Discover the latest trends in global monthly funding data, with a unique focus on companies’ domain name choices, in our monthly funding reports.

Overview

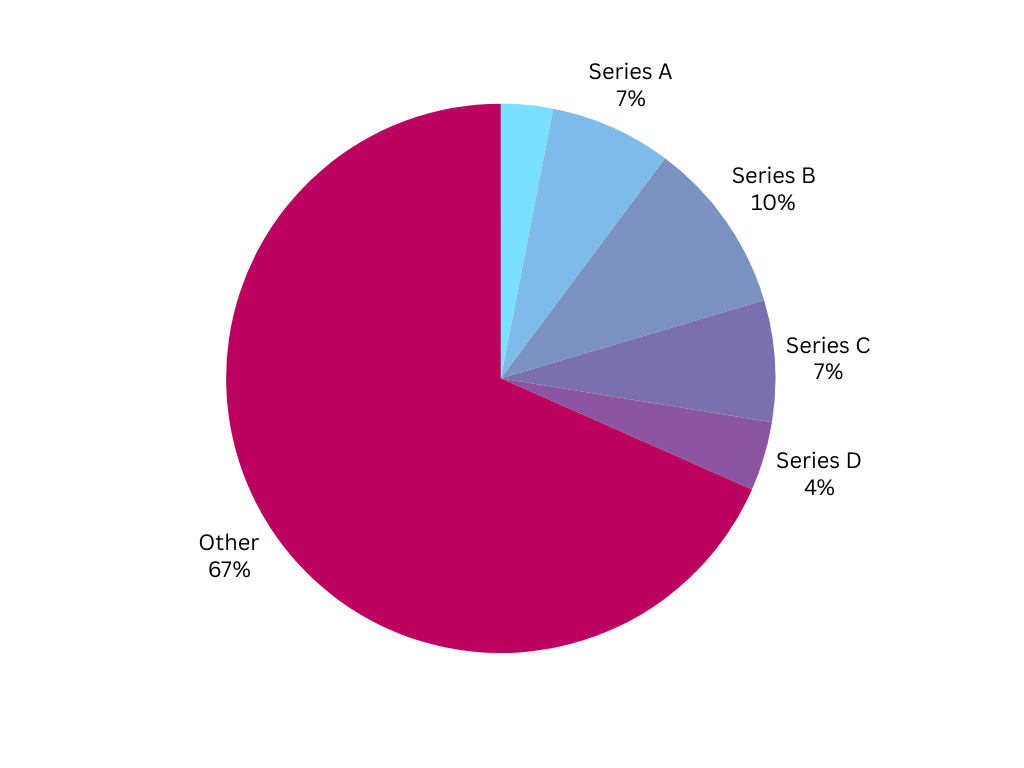

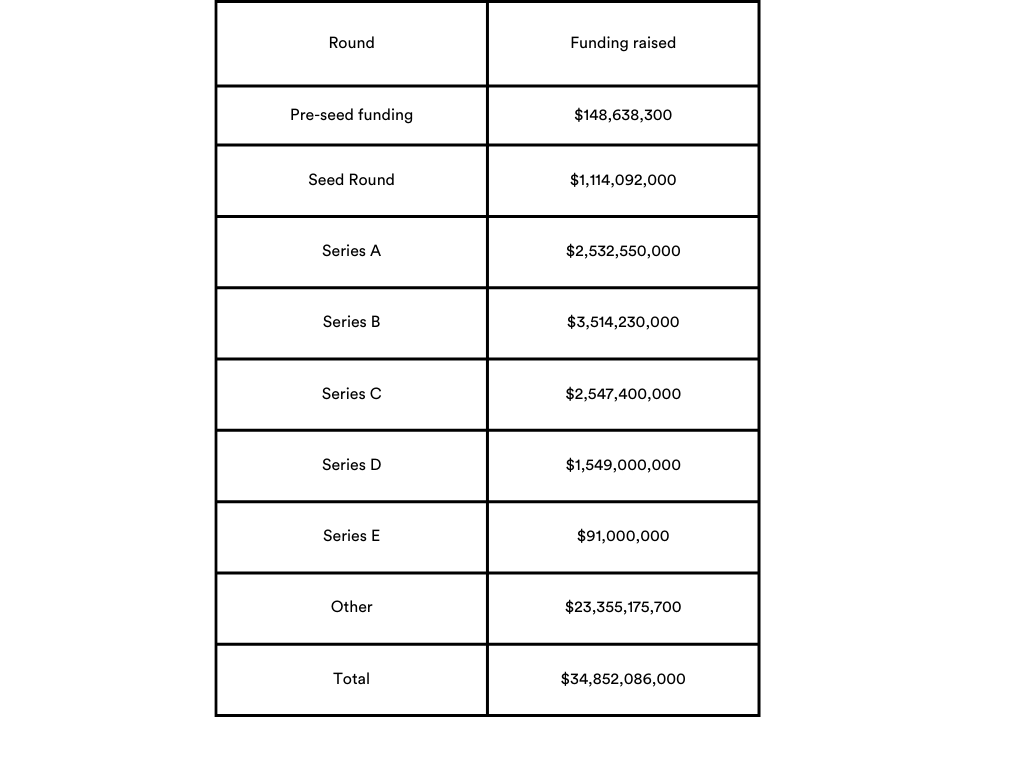

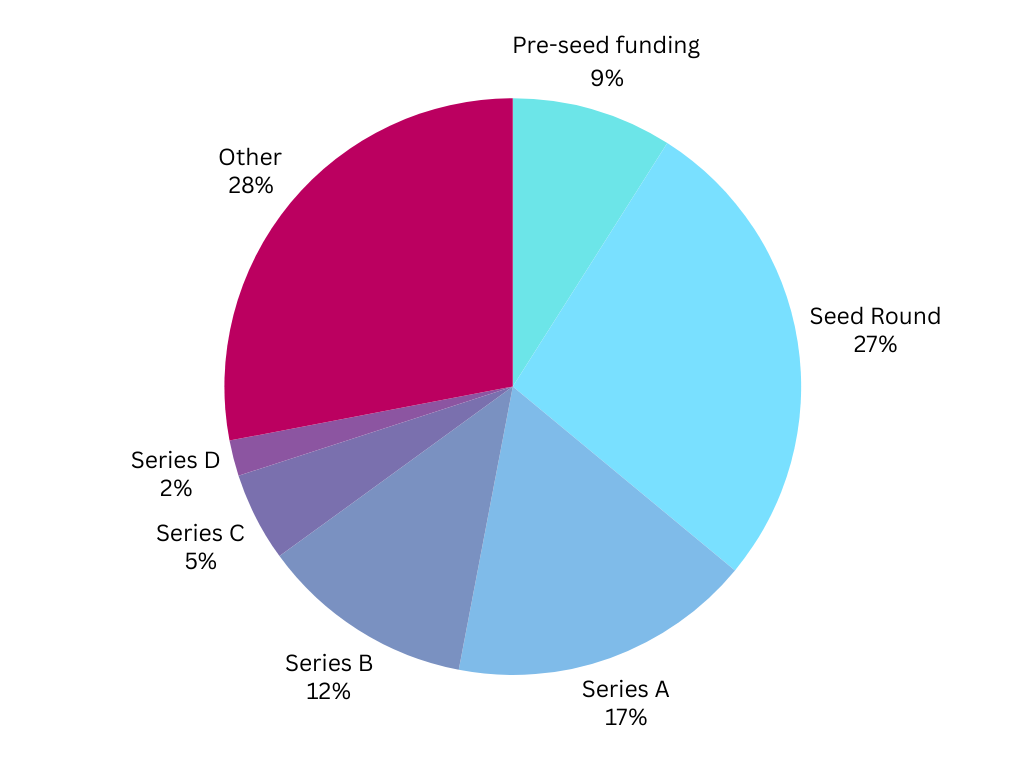

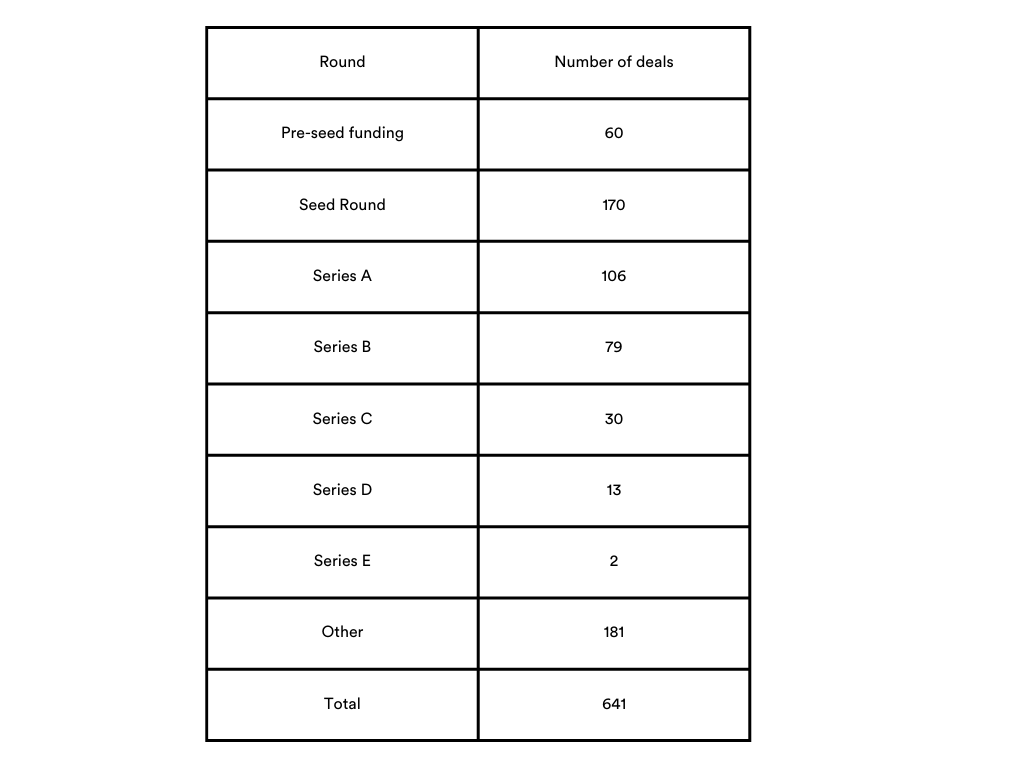

| Round | Amount September (USD) | Number deals September | Amount October (USD) | Number deals October |

| Pre-seed funding | 101,685,200 | 45 | 148,638,300 | 60 |

| Seed Round | 974,593,000 | 172 | 1,114,092,000 | 170 |

| Series A | 2,928,440,000 | 101 | 2,532,550,000 | 106 |

| Series B | 3,008,700,000 | 74 | 3,514,230,000 | 79 |

| Series C | 1,947,110,000 | 31 | 2,547,400,000 | 30 |

| Series D | 864,000,000 | 11 | 1,549,000,000 | 13 |

| Series E | 524,000,000 | 4 | 91,000,000 | 2 |

| Other | 21,499,317,750 | 174 | 23,355,175,700 | 181 |

| Total | 31,847,845,950 | 612 | 34,852,086,000 | 641 |

In October, the funding landscape experienced significant growth compared to September, with total funds increasing from $31.85 billion to $34.85 billion and the number of deals rising from 612 to 641.

Pre-seed funding saw increases in funds and deals, moving from $101.69 million across 45 deals to $148.64 million across 60 deals. Seed rounds also saw a rise in funding to $1.11 billion, though deals slightly decreased from 172 to 170, suggesting larger investments per deal.

