Overview

The pandemic created significant challenges for the oil and gas sector, particularly the industry majors. In addition to increased energy demand from rebounding economies, countries have been rushed for petroleum products over the past two years due to pandemic-induced supply constraints from producers. Many oil and gas companies attempt to reinvent themselves by concentrating on financial health, committing to climate change, and changing business models.

The big trend that people aren’t homing in on enough is the resiliency of the global oil and gas industry.

IEA’s December 2021 Oil and Gas report has outlined the following statistics for the industry:

From December onwards, global oil production is expected to outpace demand, owing to growth in the United States and OPEC+ countries. As this upward trend continues into 2022, the United States, Canada, and Brazil are expected to pump at their highest annual levels ever, increasing non-OPEC+ output by 1.8 mb/d. If the remaining OPEC+ cuts are fully unwound, Saudi Arabia and Russia could also set new highs. Global supply is predicted to increase by 6.4 million barrels per day next year, compared to 1.5 million barrels per day in 2021.

Refinery runs are expected to rise by 3.1 million barrels per day on average in 2021, recovering only 42% of the decline seen in 2020. In 2022, throughputs are expected to increase by another 3.7 mb/d.

Global oil demand is expected to increase by 5.4 million barrels per day in 2021 and by another 3.3 million barrels per day the following year when it returns to pre-Covid levels of 99.5 million barrels per day.

In a recent article, Deloitte has listed five trends in the oil and gas industry worth following in 2022:

Oil price impacts – High oil prices boost energy transition plans, challenging conventional wisdom. After going negative in April 2020, oil prices have rebounded to roughly $80/bbl. A high oil price encourages investment in more risky and costly green energy technologies like carbon capture, utilization, and storage (CCUS).

Mergers and acquisitions – ESG play a significant role in M&A transactions. Since 2021, oil prices have been rising, aided by recovering demand and OPEC supply caps. While the lull in upstream M&A activity is primarily due to Oil and Gas companies’ ongoing capital discipline, buyers’ limited visibility into sellers’ carbon profiles or assets is becoming a growing factor.

Oilfield services – Business models shift to enable a new energy era. Integrating solutions for decarbonizing upstream projects, establishing subscription-based revenue models, and diversifying into the low-carbon space might be major enablers for the future oilfield service strategy.

Fuel retailing – Convenience and experience supersede fuel as the new anchor to attract customers.

Workforce and talent – Greener jobs and differentiated benefits can help secure return and retention of the workforce.

Namepicks

Centrica

Centrica is a multinational energy and services company that provides cutting-edge solutions, services, and products. The company operates British Gas, Direct Energy, and Bord Gáis Energy brands, supported by 15,000 engineers and technicians.

Centrica has invested in the exact brand match domain name Centrica.com thus making the most out of their marketing across channels and avoiding security risks.

Engie

Engie SA is a French multinational utility company headquartered in La Défense, Courbevoie, which operates in energy transition, electricity generation, distribution, natural gas, nuclear, renewable energy, and petroleum.

Engie has secured Engie.com for its brand presence online. An exact brand match .com name like Engie.com is the natural choice of most internet users, making their marketing most effective across all channels.

Equinor

Founded in 1972, Equinor is a Norwegian energy company that focuses on oil, gas, wind, and solar energy.

Equinor has a domain name exactly matching their brand name – Equinor.com. The majority of successful global brands operate on similar names that communicate trust and authority.

Pemex

Pemex is a Mexican state-owned petroleum company founded in 1938. Pemex is Mexico’s largest corporation, the country’s top taxpayer, and one of Latin America’s largest companies.

Pemex operates on Pemex.com – an exact brand match .com domain.

Valero

Valero Energy is a Fortune 500 international transportation fuels, petrochemical goods, and power manufacturer and marketer.

Valero has invested in the exact brand match Valero.com. A short and memorable .com domain name incomparably optimizes brand recognition online.

