surveyed firms.

Customers are becoming more open to non-traditional means of handling finances, according to PwC research, with 30% of consumers wanting to increase their use of non-traditional financial services providers.

According to Statista, Venture capital (VC) fintech funding grew significantly between 2014 and 2021 despite some fluctuations. After 2021, both the value and number of VC deals declined sharply. By 2024, global VC investment in fintech had dropped to 43.4 billion U.S. dollars, down from nearly 90 billion U.S. dollars in 2022. The number of deals also saw a steep decline, falling from 6,968 to 3,856.

Key Fintech Trends Shaping the Future of the Industry

AI-Driven Financial Services – Artificial intelligence transforms fintech, enhancing customer service, risk assessments, and fraud detection through predictive analytics and automation.

Embedded Finance Growth – More companies integrate financial services directly into their platforms, making transactions seamless and boosting customer engagement.

Decentralised Finance (DeFi) & Digital Currencies – DeFi adoption continues to rise alongside Central Bank Digital Currencies (CBDCs) like the Digital Yuan and digital euro, modernising financial systems.

Biometric Security & Fraud Prevention – Banks and fintechs are implementing biometric authentication and AI-powered security measures to combat growing cyber threats.

Sustainable & Green Fintech – Fintech companies focus on ESG initiatives, offering carbon footprint tracking, blockchain-based carbon credits, and sustainable investment solutions.

Domain Names Highlights

Fintech companies prioritise securing professional, trustworthy, and user-friendly domains to strengthen their brand and enhance credibility.

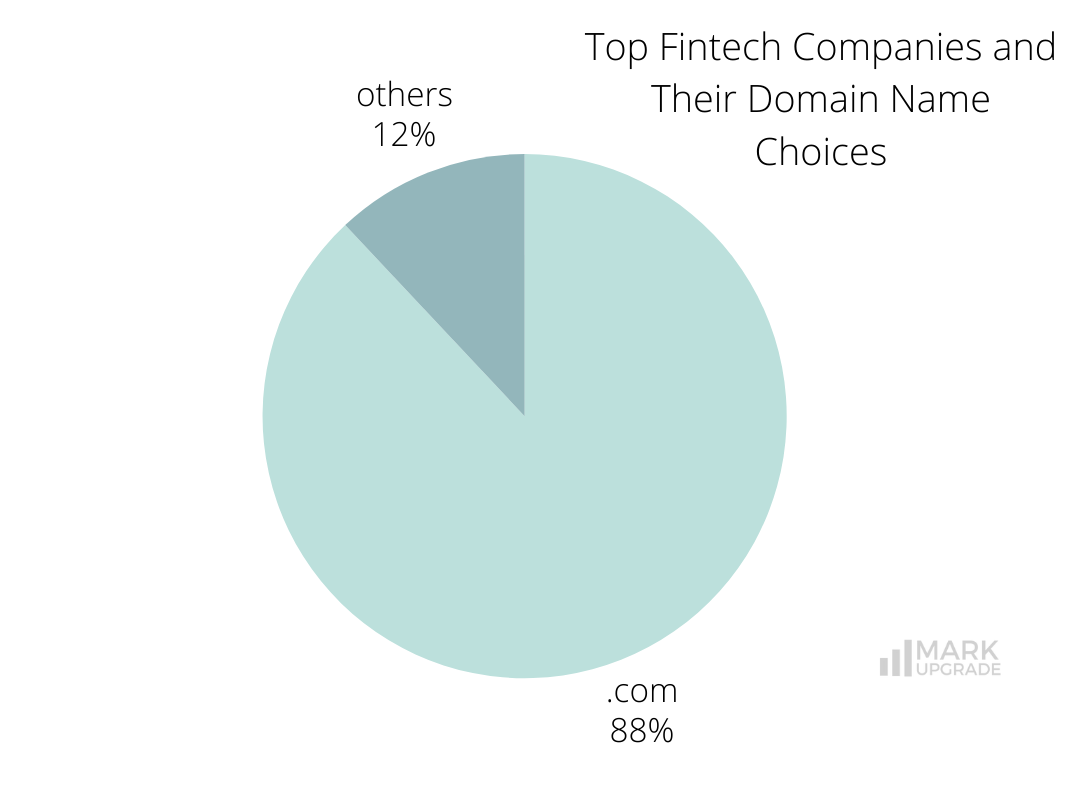

The .com extension is the clear leader among fintech companies, with 352 out of 400 choosing it for its credibility, global recognition, and accessibility.

