Discover the latest trends in global monthly funding data, with a unique focus on companies’ domain name choices, in our monthly funding reports.

Overview

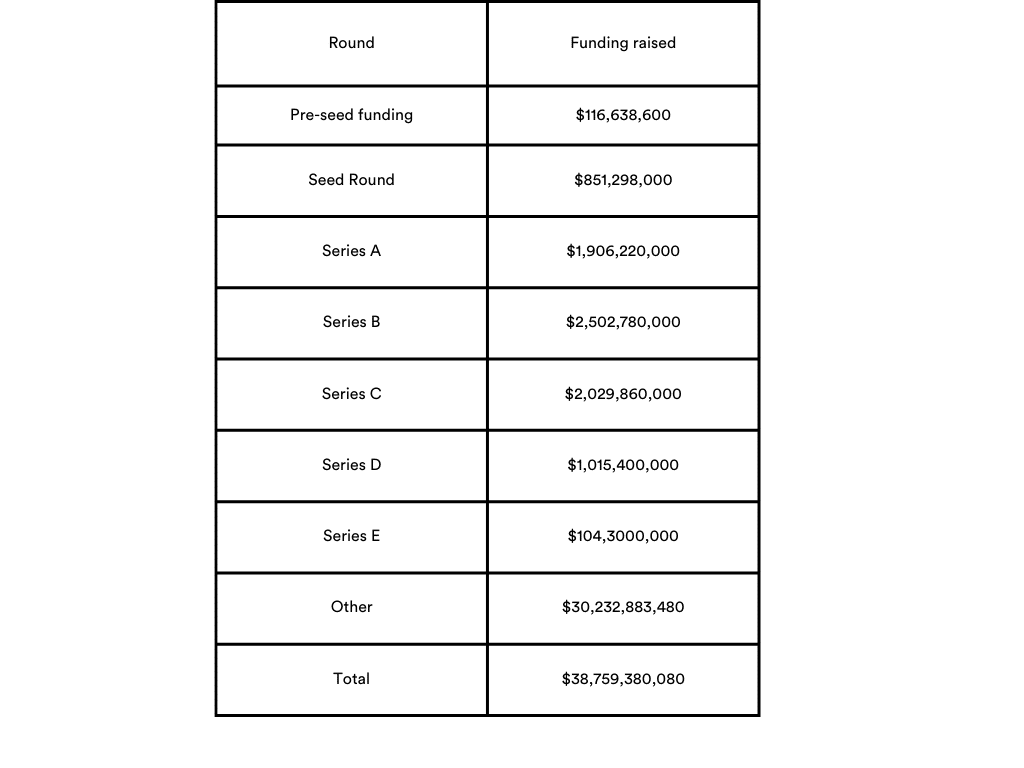

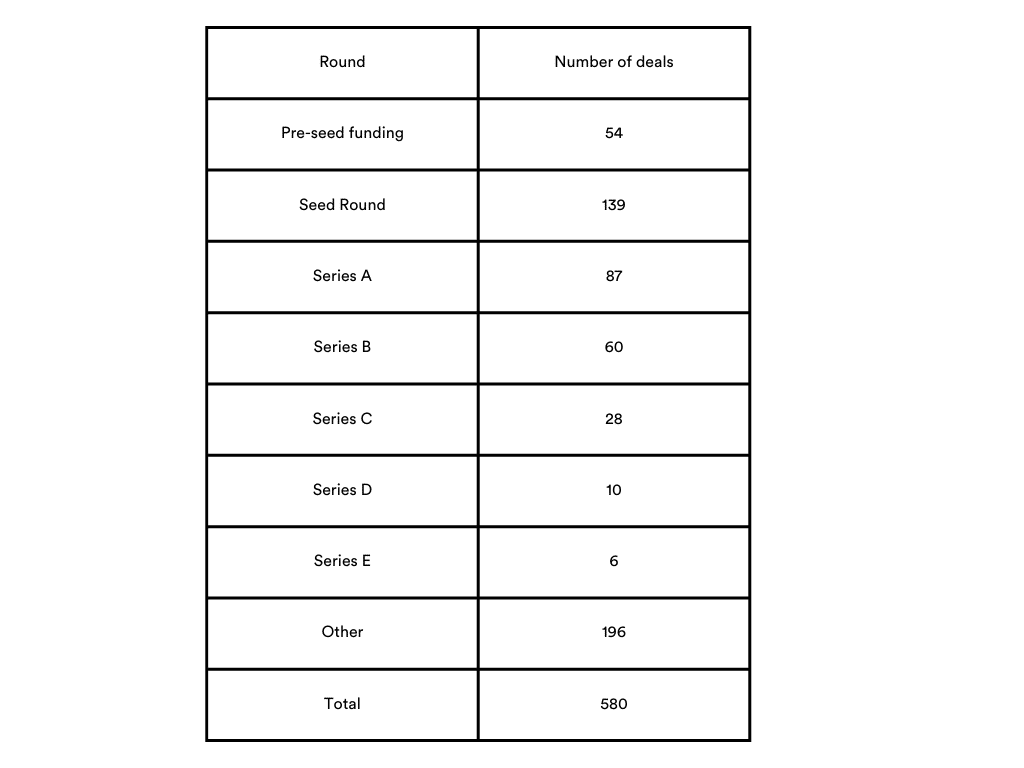

| Round | Amount October (USD) | Number deals October | Amount November (USD) | Number deals November |

| Pre-seed funding | 148,638,300 | 60 | 116,638,600 | 54 |

| Seed Round | 1,114,092,000 | 170 | 851,298,000 | 139 |

| Series A | 2,532,550,000 | 106 | 190,622,0000 | 87 |

| Series B | 3,514,230,000 | 79 | 2,502,780,000 | 60 |

| Series C | 2,547,400,000 | 30 | 2,029,860,000 | 28 |

| Series D | 1,549,000,000 | 13 | 1,015,400,000 | 10 |

| Series E | 91,000,000 | 2 | 104,3000,000 | 6 |

| Other | 23,355,175,700 | 181 | 30,232,883,480 | 196 |

| Total | 34,852,086,000 | 641 | 38,759,380,080 | 580 |

November saw $38.76 billion raised across 580 deals, surpassing October’s $34.85 billion despite fewer deals. The higher overall amount is primarily attributed to billion-dollar investments in AI companies, such as AmazonxAI raising $5 billion, Anthropic securing $4 billion, and Zepto adding $350 million. These mega-deals highlight the increasing concentration of funding in the AI sector and the growing trend of billion-dollar rounds, which now account for 16% of total venture funding in 2024, up from 15% in 2023 and significantly higher than 5% in 2022, as reported by Crunchbase.