Highlights

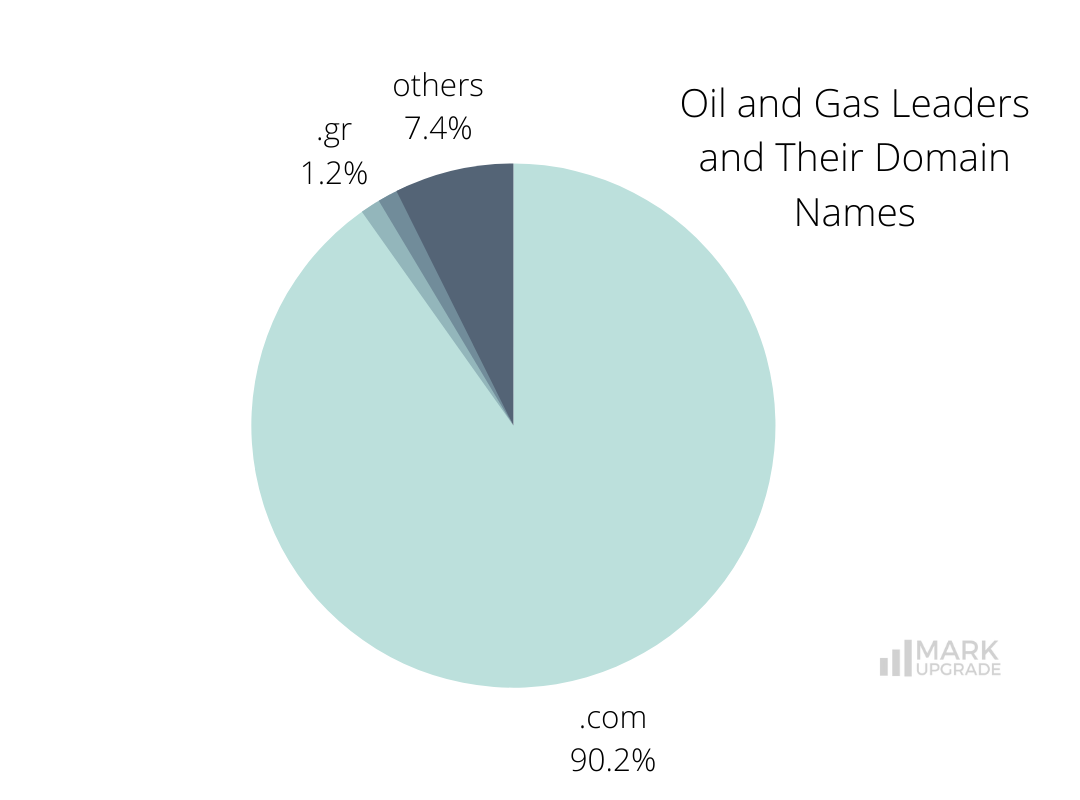

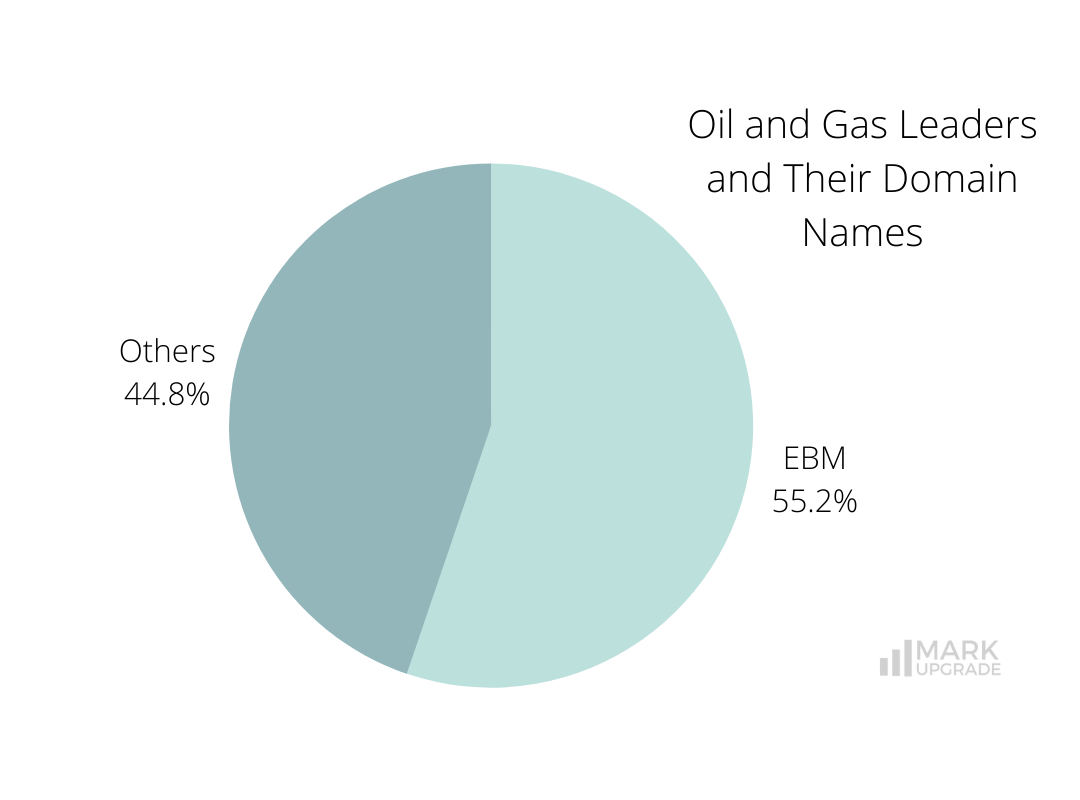

The majority of the companies, 147 out of 163 on the list, have chosen to operate on the .COM domain name, the most trusted TLD is.com, with . co coming in a close second.

90 entries operate on exact brand match domains. This ensures their brand is well protected online, avoids traffic and email leaks, and confusion amongst their customers and business partners.

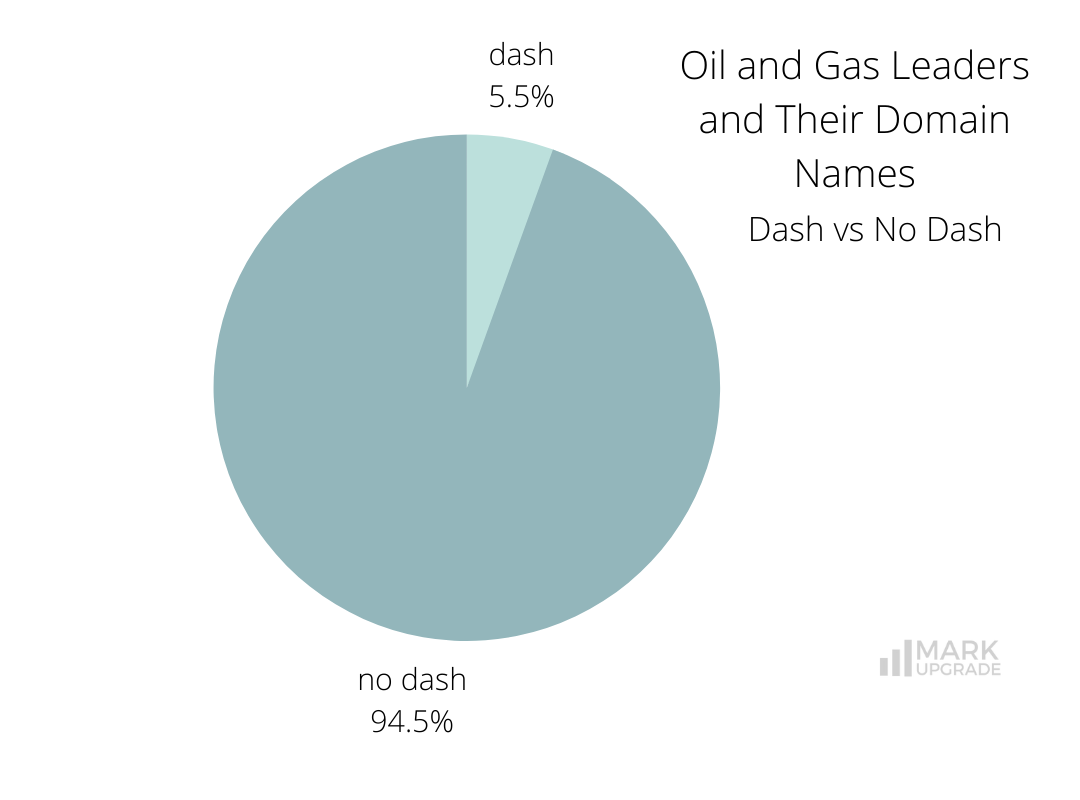

9 companies use dashes. Dashes are often included with two-word brand names or added words when the business has to compromise on their domain if the exact brand match name is taken/not within reach. Here is an article on whether a brand should include a hyphen or a number in its name.

While we make every effort to ensure the data on our site is accurate, complete, and up-to-date, we cannot guarantee its reliability. Our data is provided for informational purposes only and should not be relied upon as legal, financial, or other advice. We strongly recommend that you independently verify any information before relying on it.

How does your brand name match your company vision? What new horizons can a better name open? Get in touch if you feel your brand deserves a better name, we are always happy to help.

Previous Next