Discover the latest trends in global monthly funding data, with a unique focus on companies’ domain name choices, in our monthly funding reports.

Overview

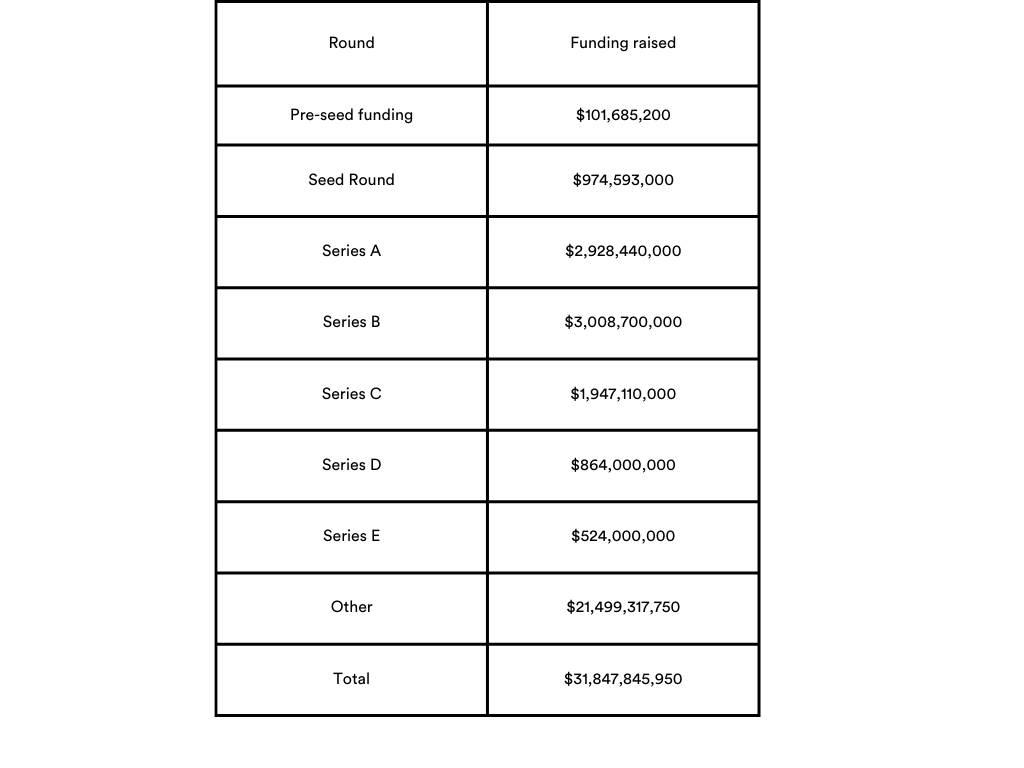

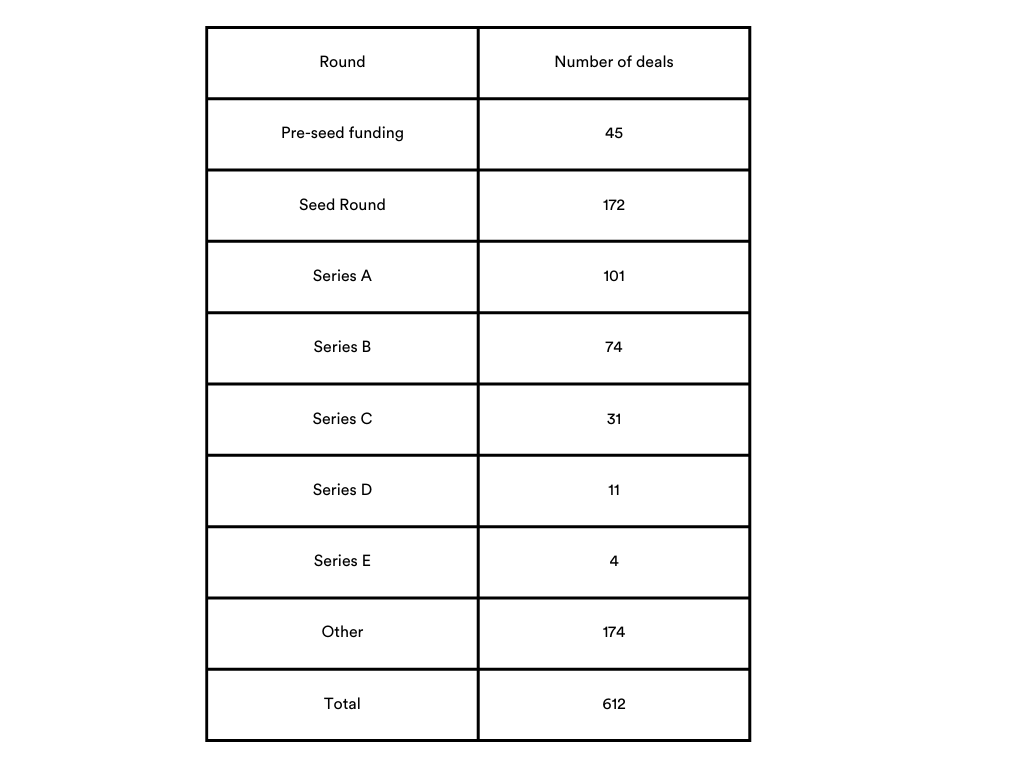

| Round | Amount August (USD) | Number deals August | Amount September (USD) | Number deals September |

| Pre-seed funding | 84,967,800 | 41 | 101,685,200 | 45 |

| Seed Round | 875,777,000 | 143 | 974,593,000 | 172 |

| Series A | 1,904,700,000 | 115 | 2,928,440,000 | 101 |

| Series B | 1,737,400,000 | 44 | 3,008,700,000 | 74 |

| Series C | 982,300,000 | 19 | 1,947,110,000 | 31 |

| Series D | 1,822,200,000 | 12 | 864,000,000 | 11 |

| Series E | 369,000,000 | 2 | 524,000,000 | 4 |

| Other | 22,193,531,000 | 188 | 21,499,317,750 | 174 |

| Total | 29,969,875,800 | 564 | 31,847,845,950 | 612 |

Key Trends in Funding Rounds from August to September

Pre-seed Funding: There was an increase in the funding amount, rising from $84.97 million to $101.69 million, and the number of deals from 41 to 45. This suggests a growing interest in very early-stage ventures.

Seed Round: Both the funding and the number of deals increased. The funding grew from $875.78 million to $974.59 million, and the number of deals from 143 to 172, indicating continued strong support for early-stage companies.

Series A: Experienced significant growth in funding, jumping from $1.90 billion to $2.93 billion, though the number of deals decreased from 115 to 101, suggesting larger average deal sizes.

Series B: The funding amount surged dramatically from $1.74 billion to $3.01 billion, with an increase in deal count from 44 to 74, reflecting a robust investment appetite for maturing startups.

Series C: Funding almost doubled to $1.95 billion, and the number of deals increased from 19 to 31, highlighting investor confidence in more established companies poised for significant growth.

Series D: Saw a decrease in funding and deal numbers, with funding dropping from $1.82 billion to $864 million, and deals decreasing from 12 to 11, possibly indicating a more cautious approach towards later-stage investments.

Series E: The funding rose from $369 million to $524 million, and the number of deals also increased from 2 to 4, suggesting continued support for mature ventures nearing exit stages.

Other: Despite a decrease in the number of deals from 188 to 174, the funding decreased slightly from $22.19 billion to $21.50 billion.

Overall: The total funding increased from about $29.97 billion to $31.85 billion, and the number of deals also grew from 564 to 612. This growth across most stages, particularly in the early and middle stages, may reflect broader investor optimism and a strategic realignment towards companies with strong growth potential amidst economic recovery phases.

