Discover the latest trends in global monthly funding data, with a unique focus on companies’ domain name choices, in our monthly funding reports.

Overview

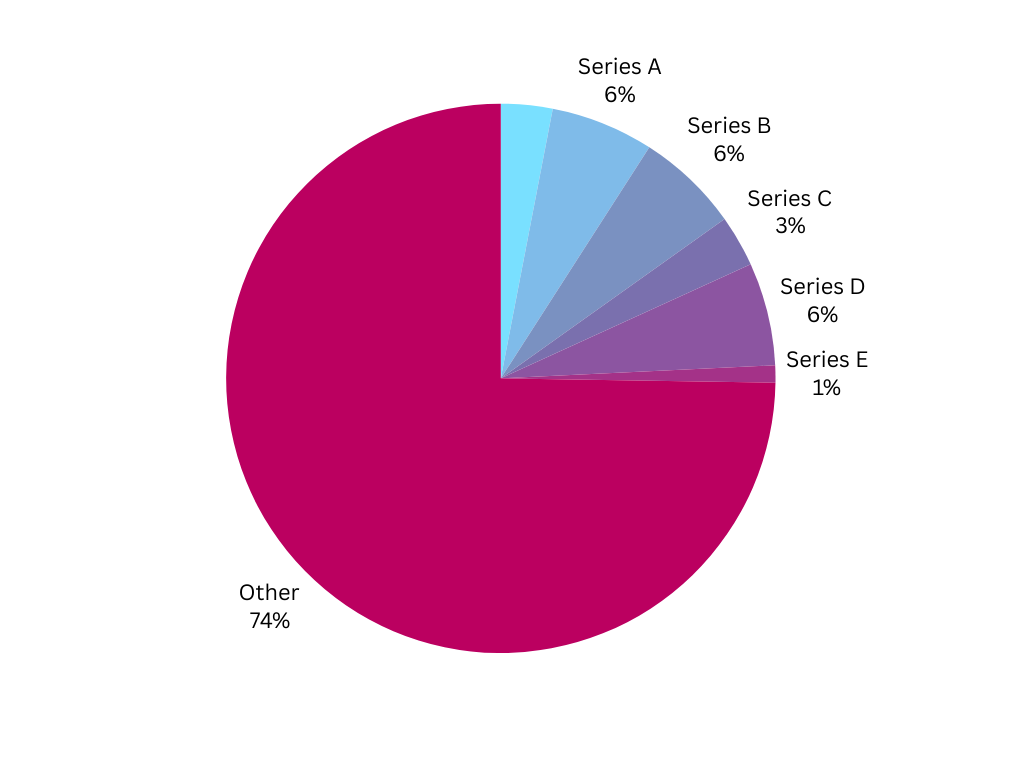

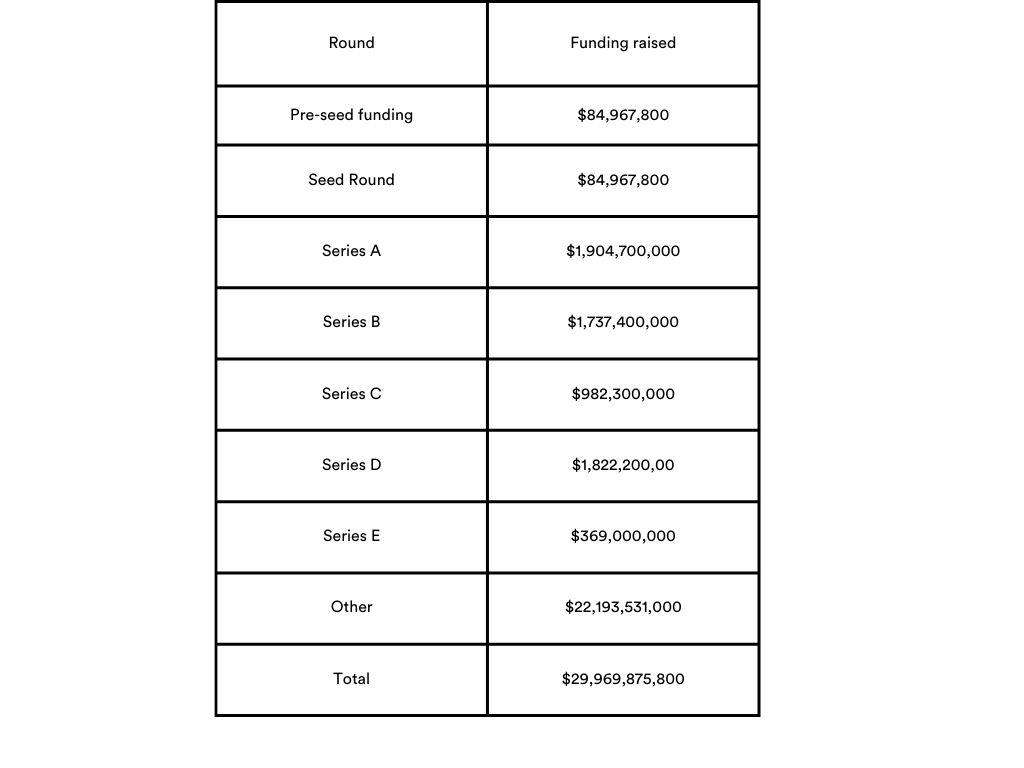

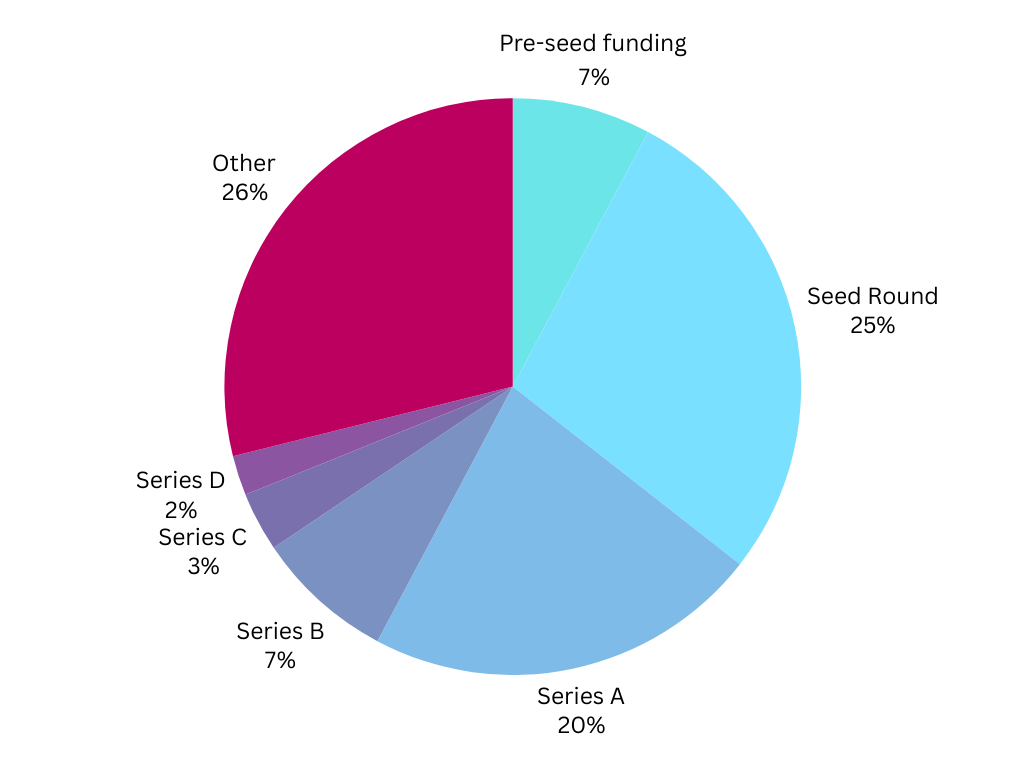

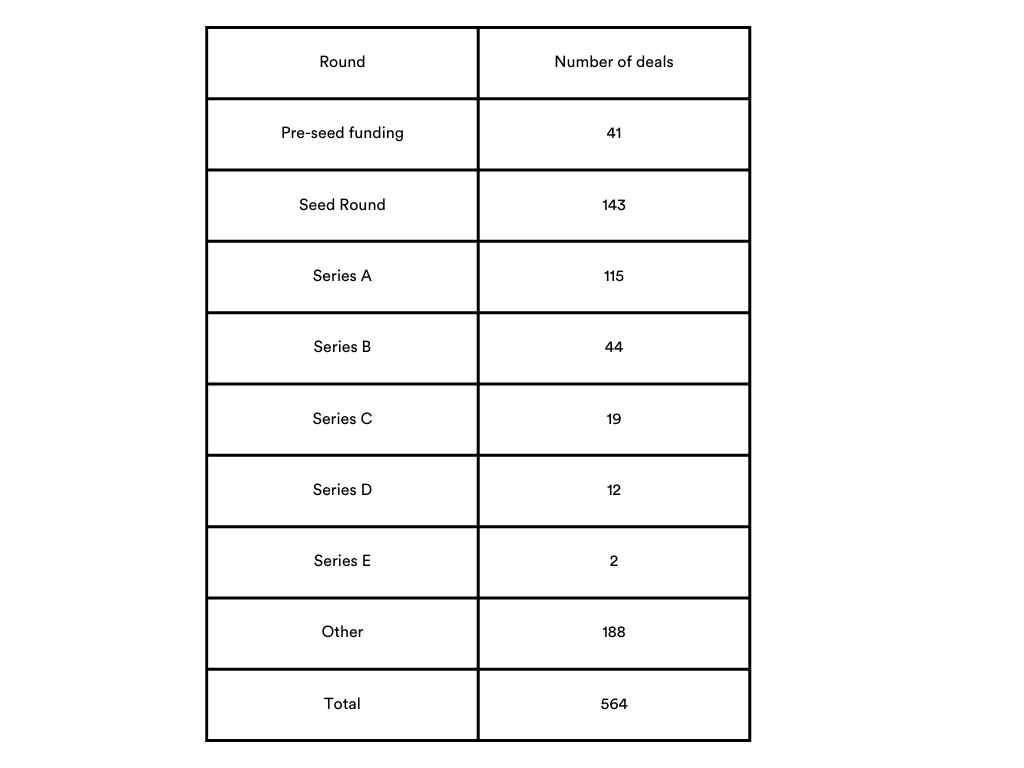

| Round | Amount July (USD) | Number deals July | Amount August (USD) | Number deals August |

| Pre-seed funding | 40,133,000 | 26 | 84,967,800 | 41 |

| Seed Round | 865,631,700 | 149 | 875,777,000 | 143 |

| Series A | 2,630,600,000 | 118 | 1,904,700,000 | 115 |

| Series B | 2,685,300,000 | 61 | 1,737,400,000 | 44 |

| Series C | 2,629,300,000 | 26 | 982,300,000 | 19 |

| Series D | 1,798,600,000 | 16 | 1,822,200,000 | 12 |

| Series E | 545,000,000 | 5 | 369,000,000 | 2 |

| Other | 17,097,889,700 | 162 | 22,193,531,000 | 188 |

| Total | 28,292,454,400 | 563 | 29,969,875,800 | 564 |

Key Trends in Funding Rounds

