On October 23, 2025, CB Insights launched the 8th annual Fintech 100, highlighting the world’s most promising fintech startups of 2025. Selected using CB Insights’ predictive signals, the list spans innovations from crypto payments infrastructure to wealth management – showcasing the companies shaping the future of financial services.

Fintech in 2025 looks different. The era of cheap capital, consumer hype, and pandemic-fueled growth has passed. But the momentum hasn’t disappeared — it’s shifted from the front end to the foundation, as companies focus on building the systems and automation that keep financial services running.

CB Insights

In this analysis, we examine the naming approaches and domain name selections of the top fintech brands featured in the 2025 Fintech 100.

Domain Names Highlights

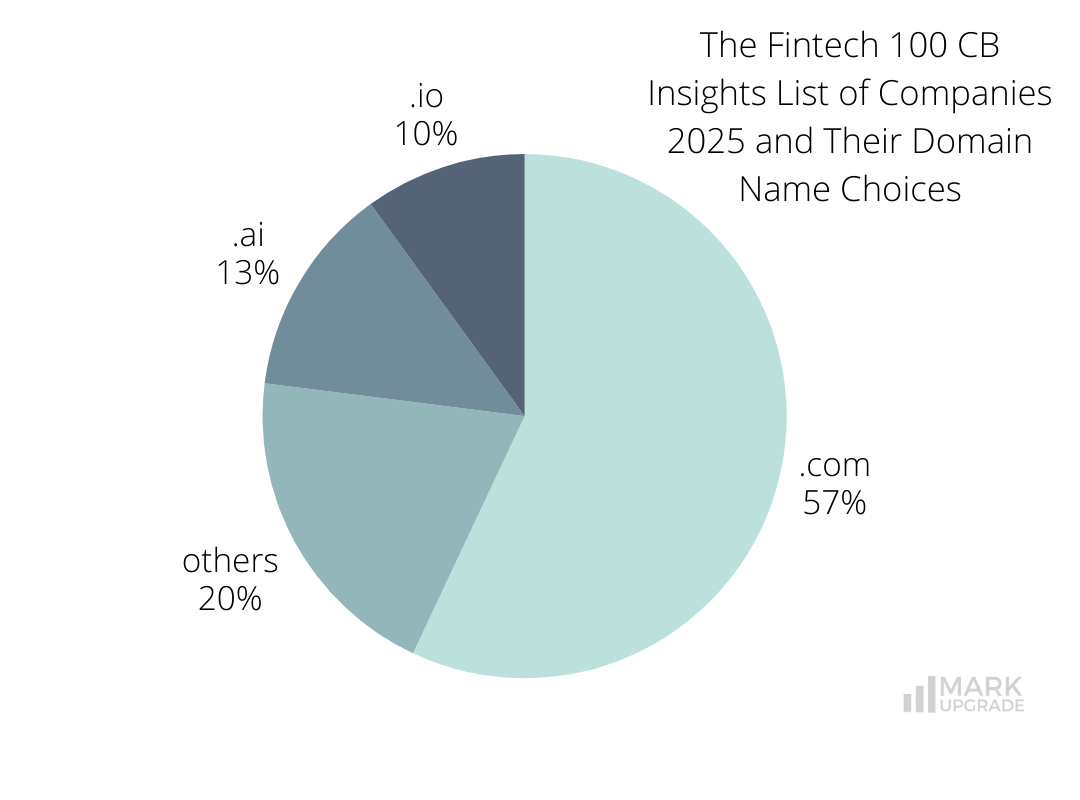

Among the companies featured on the 2025 CB Insights Fintech 100, 57 brands use the .com extension. Long established as the default on the internet, .com continues to inspire trust and familiarity among customers worldwide.

13 companies operate on .ai domain names, while 10 use .io. These extensions remain popular with tech-forward startups due to their modern image and association with innovation. However, recent research suggests that consumer enthusiasm for AI-centric branding may be fading (“Beyond the Buzzword: Why AI No Longer Wows Consumers”). At the same time, the long-term relevance of .io is less certain, given the potential risks tied to its status as a country-code domain name.