While Series A funding dipped from $2.93 billion to $2.53 billion, the number of deals increased, indicating smaller average deal sizes. Series B, C, and D rounds all experienced funding increases, with Series B notably rising to $3.51 billion as deals increased to 79. Series C and D also followed this upward trend in funding despite a slight decrease in the number of Series C deals.

Series E funding dropped from $524 million in 4 deals to $91 million in 2 deals. The ‘Other’ category, encompassing various funding types, increased in funding amount and deal count from $21.50 billion in 174 deals to $23.36 billion in 181 deals.

By funds raised/ Total funding $34,852,086,000

By number of deals/Total number of deals 641

Economic and Political Influences

U.S. Presidential Election and Market Uncertainty

The U.S. presidential election introduced significant uncertainty into global markets. Investors worldwide adopted a cautious stance, anticipating potential shifts in U.S. economic policies that could influence international trade and investment flows. Historically, election years in the U.S. bring about a degree of market volatility, as investors tend to adopt a “wait and see” approach due to potential policy shifts.

Recent reports from sources like The Financial Times and Bloomberg indicate that concerns over possible changes in economic policies post-election have led to fluctuations in investment strategies, especially in sectors reliant on federal support or regulation, such as healthcare and technology.

Monetary Policy Adjustments

Central banks across developed and emerging economies continued their monetary easing cycles in October. Notably, central banks in New Zealand and Canada reduced interest rates by 50 basis points, while the European Central Bank announced a 25 basis point cut. These actions aimed to stimulate economic activity amid global uncertainties. However, some central banks, such as Japan’s, maintained their rates, reflecting varied economic conditions and policy responses.

Geopolitical Tensions and Trade Policies

Geopolitical tensions, particularly in the Middle East, have heightened investor caution. Conflicts in the region have led to volatility in global oil prices, impacting energy markets and contributing to broader economic uncertainties. This instability has prompted investors to adopt more conservative strategies, favouring safer assets over high-risk ventures.

The U.S. election heightened concerns about potential shifts toward protectionism, with discussions around increased tariffs and their implications for global trade. Analysts warned that such measures could lead to sustained economic losses for the U.S. and its trading partners, affecting exports, imports, and overall economic growth.

Global Economic Outlook

The International Monetary Fund’s World Economic Outlook for October 2024 reported stable yet modest global growth, with risks tilted to the downside. The report emphasised the need for sustainable fiscal policies and structural reforms to promote more rapid growth. It also highlighted the role of monetary policy in recent global disinflation trends.

Shift Toward Conservative Investment Strategies

In response to the above factors, there has been a noticeable shift toward more conservative investment strategies. Investors are increasingly favouring bonds, blue-chip stocks, and stable sectors like infrastructure and essential goods. This cautious approach reflects a desire for stability amid the prevailing uncertainties, with a reduced appetite for high-risk ventures and speculative technology investments.

Key Investment Sectors in October 2024

October saw heightened investor focus across several sectors, particularly in Biopharma, Biotechnology, and Health Care, driven by the need for innovative medical solutions. Renewable Energy, Infrastructure, and Energy Storage also drew significant interest, highlighting a shift toward sustainability. The tech space, especially in AI, Cyber Security, and Cloud Computing, continued to attract funding as companies embrace digital transformation. FinTech, PropTech, and Real Estate investments remained strong due to promising returns, while industries like Aerospace, Manufacturing, and Energy gained attention for technological advancements and sustainable practices. This trend underscores a balanced approach between technological innovation and sustainable growth.

Below, we will examine some companies on our list and explore their brand and domain name choices.