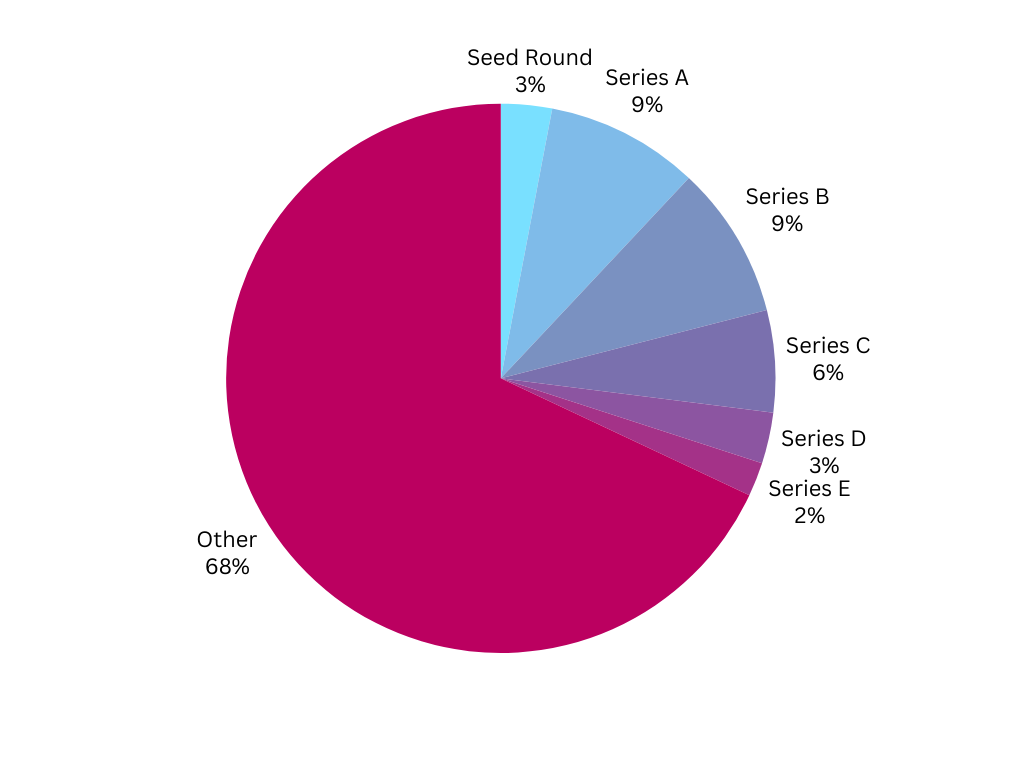

By funds raised/ Total funding $31,847,845,950

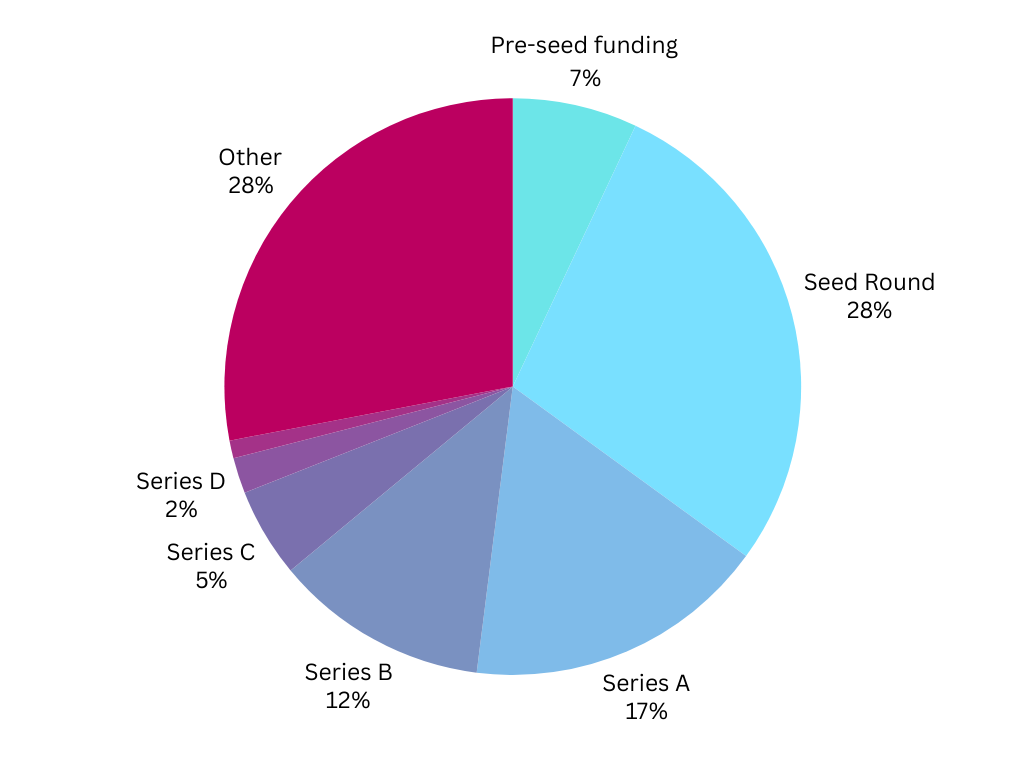

By number of deals/Total number of deals 612

Economic and Political Influences

Global concern about rising prices is decreasing, with the overall concern about inflation reaching its lowest since early 2022, which could lead to a more stable investment environment. Yet, in countries like Turkey, inflation remains a significant issue, potentially affecting funding dynamics. In the U.S., concerns about inflation have marginally increased, which might influence investor behaviour and funding activities.