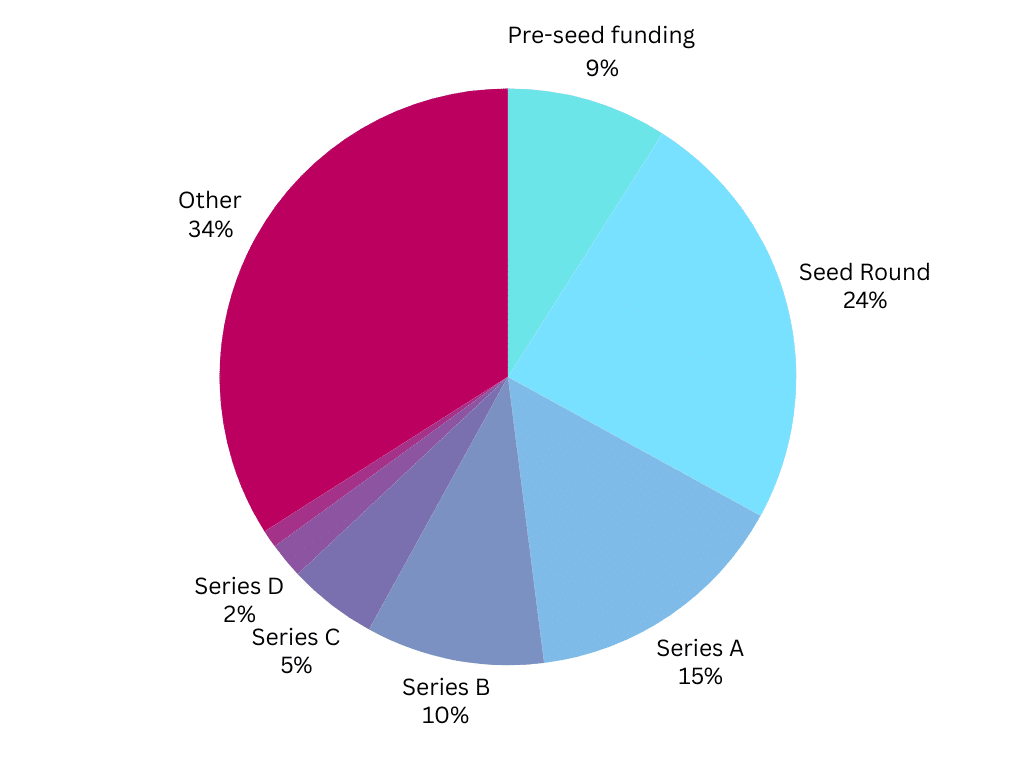

By funds raised/ Total funding $38,759,380,080

By number of deals/Total number of deals 580

Political and Economic Influences on November’s Funding Landscape

The following analysis is based on Infotec’s Global Economic Overview – November 2024, authored by Philip Shaw, Ryan Djajasaputra, Lottie Gosling, Ellie Henderson, and Sandra Horsfield from the London Economics team.

Global Political Impact

The re-election of Donald Trump as U.S. President, coupled with Republican control of the House and Senate, has introduced significant uncertainty to global markets. Potential new trade tariffs and shifts in foreign policy have left investors cautious, particularly in sectors heavily reliant on international trade. The anticipation of a 10% universal tariff has raised concerns about global supply chain disruptions, impacting funding decisions for export-driven and manufacturing industries. Meanwhile, Trump’s focus on energy independence and defence may redirect investment toward U.S.-centric energy and military technologies, potentially drawing funds away from global ventures.

U.S. Political and Economic Dynamics

In the U.S., Trump’s proposed tax cuts and regulatory changes have created optimism about short-term economic growth and heightened concerns over inflation and fiscal deficits. These factors have likely influenced investor preference for resilient industries such as artificial intelligence and healthcare, which saw record-breaking funding levels. The Fed’s cautious approach to interest rate adjustments, in light of inflation risks, further shaped the funding environment, steering investments toward sectors perceived as safe havens.

Eurozone Challenges

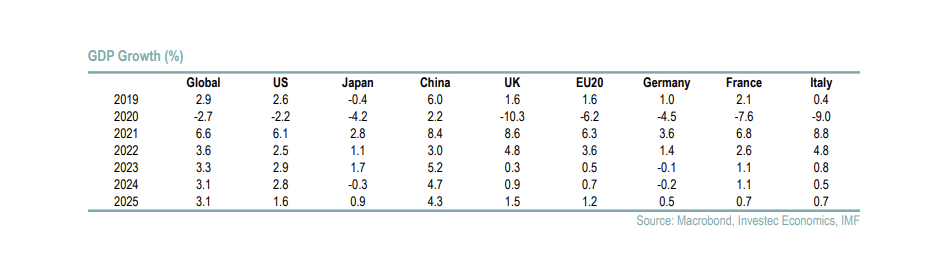

In Europe, the economic outlook remains subdued, with manufacturing continuing to lag and political uncertainties in Germany and France adding to the unease. The implications of potential U.S. tariffs and a weakening Eurozone economy have likely tempered investor confidence in the region. Eurozone-focused startups may face headwinds in securing funding, with investors gravitating toward U.S. or Asia-based opportunities offering higher growth prospects.

Emerging Markets and China

China’s projected GDP slowdown to 4.3% in 2025 reflects challenges in global trade and domestic economic restructuring. This condition likely contributed to a cautious funding climate for startups in emerging markets as investors pivot to sectors with more predictable returns, such as infrastructure and AI. The broader global uncertainty may also have spurred interest in sectors addressing geopolitical risks, such as cybersecurity and energy storage.

AI and Strategic Investments

Despite the uncertainties, the AI sector demonstrated exceptional resilience, attracting more than half of November’s total funding. Billion-dollar deals, such as AmazonxAI’s $5 billion raise and Anthropic’s $4 billion funding, underscore the shift toward large-scale, transformative investments. AI’s ability to address challenges across industries ranging from healthcare to autonomous driving has solidified its role as a critical focus for investors amid global volatility.

