Discover the latest trends in global monthly funding data, with a unique focus on companies’ domain name choices, in our monthly funding reports.

Overview

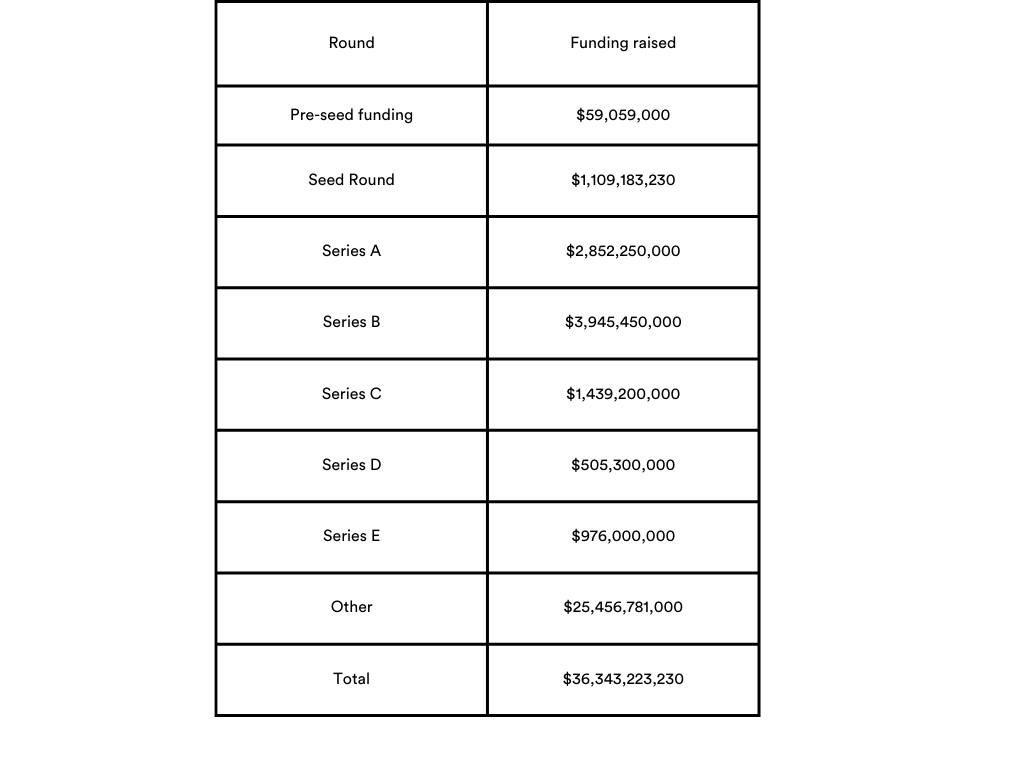

In March, Pre-seed funding experienced a significant decrease in both the amount funded and the number of deals, signalling potential caution among investors at the earliest stages.

| Round | Amount February (USD) | Number deals February | Amount March (USD) | Number deals March |

| Pre-seed funding | 148,829,000 | 35 | 59,059,000 | 27 |

| Seed Round | 984,597,000 | 169 | 1,109,183,230 | 181 |

| Series A | 2,184,530,000 | 110 | 2,852,250,000 | 112 |

| Series B | 3,311,550,000 | 49 | 3,945,450,000 | 58 |

| Series C | 1,947,900,000 | 26 | 1,439,200,000 | 19 |

| Series D | 836,000,000 | 10 | 505,300,000 | 8 |

| Series E | 633,700,000 | 5 | 976,000,000 | 8 |

| Other | 15,100,969,000 | 147 | 25,456,781,000 | 149 |

| Total | 25,148,075,000 | 551 | 36,343,223,230 | 562 |

Seed Round, Series A, and Series B saw rises in funding and number of deals, indicating growing investor confidence in mid to late-stage startups and a broader appetite for investing in innovative solutions and disruptive technologies across different sectors.

Series C and Series D funding declined in the number of deals and the amount raised, attributed to factors such as increased competition, higher investor expectations for returns, or challenges associated with scaling operations and achieving profitability.