Alternative domain extensions are far less common, with only 48 companies using options like .io, .co, and .finance. Despite their niche appeal, these extensions lack the global reach and universal recognition of .com, making them a secondary choice for companies aiming for long-term credibility and expansion.

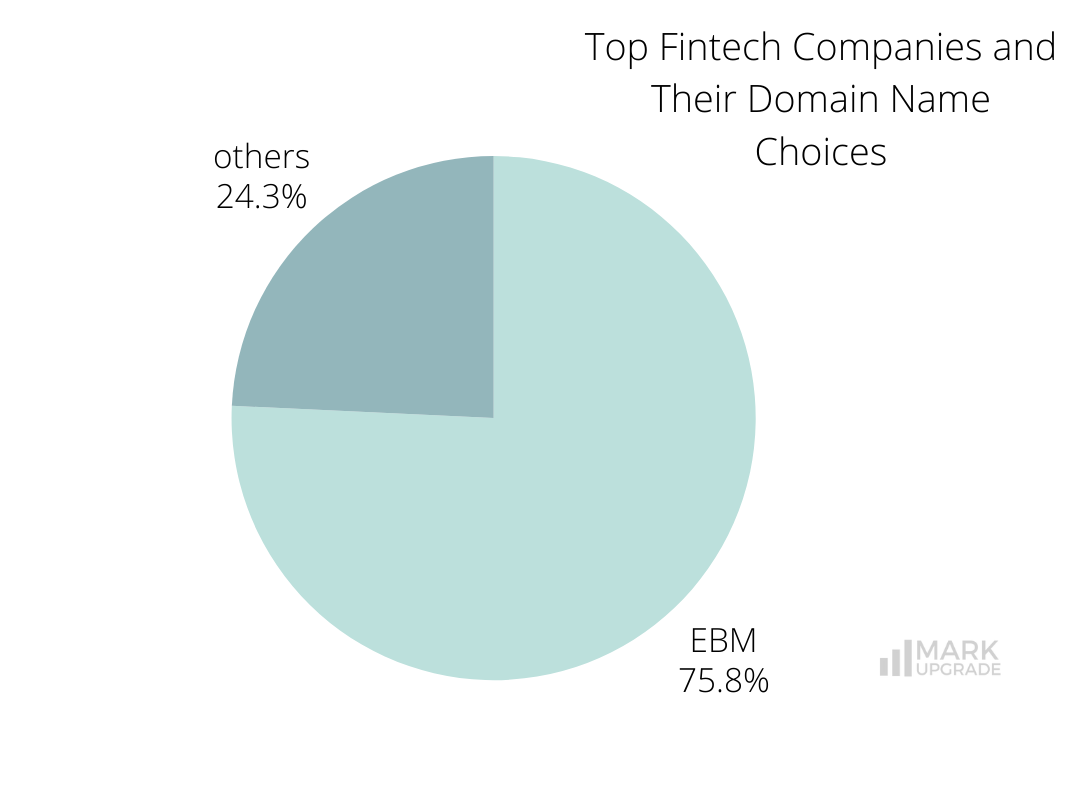

Exact Brand Match (EBM) domains are also widely favoured, with 303 companies securing one to reinforce brand consistency and ensure easy discoverability.