Domain Names Highlights

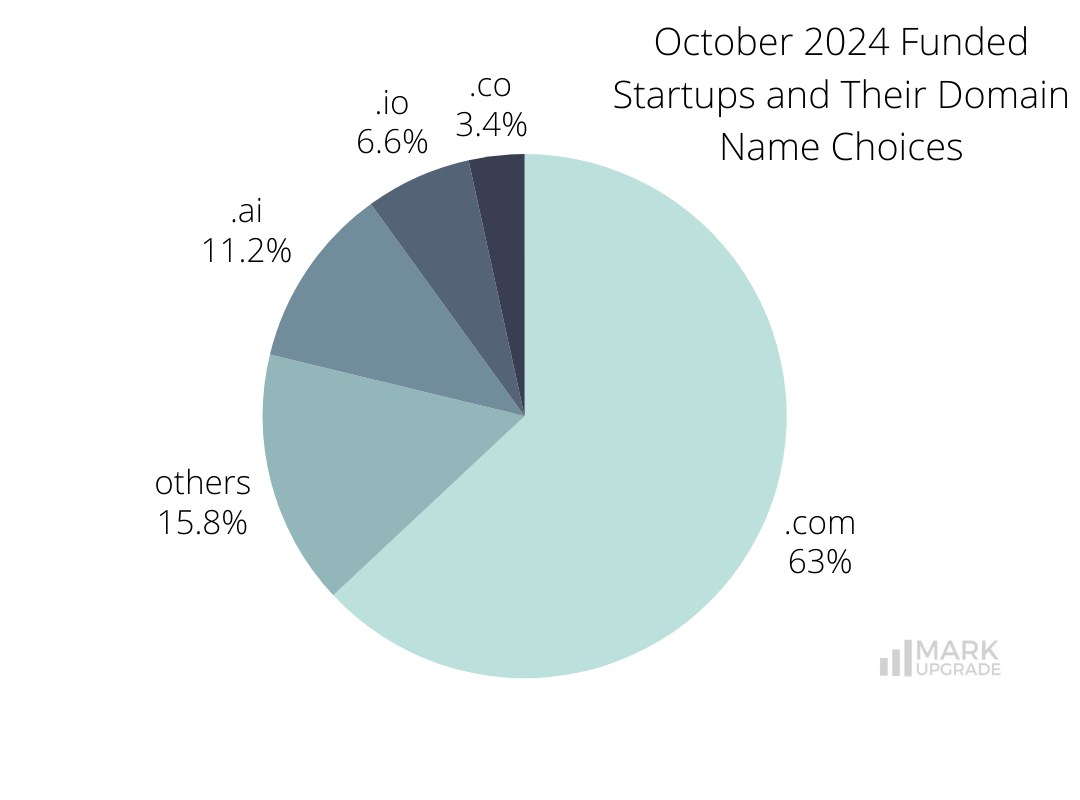

.com Domains – 404 out of 641: The .com extension remains the preferred choice due to its global recognition, credibility, and ease of recall, making it ideal for businesses aiming for a strong and professional online presence.

.ai (72 out of 641) and .io (42 out of 641) Domains: These extensions are popular among tech startups for their modern appeal and association with popular tech terms. However, recent insights suggest consumer enthusiasm for AI-related branding is waning “Beyond the Buzzword: Why AI No Longer Wows Consumers“. At the same time, the .io extension’s relevance may be uncertain due to potential risks associated with using a country-code extension.

.co Domains – 22 out of 641: Often seen as a sleek alternative to .com, .co domains are versatile but lack the widespread trust and recognition of .com, affecting user confidence.