On the other hand, Series E saw an increase in both the amount funded and the number of deals, possibly reflecting continued support for mature startups and investors’ confidence in the ability of these companies to capture market opportunities and deliver sustainable growth.

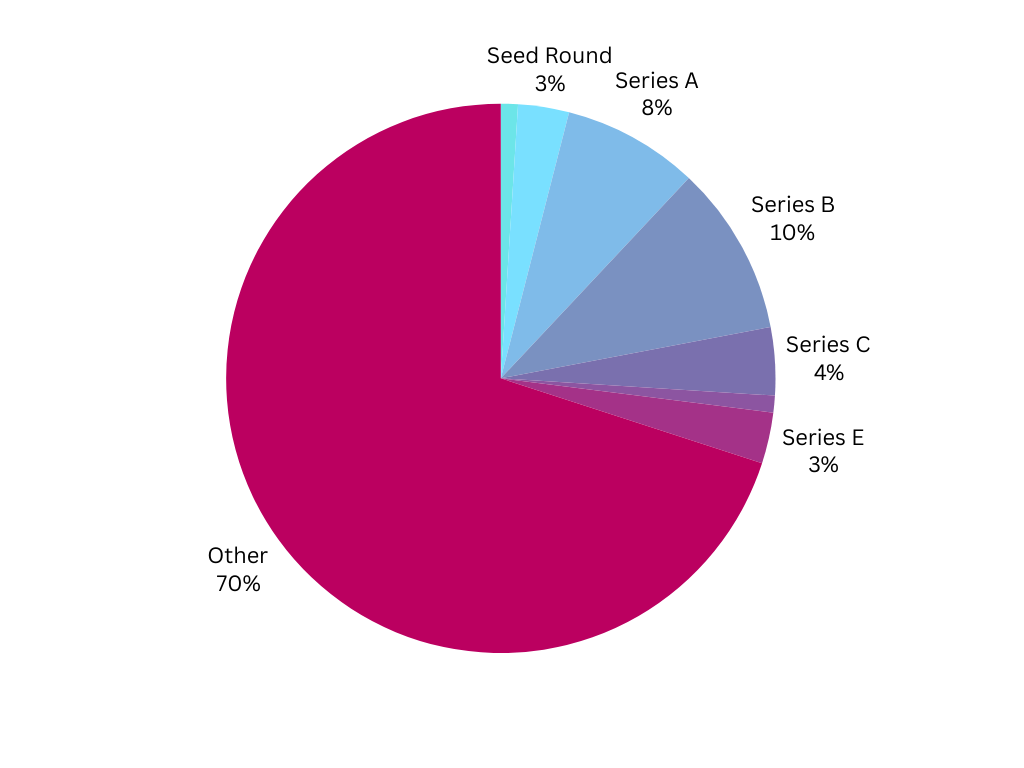

By funds raised/ Total funding $36,343,223,230

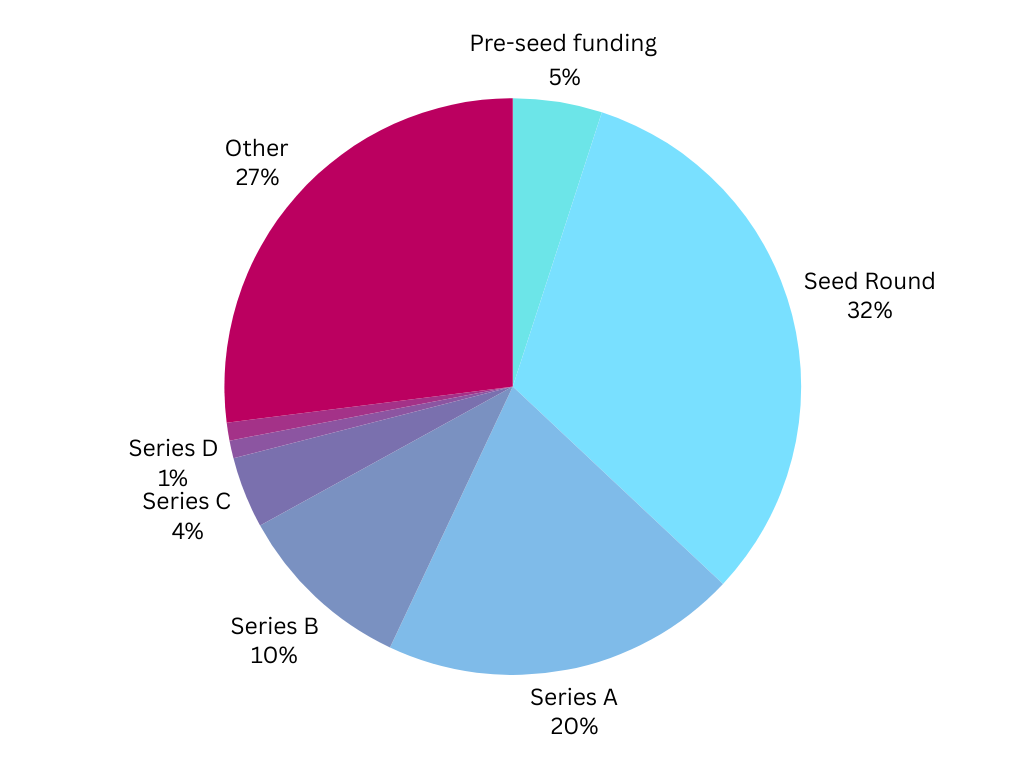

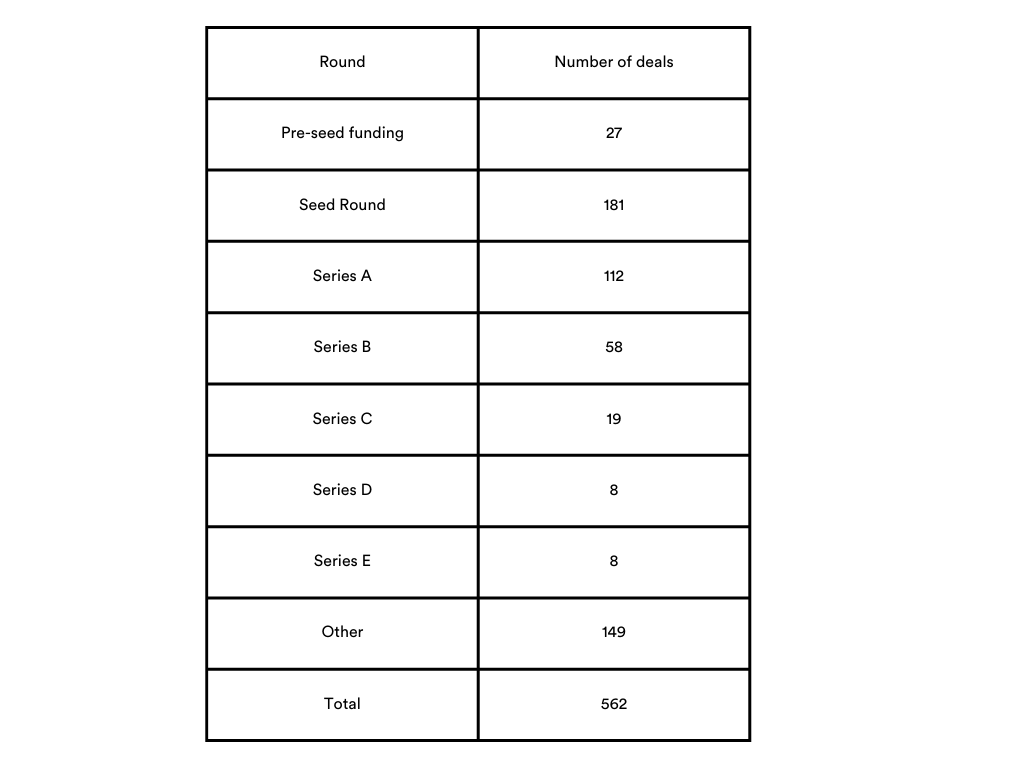

By number of deals/Total number of deals 562

Overall, March saw more deals with a substantial increase in total funding compared to February.