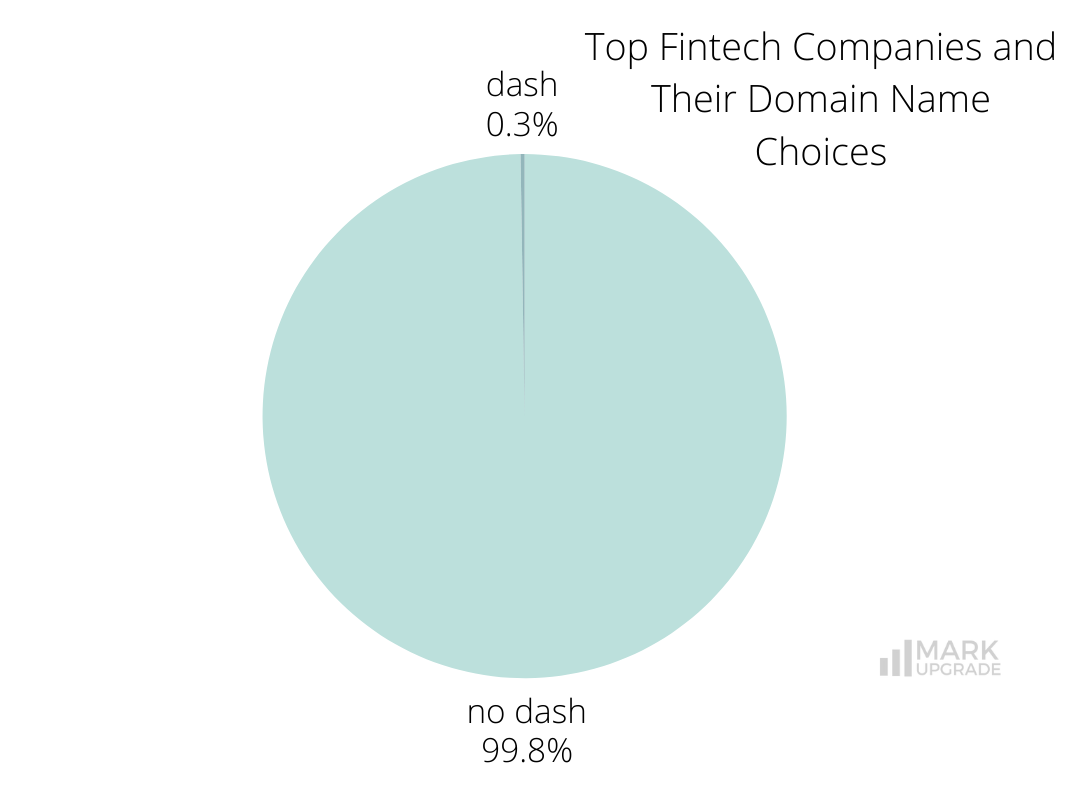

Only one company has a dash in its name. Fintech companies value clean, professional, and easy-to-remember web addresses, reinforcing the importance of EBM .com domains as the industry standard.

Naming Trends in FinTech Companies

Short, Catchy Names

One-word, memorable names create a modern, tech-forward impression.

Examples: Affirm, Alto, Blend, Brex, Chime, Klarna, Plaid, Revolut, Stripe, Wise.

Tech and Finance-Inspired Terms

Names incorporating financial and technology-related words ensure instant recognition.

Examples: AccessFintech, Alloy, Blockchain.com, Finix, Payhawk, Wealthsimple.

Invented and Modified Words

Unique, slightly altered, or entirely new words enhance brand distinctiveness.

Examples: Addepar, Codat, Mambu, Nymbus, Quantexa, Yapstone.

Consumer-Oriented Names

Words linked to trust, security and financial well-being appeal to users.

Examples: Betterment, Happy Money, Personal Capital, Trust & Will, Upgrade.

Nature, Movement, and Speed Themes

Names inspired by fluidity, stability, and innovation convey agility.

Examples: BlueVine, Current, Greenlight, OakNorth, Ripple, Tide.

Namepicks

Check out our article “How to Name a Unicorn?” for insights on choosing a brand name that can help elevate your startup to unicorn status.