Key Investment Sectors in November 2024

November’s investment trends highlight strong interest in Biotechnology, Health, and FinTech, focusing on therapeutics, medical devices, payments, and lending solutions. Artificial Intelligence (AI) leads the landscape with applications in Generative AI, Machine Learning, Autonomous Vehicles, and Cybersecurity. Clean Energy, Renewable Energy, and Battery Technology reflect growing sustainability priorities, while sectors like E-Commerce, Consumer Technology, and Cloud Infrastructure attract continued capital. Emerging areas, including Blockchain, AgTech, and Environmental Consulting, emphasise the dynamic mix of traditional and innovative industries driving investor interest.

Domain Names Highlights

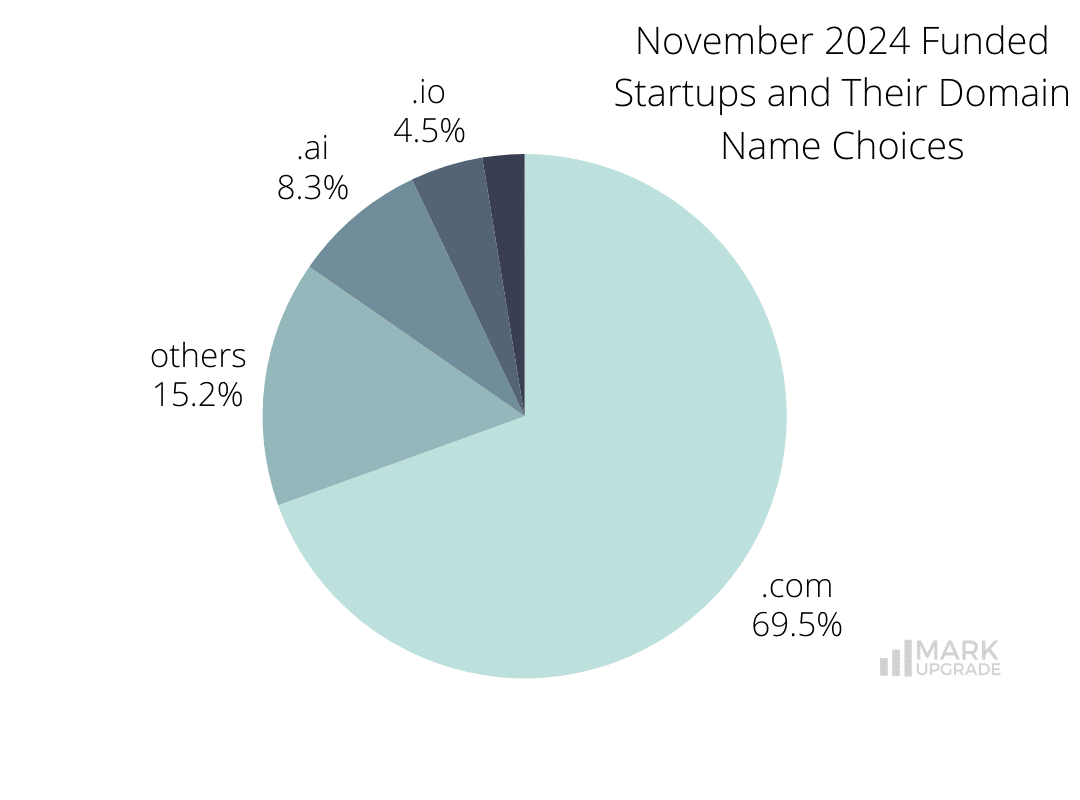

.com Domains – 403 companies from our list use .com domains, reflecting its status as the most recognised and trusted extension for businesses with global ambitions.

.ai and .io Domains: While .ai (48) and .io (26) extensions remain popular for tech-focused startups, their niche appeal, political changes, security vulnerabilities, and potential reputational issues can challenge broader scalability.