Pre-seed Funding: In August, pre-seed funding nearly doubled in deal numbers, signalling strong interest in nurturing new startups and suggesting investors are attracted to the potential for high returns with low initial investments.

Seed Round: Seed funding remained stable, reflecting continued confidence in startups that have moved beyond the conceptual phase.

Series A, B, and C Rounds: There was a decrease across Series A, B, and C funding, with all three stages experiencing reduced amounts and fewer deals. This trend suggests a cautious pullback from investing in ventures that are beyond the early stages but not yet fully mature, likely due to increased risk assessments and shifting investor focus towards earlier, less capital-intensive opportunities

Series D: Series D rounds saw a slight increase in funding but fewer deals, suggesting a focus on providing more substantial support to fewer up-and-coming ventures.

Series E: Series E funding experienced a sharp decline, indicating a marked reduction in investment in late-stage ventures, likely due to recalibrations of risk amid fluctuating market conditions.

Overall Trends: The overall funding landscape in August showed a slight deal increase and a more substantial rise in total funding.

By funds raised/ Total funding $29,969,875,800

By number of deals/Total number of deals 564

Economic and Political Influences

There has been a severe drop in venture funding for Chinese startups, as Chris Metinko explains, indicating a global financial caution that affects not just Asian markets but also other international markets. In light of a worldwide shift in market sentiments, China’s venture funding has reached a decade low, leading investors to hedge risks by investing in less mature markets or early-stage companies that promise faster returns but at higher risk. A 60% rise in U.S. startup failures is making investors more cautious, even with big money flowing into tech like AI. The ongoing war in Ukraine and the upcoming U.S. presidential elections add to this uncertainty, shaking global market stability and affecting investors’ confidence.

