Overview

Covid-19 has revolutionized the digital payments landscape as the buying experience gets more streamlined and user-friendly resulting in the emergence of many sub-industries, such as Buy Now Pay Later (BNPL). Put simply, BNPL allows shoppers to pay for their items throughout installments, usually over a period of few months.

BNPL is broadening financial inclusion by providing meaningful benefits to consumers and businesses accepting these forms of payment. For businesses, offering a BNPL option increases cart conversion as well as average order value. For consumers, it’s a great way to purchase the items you need, to manage surprises and also obtain the things you aspire to own by paying overtime.

Brad Paterson, CEO of Splitit for Nasdaq

BNPL services are primarily adopted by Millenials and Gen Z, who do not have any credit history but are looking for short-term credits.

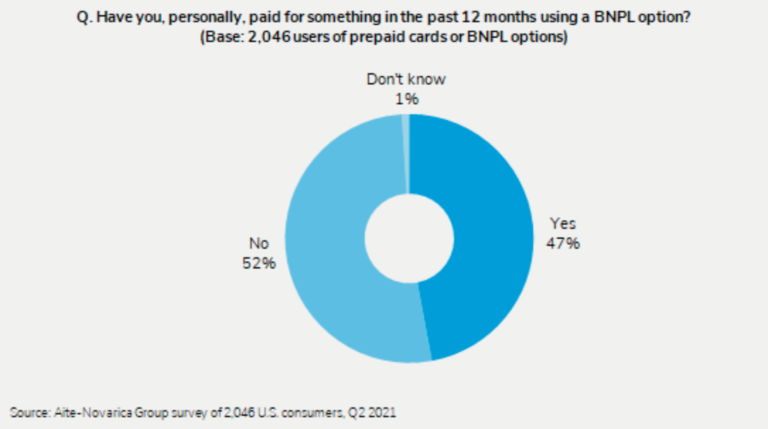

Alta-Novarica Group survey shows that 47% of the participants in the research have paid for something using a BNPL option in the past 12 months.

One of the best advantages of the BNPL option is that it can be implemented on any platform allowing users to buy various products from food to medicines and clothes. BNPL plans usually do not charge interest or fees if the users comply with the defined repayment terms and don’t have annual fees, typical for credit cards.

As e-commerce continues to be the dominant way that younger consumers shop today, being able to capture the consumer at the point of need, right when they are checking out of an e-commerce transaction, for example, has become ever more seamless.

Kim Muhota, head of financial services North America at SSA & Company

According to Worldpay, BNPL accounted for 2.1% of all worldwide e-commerce transactions in 2020, or around $97 billion, and is expected to double to 4.2% by 2024. From 2021 to 2028, the worldwide buy now pay later market is predicted to grow at a CAGR of 22.4 percent, reaching $ 20.40 billion.

BNPL is gaining extreme popularity in India due to the credit rating in the country.

Only 60-70 million Indians have access to credit today, which means 93% of India has no access to credit.

Upasana Taku, co-founder of MobiKwik for Livemint

According to Redseer, the BNPL market in India would grow to $45-50 billion by 2026, up from $3-3.5 billion presently. The number of BNPL users in the country might increase to 80-100 million by then, up from the current 10-15 million.

A recent report of Research and Markets has highlighted the following industry trends:

The online segment is expected to increase the most throughout the projection period (2021-2028). BNPL platforms are cooperating with many e-commerce enterprises. As a result, clients are increasingly turning to online payment methods.

To optimize their tax deductions, small and medium businesses are increasingly turning to buy now pay later services. The flexible repayment options and transparent fees assist companies in managing their expenses.

The fashion and garment segment is expected to register the highest growth in terms of end-use as millennials extensively use BNPL services to pay for apparel in installments.

The presence of a high number of buy now pay later service providers in the North American region is likely to generate growth opportunities for the regional market.

