Discover the latest trends in global monthly funding data, with a unique focus on companies’ domain name choices, in our monthly funding reports.

Overview

In July, the investment landscape for startup funding showed several shifts compared to June, influenced by both internal business dynamics and broader economic conditions as outlined in the July 2024 World Economic Outlook (WEO) by the IMF and Ipsos Monthly report.

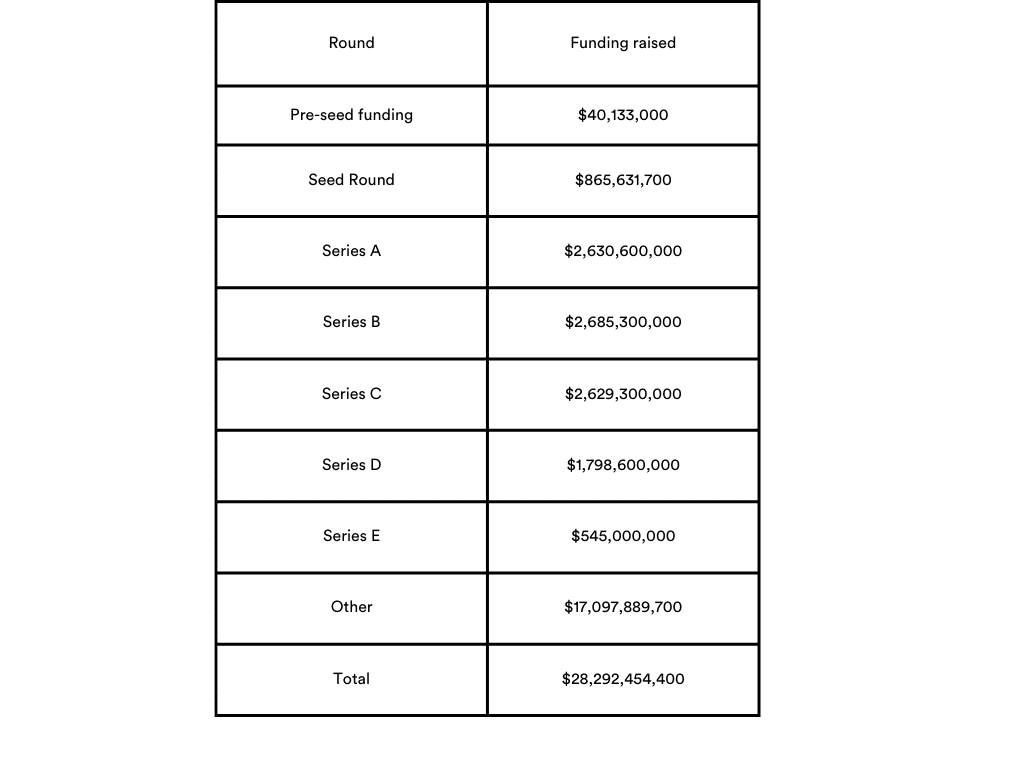

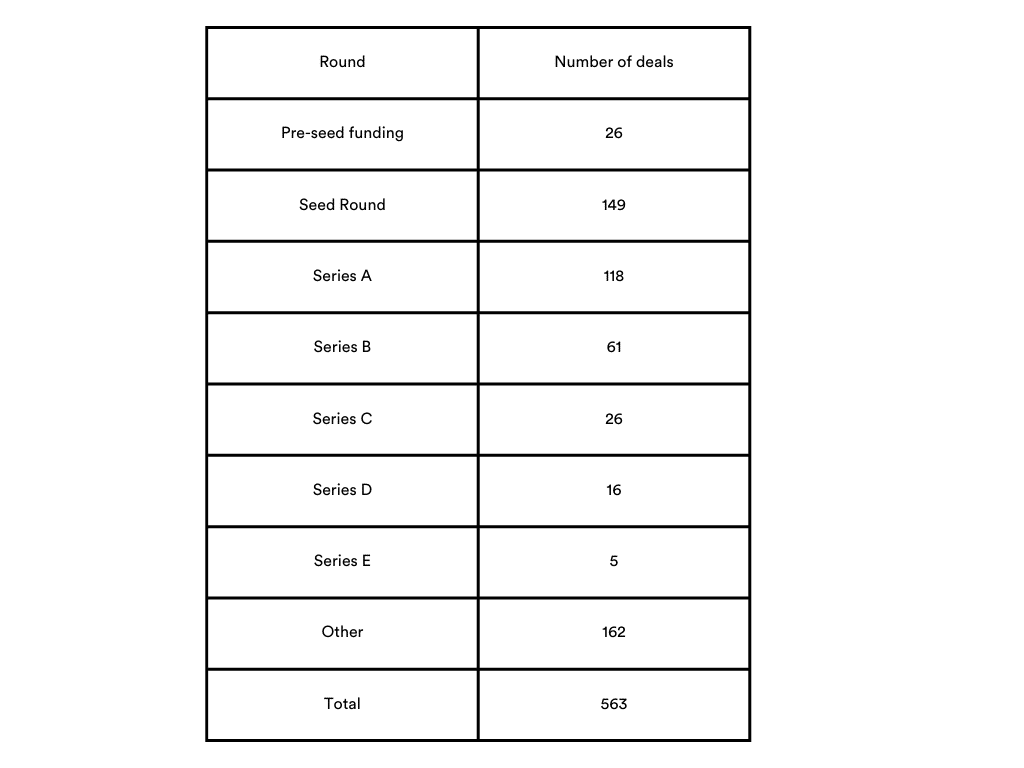

| Round | Amount June (USD) | Number deals June | Amount July (USD) | Number deals July |

| Pre-seed funding | 32,218,000 | 16 | 40,133,000 | 26 |

| Seed Round | 1,125,507,000 | 154 | 865,631,700 | 149 |

| Series A | 2,763,900,000 | 129 | 2,630,600,000 | 118 |

| Series B | 3,382,100,000 | 60 | 2,685,300,000 | 61 |

| Series C | 1,319,700,000 | 21 | 2,629,300,000 | 26 |

| Series D | 1,249,000,000 | 9 | 1,798,600,000 | 16 |

| Series E | 524,000,000 | 5 | 545,000,000 | 5 |

| Other | 21,293,759,000 | 158 | 17,097,889,700 | 162 |

| Total | 31,690,184,000 | 552 | 28,292,454,400 | 563 |

Key Trends in Funding Rounds

Pre-seed: The number of pre-seed deals increased significantly, with a modest increase in the amount raised, suggesting rising investor interest in early-stage ventures.

Seed Round, Series A, B, and C: Seed Round and Series A saw declines in both the amount raised and the number of deals, reflecting increased investor caution and possibly tighter capital conditions. Series B, although with a similar number of deals, decreased in the amount raised. In contrast, Series C experienced an increase in the number of deals but a decrease in total funding, indicating smaller average deal sizes.

Series D: Series D funding in July saw a notable increase in the amount raised and the number of deals compared to the previous month. Series D companies are typically at a more advanced stage of development, closer to an IPO or major acquisition. The increased investment reflects confidence in their stability and continued growth potential.

Despite an increase in the number of deals from June to July, total funding decreased by approximately $3.4 billion, indicating interest in less capital-intensive investments.