Regional Economic Outlooks

Europe, where economic growth forecasts are being trimmed, may have a lower appetite for risk, resulting in reduced funding for later-stage ventures, such as Series A, B, and C. Coupled with significant economic slowdowns in major markets like China, this conservative approach in Europe points to a global trend of risk aversion among investors, favouring early-stage investments that require less capital and potentially deliver quicker, higher returns.

Broader Economic Concerns: Global economic conditions are marked by disinflation, but risks are rising as oil prices fluctuate and inflation rates vary across sectors. Due to these economic complexities, investing requires a strategic and cautious approach that balances potential returns with current economic conditions.

Investor interest is concentrated in several key sectors: Investor interest spans multiple sectors, reflecting strategic priorities and emerging opportunities across Technology and Cybersecurity, Financial Services and Insurance, Healthcare and Life Sciences, Energy and Environment, Transportation and Automotive, and Agriculture and Food. Key focuses include Cyber Security, Information Technology, Network Security, Cloud Management, SaaS, Developer APIs, FinTech, InsurTech, Real Estate, Risk Management, Biotechnology, Pharmaceuticals, Clinical Trials, Medical Devices, traditional and renewable energy, energy efficiency, energy storage, autonomous vehicles, electric vehicles, aerospace, and innovations in sustainable farming and food production.

Below, we will examine some companies on our list and explore their brand and domain name choices.

Namepicks

Anduril Industries

Industry: Aerospace, Government, Military, National Security

Funds Raised: $1,500,000,000 Series F

The defence technology startup Anduril Industries Inc. has secured $1.5 billion in a new funding round, planning to invest hundreds of millions in a new facility to ramp up the production of its rockets, underwater vehicles, and other autonomous weapons systems.

The deal, which values Anduril at $14 billion, is one of the largest venture capital deals this year, reflecting Anduril’s success in securing government contracts and growing investor interest in defence tech companies.

Named after Andúril, Aragorn’s mythical sword in “The Lord of the Rings,” which means “Flame of the West” in the novels’ Quenya language, the company underscores its narrative with robust branding. It operates both Anduril.com and AndurilIndustries.com, enhancing online brand protection and making it easier for customers, partners, and investors to find and engage with their brand. Exact Brand Match (EBM) domains are a popular choice among military tech companies for establishing a strong online presence, as detailed in our article on domain name preferences in the sector.

CloudPay

Industry: Big Data, Bookkeeping and Payroll, Cloud Infrastructure, Financial Services, FinTech, Human Resources

Funds Raised: $120,000,000 Venture Round

CloudPay, a leader in global payroll and payment solutions, secured $120 million in funding led by Blue Owl Capital and contributions from existing investors. This funding boosts CloudPay’s ability to expand and innovate, particularly in automating and integrating AI into its services.

Serving over 280 corporate clients across more than 130 countries, CloudPay plans to enhance its technological offerings and expand its global workforce. The funding will support CloudPay’s commitment to delivering cutting-edge solutions to its worldwide clientele.

Global payroll is a growing market providing tremendous opportunities for CloudPay, and this funding gives us the flexibility to accelerate our journey. Our focus on payroll and payment offerings resonates very well with our esteemed global clientele. With the support of Blue Owl Capital, we are strengthening our capital base while continuing to invest in our state-of-the-art solutions for global organisations and their employees worldwide.

Dr Roland Folz, CEO of CloudPay, in a press release

CloudPay has invested in CloudPay.com – an EBM .com name. This is most internet users’ natural choice; securing that domain for their business indicates that CloudPay is here to stay.

Cribl

Industry: Big Data, Information Technology, Real Time, Software

Funds Raised: $319,000,000 Series E

Cribl offers a robust data management solution designed for IT and security teams, known as the Data Engine for IT and Security. Its product suite, which includes Cribl Stream, Cribl Edge, and Cribl Search, helps organisations flexibly collect, process, and analyse data from any source. Since its founding in 2018, the San Francisco-based, remote-first company has supported Fortune 1000 companies globally in managing data in a dynamic digital environment.