AI remained a standout sector for investment, followed by healthcare and biotech, with investments also flowing into various other industries such as education, finance, and consumer goods.

Below, we will examine some companies on our list and explore their brand and domain name choices.

Namepicks

Alumis

Industry: Biotechnology, Health Care, Life Science, Precision Medicine

Funds Raised: $259,000,000 Series C

Alumis, a clinical-stage biopharmaceutical company, secured a $259 million Series C financing led by Foresite Capital, Samsara BioCapital, and venBio Partners. This funding will accelerate the clinical development of ESK-001, a potential treatment for immune-mediated diseases, including plaque psoriasis and systemic lupus erythematosus (SLE). Alumis plans to explore ESK-001’s application in other autoimmune conditions and advance its pipeline programs, supported by precision data analytics.

Alumis rebranded from Esker Therapeutics after raising a whopping $200 million in Series B financing. The company’s name change to Alumis (“alumer” for “lighten/enlightened” and “immunis” for “immunology”) reflected the transformation of the organisation and overall vision to provide meaningful therapeutic solutions for people with autoimmune disease.

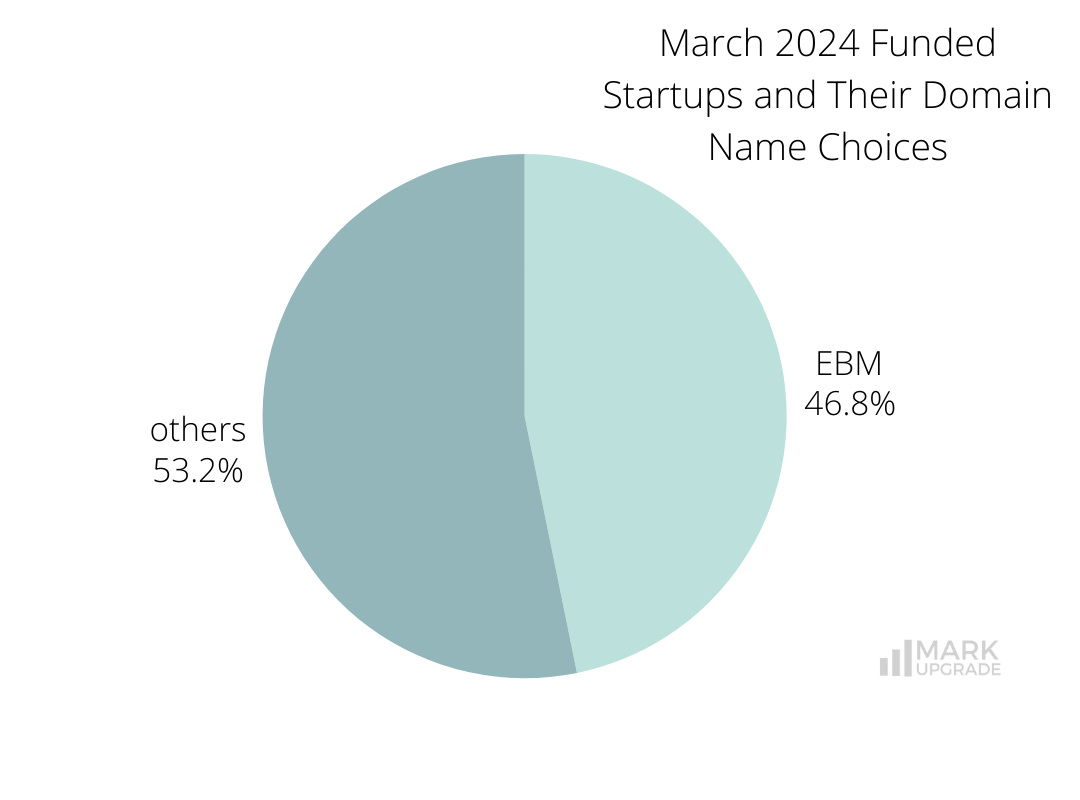

Alumis has invested in the Exact Brand Match (EBM) domain Alumis.com, maximising its marketing across channels and avoiding security risks.