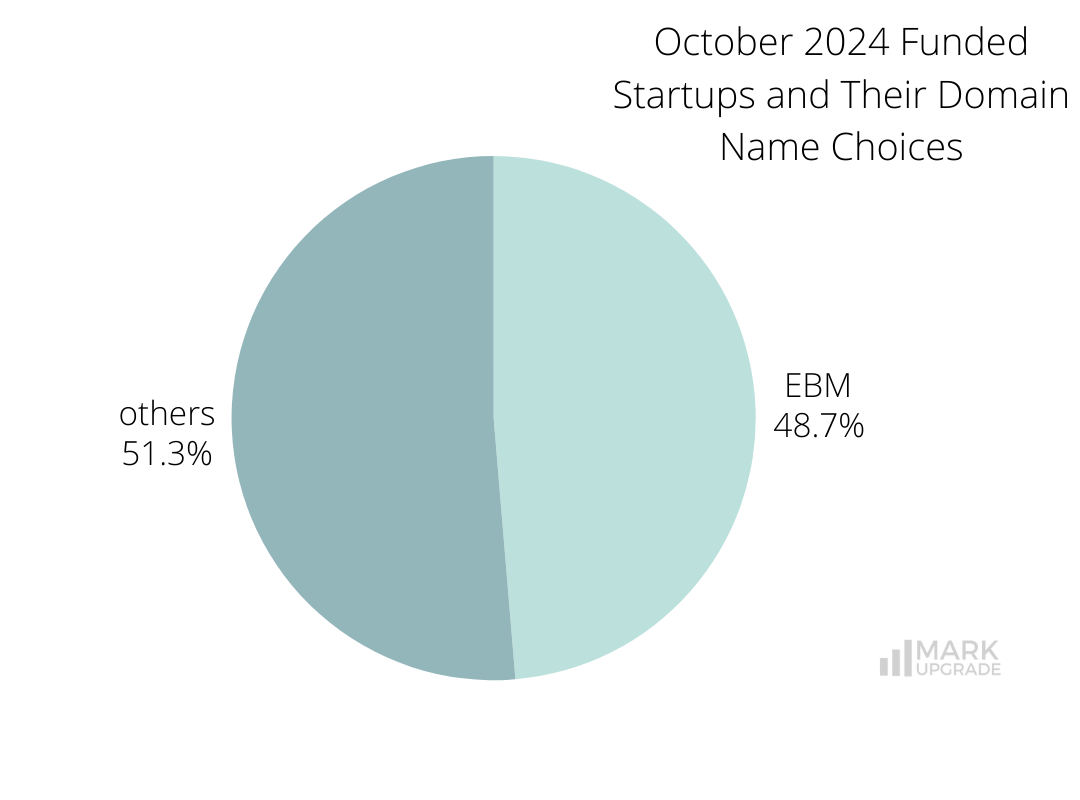

Exact Brand Match (EBM) Domains – 312 out of 641: Nearly half of the companies use EBM domains, which enhance brand recognition, trust, and online authority, making it easier for customers and partners to locate and interact with the brand.