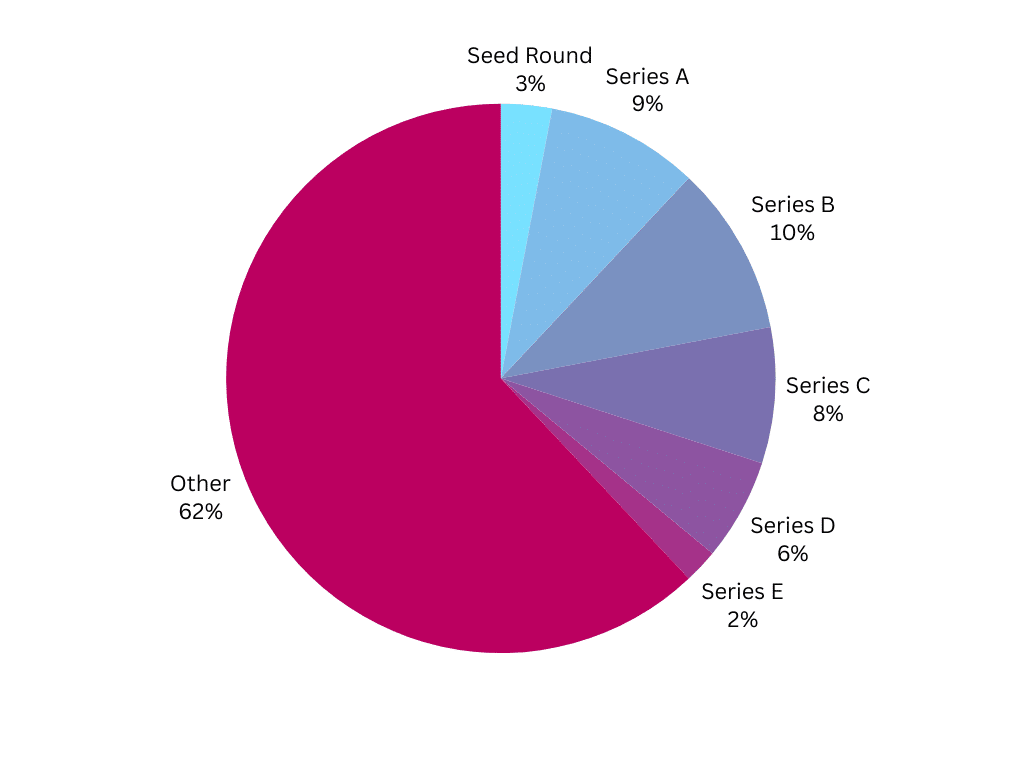

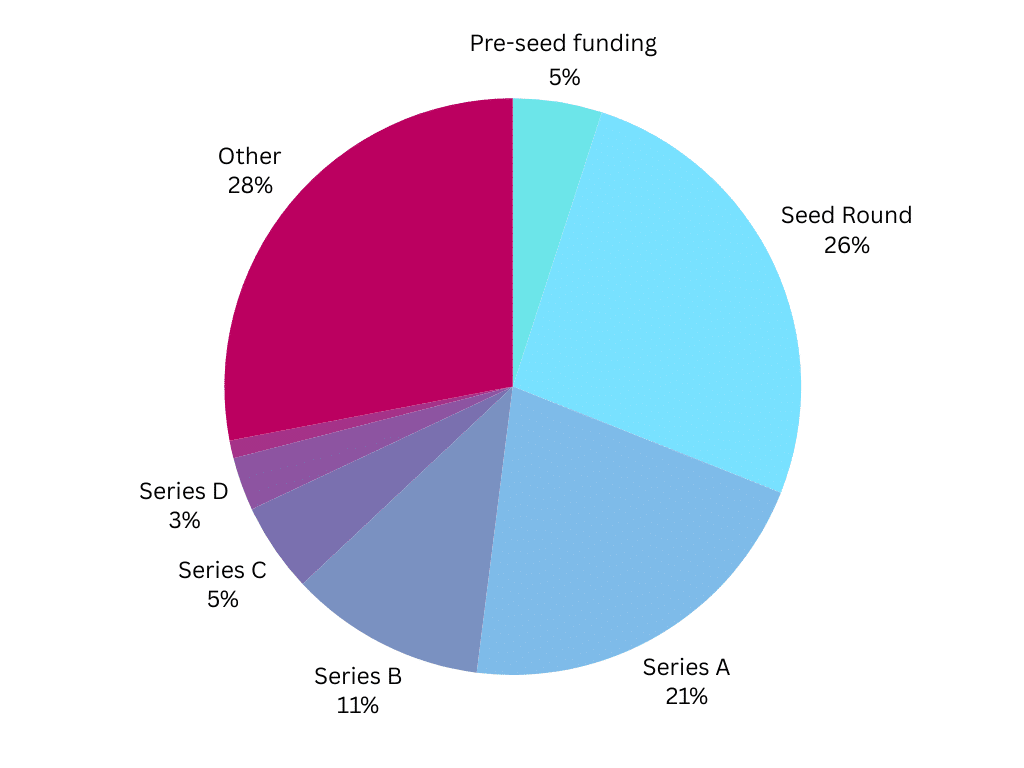

By funds raised/ Total funding $28,292,454,400

By number of deals/Total number of deals 563

Economic and Political Influences

Global Economic Outlook: According to the IMF’s July 2024 WEO update, global growth projections are stable but modest, with significant regional variations and persistent inflation pressures, especially from services.