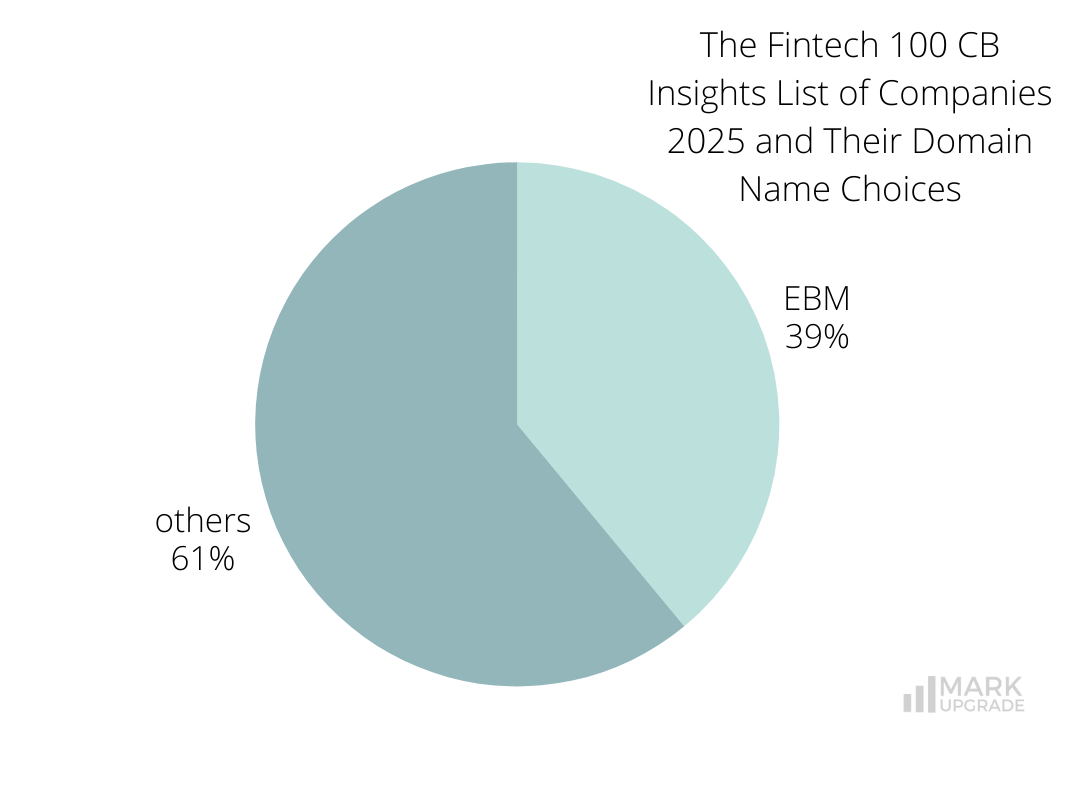

In terms of branding strategy, 39 companies have secured Exact Brand Match (EBM) domain names. EBM domain names are a natural choice for most internet users when searching for the company online, offering brand consistency and a stronger online presence.