Anthropic

Industry: Artificial Intelligence (AI), Generative AI, Information Technology, Machine Learning

Funds Raised: $2,750,000,000 Corporate Round

Amazon is making waves with its biggest outside investment yet, pouring a whopping $2.75 billion into Anthropic, an AI startup leading the race in generative artificial intelligence. The investment comes as part of a strategic move by Amazon to gain an edge in the AI revolution, with Anthropic’s foundation model and chatbot, Claude, competing with industry giants like OpenAI and ChatGPT. Amazon will retain a majority stake in Anthropic and will not have a seat on the board. Anthropic’s last valuation was $18.4 billion. Over the past year, Anthropic closed five different funding deals worth about $7.3 billion.

Generative AI is poised to be the most transformational technology of our time, and we believe our strategic collaboration with Anthropic will further improve our customer’s experiences, and look forward to what’s next.

Swami Sivasubramanian, Vice President of Data and AI at AWS cloud provider

With its impressive funding achievements, Anthropic has prioritised its online presence by investing in the Exact Brand Match (EBM) Anthropic.com, ensuring optimal effectiveness in marketing across all channels.

Anthropic is featured in our Top 100 AI Startups in 2023 by CB Insights and Their Domain Name Choices.

Claroty

Industry: Cyber Security, Industrial, Network Security, Security

Funds Raised: $100,000,000 Venture Round

Claroty, a cybersecurity company that provides solutions to protect infrastructure and industrial networks from cyber threats, has secured $100 million in strategic growth financing to accelerate vertical and regional expansion, product innovation, and strategic partnerships. Led by equity investor Delta-v Capital and joined by AB Private Credit Investors at AllianceBernstein, Standard Investments, Toshiba Digital Solutions, SE Ventures, Rockwell Automation, and Silicon Valley Bank, this investment enhances Claroty’s position in the critical infrastructure cybersecurity market.

The past year has brought unprecedented geopolitical, macroeconomic, and regulatory changes that have created new trends and challenges for those charged with protecting the world’s critical infrastructure.

Yaniv Vardi, CEO of Claroty

With funding totalling $635 million, the company plans to scale its platform approach to cyber-physical systems protection across key verticals and regions, fuel research and development, and bolster strategic partnerships. Amid recent milestones and recognitions, including surpassing $100 million in annual recurring revenue in 2023 and strategic alliances with industry leaders, Claroty aims to advance its mission of ensuring the cyber and physical worlds can safely connect to drive progress and support lives.

Like most of the companies in our Top Cybersecurity Companies and Their Domain Name Choices List, Claroty operates on an Exact Brand Match (EBM) domain, Claroty.com. This choice instils confidence in clients and effectively communicates the company’s commitment to reliability and professionalism in safeguarding sensitive data and systems.

Mews

Industry: Enterprise Software, Hospitality, Hotel, Property Management, Travel

Funds Raised: $110,000,000 Series D

Mews is a cloud-based hotel property management system that simplifies hotel operations, allowing properties to focus on their guests. The company announced a fresh funding round of $110 million, led by existing investor Kinnevik, alongside Revaia, Goldman Sachs Alternatives, Notion Capital, and new investor LGVP, valuing the company at $1.2 billion.

Founded in 2012 by ex-hotelier Richard Valtr, Mews aims to revolutionise hotel operations with its cloud-based system that integrates with thousands of other tech solutions. With over 60% revenue growth year-on-year, Mews plans to prioritise global expansion, research and development, and acquisitions, enabling innovative hospitality organisations to accelerate their digital transformation. This funding underscores Mews’ commitment to streamlining operations for modern hoteliers, transforming guest experiences, and creating more profitable businesses across 5,000 customers worldwide.

In October 2020, Mews underwent a significant branding transformation, prompted by the realisation that it had outgrown its existing logo and style.

A brand isn’t just something that you put on a t-shirt or at the top left of a page – it’s actually something that represents who you are as a company and can express in multiple ways all the different angles of where you’re going. We were looking for something that expressed the evolution of Mews but also the versatility of the brand and all the different areas that we are active in now and the near future.