Regional Economic Outlooks

Business activities are strengthening, particularly in the service sectors, while manufacturing continues to face challenges. This disparity might influence investment trends, favouring service-oriented startups over those in manufacturing. Europe is experiencing a rise in consumer confidence, which could encourage investments in consumer-focused businesses, though ongoing economic challenges might still temper investment enthusiasm.

Broader Economic Concerns

The broader economic landscape shows declining inflation trends, especially in services, suggesting a gradually stabilising economic environment that could bolster funding activities. Although global economic growth remains modest, the forecast is stable, indicating a cautious yet steady investment climate.

Political Landscape and Its Impact

2024 marks a significant year politically, with numerous global elections set to occur, affecting nearly 60% of the world’s GDP. This “global elections supercycle” could lead to regulatory and policy uncertainty, impacting investment strategies and possibly leading to cautious funding decisions as investors wait to see the outcomes of these elections and their economic implications. This backdrop of political events, combined with economic factors, suggests a complex but cautiously optimistic funding environment for September.

Investor interest

Investor interest spans a diverse array of key sectors, highlighting a robust focus on energy, particularly renewable and solar energy, along with significant engagements in energy storage and environmental engineering. Financial services also see strong investment across banking, fintech, lending, and mortgages. In healthcare, there’s heavy investment in biotechnology, including biopharma, medical technologies, and pharmaceutical manufacturing. Technology sectors attract considerable attention, especially in cloud infrastructure, data centres, and telecommunications, alongside enterprise software for hospitality and travel. Manufacturing and real estate investments are notable, particularly those that integrate technology and sustainability. The entertainment industry, especially gaming, along with logistics and transportation sectors, also draw significant investor interest, underscoring the broad range of opportunities driven by innovation and sustainability in the global market.

Below, we will examine some companies on our list and explore their brand and domain name choices.

Namepicks

Alan

Industry: Financial Services, Health Care, Health Insurance, Insurance

Funds Raised: €173,000,000 Series F

Alan, the health insurance startup, has reached a valuation of $4.5 billion following a new funding round that secured $193 million. Belfius, one of Belgium’s largest banks, led the investment, which also formed a distribution partnership with Alan. This Series F round included contributions from existing investors such as the Ontario Teachers’ Pension Plan, Temasek, Coatue, and Lakestar.

Initially focusing on supplemental health insurance for French companies, Alan has automated many claim processes, enabling rapid reimbursements. The firm has diversified its services to include virtual doctor consultations, prescription glasses, and wellness content through its app, incorporating AI to boost efficiency.

Alan, included in our reports on using Personal names as brand names and Top Insurtech Companies, operates on the four-letter Exact Brand Match (EBM) domain, Alan.com. This choice reflects the benefits of personal names in branding—enhancing trust, fostering a personal connection with customers, and imbuing the brand with a unique character and authenticity. Named after the mathematician Alan Turing and the philosopher Alan Watts, the brand embodies the fusion of sciences and humanities, aligning with its vision for the future of healthcare. Four-letter domains like Alan.com are highly prized for their brevity, memorability, and versatility, significantly enhancing a company’s digital identity.

Egym

Industry: Fitness, Sports, Wellness

Funds Raised: $200,000,000 Series G

EGYM, a leader in digital solutions for the fitness industry, has secured €207 million in growth capital from US investor Affinity Partners and existing investors to accelerate the digitization of the fitness sector and transform healthcare from repair to prevention. This funding, part of a Series F round, will enhance EGYM’s digital offerings and expand the EGYM Wellpass corporate health network. EGYM Wellpass is the leading network in Germany, Austria, and France, serving nearly 2.5 million employees from over 7,500 companies and reaching $1.2 billion in valuation.

The investment supports EGYM’s international expansion, including the recent acquisition of Gymlib, a leader in the French corporate health market. Philipp Roesch-Schlanderer, CEO of EGYM, highlighted the partnership’s goal to make fitness clubs central to healthcare transformation. Asad Naqvi from Affinity Partners noted EGYM’s strong growth and technology-driven model as critical reasons for their investment. With this funding, EGYM aims to develop its Wellpass program further to benefit employers and fitness facilities, leveraging the increasing demand for workplace health management.