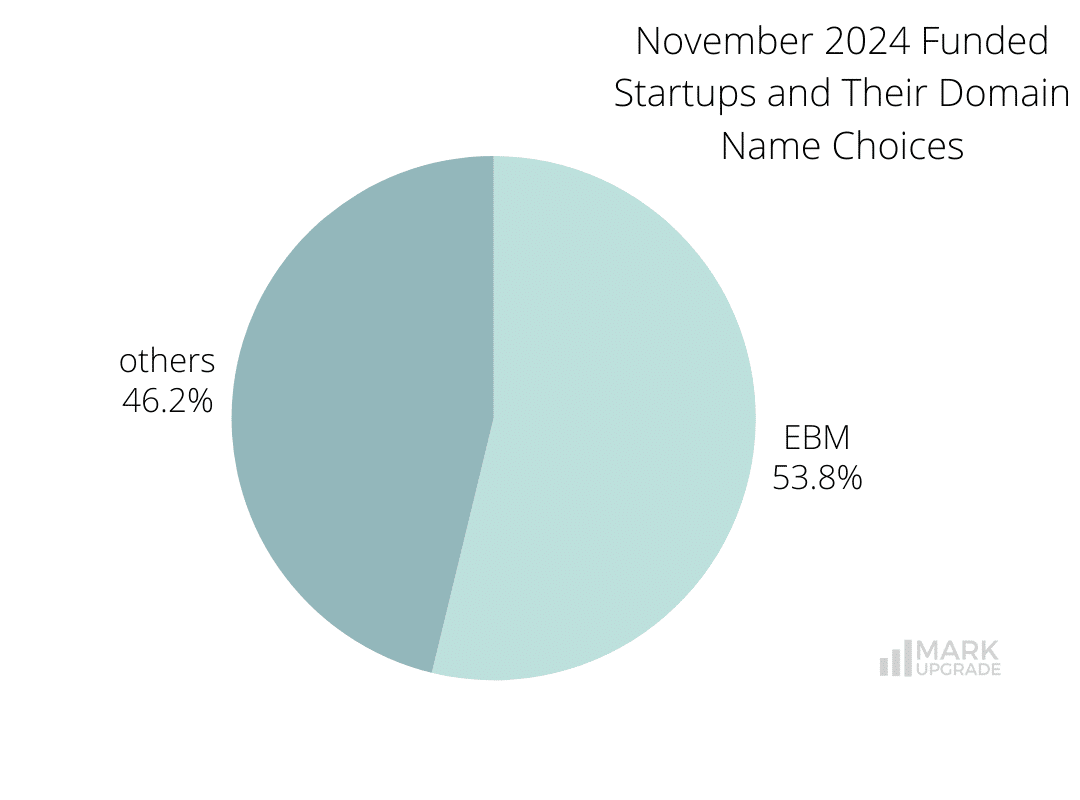

Exact Brand Match (EBM) Domains– 312 companies have adopted Exact Brand Match (EBM) domains, prioritising strong brand recognition, credibility, and ease of customer access.