In August 2024, Cribl secured $319 million in Series E funding led by GV (Google Ventures), bringing its valuation to $3.5 billion. This funding supports Cribl’s goal to enhance data utility for IT and security by being vendor-agnostic. The company has shown significant growth, with a 163% CAGR in annual recurring revenue over the last four years, cementing its role in enterprise data infrastructure.

The term “Cribl” is derived from “cribble,” a tool used in gold panning to separate valuable material from lesser ones, mirroring the company’s data filtering solutions. Initially launched on Cribl.io, the company later acquired the more credible and professional Cribl.com to overcome the limitations of the “.io” domain, such as reduced recognition and potential market confusion, thus strengthening its online presence and brand reliability.

Groq

Industry: Artificial Intelligence (AI), Electronics, Machine Learning, Semiconductor

Funds Raised: $640,000,000 Series D

Groq, a Silicon Valley-based leader in fast AI inference, recently announced a significant $640 million Series D funding round, pushing its valuation to $2.8 billion. Groq’s innovative vertically integrated AI inference platform is in high demand for its record-breaking speed and efficiency in AI model deployment.

Jonathan Ross, CEO and Founder of Groq, highlighted the investment’s role in scaling their operations:

You can’t power AI without inference compute. This funding will enable us to deploy over 100,000 additional LPUs into GroqCloud. Having secured twice the funding sought, we now plan to significantly expand our talent density.

Jonathan Ross, CEO and Founder of Groq

The funding will be used to expand Groq’s capacity and enhance its tokens-as-a-service (TaaS) offerings on GroqCloud, supporting the development of AI applications using models like Llama 3.1 and Whisper Large V3. The company aims to deploy over 108,000 LPUs by early 2025, significantly expanding its AI inference capabilities. This strategic growth is supported by the recent addition of Stuart Pann as COO and Yann LeCun as a technical advisor, underscoring Groq’s commitment to leading the AI industry in performance and innovation.

The name “Groq” originates from “grok,” meaning to understand profoundly and intuitively, highlighting the company’s commitment to delivering deep and innovative AI inference solutions. Groq has secured Groq.com as its domain, ensuring a strong and clear online identity that aligns perfectly with its brand name.

Hedra

Industry: Media Production

Funds Raised: $10,000,000 Seed Round

Hedra, a new player in the generative AI video creation market, has launched with a $10 million seed investment from prominent investors like Index Ventures, Abstract, and A16Z Speedrun. Positioned to innovate in a competitive field alongside companies like Runway and Pica, Hedra introduces “Character-1”, a tool designed for creating detailed, character-focused videos with enhanced control and speed. This tool mainly targets content creators looking to streamline production for platforms like YouTube and e-learning systems.

Since its launch, Hedra has attracted over 350,000 users who have produced more than 1.6 million videos, demonstrating significant market traction. The backing of influential investors underscores confidence in Hedra’s potential to reshape video production with AI, offering a comprehensive studio that melds various elements of content creation into a unified workflow. This approach not only simplifies the video creation process but also enriches the capabilities of digital avatars, providing users with a versatile tool for diverse content needs.

Hedra has secured Hedra.com for its brand presence online. An EBM .com name like Hedra.com is the natural choice of most internet users, making their marketing most effective across all channels.