Richard Valtr, CEO of Mews, in a press release

Mews operates on the Exact Brand Match (EBM) domain Mews.com, a premium four-letter domain name, ensuring a strong online presence and brand recognition.

Mews is featured in our December 2022 Funded Startups and Their Domain Name Choices.

Tubulis

Industry: Biotechnology, Health Care, Life Science, Pharmaceutical, Therapeutics

Funds Raised: $139,000,000 Series B2

Tubulis is a German chemotherapeutic medication developer specialising in cancer and chronic disease treatment. The company has successfully closed a €128 million (approx. $139 million) Series B2 financing round co-led by EQT Life Sciences and Nextech Invest, along with participation from other leading biotechnology investors, to accelerate the clinical development of its solid tumour-focused ADC pipeline, support the progress of its lead candidates TUB-030 and TUB-040, further technology development, and expansion into the US.

Our goal is to establish Tubulis as a global ADC leader as we transition into a clinical-stage company and harness the full power of ADCs to bring their therapeutic value to patients with solid tumors.

Dominik Schumacher, PhD, CEO and Co-founder of Tubulis

As highlighted in our article Emerging Biotech Companies to Watch in 2024 and Their Domain Name Choices, biotech companies like Tubulis understand the importance of a strong online presence. Tubulis operates on the Exact Brand Match (EBM) domain Tubulis.com, reinforcing credibility, trust, and respect.

Highlights

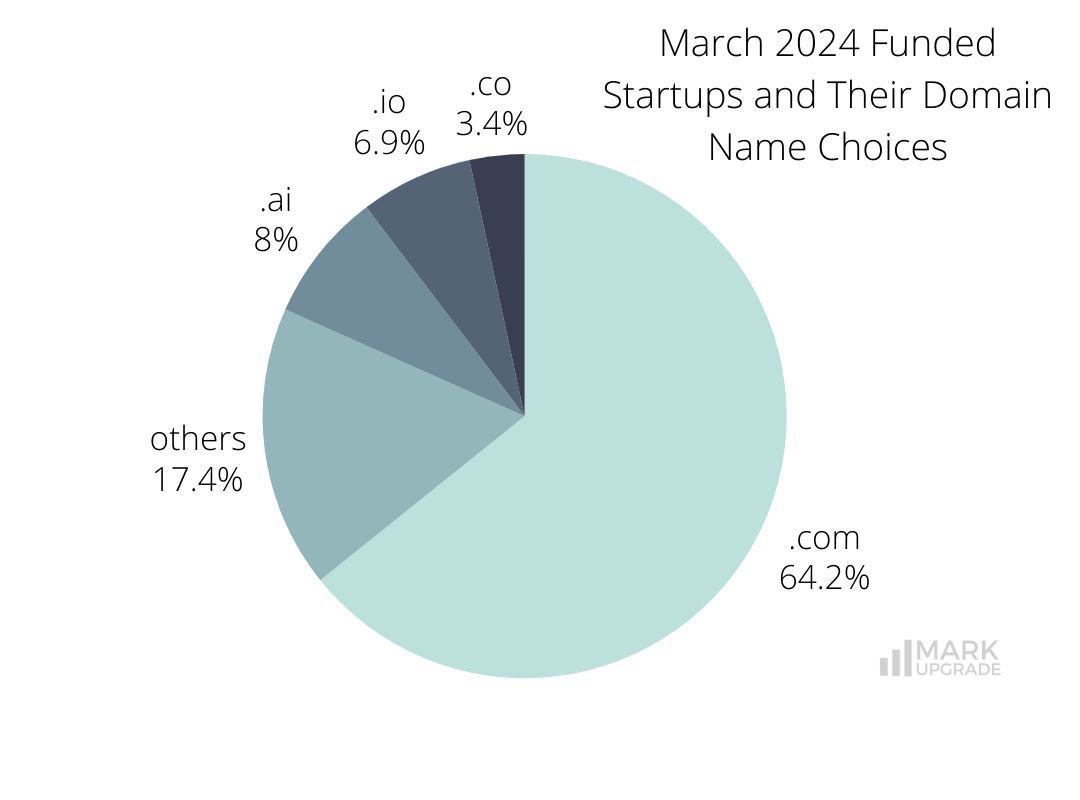

The .com extension, which 361 companies choose for their domains, remains the gold standard for businesses. It provides a globally recognised and trustworthy online presence.