Cedar

Cedar is a patient payment and engagement platform for hospitals, health systems, and medical groups, aiming to enhance the end-to-end patient experience. Founded in 2016 and headquartered in New York, United States, Cedar leverages advanced data science to customise and simplify the payment process, offering patients a modern, consumer-friendly way to manage and pay their bills.

Interesting fact: The company’s name, Cedar, draws inspiration from the cedar tree, symbolising strength, resilience, and longevity. In various cultures, cedar trees are revered for their durability and natural beauty, qualities that align with the company’s mission to provide enduring and robust solutions in healthcare.

Cedar has secured Cedar.com for their brand presence online. An Exact Brand Match (EBM) name like Cedar.com is the natural choice of most internet users, making their marketing most effective across all channels.

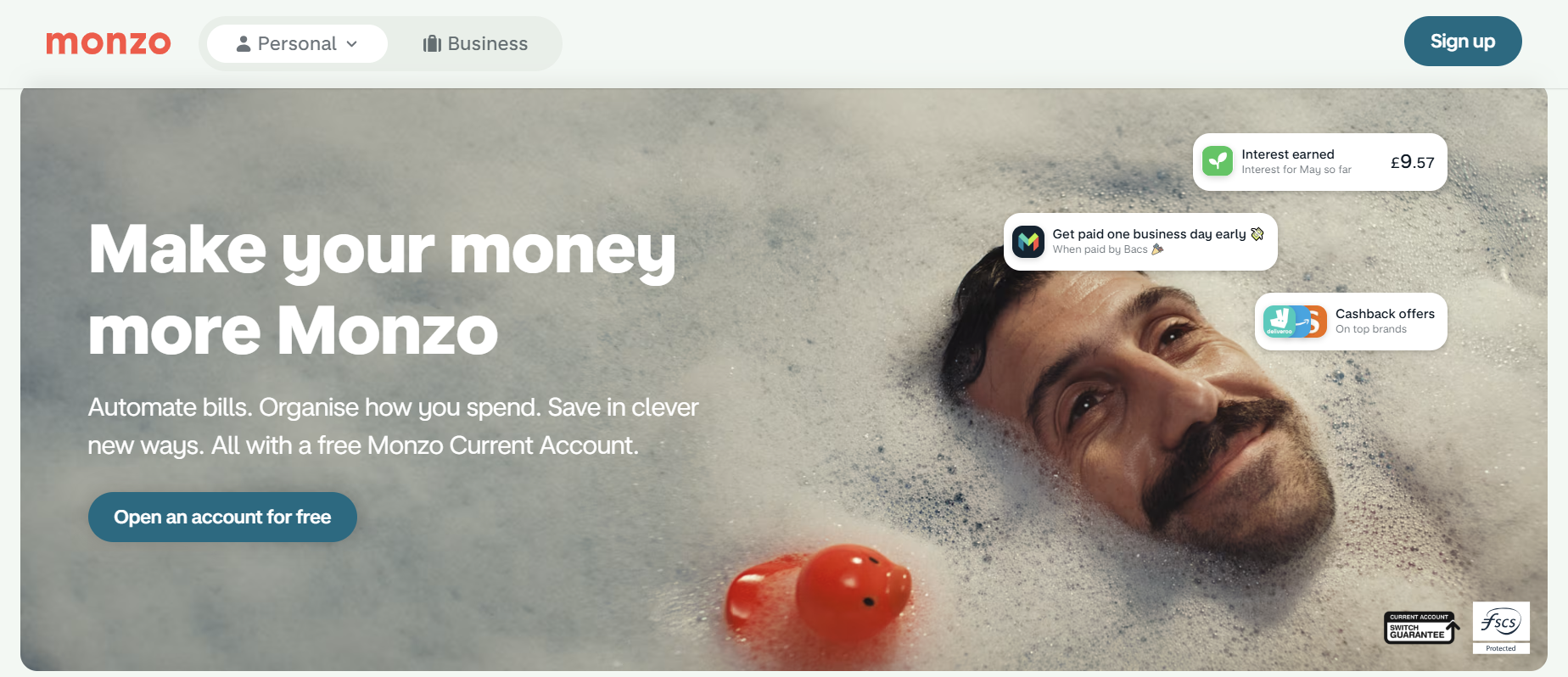

Monzo

Monzo is a UK-based online bank. The company offers its customers a wide range of products and services through a digital platform and marketplace. In 2024, Monzo removed the waitlist for its under-16 bank account, allowing parents to instantly sign up children aged 6 to 15. The account includes a debit card, savings pots, and parental controls, making digital banking more accessible for young users.