EGYM operates on the EBM domain EGYM.com, enhancing its online presence and brand consistency, much like the majority of companies featured in our “100+ Fitness Companies and Their Domain Name Choices” list. This domain choice supports EGYM’s credibility and market visibility, vital for its digital and global expansion strategy.

Forterra

Industry: Military

Funds Raised: $75,000,000 Series B

Forterra, previously known as Robotic Research Autonomous Industries, has recently secured $75 million in a Series B funding round over 2.5 times oversubscribed. The round was led by Moore Strategic Ventures, XYZ Venture Capital, and Hedosophia, with contributions from Standard Investments and returning investors such as Enlightenment Capital, Crescent Cove Advisors, and Four More Capital. This funding will enable Forterra to accelerate and expand the deployment of their AutoDrive® autonomous driving system in the defence and industrial sectors.

Josh Araujo, CEO of Forterra, emphasised the company’s commitment to enhancing the safety and efficiency of soldiers, Marines, and industrial workers by removing them from hazardous environments. “This funding allows us to further develop, test, and deploy self-driving platforms with ever-increasing capabilities for both defence and industrial applications,” said Araujo.

Forterra has invested in the EBM domain, Forterra.com, a common choice among top military technology companies. This domain emphasises the company’s professionalism and trustworthiness, which are essential in the defence industry. An EBM domain enhances online visibility, protects the brand, and facilitates global accessibility, improving engagement with clients and investors.

Glean

Industry: Artificial Intelligence (AI), Generative AI, Machine Learning, SaaS, Search Engine

Funds Raised: $260,000,000 Series E

Glean, a company specialising in generative AI for enterprises has successfully raised over $200M at a valuation of $2.2 billion. The funding round, led by Kleiner Perkins and Lightspeed Venture Partners, saw participation from several prestigious firms, including Sequoia Capital, Coatue, ICONIQ Growth, and IVP, and strategic investors like Capital One Ventures and Citi. Glean’s platform enhances enterprise productivity by integrating cutting-edge search and RAG technology with generative AI, enabling personalised responses based on an organisation’s unique knowledge graph. Amid growing demand for responsible AI deployment in businesses, Glean offers a secure and scalable solution, bridging large language models with enterprise data. This funding will fuel Glean’s mission to refine and expand AI-driven solutions, solidifying its position as a leader in the enterprise AI space.

Glean operates under the exact brand match domain Glean.com, enhancing its online presence and aligning with its brand identity. This choice communicates trust and authority, protects the brand online, and prevents traffic and email leaks.

Unlock

Industry: Finance, Financial Services, Real Estate

Funds Raised: $280,000,000 Series B

Unlock Technologies, a leader in the fintech sector has secured a $280 million capital commitment to expand and enhance its home equity solutions for homeowners. This funding includes a $30 million Series B equity investment and a $250 million capital commitment from D2 Asset Management to support growth. The capital will be used to introduce new products, enhance Unlock’s technology platform, and expand nationwide, providing more homeowners with flexible financial solutions. With this support, Unlock aims to democratise home equity and empower homeowners to achieve their financial goals, improving access to home equity solutions across different homeowner segments.

Unlock has invested in the Exact Brand Match (EBM) domain Unlock.com, increasing its credibility and trustworthiness. This easily recognisable dictionary-word domain simplifies customer interactions. It strengthens the company’s credibility in financial services while enhancing marketing effectiveness and its professional image, helping attract more customers and streamline transactions.