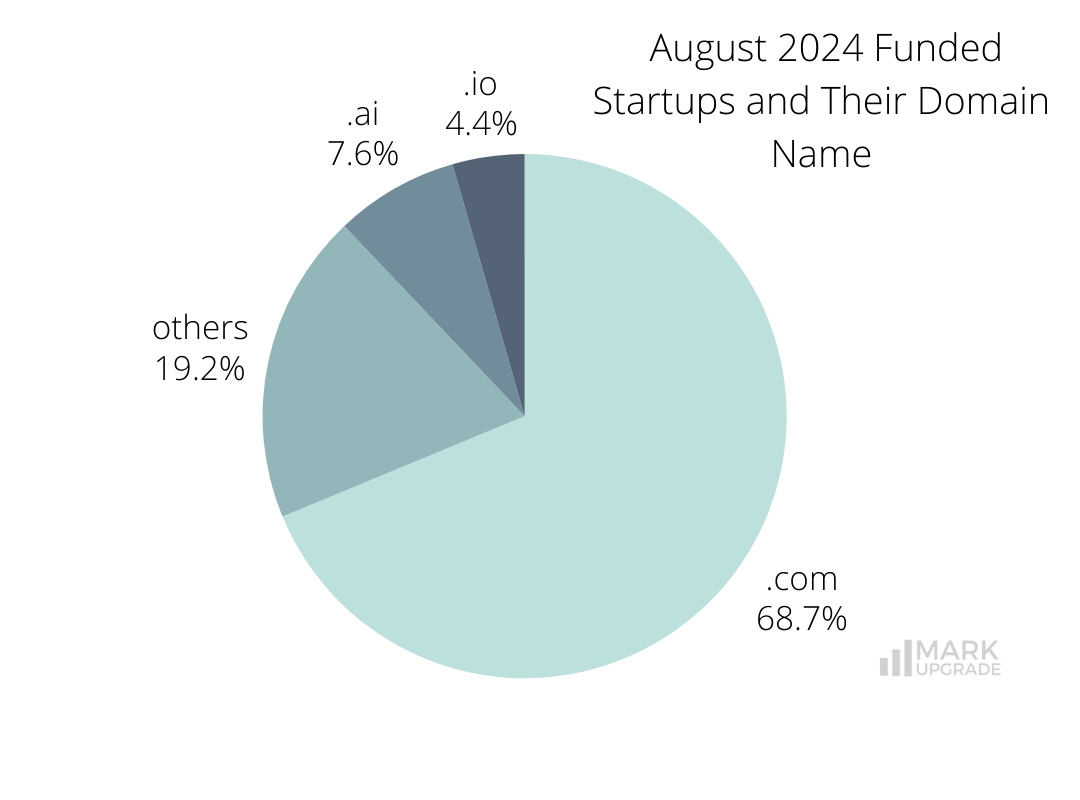

Highlights

387 companies out of 564 have secured a domain with a .com extension, which remains the most recognised and trusted, enhancing a company’s professional image and market reach.

43 and 25 companies have chosen the .ai and .io extensions, respectively. While these extensions appeal to tech-focused startups for their modern connotations, their niche focus might limit broader audience reach compared to more universally recognised extensions like .com.

