Discover the latest trends in global monthly funding data, with a unique focus on companies’ domain name choices, in our monthly funding reports.

Overview

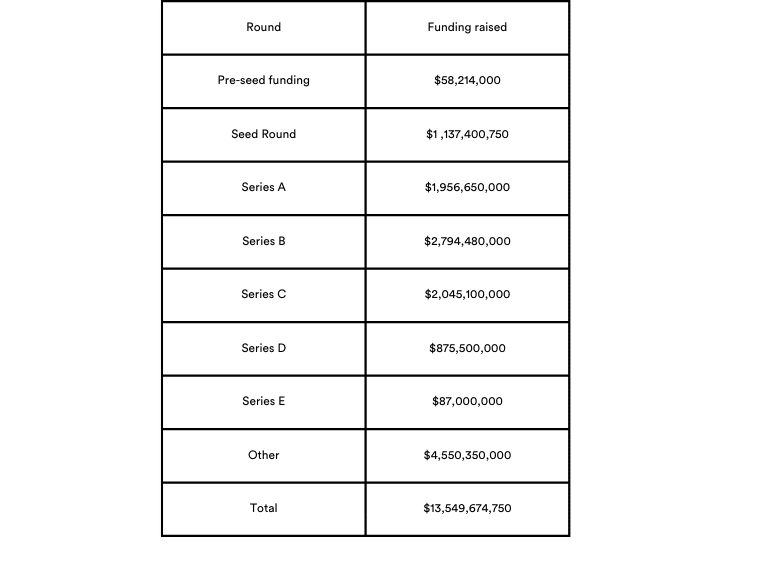

In June, the funding landscape showed varying trends across different rounds. Pre-seed funding amounted to $58.2 million with 24 deals, while Seed Round reached $1.1 billion with 189. Series A funding stood at $1.9 billion with 106 deals, Series B received $2.8 billion with 71, and Series C obtained $2.0 billion with 30 deals. Series D secured $875.5 million with 9 deals, and Series E acquired $87 million with 1. Other funding rounds accounted for $66.5 billion with 72 deals. Seed Round and Series B emerged as the top-funded rounds, indicating sustained investor interest in early-stage and growth-stage startups. Series A and Series C also attracted significant investments, showcasing continued support for companies at these crucial stages of growth. The relatively lower number of deals in Series D and Series E suggests a more selective approach by investors in these later stages.

June, also marking the end of the second quarter of 2023, witnessed a decline in global venture investement despite substantial funding and M&A deals within the artificial intelligence sector. Crunchbase data reveals that Q2 2023 decreased 18% quarter over quarter, amounting to $65 billion. This represents a significant drop of 49% compared to the second quarter of 2022, where $127 billion was invested by startup investors. The trend continued in the first half of 2023, with global funding reaching $144 billion, marking a 51% decline from the $293 billion invested in H1 2022 and a 10% decline from the second half of 2022. Despite these numbers, the AI sector played a significant role, contributing nearly a fifth of the total global venture funding. The impact of AI-driven companies and the launch of OpenAI’s ChatGPT have undoubtedly influenced the funding landscape in 2023.

| Round | Amount May (USD) | Number deals may | Amount June (USD) | Number deals June |

| Pre-seed funding | $63,463,000 | 29 | $58,214,000 | 24 |

| Seed Round | $975,498,215 | 160 | $1,137,400,750 | 189 |

| Series A | $2,302,950,000 | 98 | $1,956,650,000 | 106 |

| Series B | $2,135,220,000 | 58 | $2,794,480,000 | 71 |

| Series C | $1,481,700,000 | 22 | $2,045,100,000 | 30 |

| Series D | $1,890,800,000 | 19 | $875,500,000 | 9 |

| Series E | $315,000,000 | 4 | $87,000,000 | 1 |

| Other | $11,716,570,000 | 110 | $4,550,350,000 | 72 |

| Total | $20,881,201,215 | 500 | $13,549,674,750 | 502 |

By funds raised/ Total funding $13,549,674,750

By number of deals/Total number of deals 502

While funding amounts have experienced a significant decline year over year, deal volumes have also seen a decrease, although not as drastic. Deal volumes have dropped by 37% compared to the previous year, with each stage showing a decline of more than a third. In the past quarter, over 6,000 startups secured funding, in contrast to the more than 9,500 startups that raised funds during the same period last year.

The sectors with the biggest funding rounds include Health Care, Productivity Tools, and Wellness, indicating significant investments in these industries. The Biotechnology, Medical Device, and Pharmaceutical sectors have also seen substantial funding, reflecting the ongoing advancements in healthcare and life sciences.

Namepicks

Cart.com

Cart.com, an Austin-based e-commerce services company, has achieved unicorn status with a $60 million Series C funding round, bringing its valuation to $1.2 billion. Cart.com offers commerce and logistics technology solutions and serves thousands of brands. The latest funding round saw an increase in valuation compared to previous rounds, with participation from well-known investors. While the e-commerce market has experienced challenges, including shifts in consumer behaviour and economic conditions, Cart.com’s growth and funding achievements demonstrates its resilience and commitment to driving innovation.

At the heart of Cart.com’s success lies its strategic investment in a category-defining domain name, a decision made by founders Omair Tariq and Jim Jacobson before the company’s launch. This foresight in securing a premium domain name has played a crucial role in establishing Cart.com as a leading player in the e-commerce industry.