Interesting fact: Monzo initially launched as Mondo but was forced to rebrand in 2016 due to a trademark dispute. The company invited customers to help choose a new name, receiving over 12,000 suggestions before settling on Monzo.

Following the rebrand, Monzo upgraded from GetMonzo.co.uk to the Exact Brand Match (EBM) domain Monzo.com, securing a stronger global identity. During the transition, a rival company took advantage of the situation by acquiring a similar domain and redirecting traffic to its own site.

Velera

Velera, formerly PSCU/Co-op Solutions, is a leading credit union service organisation (CUSO) providing payment processing, fraud management, digital banking, and data analytics to over 4,000 financial institutions. The rebrand reflects a commitment to driving growth and innovation in the credit union space, symbolised by the arrow in its new logo. While Co-op Solutions remains for ATM Network and Shared Branching services, Valera will roll out in phases over the next year. The shift marks a new era of agility and partnership, equipping credit unions with a competitive edge in a rapidly evolving financial landscape.

Interesting fact: Velera is derived from the Latin root velox, meaning swift or rapid, which aligns with the company’s mission to drive momentum and growth for credit unions. Speed is a key attribute in financial services, where efficiency, seamless transactions, and quick decision-making are crucial.

The company reinforces its identity as a fast, innovative, and reliable partner for credit unions by securing the valuable dictionary-word EBM domain Velera.com.