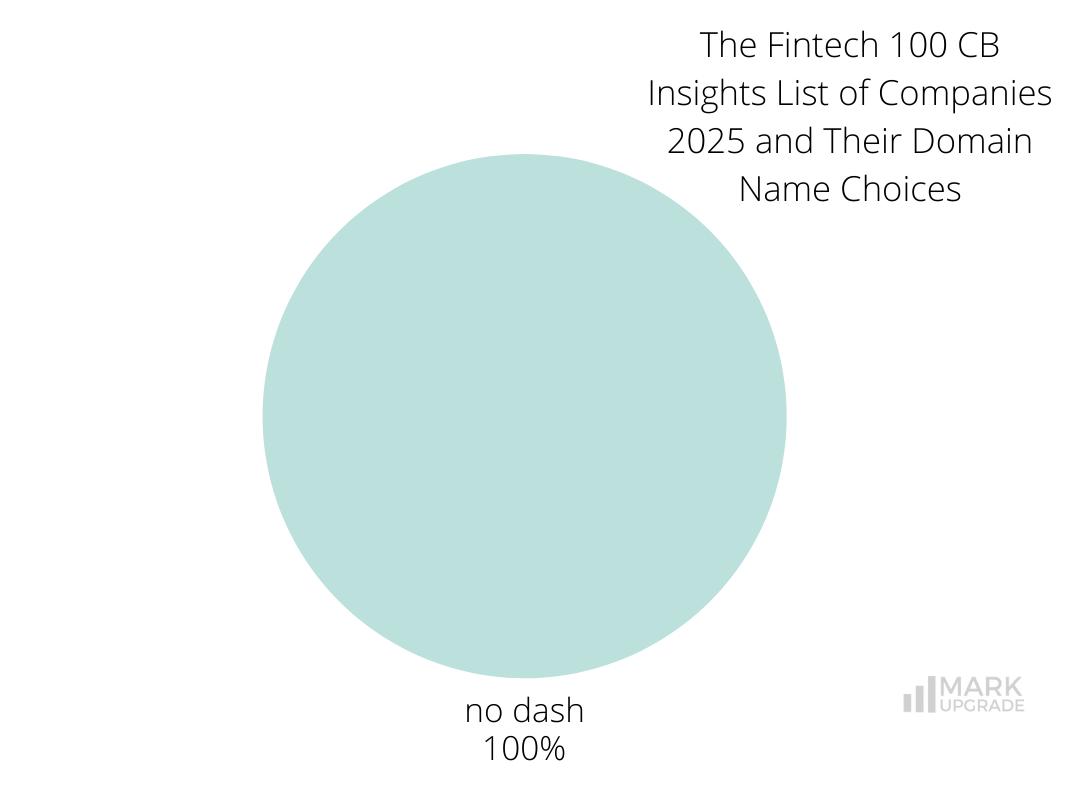

Notably, none of the companies on the list use hyphens in their domain names. Hyphenated domain names are generally harder to remember and type, making them less intuitive and less user-friendly for consumers.

Naming Trends in the 2025 CB Insights Fintech 100

Dictionary Words as Brand Names

Using dictionary words as brand names remains a strong trend. These names are easy to recall, widely recognisable across markets, and flexible for storytelling and marketing.

Examples: Hawk, Beam, Affinity, Conduit, Due, Rain, Campfire, Jump, Unique, Every, Upstage, Alpaca.

Short and Compact Names

Short names are highly effective in fintech – they’re memorable, easy to search, and frictionless to type, especially in digital-first products.

Examples: Hawk, Uzum, Beam, Due, Noah, Rain, Nada, Capi, Enza, Toku, Yuno, Dub.

Personal Names as Brand Names

Brands built around personal names often feel more human and approachable. This strategy helps establish trust and emotional connection, making fintech products feel less abstract and more relatable.

Examples: Murphy, Noah, Clara, Mendel, Debbie, Nada.

AI- and Tech-Inspired Naming

As AI-driven financial solutions continue to expand, many companies signal innovation through names that reference artificial intelligence, automation, or advanced technology. These names imply intelligence, speed, and efficiency.

Examples: Auditoria.AI, Further AI, Axyon AI, RD Technologies, Cryptio.

Finance- and Banking-Led Names

Some fintech brands opt for clarity by embedding financial or banking terminology directly into their names, instantly communicating their function or value proposition.

Examples: CrediLinq, InDebted, InstaPay, Payrails, PayTic, Maple Finance, RedotPay.

Namepicks

Candidly

Candidly is a fintech company focused on helping employees manage and optimise their student debt and broader financial wellness. The platform works primarily through employers, offering tools that support student loan repayment, refinancing navigation, and long-term financial planning.

Originally founded in 2016 as FutureFuel.io, the company rebranded to Candidly in 2022, initially operating on the domain names Candid.ly and GetCandidly.com.

Candidly embodies our position today as an advocate for destigmatizing debt and approaching conversations on how to manage the full lifecycle of education expenses with candor. Candidly reflects who we are as a company and how we engage with our users. We are direct, honest, approachable, sincere, and transparent… Our trusted, intelligent, and comprehensive solutions enable Americans to build financial resilience so they can reap the rewards of their investment in education. Because candidly – education should propel people toward opportunity, not be a financial headwind that holds them back.

Laurel Taylor, Co-founder, on the rebrand to Candidly

Over time, the company appears to have upgraded its domain name strategy, securing the Exact Brand Match (EBM) domain name, Candidly.com, which now redirects to GetCandidly.com. This move signals a clear maturation of the brand and a stronger long-term commitment to clarity and consistency.

Domain names that rely on extra words or non-.com extensions are often less intuitive, harder to recall, and can dilute brand impact. While they may work as interim solutions, they rarely offer the instant recognition or marketing efficiency of an EBM domain name.

Candidly.com is the most natural and intuitive way users would expect to find the brand online. By securing it, Candidly reinforces brand trust, improves discoverability, and strengthens its overall digital presence.

Noah

Noah is a London–based fintech innovator on a mission to make global money movement as seamless and instant as information flows. The company builds API-first, stablecoin-powered payment infrastructure that enables businesses to send and receive cross-border payments in real time, at lower cost, and with full compliance – bypassing slow legacy systems.

Information moves globally in a matter of milliseconds. We believe that money should too. With Noah you can make cross-border payments instantly, with reduced fees and full traceability – all via a single API.

Noah

The company has leveraged the power of a personal name in its branding. Noah is a male given name derived from the Biblical figure Noah. It is believed to be of Hebrew origin from the root word “nuach”/“nuakh”, meaning rest. Another explanation says that it is derived from the Hebrew root word Nahum meaning “to comfort” with the final consonant dropped.