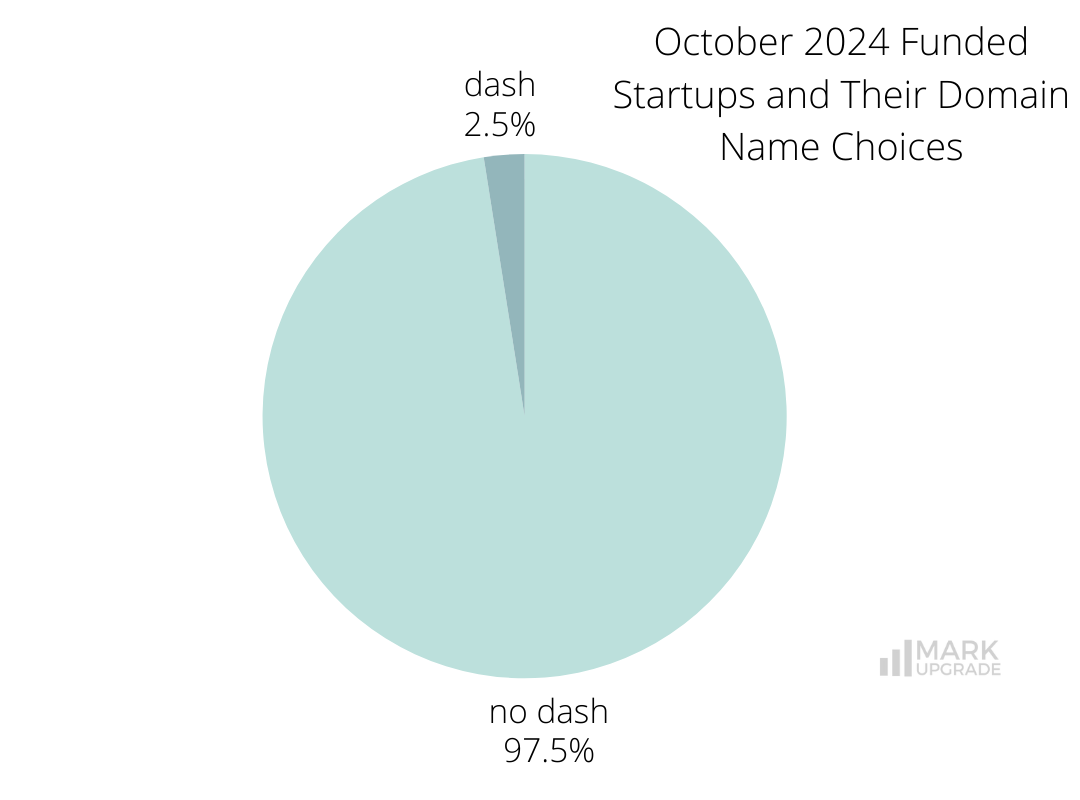

Dash Domains – 16 out of 641: Domains with dashes are typically used when preferred names are unavailable or with two-word brand names, yet they can lead to user confusion and reduce overall memorability.

Namepicks

Armis

Industry: Cyber Security, Information Technology, Internet of Things, Network Security

Funds Raised: $200,000,000 in Series D at $4.2 Billion Valuation

Armis, an Israeli cybersecurity company specialising in cyber exposure management, raised $200 million in a Series D funding round, bringing its valuation to $4.2 billion. This round was led by General Catalyst and Alkeon Capital, with participation from existing backers Brookfield Technology Partners and Georgian. Founded in 2015 by Yevgeny Dibrov and Nadir Izrael, Armis helps organisations discover, monitor, and secure all connected IoT devices across their networks.

The newly secured funds will accelerate Armis’ growth, enhance its cybersecurity platform, and prepare for a potential IPO. The company aims to continue expanding its comprehensive security solutions for IT, cloud, and cyber-physical systems, driving customer satisfaction and innovation.

We are excited about the addition of General Catalyst and Alkeon Capital to our amazing investors and strategic partners. Armis’ history of rapid and global scaling highlights the growing need for organisations to drive toward an asset-centric approach to cybersecurity. This new funding will allow us to continue that rapid pace of value creation for our customers and shareholders, further highlighting our relentless commitment to innovation on our platform and to customer satisfaction that will continue driving our growth for many years to come.

Jonathan Carr, CFO of Armis, highlighted the company’s focus on growth and firm commitment to Armis customers in a press release

Armis has invested in the Exact Brand Match (EBM) domain Armis.com. EBM domains are preferred among cybersecurity companies as they enhance brand authority, credibility, and ease of customer recognition.

Moniepoint

Industry: Banking, Credit, Finance, Financial Services, Payments

Funds Raised: $110,000,000 in Series C

Moniepoint, an African fintech company, \raised $110 million in a Series C funding round led by Development Partners International’s ADP III fund, with participation from Google’s Africa Investment Fund, Verod Capital, and Lightrock. This funding has increased Moniepoint’s valuation to over $1 billion, earning it unicorn status. Founded in 2015 under the name TeamApt, Moniepoint initially provided infrastructure and payment solutions for banks but later shifted focus to serve small and medium-sized businesses (SMBs) in Nigeria.

When we started out in 2015, we were primarily providing back office payment infrastructure for banks and needed an apt team, hence the name TeamApt. Since then, we have evolved significantly, and our flagship business banking solution, Moniepoint, has become our core focus and where we see the future. Now, as we head into our next step in our journey, we’ve changed our name to reflect the company’s commitment to enable a world where any business has access to the digital tools and capital needed to grow, no matter its stage, size or location, and as Moniepoint we believe we can achieve this.