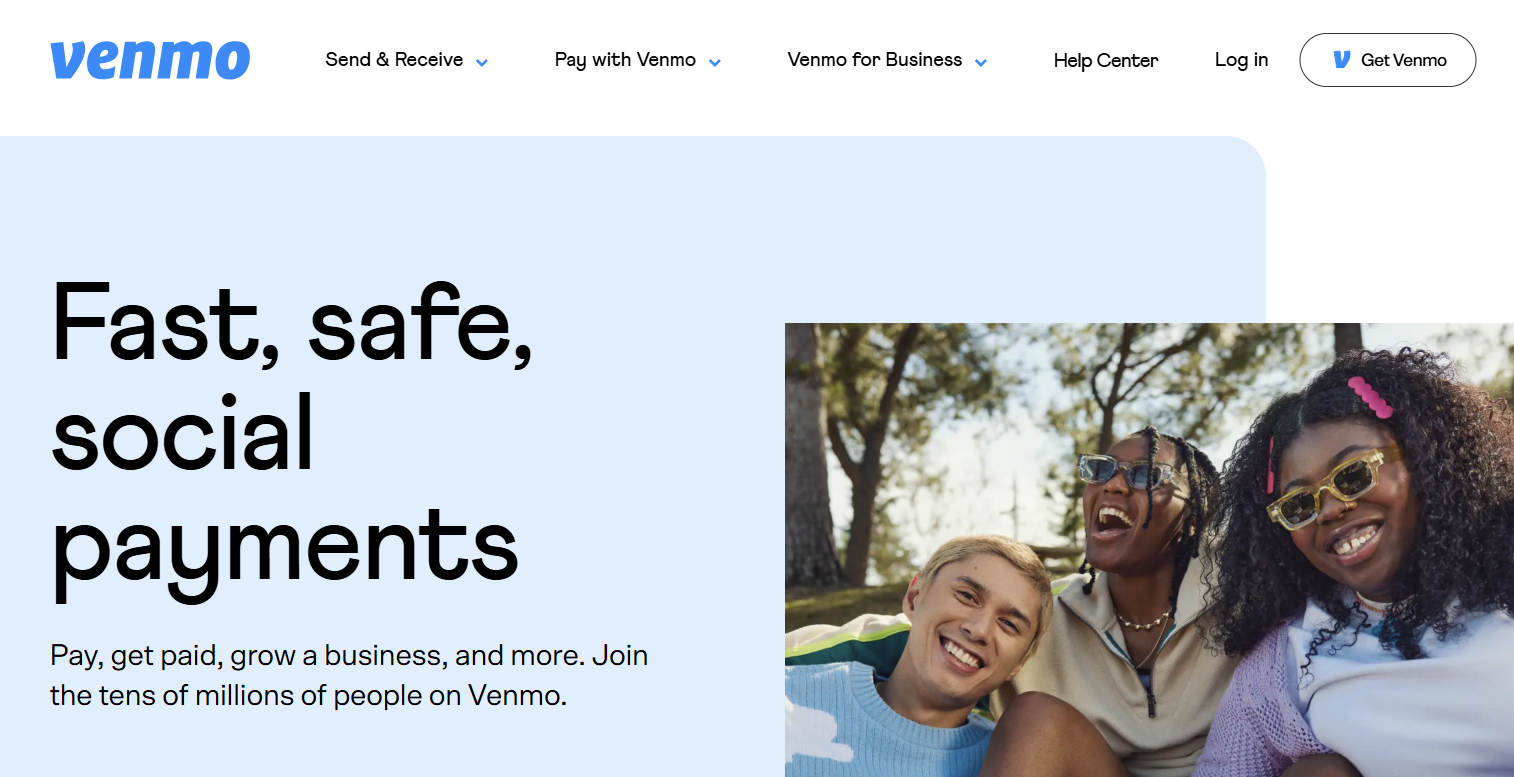

Venmo

Venmo is a mobile payment service owned by PayPal, enabling users in the United States to transfer funds via a mobile app. Founders Andrew Kortina and Iqram Magdon-Ismail met as freshmen roommates at the University of Pennsylvania. The idea for Venmo originated when Magdon-Ismail forgot his wallet during a visit to Kortina, highlighting the inconvenience of traditional payment methods and inspiring them to develop a mobile solution.

Interesting fact: The name “Venmo” is a combination of the Latin word “vendere,” meaning “to sell,” and “mo,” short for “mobile,” reflecting the company’s focus on mobile transactions.

The company initially used Venmo.me before acquiring the EBM domain Venmo.com, securing a stronger brand identity, eliminating user confusion, and ensuring a seamless, trustworthy, and easily accessible online presence.