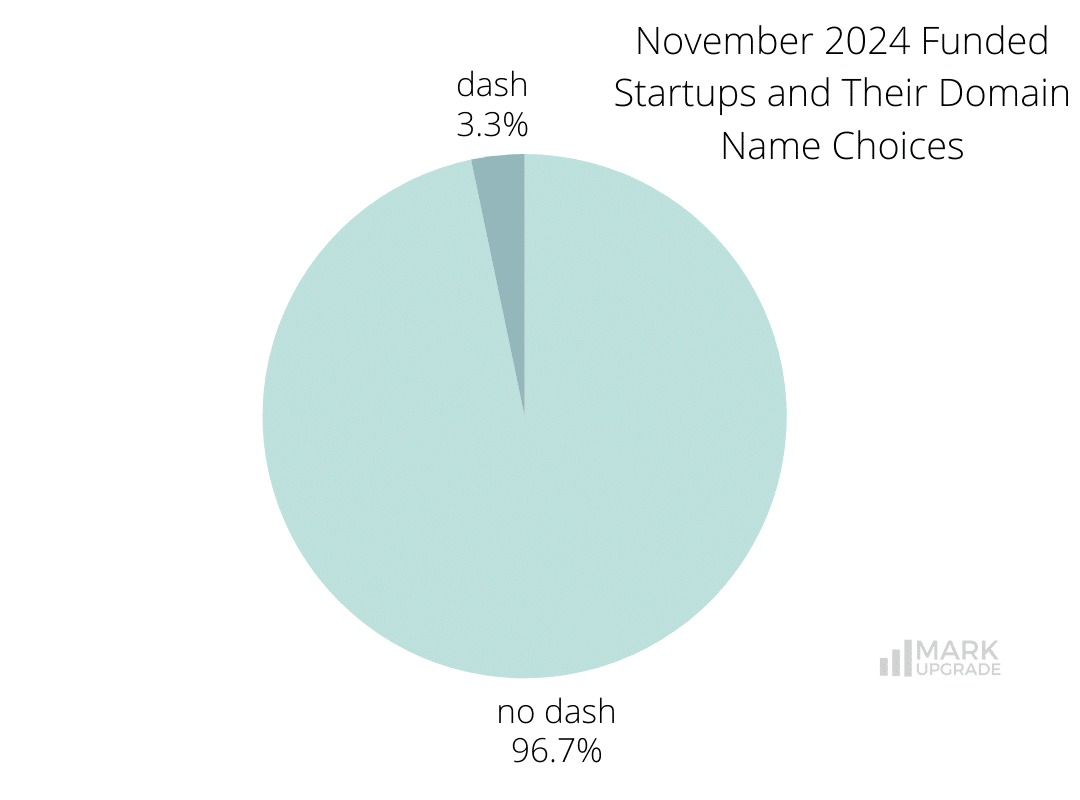

Dash Domains – 19 out of 580: Dashes are often included with two-word brand names or added words when the business compromises on their domain if the exact brand match name is taken/not within reach.

Namepicks

Anthropic

Industry: Artificial Intelligence (AI), Generative AI, Information Technology, Machine Learning

Funds Raised: $4,000,000,000

Anthropic, an AI startup founded in 2021 by former OpenAI executives, focuses on developing advanced AI systems, emphasising safety and reliability. In November 2024, Amazon invested an additional $4 billion in Anthropic, bringing its total investment to $8 billion. This partnership designates Amazon Web Services (AWS) as Anthropic’s primary cloud and training provider, with plans to integrate Anthropic’s AI models into AWS offerings.

By collaborating with Anthropic on the development of our custom Trainium chips, we’ll keep pushing the boundaries of what customers can achieve with generative AI technologies. We’ve been impressed by Anthropic’s pace of innovation and commitment to responsible development of generative AI, and look forward to deepening our collaboration.

AWS CEO Matt Garman said in a statement

The funding aims to enhance the development of Anthropic’s AI assistant, Claude, and to advance the company’s AI research and deployment capabilities.

The word “Anthropic” originates from the Ancient Greek word ‘ánthrōpikós'(ἄνθρωπικός), meaning ‘human.’ It signifies things related to human beings or the period of their existence on earth.

Anthropic operates on the Exact Brand Match (EBM) domain Anthropic.com, a key asset in the competitive AI sector, where trust, credibility, and global recognition are essential for attracting partners, customers, and investors.

Cyera

Industry: Artificial Intelligence (AI), Cloud Data Services, Cyber Security, Network Security

Funds Raised: $300,000,000 in Series D

Cyera is a New York City-based data security company specialising in an AI-powered platform that helps organisations manage and protect their data across complex digital environments. Combining advanced data security posture management with real-time enforcement controls, Cyera provides comprehensive solutions to safeguard data assets against evolving cybersecurity threats. Cyera raised $300 million in Series D funding, led by Accel and Sapphire Ventures, with participation from Sequoia, Redpoint, Coatue, and Georgian, bringing its total funding to $760 million and valuing the company at $3 billion. The funding will support the expansion of product capabilities, accelerate innovation, and enhance Cyera’s ability to address the growing cybersecurity needs of its customers.

Cyera operates on Cyera.io while also securing the Exact Brand Match Cyera.com. This investment ensures seamless access for global users, boosts trust, and reinforces the company’s position as a trusted name in data security.

Cresta

Industry: Artificial Intelligence (AI), Automotive, Customer Service, Intelligent Systems, Machine Learning, Natural Language Processing, Retail, Software, Telecommunications

Funds Raised: $125,000,000 in Series D

Cresta is a leading AI-powered platform transforming the contact centre industry that focuses on enhancing customer interactions by combining human expertise with advanced AI solutions. The company offers tools such as real-time insights, virtual agents, and behavioural best practices to improve customer satisfaction and operational efficiency. Cresta secured $125 million in Series D funding, co-led by World Innovation Lab (WiL) and QIA, with participation from major investors like Accenture and Qualcomm. This brings Cresta’s total funding to over $270 million. The funds will be used to expand R&D efforts, establish engineering hubs in Romania and India, and advance innovations like Cresta Voice Virtual Agent, ensuring 24/7 personalised customer experiences. With partnerships with leading brands like Cox Communications and United Airlines, Cresta continues to redefine the contact centre landscape with human-centric AI solutions.