Highlights

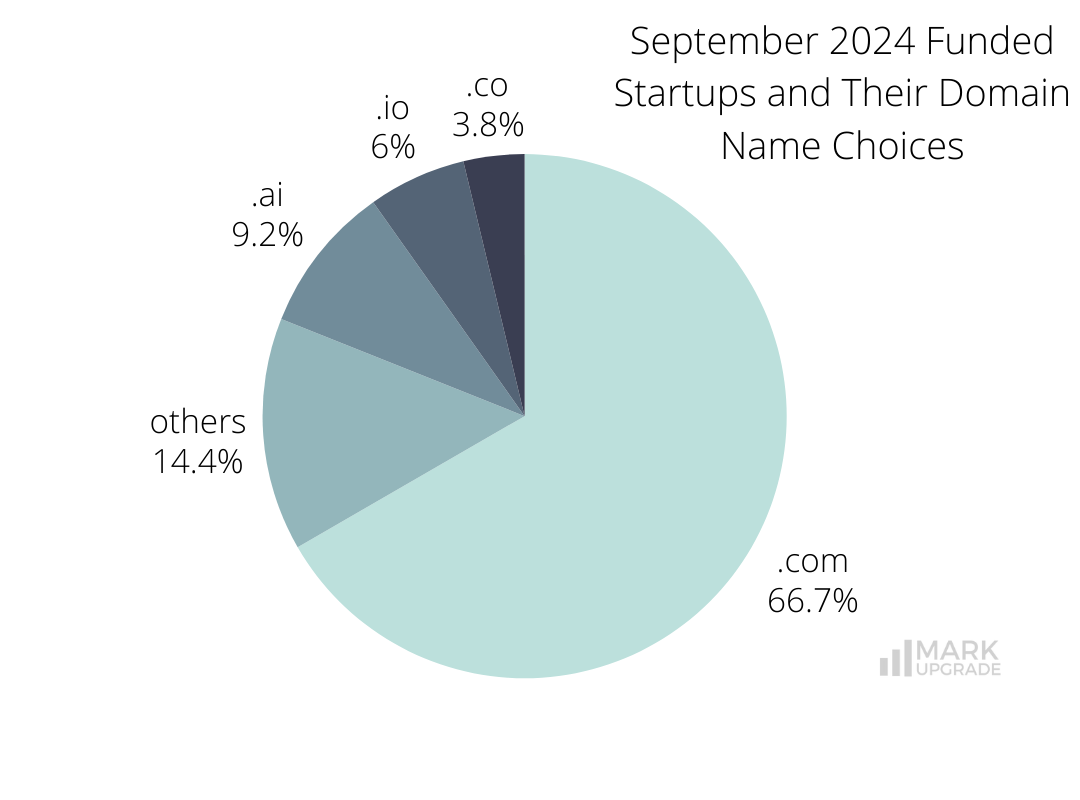

.com domains were chosen by 408 out of 612 businesses, underscoring the global appeal and trustworthiness commonly associated with this extension, they ensure a broad and professional online presence.

.ai and .io domains, selected by 56 and 37 out of 612 companies respectively, are favoured by tech startups for their modern implications. As companies expand beyond tech-centric circles, these niche choices might limit visibility.