Namepicks

Afterpay

AfterPay was founded in 2010 and offers payment-after-delivery service for e-Commerce, m-Commerce, and cross-channel post-payment services. The business operates globally, and has recently introduced cross-border trading for its Canadian merchant partners, allowing them to offer their products to buyers in the US using its popular Buy Now, Pay Later payment solution.

They operate on Afterpay.com and also own a number of country extensions as well as afterpaytouch.com for their corporate relations site.

Klarna

Klarna’s offering to consumers and retailers include payments, social shopping, and personal finances. The business has over 250,000 retail partners, including H&M, IKEA, Expedia Group, Samsung, ASOS, Peloton, Abercrombie & Fitch, Nike and AliExpress have enabled Klarna’s innovative shopping experience online and in-store. Klarna is one of the most highly valued private fintechs globally with a valuation of $45.6 billion.

The business was was founded in 2005 in Sweden by three young entrepreneurs Sebastian, Niklas, and Victor. They changed the initial company name – Kreditor Europe, after they got their fist investor. The name “Klarna” means “clear” in Swedish.

Our first angel investor Jane Walerud came on board and at this time the company was called Kreditor Europe AB. We picked the name because it made us “sound serious, trustworthy and larger than we were”.

Klarna Team

ePayLater

ePayLater is a digital payment solution offered by Arthashastra Fintech Pvt. The company was founded in 2015 in Mumbai, India, and has raised $15.7 million in funding over five rounds.

ePayLater operates on the country extension .IN. .IN is the Internet country code top-level domain (ccTLD) for India and, as of 2005, is available to anyone and used by companies, individuals, and organizations in India. There was no functional site on epaylater.com at the time of our visit.

Zilch

Zilch app was founded in 2018 by Philip Belamant . The startup has recently become the fastest European double unicorn with a valuation of over $1.9 billion. Zilch has chosen a domain name that corresponds to their global ambitions and communicates their vision – Zilch.com. The word means “nothing, none” – communicating clearly the seamless, interest-free experience the startup prides itself with.

The company has also secured the descriptive domain name payzlich.com. Most successful global brands use the power of domains and maintain portfolios of names that serve different purposes – to protect their brand, as part of marketing campaigns, sub-brands, or products, to appeal to specific audiences, and many others.

Pace

Pace is a Singapore-based fintech solution company that allows customers to buy now pay later (BNPL). The startup has recently announced that it closed a new funding round.

Pace operates on Pacenow.co. A lot of startups use the .CO extension as an alternative to .COM as it sounds similar to corporations and companies. Adding a descriptive additional word can also cause confusion and make any marketing efforts less effective by driving visitors to more obvious versions of the domain.

Highlights

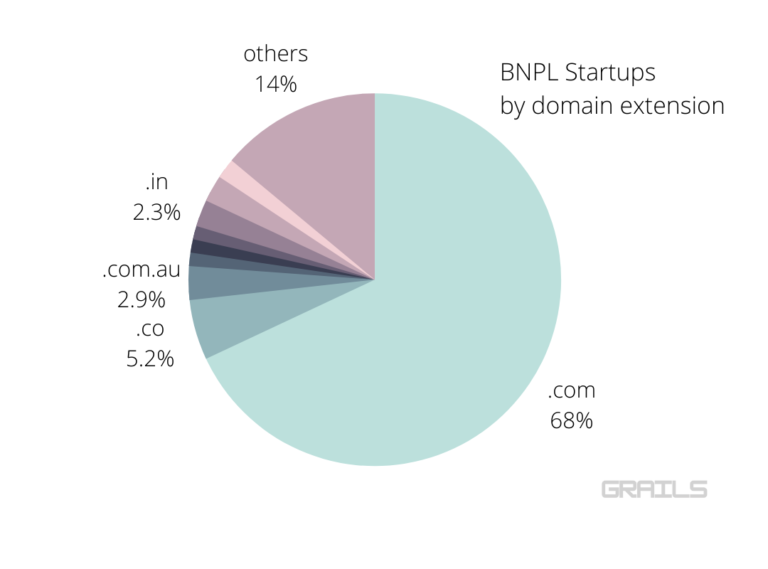

117 BNPL startups have opted for the popular .com extension. Over 60% of the top 500 most popular websites in the world based on Domain Authority operate on .com names.