Tosin Eniolorunda, Co-founder and CEO of Moniepoint

The company now offers SMB services like working capital loans, business management tools, and insurance. Dominating Nigeria’s POS market, Moniepoint processes over 800 million monthly transactions, totalling over $17 billion. The company plans to use this new funding to expand its digital banking, payments, and business solutions across Africa.

Moniepoint has secured the EBM domain Moniepoint.com, strengthening its brand authority, ensuring online protection, and enhancing trust among customers and business partners.

OpenAI

Industry: Artificial Intelligence (AI), Generative AI, Machine Learning, Natural Language Processing, Software

Funds Raised: $6,600,000,000

OpenAI has recently secured $6.6 billion in new funding, pushing its post-money valuation to an impressive $157 billion. This significant capital injection will enable the company to further its leadership in AI research, expand its capacity, and continue developing innovative tools to enhance productivity and solve complex problems. With over 250 million users engaging with ChatGPT weekly, OpenAI is progressing towards its mission of making advanced intelligence accessible to all. The new funding underscores investor confidence in OpenAI’s vision to shape a future where AI benefits everyone, including collaborative efforts with governments to unlock the full potential of this technology.

Recently, OpenAI has expanded its domain portfolio by acquiring the high-value domain Chat.com, which now redirects to its popular AI-powered chatbot, ChatGPT. Initially registered in 1996, the domain was last purchased in March 2023 by HubSpot co-founder Dharmesh Shah for over $15 million. Although the purchase price by OpenAI remains undisclosed, this acquisition underscores its strategic focus on enhancing its online presence and accessibility. While OpenAI hasn’t disclosed the purchase price, this acquisition reflects its strategic intent to strengthen its online presence and broaden accessibility.

Powin

Industry: Battery, Energy, Energy Storage, Manufacturing, Renewable Energy, Semiconductor

Funds Raised: $200,000,000

Powin, a leader in battery energy storage, secured a revolving credit facility of up to $200 million primarily from insurance accounts managed by KKR, a leading global investment firm. This funding will help Powin expand its business, drive innovation, and strengthen its financial position. The company plans to use this money to keep up with the growing energy demand.

CEO Jeff Waters highlighted that KKR’s support will help Powin grow faster and provide even better solutions for its customers.

Powin stands out as a leader and innovator in the clean energy space. We are proud to support them and their efforts to expand the use of battery energy storage systems through our deep experience in Asset-Based-Finance.

Sam Mencoff, a Director at KKR, in a press release

Powin.com is the domain name this startup has chosen to operate on; it perfectly matches their brand name, and the .com extension is what visitors intuitively lean towards when typing a web address.

Reflexivity

Industry: Artificial Intelligence (AI), Cryptocurrency, FinTech. Machine Learning

Funds Raised: $30,000,000 in Series B Funding

Reflexivity, previously known as Toggle AI, has recently secured $30 million in Series B funding led by Greycroft and Interactive Brokers, with additional backing from high-profile investors like Stanley Druckenmiller and Greg Coffey. This investment highlights Reflexivity’s leadership in using AI to transform financial analysis. According to CEO Jan Szilagyi, this new capital will accelerate their product development and expand the reach of their platform, which is designed to lower barriers to sophisticated financial analysis and enhance decision-making for their clients. With offices in New York, London, and Tokyo, Reflexivity is driven by a team of industry experts committed to revolutionising investment management through cutting-edge AI solutions.

Reflexivity has invested in Reflexivity.com – an exact brand match domain name. EBM domains enhance global appeal, credibility, and trustworthiness and are the preferred choice among FinTech companies.

While we make every effort to ensure the data on our site is accurate, complete, and up-to-date, we cannot guarantee its reliability. Our data is provided for informational purposes only and should not be relied upon as legal, financial, or other advice. We strongly recommend that you independently verify any information before relying on it.

The right domain name is an important consideration when it comes to building and protecting your brand. If you’re ready to take the next step and invest in a perfect domain name for your business, contact us to learn more about our available options and how we can help you get started.

Other resources

2024 branding domain domain name domain names domains funded Funded Startups funding Monthly Funding Report naming october

Previous Next