Inflation and Interest Rates: With services inflation holding up and complicating monetary policy normalisation, there are heightened expectations of prolonged higher interest rates. This scenario can lead to tighter liquidity conditions and more selective investment criteria, impacting funding availability, especially for early-stage startups.

Trade Tensions and Policy Uncertainty: Renewed trade tensions and policy uncertainties also contribute to a risk-averse investment climate. This can make investors wary of committing large sums to ventures that may be affected by geopolitical shifts or trade disruptions.

Regional Economic Outlooks

Positive Economic Outlook in the US: Contrasting with the broader global caution, the US economy has improved, reaching its highest in nearly three years. A relatively stable economic climate might explain the increased willingness of investors to engage in larger Series D funding rounds.

Drop in Europe: In contrast, Europe has seen a downturn in its economic outlook, likely leading to a sharper investment reduction impacting the overall funding amounts, which fell despite an increase in deals.

With inflation and ongoing uncertainties shaping the economic landscape, July’s funding approach mirrors the global economy’s cautious optimism. Investors strategically navigate these challenges by adapting their investments to more conservative and calculated risks. This careful balance aims to capitalise on opportunities while mitigating potential downturns, demonstrating a pragmatic adaptation to the evolving financial landscape.

Investor interest is concentrated in several key sectors: Investor interest is increasingly focusing on broad sectors such as Technology and AI, which spans software development, artificial intelligence applications, and information technology innovations. There’s also significant attention on Health and Biotechnology, which covers everything from precision medicine and oncology to mental healthcare and health diagnostics. Sectors like Transportation and Logistics are gaining traction, integrating mobile apps and taxi services with logistics solutions. Other key areas of focus include Agritech and Environmental Technologies, which combine agriculture advancements with sustainable practices like electric vehicles and analytics, and Advanced Manufacturing, which includes electronics and semiconductors.

In the second quarter of 2024, venture funding for Cybersecurity startups increased by more than 100% compared to the previous year due to the high demand for strong security solutions in the face of rising cyber threats and the growing integration of digital technologies in business operations.

On the contrary, funding for AdTech startups plummeted, with a sharp decline in investment as the industry faced challenges such as market saturation, regulatory pressures, and economic uncertainties, leading to one of the slowest years for AdTech funding in over a decade.

Below, we will examine some companies on our list and explore their brand and domain name choices.