Redpanda

Redpanda (originally called Vectorized) has emerged as a game-changer in the data streaming space by providing a modern approach to real-time data capture while maintaining compatibility with Kafka, a widely adopted open-source streaming project. The company’s innovative solution has garnered significant attention and customer adoption, leading to its recent funding success. Just 16 months after announcing a $50 million Series B round, Redpanda has secured a remarkable $100 million in Series C funding. This impressive funding trajectory reflects the exceptional performance and growth of the company. CEO Alex Gallego attributes the success to Redpanda’s strong performance, prompting existing investors to seize the opportunity and contribute additional investment to support the startup’s remarkable expansion.

Operating on the exact brand match domain name Redpanda.com, the company capitalises on the existing familiarity and positive associations associated with the name, which has become widely recognised and beloved as its flagship product. More about Redpanda’s rebrand can be found here.

CleanCapital

CleanCapital is a company that operates over 200 solar and energy storage projects across the United States. In early June, they announced a new investment of up to $500 million from Manulife Investment Management. This funding will help CleanCapital support the development of new solar and storage projects, acquire renewable energy assets throughout the country, and expand their partnerships in emerging markets.

CleanCapital’s choice of brand name reflects its focus on clean and sustainable energy solutions. The combination of “Clean” and “Capital” effectively communicates the company’s commitment to financing and operating renewable energy projects. Many successful companies, such as PayPal, Coca-Cola, and LinkedIn, have also adopted two-word brand names, showcasing the effectiveness and impact of this naming strategy. With EBM Cleancapital.com, the company can easily establish its brand identity and connect with its target audience in the competitive clean energy industry.

Cohere

Cohere, a Toronto-based startup, has raised a remarkable $270 million in Series C funding, led by Inovia Capital, bringing its valuation to $2.2 billion.

Cohere specializes in building large language models that enable artificial intelligence (AI) to learn from new data and can be tailored for various applications such as interactive chat and text generation. The brand name “Cohere” emphasize on the concept of unity and placemaking, combining “co” to symbolize collective ownership and “here” to denote a sense of presence and connection.

The company has secured ownership of the domain names Cohere.ai and Cohere.com, recognised the advantages of owning multiple domain names beyond SEO optimization. One primary reason is domain name upgrades, where startups initially launch on a specific extension (e.g., .ai) and later invest in securing their exact brand match .com domain (e.g., Cohere.com). This strategic move not only enhances their online presence and brand identity but also provides benefits such as brand protection, easier access for clients and investors, and the ability to support various marketing campaigns, products, and sub-brands.

Boxhub

New York-based online marketplace Boxhub has successfully raised $12.4 million in Series A funding, led by AlleyCorp and with participation from Solasta Ventures, Interplay VC, FJ Labs, and Hum Capital. The funding will be utilized to accelerate international expansion and product development for Boxhub, an e-commerce and logistics platform that facilitates the purchase, sale, and delivery of shipping containers. With an innovative approach that repurposes retired containers from international trade, Boxhub has gained traction among a diverse range of customers, including retailers, construction firms, non-profits, and consumers engaged in container-based upcycling projects. This latest funding round follows Boxhub’s $2.4 million seed round in 2022, which included notable investors such as Delivery Hero founder Niklas Östberg and Unity Technologies founder David Helgason.

The name “Boxhub” accurately represents the core concept of the platform, acting as a centralized marketplace for buyers and sellers of shipping containers. The acquisition of the domain name Boxhub.com further emphasizes the company’s commitment to its online presence and brand recognition. Having a short and memorable domain name like Boxhub.com contributes to better brand visibility and builds trust among consumers.

Highlights

The majority of companies (328 out of 502) opted for the popular “.com” domain extension, which has long been associated with credibility and trust in the online world.

.io is the second preferred choice with 42 companies operating on this extension, followed by .ai with 36 entries. While .io and .ai domains may be less expensive and easier to obtain than some other popular extensions, they may not be as widely recognized by potential customers and may not convey the same level of credibility.

14 companies chose the .co extension, which is the country code top-level domain (ccTLD) for Colombia, but it is also commonly used by companies and individuals as an alternative to the more well-known .com extension.

8 companies went with the unique .xyz domain, while 74 chose other extensions, indicating a diverse range of choices.

232 companies in our list have invested in exact brand match domains. A solid online presence is critical to any company’s success. An exact-match top-level domain name ensures that the business will be easily found online, as the default domain is what customers will look for when trying to reach the brand.

Dashes are used in 18 names on the list. Adding hyphens is not advised since it adds complexity for consumers who frequently overlook it while typing in a domain name.

While we make every effort to ensure the data on our site is accurate, complete, and up-to-date, we cannot guarantee its reliability. Our data is provided for informational purposes only and should not be relied upon as legal, financial, or other advice. We strongly recommend that you independently verify any information before relying on it.

Other resources

- Monthly Funding Report: May 2023 Funded Startups and Their Domain Name Choices

- The Importance of Investing in a Strong Domain Name for Your Business

- I don’t need to invest in a domain name, everyone finds me on Google anyway…or do they?

- Top 100 Most Inspiring Brands 2022 by Wunderman Thompson and Their Domain Name Choices

Whether you’re a small business owner or a large corporation, a premium domain name can help boost your brand and increase your online presence. If you’re ready to take the next step, contact us to learn more about our premium domain name options and how they can benefit your business.

2023 branding domain domain name domain names domains funding June naming startup

Previous Next