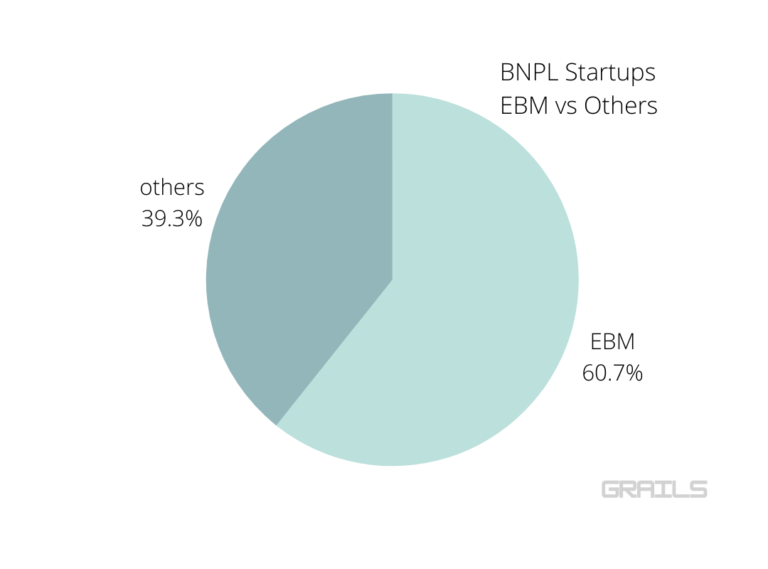

102 companies use EBM domains. The majority of successful global brands operate on similar names that communicate trust and authority.

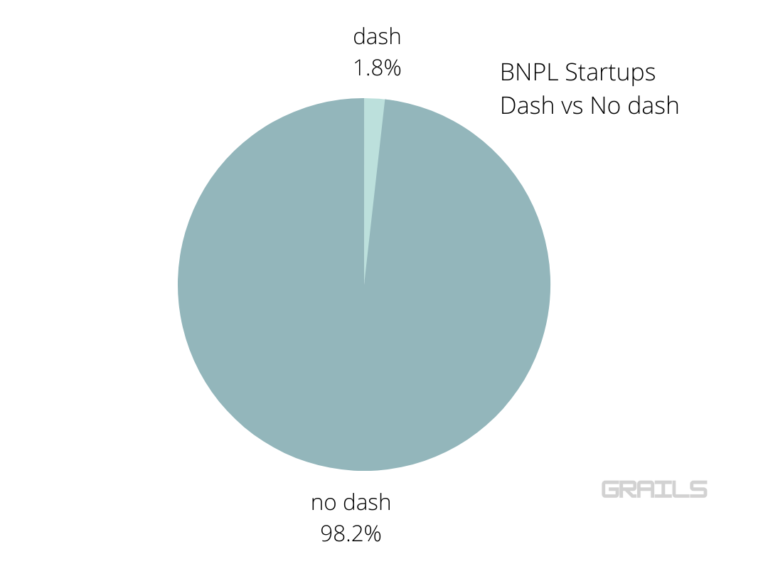

Only 3 companies on the list have a dash in their domain name.

While we make every effort to ensure the data on our site is accurate, complete, and up-to-date, we cannot guarantee its reliability. Our data is provided for informational purposes only and should not be relied upon as legal, financial, or other advice. We strongly recommend that you independently verify any information before relying on it.

Other resources

- The Fintech 250 CB Insights List of Companies 2022 and Their Domain Name Choices

- Maximizing SEO Potential with a Memorable and Unique Domain Name

- Why Your Domain Name Matters: 4 Reasons Why .Com Domain Names Are The Best For Your Brand

- What domain names did the Top 10 Tech Companies choose for their brands?

How does your brand name match your company vision? What new horizons can a better name open? Get in touch if you feel your brand deserves a better name, we are always happy to help.

Previous Next