Domain Names Highlights

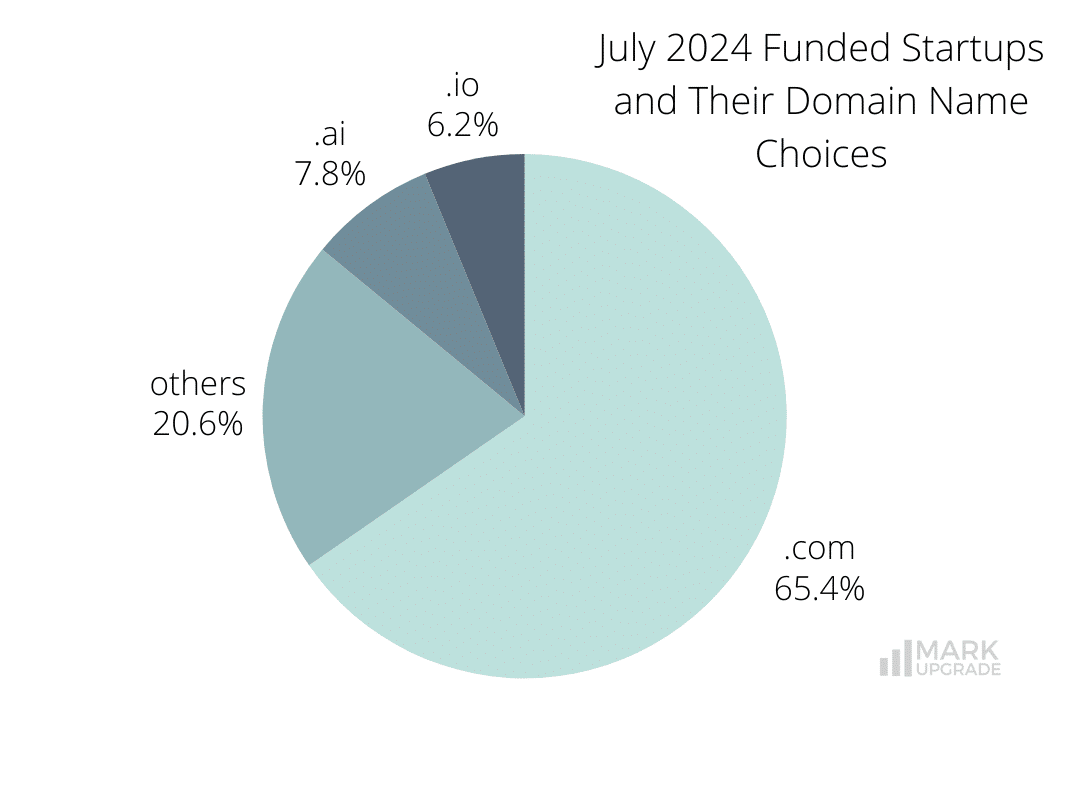

Of 563 companies, 368 have chosen the most recognized and trusted globally .com extension, enhancing a company’s professional image and broad market reach.

The .io extension, favoured by 35 tech startups, is known for its association with “input/output,” appealing to a tech-savvy audience. Similarly, the .ai extension, chosen by 44 companies, signals a focus on artificial intelligence.

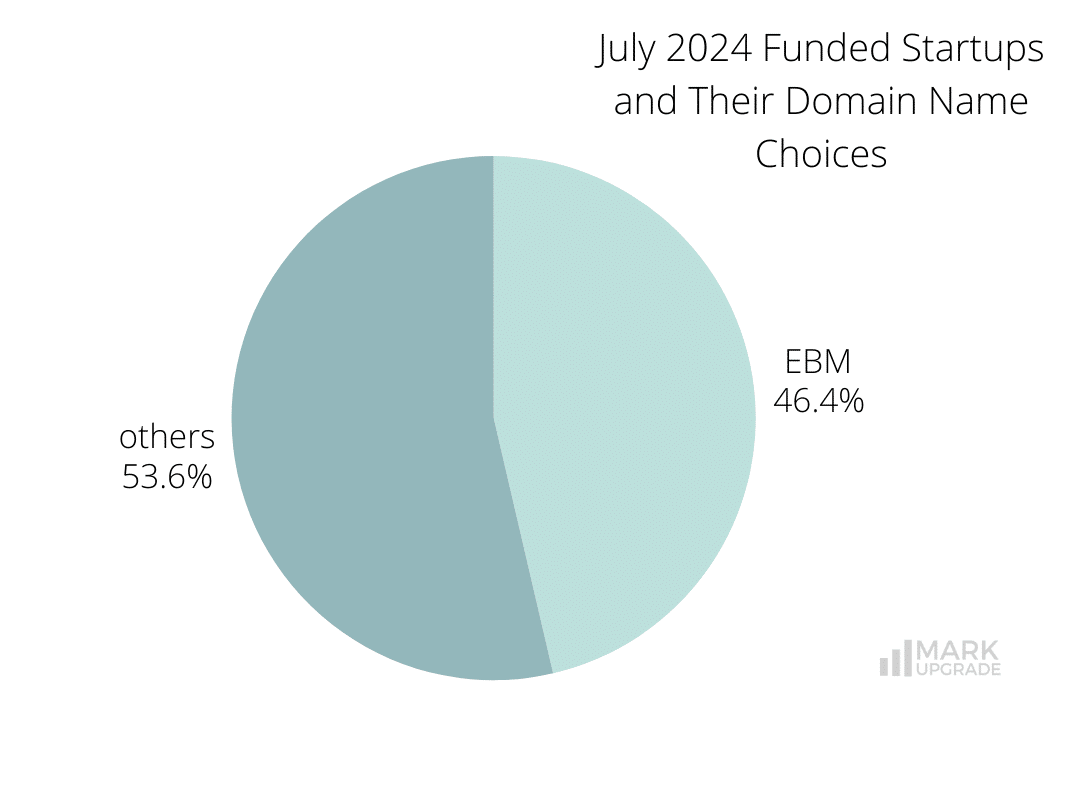

Exact Brand Match (EBM) domains, selected by 261 companies, are crucial for reinforcing brand identity and ensuring easy recall, particularly valuable for marketing and securing online authority in competitive sectors.