At Cresta, we’ve built a platform that doesn’t just automate tasks for the sake of efficiency. We’re enabling contact centres to leverage real-time insights, behavioural best practices, and virtual agents to fundamentally reimagine how they operate. And we’re doing it in a way that puts the human element in the centre. Our AI blends human augmentation with AI automation through virtual agents in a flywheel that helps enterprises successfully transition into the AI era.

Cresta’s press release

Cresta has secured Cresta.com for their brand presence online. An exact brand match .com name like Cresta.com is the natural choice of most internet users, making their marketing most effective across all channels.

xAI

Industry: Artificial Intelligence (AI), Cloud Data Services, Cyber Security, Network Security

Funds Raised: $6,000,000,000

xAI, founded by Elon Musk, is focused on developing artificial intelligence to accelerate human scientific discovery and deepen our understanding of the universe. With a team contributing to groundbreaking innovations like GPT-3.5, GPT-4, and AlphaStar, the company blends expertise and vision to push the boundaries of AI research and application.

In November 2024, xAI secured a $6 billion funding round, valuing the company at $50 billion, making it the second-most-valuable generative AI company globally, trailing only OpenAI. Investors in this round include the Qatar Investment Authority, Valor Equity Partners, Andreessen Horowitz, and Sequoia Capital. The funding will fuel further innovation and expand xAI’s ability to deliver cutting-edge AI solutions through partnerships like its collaboration with X Corp, bringing advanced technology to over 500 million users of the X app.

xAI operates on the domain X.ai, cleverly positioning the domain as a core element of its brand identity. While the .ai extension resonates strongly with the AI sector, it carries potential risks. SmartBranding’s article notes that relying on country-code domains like .ai, initially designated for Anguilla, can pose stability concerns. Businesses using such domains may face unexpected disruptions, as seen with challenges around the .io extension.

Writer

Industry: Content, Generative AI, Natural Language Processing, Productivity Tools, Virtual Assistant

Funds Raised: $200,000,000 in Series C

Writer, founded in 2020 by May Habib and Waseem AlShikh, has evolved into a comprehensive generative AI platform offering customisable tools for various enterprise applications. The company’s advancements include the Palmyra model family for text generation and Palmyra X 004, which was developed almost entirely on synthetic data. Writer also provides AI agents, no-code tools, and customisable AI guardrails for seamless enterprise integration.

At Writer, we’re not just creating AI models that can execute tasks, but developing advanced AI systems that deliver mission-critical enterprise work. With this new funding, we’re laser-focused on delivering the next generation of autonomous AI solutions that are secure, reliable, and adaptable in highly complex, real-world enterprise scenarios.

Writer CEO May Habib in a statement

Writer raised $200 million in a Series C funding round, valuing the company at $1.9 billion. The round was co-led by Premji Invest, Radical Ventures, and ICONIQ Growth, with participation from Salesforce Ventures, Adobe Ventures, B Capital, and others, bringing its total funding to $326 million. The funding will drive product development and reinforce Writer’s position as a leader in the enterprise generative AI sector, serving major clients like Salesforce, Uber, Accenture, and Intuit.

Writer operates on the valuable one-word .com domain Writer.com. Such meaningful dictionary-word domains are highly sought for memorability, global appeal, and authority. They’re easier to reach, attract more traffic, and make it more likely for customers to find them, return to them, remember them, and recommend them.

While we make every effort to ensure the data on our site is accurate, complete, and up-to-date, we cannot guarantee its reliability. Our data is provided for informational purposes only and should not be relied upon as legal, financial, or other advice. We strongly recommend that you independently verify any information before relying on it.

The right domain name is an important consideration when it comes to building and protecting your brand. If you’re ready to take the next step and invest in a perfect domain name for your business, contact us to learn more about our available options and how we can help you get started.

Other resources

branding business domain domain name domain names domains funding Monthly Funding Report naming november startup

Previous Next