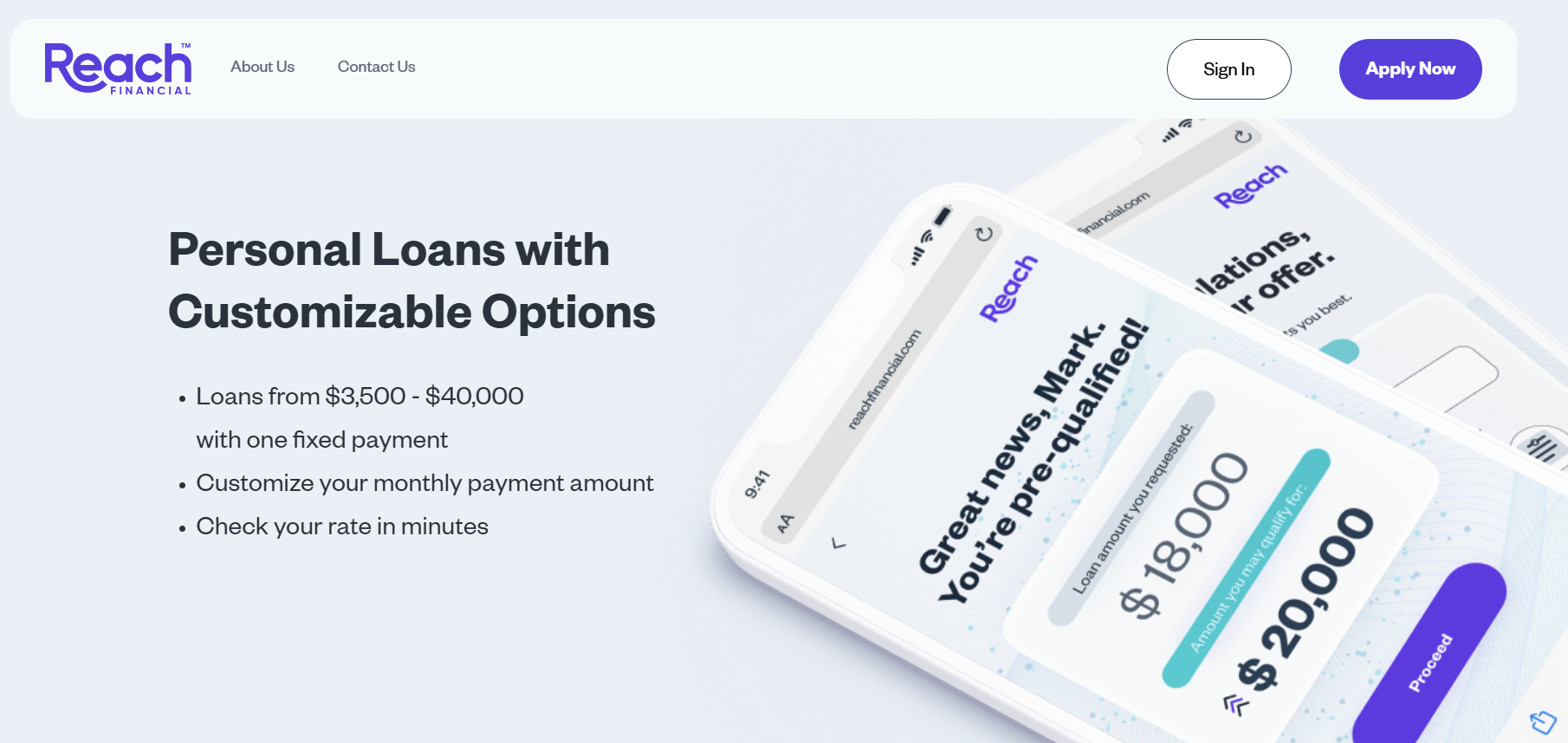

Reach Financial

Reach Financial, formerly known as Liberty Lending, is a New York-based financial services company focused on technology-driven consumer lending solutions. The company specialises in customisable personal loans that help individuals pay off debt faster and take control of their financial future. The rebrand to Reach Financial reflects the company’s ambition to expand beyond lending, offering tools and services that support customers in achieving their broader financial goals.

Interesting fact: Reach Financial marked a significant milestone in January 2025 with the launch of Reach ABS Trust 2025-1, a $319.308 million Asset-Backed Securities (ABS) transaction, reinforcing the company’s presence in consumer finance and expanding lending capabilities.

Following the rebrand, the company secured the highly sought-after strategic garde domain, Reach.com, strengthening its brand presence and digital identity. Investing in a short, intuitive, and trustworthy domain like Reach.com strengthens credibility, improves accessibility, and ensures a seamless user experience, reinforcing the company’s commitment to building trust and transparency in the fintech space.

While we make every effort to ensure the data on our site is accurate, complete, and up-to-date, we cannot guarantee its reliability. Our data is provided for informational purposes only and should not be relied upon as legal, financial, or other advice. We strongly recommend that you independently verify any information before relying on it.

The right domain name is an important consideration when it comes to building and protecting your brand. If you’re ready to take the next step and invest in a perfect domain name for your business, contact us to learn more about our available options and how we can help you get started.

Other resources

branding domain domain name domains finance fintech naming startup startups technology upgrade

Previous Next