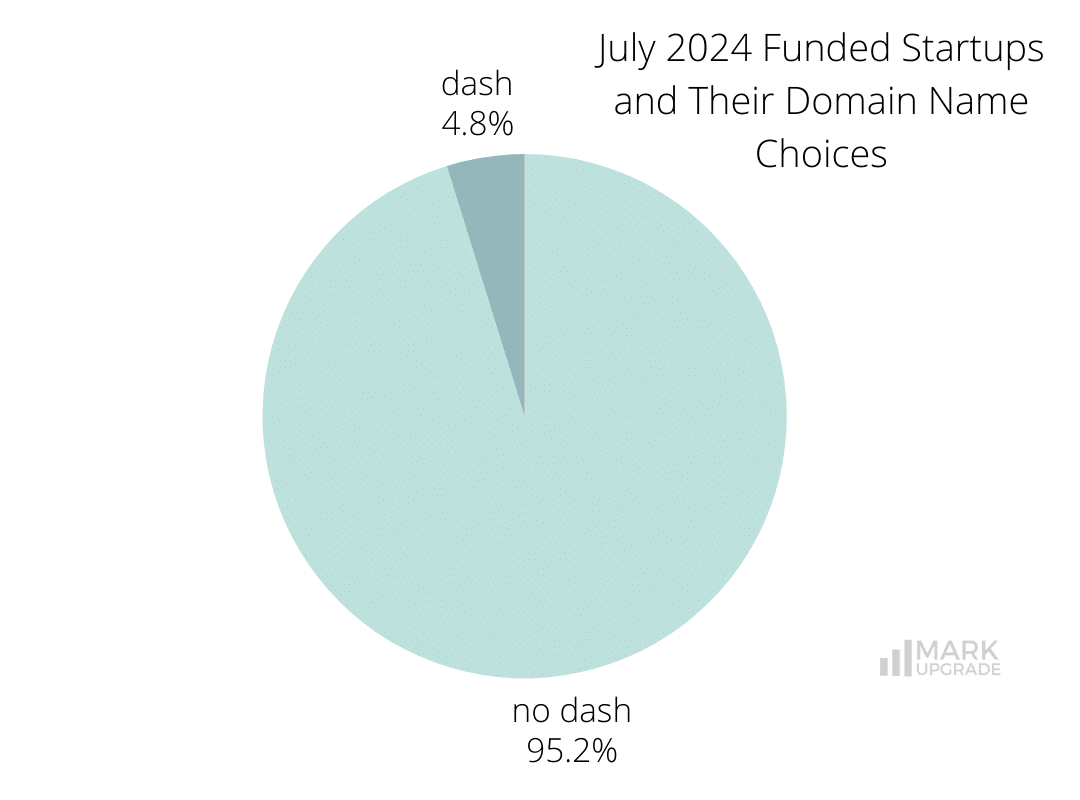

27 companies use dashes in their domain names. Dashes are often included with two-word brand names or with added words when a business has to compromise on its domain if the exact brand match name is taken or not within reach.

Namepicks

Check out our article “How to Name a Unicorn?” for insights on choosing a brand name that can help elevate your startup to unicorn status.

Astranis

Industry: Aerospace, Internet, Satellite Communication, Telecommunications

Funds Raised: $200,000,000 Series D

Astranis, a space startup that builds small, cost-effective telecommunications satellites to provide internet access in remote regions, announced on July 24 that it had raised $200 million. This funding will fully support its Omega program through to the launch of its first next-generation broadband spacecraft in 2026.

Astranis has chosen a domain name that clearly corresponds to its global ambitions and communicates its vision—Astranis.com. The company also owns Astranis.io and has cleverly utilised the domain name Orbit.ing to showcase its satellites, both launched and in development.