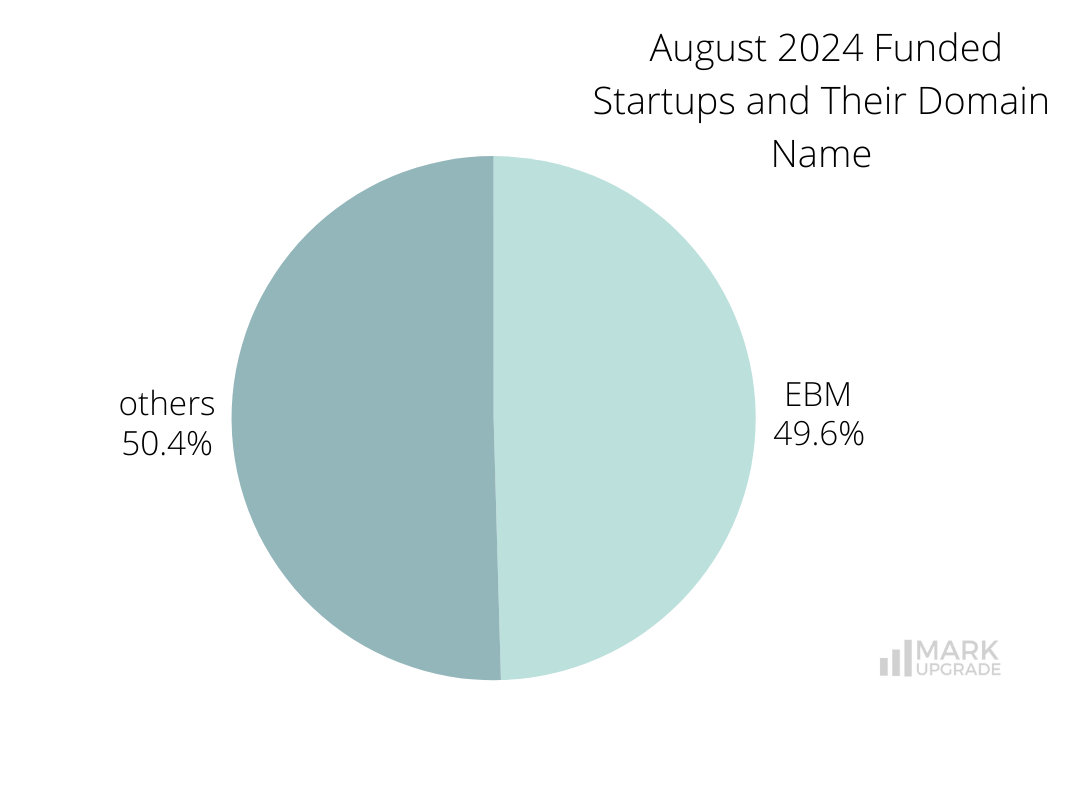

Almost half of the entries operate on EBMs, which is crucial for branding consistency and significantly enhancing online identity and market presence.

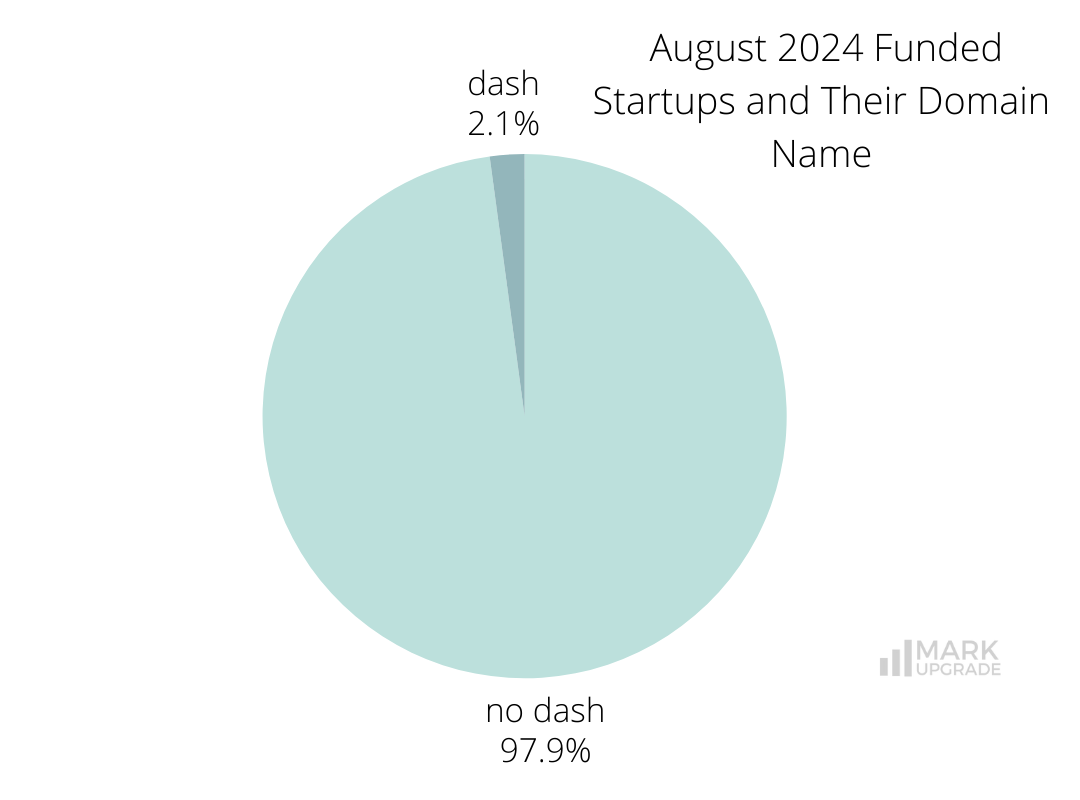

12 companies have included dash in their domain name. Dashes are used when the direct EBM domain isn’t available, offering an alternative but potentially complicating clarity in communication.

While we make every effort to ensure the data on our site is accurate, complete, and up-to-date, we cannot guarantee its reliability. Our data is provided for informational purposes only and should not be relied upon as legal, financial, or other advice. We strongly recommend that you independently verify any information before relying on it.

Other resources

branding business domain domain name domain names domains funding naming startup

Previous Next