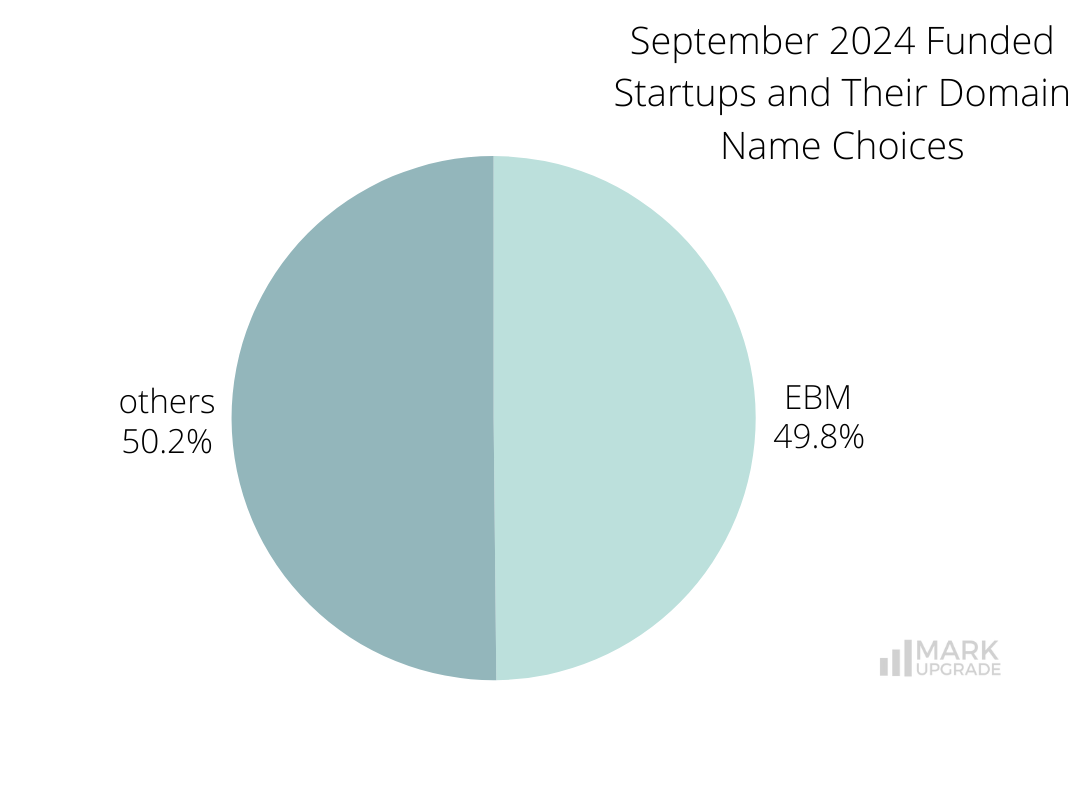

305 of 612 companies use EBM domains, which significantly increase brand recognition, trust, and credibility. They are the natural choice for most internet users, making marketing efforts more effective at every level.

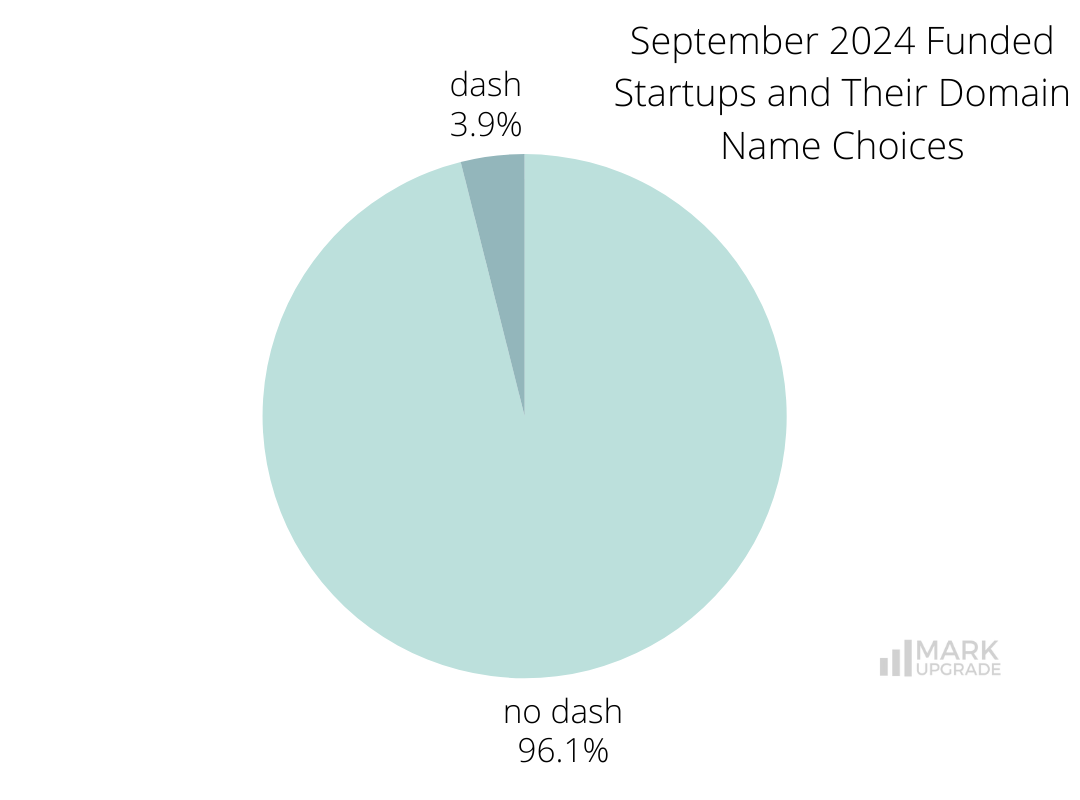

24 companies have included dash in their domains. Dashes are used when the direct EBM domain isn’t available, offering an alternative but potentially complicating clarity in communication.

While we make every effort to ensure the data on our site is accurate, complete, and up-to-date, we cannot guarantee its reliability. Our data is provided for informational purposes only and should not be relied upon as legal, financial, or other advice. We strongly recommend that you independently verify any information before relying on it.

Previous Next