Clio

Industry: CRM, Legal, Legal Tech, Software

Funds Raised: $900,000,000 Series F

Clio, a law practice management company, set a new record in legal tech funding with a massive $900 million raise, valuing the company at $3 billion. This Series F round, led by leading investors including New Enterprise Associates and Goldman Sachs, marks the largest investment ever in a cloud legal technology sector. Clio plans to use this investment to further develop its multi-product platform and expand its market reach globally, aiming to serve larger firms and extend its presence to over 130 countries.

We are pioneering this future for our customers, driven by our mission to transform the legal experience for all. Our commitment to delivering unparalleled value propels every decision we make, and we are inspired by the massive opportunities ahead.

Jack Newton, CEO and Founder of Clio

Launching initially on the domain “goclio.com,” Clio utilised the action verb “go” to convey a sense of immediacy and forward motion. While action verbs can grab attention and encourage users by highlighting a problem-solving approach, they might not clearly express all that a company offers, potentially making the brand’s message less clear. Recognising the benefits of an Exact Brand Match (EBM) domain, Clio upgraded to the premium Clio.com. EBM domains are the preferred choice for Legal Tech companies as they increase brand recognition, credibility and trust and strengthen online identity.

Human Interest

Industry: Employee Benefits, Finance, FinTech, Insurance, InsurTech, Retirement, Wealth Management

Funds Raised: $,242,000,000 Venture Round

San Francisco-based Human Interest provides a platform that helps small and medium-sized businesses provide 401(k) plans to employees. The software also offers features for managing other types of retirement accounts. According to Human Interest, its platform supports over one million workers at more than 25,000 businesses.

This latest raise was designed to bring additional top-tier public equity investors onto the cap table. Human Interest is approaching cash flow break-even and has enough cash on the balance sheet to fund continued 70%+ year-over-year growth without additional capital.

Human Interest’s announcement

Human Interest operates on the EBM domain HumanInterest.com. Employment companies favour EBM domains because they convey professionalism and reliability, essential qualities for attracting top talent and establishing trust with potential employees and business partners. These domains also simplify the search process for job seekers, directly connecting them with the company’s resources and opportunities, thus enhancing user experience and improving recruitment efficiency.

Matera

Industry: Banking, Financial Services, FinTech, Retail Technology, Risk Management

Funds Raised: $100,000,000 Private Equity

Brazil and US-based Matera has secured a $100 million investment from Warburg Pincus, a private equity firm headquartered in New York. The company plans to use these funds to accelerate its expansion into the North American market and to enhance its product development. Founded in Brazil and led by CEO Carlos Netto, Matera provides core banking, instant payment, and QR code payment solutions for financial institutions. With over 30 years of experience, Matera is recognized for delivering best-in-class software solutions.

Matera operates under the Exact Brand Match (EBM) domain Matera.com, a straightforward and memorable domain that helps in establishing a solid online presence. Owning an EBM domain in FinTech is essential for promoting user confidence and facilitating seamless interactions in a highly competitive and security-conscious market.

Saronic

Industry: Artificial Intelligence (AI), Manufacturing, Marine Technology, Military, National Security, Security

Funds Raised: $175,000,000 Series B

Saronic, a defence technology leader specialising in autonomous surface vessels (ASVs), raised $175 million in a Series B round, valuing the company at $1 billion. Saronic is redefining maritime superiority for the U.S. Navy and its allies by delivering highly effective and advanced ASVs rapidly to meet the growing needs of the Joint Force. Designed to augment the existing Fleet, Saronic’s ASVs serve as force multipliers, working alongside manned systems to extend naval capabilities while reducing risk to human life and missions. This new investment will not only accelerate Saronic’s domestic and international growth but also expand its in-house manufacturing capabilities and increase production across all ASV models.

Saronic operates on the EBM domain Saronic.com. This ensures their brand is well protected online, avoids traffic and email leaks as well as confusion amongst their customers and business partners.

While we make every effort to ensure the data on our site is accurate, complete, and up-to-date, we cannot guarantee its reliability. Our data is provided for informational purposes only and should not be relied upon as legal, financial, or other advice. We strongly recommend that you independently verify any information before relying on it.

Whether you’re a small business owner or a large corporation, a premium domain name can help boost your brand and increase your online presence. If you’re ready to take the next step, contact us to learn more about our premium domain name options and how they can benefit your business.

Previous Next