By choosing a personal name, the brand moves away from abstract or technical language and instead speaks in human terms. According to our recent report, brands built around personal names benefit from higher levels of trust, a more intimate relationship with customers, and a stronger sense of authenticity. A name like Noah feels familiar and timeless, helping the company stand out while remaining approachable.

This positioning is further strengthened by the company’s ownership of the domain name Noah.com. The domain name is intuitive, easy to remember, and instantly credible, reinforcing brand consistency and long-term digital visibility.

Aspora

Aspora is a fintech platform focused on “global finance for global Indians,” designed to serve the financial needs of Indians living and working abroad. The company enables fast, transparent cross-border money transfers with real-time exchange rates, low fees, and a seamless digital experience.

Founded in 2022 as Vance, operating on Vance.tech, the company rebranded to Aspora in April 2025. The new name, Aspora, is inspired by the idea of serving the global diaspora and helping them achieve their aspirations, reflecting the company’s focus on global finance for global Indians.

Our new name better captures who we truly serve—people building lives across borders.

Aspora

The new brand now operates under the EBM domain name Aspora.com, ensuring a simple, credible, and easily discoverable online presence.

Yaspa

Yaspa is a London-based fintech company providing instant bank payments and identity services powered by open banking. Founded in 2017 under the name Citizen, the company rebranded to Yaspa in 2023 as a strategic move to better reflect its evolution and introduce a unique name that clearly sets it apart in a competitive market.

When the business was launched in 2017, our focus was on building trusted identities for individuals – citizens. Open banking has been a core part of delivering that data, and that trust, and we have seen extraordinary success on the payments side. The idea of using data to inform trust is still core to our proposition – but there’s no getting away from the fact that ‘citizen’ is a generic term, and there are several other large ‘Citizen’ brands out there, including in financial services.

Yaspa’s team

The new name, Yaspa, was chosen to be simple, memorable, and easy to pronounce globally. A YouGov survey commissioned by the company found that “Yaspa” was rated as more memorable than Citizen, particularly among people under 50.

We were looking for a name that was simple, memorable and easy for non-English speakers to pronounce. Working with both external agencies and our own teams, after much brainstorming the word ‘yaspa’ took seed. Its constituent letters reflect what we do ‘PAY’ and how we do it ‘ASAP’, and it has a feel that is as friendly and approachable as our business customers find us to work with. We’ve nurtured it gently over the last few months and it has continued to stand strong.

Yaspa’s team

The rebrand also resolved a key digital branding challenge. As Citizen, the company operated under the domain name PayWithCitizen.com, while the more intuitive Citizen.com was owned by another company with the same name. This kind of mismatch can lead to confusion, lost website traffic, misdirected emails, and weaker advertising performance.

As part of the rebrand, the company secured Yaspa.com, removing the risk of confusion and ensuring a seamless path for customers and partners to find and engage with the brand.

InDebted

InDebted is a debt collection fintech company founded in Sydney, Australia, in 2016, with a mission to revolutionise how organisations around the world support consumers through debt.

Rather than relying on traditional, often aggressive collection methods, InDebted uses AI, machine learning, automation, and data-driven engagement to personalise the debt collection experience and make it more efficient and respectful for both businesses and their customers.

Debt is hard, but dealing with it doesn’t have to be. At InDebted, we’re changing the world of consumer debt for good by making the process better for everyone involved. Our approach works—we help companies get better results, scale more efficiently and reduce operational risk through our human-centered technology.

InDebted

InDebted owns InDebted.com, which currently redirects to InDebted.co, suggesting the company initially launched using the .co extension and later secured the .com domain name to strengthen its online presence and brand consistency.

The .co extension is the country code top-level domain (ccTLD) for Colombia. While country code domain names can provide greater name availability, they may also introduce challenges such as user confusion and traffic leakage to the matching .com.

By securing InDebted.com, InDebted improves brand clarity, protects its identity online, and ensures customers and partners reach the correct destination.

While we make every effort to ensure the data on our site is accurate, complete, and up-to-date, we cannot guarantee its reliability. Our data is provided for informational purposes only and should not be relied upon as legal, financial, or other advice. We strongly recommend that you independently verify any information before relying on it.

The right domain name is an important consideration when it comes to building and protecting your brand. If you’re ready to take the next step and invest in a perfect domain name for your business, contact us to learn more about our available options and how we can help you get started.

Other resources

branding domain domain name domain names domains fintech naming

Previous Next