The choice of an Exact Brand Match (EBM) .com domain offers companies immediate brand recognition and credibility while also enhancing their online visibility, as seen with 263 companies.

Other extensions, such as .ai and .io, are favoured by tech startups and innovative companies for their association with artificial intelligence and tech-savvy solutions, with 45 and 39 companies, respectively opting for them.

.co, chosen by 19 companies, seems popular among startups and businesses seeking a short and memorable domain extension.

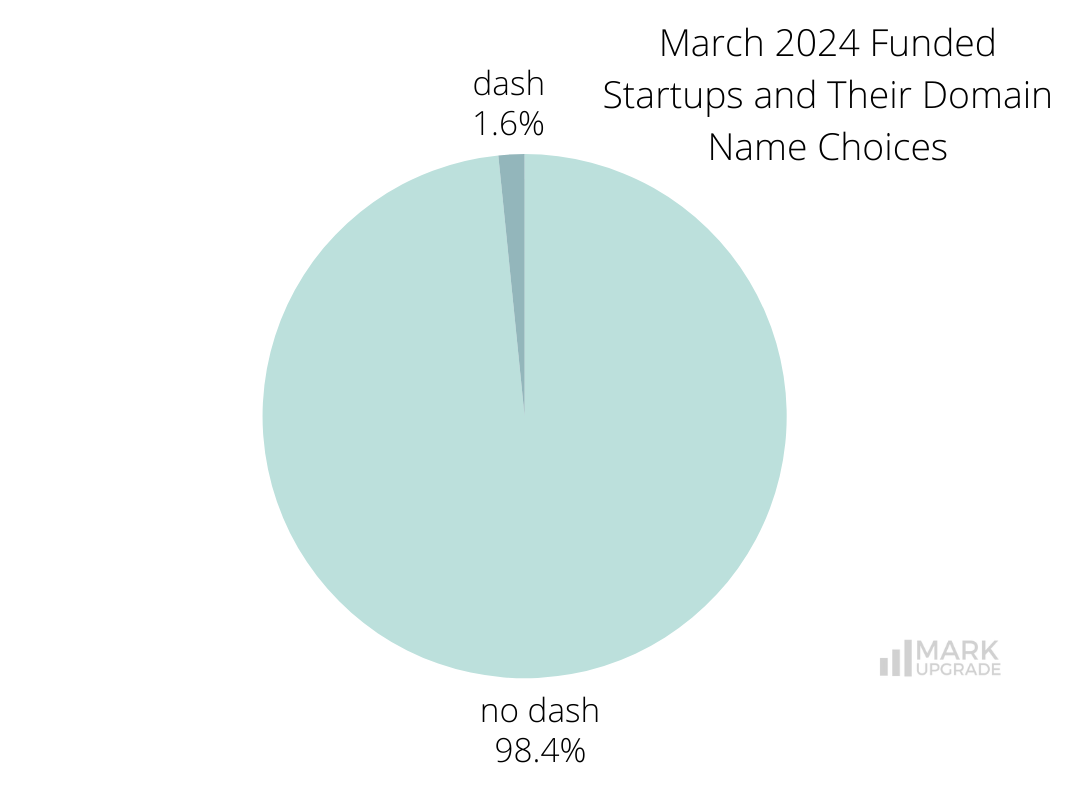

9 companies are using domain names with dashes.

While we make every effort to ensure the data on our site is accurate, complete, and up-to-date, we cannot guarantee its reliability. Our data is provided for informational purposes only and should not be relied upon as legal, financial, or other advice. We strongly recommend that you independently verify any information before relying on it.

In today’s competitive online market, a premium domain name can set your business apart from the competition. Don’t settle for a compromise – contact us to explore the many benefits of premium domain names and how they can help your business grow.

Other resources

2024 branding business domain domain name domain names domains funding march Monthly Funding Report naming startup

Previous Next